India CV OEMs maintain growth in August 2017, uptick in M&HCVs continues

Medium and heavy commercial vehicles have registered strong growth of 52 percent in August 2017 at 10,926 units (August 2016: 7,190).

There's good news on the commercial vehicle (CV) industry front. After a tepid Q1, the industry has seen growth continue for the second straight month.

All the key manufacturers have clocked sizeable growth in August sales. Tata Motors and Ashok Leyland have registered double -igit growth in overall sales. Importantly, sales of the critical medium and heavy commercial vehicle (M&HCV) sector have maintained an upward trajectory in August.

The higher growth indicates that manufacturers have been able to address bottlenecks in the supply chain and streamline their BS IV production. It also appears that fleet operators are now gradually showing interest in upgrading their fleet as the initial concern pertaining to BS IV vehicles efficiencies, production ramp-up and uncertainty towards prices post GSThave now largely been addressed.

The past two months' sales have given the much-needed impetus to CV sales and manufacturers are anticipating growth to remain intact, fingers firmly crossed. With the festival season having just begun, they are hoping overall CV buying in the country will improve. The uptick in infrastructure spending and higher construction activities also driving higher tipper sales; this trend is likely to continue further helping the overall M&HCV segment's growth.

In its outlook for FY2018, ratings agency ICRA expects the M&HCV truck segment to grow by 6-8 percent, LCVs by 7-8 percent and buses by 7-9 percent. According to ICRA, higher budgetary allocation towards the infrastructure and rural sectors, scrappage program, NGT’s ban to drive replacement demand, and also stricter compliance with respect to overloading and vehicle dimension (for specific applications i.e. car carriers etc) will help drive demand for additional vehicles in the M&HCV segment in FY18.

How the OEMs fared in August

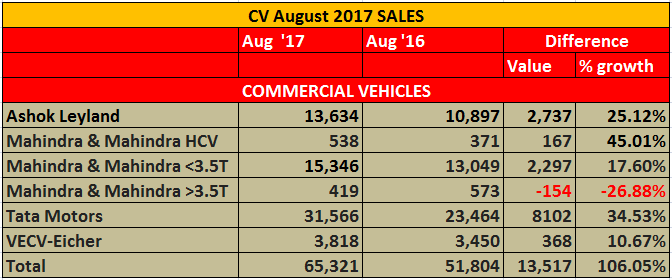

On the monthly sales front, Tata Motors’ overall CV sales rose 34 percent in August at 31,566 units (August 2016: 23,464) due to the continued ramp-up in production of BS IV vehicles since April this year. The company also passed on the benefits of GST to consumers by reducing the prices of its vehicles across all CV segments.

Tata M&HCVs posted strong growth of 52 percent in August 2017 at 10,926 units (August 2016: 7,190). According to the company, this segment witnessed a strong pickup in demand on the back of continuously increasing acceptance of SCR technology and driven by the stricter implementation of regulatory norms on overloading, as well as sector-specific (trucks and construction tippers) demand. The I&LCV truck segment sales were up by 44 percent at 3,881 units (August 2016: 2,703) due to increased buying with the upcoming of the festive season.

Tata Motors Passenger Carrier sales (including buses), in August 2017 were down by marginal 4 percent at 4,078 units (August 2016: 4,238) largely due to delay in procurement from the State Transport Undertakings. The SCV cargo and pickup segment maintained the growth momentum at 12,681 units, up 35 percent (August 2016: 9,377) as demand for new products like the XL range of Tata Ace and the Xenon Yodha pickup grew.

Ashok Leyland registered smart growth in its overall CV sales, growing by 25 percent with sales of 13,634 units (August 2016: 10,897.) Its M&HCV sales rose 29 percent to 10,567 units (August 2016: 8,201) while LCVs posted 14 percent YoY growth at 3,067 units sold (August 2016: 2,696).

Mahindra & Mahindra’s total CV numbers were up by 17 percent to 16,303 units (August 2016: 13,993). Its M&HCV sales remained positive, growing 45 percent to 538 units albeit on a low year-ago base (August 2016: 371). The below-3.5T GVW segment grew 18 percent YoY, selling 15,346 units (August 2016: 13,049), while those in the above-3.5T GVW segment turned negative down by 27 percent with sales of 419 units (August 2016: 573).

VE Commercial Vehicles’ domestic sales were up by 10.67 percent with total sales of 3,818 units (August 2016: 3, 450 units). The company will be looking to drive numbers with growing demand for its recently launched Pro 5000 Series of trucks.

Speaking to Autocar Professional last month, Vinod Aggarwal, managing director and CEO, VE Commercial Vehicles, said, “The newly launched Pro 5000 series trucks have been received well by customers and with the old VE Series trucks, Pro 6000, Pro 8000 range and now the Pro 5000 Series, we have got products across every price point, applications and every customer need with the widest range of engines equipped with both EGR and SCR technologies. We are capable of meeting all customer needs.”

Also read : Carmakers post robust sales in August, consumers buy big before new GST cess kicks in

RELATED ARTICLES

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

04 Sep 2017

04 Sep 2017

10689 Views

10689 Views

Autocar Pro News Desk

Autocar Pro News Desk