India CV sales record sharp recovery in July 2017, uptick in M&HCV numbers

After a poor first quarter of FY2018, the first month in the GST era has seen the CV sector drive confidently onto growth road, with demand for M&HCVs up and that for LCVs consistent.

After reasonably tough Q1 (April-June 2017) when overall sales at 151,837 units were down 9.08 percent YoY, the commercial vehicle (CV) sector has recorded a sharp recovery in July driven by an uptick in the critical medium and heavy commercial vehicle (M&HCV) segment. After the steep declines in April (-22.93%) and May (-14.40%), CV manufacturers saw green shoots of recovery and entered growth lane (+1.44%).

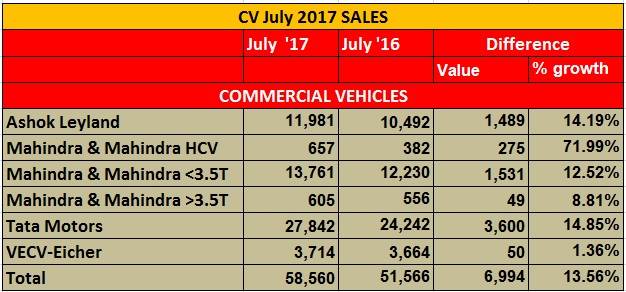

For July, which opened the era of GST, all major CV manufacturers have registered higher growth across both the M&HCV and LCV segments. Market leader Tata Motors, which has seen a correction in its sales over the past three months, has returned to growth territory with overall sales up by 15 percent in July. Similarly, Ashok Leyland, the second largest CV player, which also saw sales fall in the first two months of FY2018, posted double-digit growth in July.

For industry, the strong comeback in the M&HCV segment signals the return of demand on the back of improving economic indicators, benefits of GST to the transportation sector due to vanishing check-points, and increasing freight and logistics efficiencies. These factors are also motivators for fleet operators to start looking at expanding their fleets.

According to Subrata Ray, senior group vice-president of ratings agency ICRA, “Despite a weak performance in the first quarter, the industry will find its momentum back aided by increased thrust on infrastructure and rural sectors in the recent Budget, potential implementation of fleet modernization or scrappage program and higher demand from consumption-driven sectors, especially for LCVs and intermediate commercial vehicles (ICVs). Given these considerations, the domestic CV industry is likely to register a growth of 6-8 percent in FY2018.”

According to ICRA, within the CV industry, the M&HCV (truck) segment will get support from pent-up demand with GST coming into force, higher budgetary allocation towards infrastructure and rural sectors, potential implementation of vehicle scrappage program and stricter implementation of regulatory norms especially related to vehicle length (for certain applications) and overloading norms. In addition, the National Green Tribunal’s (NGT) thrust on phasing out old diesel vehicles along with the government's proposed vehicle modernisation program would trigger replacement-led demand. Apart from favorable regulatory developments, resumption of mining activities in select states would also continue to support demand for tippers, a segment which has outperformed the industry during the current fiscal.

Truck rentals down in July

According to the Indian Foundation of Transport Research and Training (IFTRT) which tracks truck rentals in the country, “Retail parcel booking/part load freight charges in the first fortnight of GST witnessed an unprecedented slump in cargo movement. It was the key factor adversely impacting retail consignment booking and delivery charges. Instances of untaxed, wrong declarations and under-reported consignments have come down drastically on most interstate routes as MSMEs, wholesales and distribution businesses, in particular, are very hesitant and fearful to despatch untaxed cargo under the GST regime. Untaxed invoices dodging the tax authorities, for the time being, have virtually disappeared from the freight market, except for few inter-state destinations in Rajasthan, Madhya Pradesh, Bihar, Chattisgarh, Gujarat and parts of Maharashtra and North-East India.

How the OEMs fared in July

On the monthly sales front, Tata Motors’ overall CV sales rose 15 percent in July at 27,842 units (July 2016: 24,242) backed by the ramp-up of BS IV production, across segments.

While demand for its M&HCVs was up 10 percent in July 2017 at 8,640 units (July 2016: 7,879), the I&LCV truck segment grew by 28 percent at 3,354 units (July 2016: 2,626 units) on the back of a good market response to the new Ultra range and the new BS IV range in other products.

According to the company, “The M&HCV segment saw a rebound in July 2017 and witnessed a pick-up in demand and availability because of continued production ramp up. New models launched in the fastest growing segments of 49-ton and 37-ton categories have also gained strong traction in the market.”

Tata Motors’ passenger carrier sales (including buses) though saw a 15 percent decline to 4,472 units (July 2016: 5,233) largely due to supply constraints in the bus segment. The SCV cargo and pickup segment continued the growth momentum with sales of 11,376 units, up by 34 percent (July 2016: 8,504) due to good market demand for the Ace XL, Mega XL, Zip XL, and the new Tata Yodha.

Ashok Leyland registered double-digit growth, growing by 14 percent with sales of 11,981 units (July 2016: 10,492.) M&HCV sales rose 10 percent to 9,026 units (July 2016: 8,182) while LCVs posted strong 28 percent YoY growth at 2,955 units sold (July 2016: 2,310).

Mahindra & Mahindra’s total CV numbers were up by 14 percent to 15,023 units (July 2016: 13,186). Its M&HCV sales turned positive, growing 72 percent to 657 units albeit on a low year-ago base (July 2016: 382). The below-3.5T GVW segment grew 13 percent YoY, selling 13,761 units (July 2016: 12,230), while those in the above-3.5T GVW segment turned positive by growing 9 percent with sales of 605 units (July 2016: 556).

VE Commercial Vehicles’ domestic sales were up marginally by 1.4 percent with total sales of 3,714 units (July 2016: 3,664 units). The company will be looking to drive numbers with growing demand for its recently launched Pro 5000 Series of trucks.

RELATED ARTICLES

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

Maruti Suzuki tops PV exports for third fiscal in a row, VW, Honda and Toyota shine in FY2024

With its best-ever exports of 280,712 units, Maruti Suzuki retains PV exporter crown in FY2024; Hyundai with 163,155 uni...

02 Aug 2017

02 Aug 2017

10463 Views

10463 Views

Autocar Pro News Desk

Autocar Pro News Desk