INDIA SALES: November numbers point to a robust FY2018 for industry

While November 2017's sales reflect strongly on lower year-ago numbers, the fact is that the economy is recovering, consumer sentiment has improved and OEMs are busy with the new product factory.

Like the uptick in India’s GDP, India’s automobile manufacturers across the passenger vehicle, commercial vehicle and two-wheeler segments have reported improved sales numbers in the month gone by. From the looks of it, the buzz is gradually getting back and the improved sales numbers in November 2017 are proof of that. Nonetheless, the numbers are to be looked at in the context of a year-ago low base and a tough November 2016 when the industry and the country was hit by the big sales speedbreaker: demonetisation. Here’s looking first at the passenger vehicle industry.

Maruti Suzuki India, which controls the fortunes of the PV industry, reported sales of 144,297 units (+14.3%) and it looks well set to notch its best-ever sales for a fiscal year. In FY2017, the company had sold a total of 1,568,603 units (domestic + exports). Given the current pace of its sales, Maruti should easily surpass this number. With four months of FY2018 still to go, the company has sold a total of 1,187,735 units (+14.6%). As is known, the company is gunning for 2 million sales annually by the year 2020. And it has 2.5 million sales in its crosshairs by FY2023.

For Maruti, its quintet of compact cars (Swift, Celerio, Ignis, Baleno and Dzire) and utility vehicles (Gypsy, Ertiga, S-Cross and Vitara Brezza) have helped overall numbers. At 65,447 units sold (November 2016: 49,431), the five cars posted 32.4 percent year-on-year growth while the UVs, with 23,072 units, clocked 34 percent YoY growth (November 2016: 17,215).

Sales for the entry-level hatchback duo of the Alto and Wagon R, which sold 38,204 units were flat (November 2016: 38,886). If there is a growing concern for Maruti, then it would the declining sales of the Ciaz premium sedan. In November 2017, the Ciaz sold a total of 4,009 units, down a sizeable 26.2 percent (November 2016: 5,443). Bringing up the rear are the two vans, the Omni and the Eeco which together sold 13,565 units, up 10.8 percent (November 2016: 12,238).

Hyundai Motor India, the No. 2 passenger vehicle player, sold 44,008 units in November, which marks 10 percent YoY growth (November 2016: 40,016). Its top performers across segments include the Grand i10, Elite i20 and the Creta SUV, all having put up a good show in their respective segments, just as they did in the recent past. Also, the third-generation Hyundai Verna sedan, launched a few months ago in August, is garnering good numbers for the company, having sold a cumulative 15,534 units in just over two months until October 2017.

According to Rakesh Srivastava, director, sales and marketing, “Hyundai’s volumes of 44,008 units is a growth of 10 percent with strong performance of the newly launched bestseller next-generation Verna along with Grand i10, Elite i20 and Creta. Due to strong pull of festive demand on the strength of a buoyant rural market, we hope to build on this positive momentum with cumulative retail sales of 200,000 units for the September to December 2017 period. We have also strengthened our export with first despatch of 2,022 units of made-in-India Vernas to Middle-East markets from November 2017.”

Tata Motors is on a roll. The company’s passenger vehicle division sold 17,157 units, which marks smart YoY growth of 35 percent (November 2016: 12,736), essentially led by the strong growth momentum of new-generation Tata cars like the Tiago, Hexa, Tigor and the Nexon.

To meet the growing demand for the Nexon compact SUV, Tata Motors has ramped up its production and earlier this week rolled out the 10,000th Nexon from its Ranjangaon facility. Cumulative PV sales in the domestic market for the April-November 2017 period are 115,049 units, a growth of 13 percent (April-November 2016: 101,712).

Mahindra & Mahindra has made the most of a buoyant November. The company PV segment (which includes UVs, cars and vans) sold 16,030 vehicles as against 13,198 vehicles during November 2016, a growth of 21 percent.

Commenting on the monthly performance, Rajan Wadhera, president, Automotive Sector, M&M, said, “We are happy to be in a positive growth phase for November 2017, which is usually a lean period after the festive season. Our passenger and small commercial vehicles growth for the month of November has been very encouraging. We expect our growth momentum to continue on the back of some recent refresh launches as well as the positivity of our product portfolio.”

Toyota Kirloskar Motor sold a total of 12,734 units in the domestic market in November 2017, a YoY increase of 13 percent (November 2016: 11,309). Commenting on the monthly sales, N Raja, director and senior VP (Sales & Marketing) said, “November has been promising for us with double-digit growth. TKM has sustained a positive growth since last three months. With maximum utilisation of Plant 1 and maintaining lean inventory, we are trying to reduce the waiting period of the Innova and Fortuner, which continue to witness strong demand in the market. The Etios Liva has also done really well this month and has positively contributed towards the overall domestic sales growth. We expect the positive trend in customer demand to continue in the year-end sales as well.”

Honda Cars India is also on a high, having registered monthly domestic sales of 11,819 units in November 2017, a handsome 47 percent YoY growth (November 2016: 8,029). For the fiscal’s first eight months, cumulative sales total 117,322 units, up 19 percent, against 98,451 units in April-November 2016.

The WR-V was the best-seller for Honda with 3,521 units, followed by the popular City (3,315), Jazz (2,039), Amaze (1,976), BR-V (793), Brio (154) and CR-V (21)

Commenting on the sales, Yoichiro Ueno, president and CEO, Honda Cars India, “Last year Honda Cars India’s sales in November were severely affected by demonetisation. Although November volumes this year have shown improvement over last year, the market is still to recover fully from the GST-related changes affecting consumers at large. On a cumulative basis, HCIL sales have grown by 19 percent, backed by strong performance of our models across markets. It gives us the confidence that we will have good growth in this fiscal year.

Ford India displayed an enthusiastic performance with great boost coming in from its newly introduced EcoSport facelift compact SUV launched on November 9. The company registered total domestic sales of 7,777 units, posting growth of 13.10 percent (November 2016: 6,876).

According to Anurag Mehrotra, president and managing director, Ford India, ”November was all about the new EcoSport. Our fun, stylish, powerful and connected compact SUV is winning the hearts and minds of customers, not only with its introductory price but the whole host of features. We are confident of maintaining this sales momentum getting into 2018, despite macroeconomic indicators suggesting volatility in inflation and crude prices impacting the industry growth over the near-medium term.”

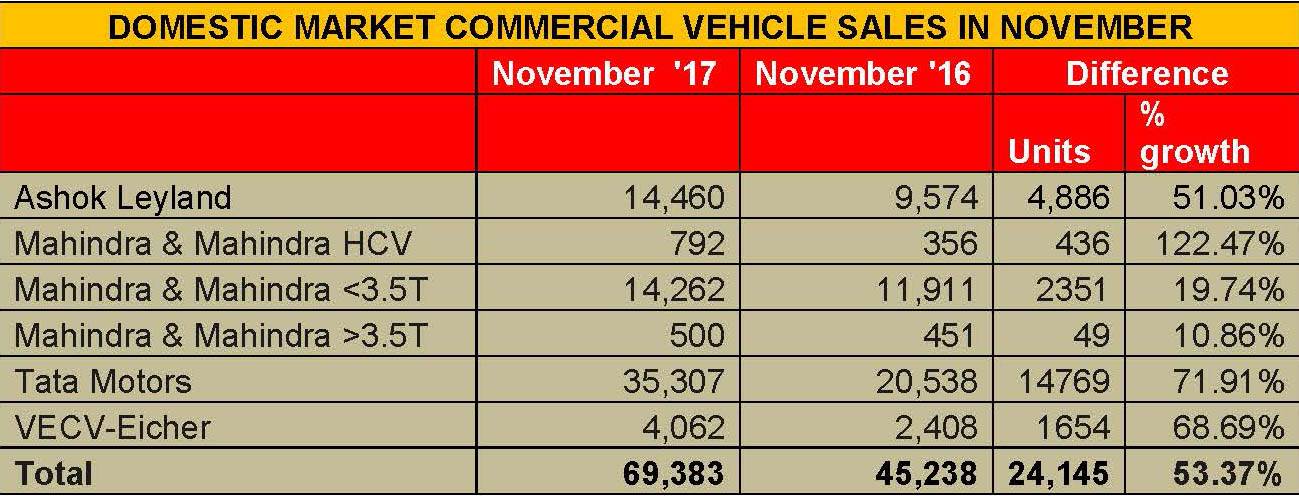

CV OEMs do well in both M&HCVs and LCVs

In a manner similar to the PV segment, the commercial vehicle (CV) market numbers have notched handsome sales albeit the numbers have to be seen in the background of the demonetisation strategy which adversely impacted sales in November 2016.

Nevertheless, November 2017 has turned out to be a cracker of a month for the commercial vehicle (CV) segment as overall sales made a strong comeback after a tepid October 2017. Both medium and heavy commercial vehicle (M&HCV) and light commercial vehicle (LCV) sales have recorded a sharp increase in year-on-year sales and all the manufacturers in the Indian market have notched remarkable gains.

Tata Motors and Ashok Leyland, the biggest players in the M&HCV segment, have seen their numbers grow 88 and 54 percent respectively, their biggest monthly gain in recent years. Mahindra & Mahindra (M&M) and VE Commercial Vehicles have also registered smart upticks with YoY growth of 22 and 68 percent respectively. The growing demand in the M&HCV segment indicates buyers are now finally taking on the vehicle price increases brought about by the upgrade to BS IV, while also benefiting from GST-driven gains.

The CV industry in India has experienced a turbulent year in the first two-quarters of FY2017-18. Q1 sales were down 9 percent due to BS IV implementation as fleet buyers made heavy purchases in March before truck prices rose from April 1. With the BS IV impact somewhat stabilising, Q2 saw a marginal revival in sales what with the festive season also giving a fillip to sales. As a result, overall CV sales in April-October 2017 turned positive and grew by 6.04 percent to 423,135 units comprising 154,843 M&HCVs (-5.38%) and 268,292 LCVs (+13.97%).

Tata Motors, which is having a good run in the passenger vehicle market with its clutch of new cars like the Hexa, Tiago, Tigor and the Nexon, has dominated news in the CV world since the past few months. Tata Motors’ sold a total of 35,307 units, up a massive 72 percent compared to 20,538 units in November 2016. The M&HCV trucks segment is up 88 percent YoY with total sales of 12,851 units. According to the company, “The sales growth was largely driven by the success of our SCR (Selective Catalytic Reduction) technology, which has been well accepted by customers. Increased demand for the new tonnage vehicles, infrastructure development led by government funding and a keen focus on customer requirements have helped to revive the M&HCV performance.”

Tata’s I&LCV sales grew by 76 percent at 3,984 units on the back of better performance of new product introductions and continued demand. Its pickups also saw demand grow with sales up by 53 percent to 4,685 units; the recently launched Xenon Yodha continues to gain acceptance and volumes across markets. Its small CV sales at 10,265 units are up 77 percent over year-ago sales as a result of strong market acceptance of the Ace Mega XL range. Tata’s commercial passenger carrier segment (including buses) sales were 3,520 units in November 2017, up by 36.5 percent over last year.

According to Tata Motors, “The commercial sector has bounced back strongly after the initial disruption in the market surrounding demonetisation and the BS IV transition that largely affected the transport industry last year. Consumption-driven sectors have shown an uptick in sales since July 2017 and continue even after the festival season. The increased demand for vehicles across segments and production ramp-up of the new range of BS IV vehicles has given a strong boost to overall sales growth.”

Like the market leader, Ashok Leyland also registered massive gains in sales last month with total sales of 14,460 CVs, up by 51 percent. (November 2016: 9,574). Its M&HCV numbers have bounced back, growing 54 percent to 10,641 units (November 2016: 6,928) while LCVs too posted strong 44 percent YoY growth at 3,819 units sold (November 2016: 2,646).

November also saw Mahindra & Mahindra notch considerable growth; with overall CV sales of 15,554 units, its YoY growth was 22 percent (November 2016: 12,718). The company sold 792 M&HCVs, up 122 percent albeit on a low year-ago base (November 2016: 356). The below-3.5T GVW segment numbers were up by 20 percent YoY, at 14,262 units (November 2016: 11,911), while those in the above-3.5T GVW segment grew by 11 percent with sales of 500 units (November 2016: 451).

VE Commercial Vehicles’ domestic sales were up by 68.7 percent with total sales of 4,062 units (November 2016: 2,408 units).

Two-wheeler OEMs ride strong wave of demand

The highest volume-grossing segment in the Indian automobile sector registered strong growth in the penultimate month of CY2017 with most manufacturers recording positive, above-expectation numbers. However, it would help to know that the figures are relative to the low base of November 2016, when sales across the industry had hit rock bottom due to the government's demonetisation drive.

India’s No 1 two-wheeler brand, Hero MotoCorp sold a total of 605,270 units, registering a growth of 26 percent (November 2016: 479,856). Of this, the company sold 525,224 motorcycles and 80,046 scooters, including its Maestro Edge, Duet and Pleasure gearless offerings.

Sales of its commuter motorcycles, which include the Splendor, Passion, HF Deluxe and the Glamour continue to be the main growth drivers. The company is looking to re-enter the midsize 200cc capacity segment and last month unveiled its XPulse concept, with adventure tourer credentials, at the EICMA Show in Milan. With no set deadline for its launch, the adventurer tourer is expected to be introduced sometime in CY2018 in the Indian market.

Honda Motorcycle & Scooter India posted sales of 432,350 units in November, recording a considerable 44 percent growth (November 2016: 299,414). Motorcycles contributed 150,606 units (+56%, November 2016: 96,338), while scooter sales clocked 281,744 units, recording a 39 percent growth (November 2016: 203,076), also owing to contribution from the newly introduced 125cc Grazia scooter, which went past the 15,000 units mark until the end of the month since its launch on November 8.

According to Yadvinder Singh Guleria, senior vice-president (Sales & Marketing), Honda Motorcycle & Scooter India, “Demonetisation last November definitely created a low base effect but the demand in November was visible. While the Activa legacy goes strong, the new scooter Grazia ensured that excitement continued even after the festive season. The motorcycle sales momentum was led by rural demand. Creating a new record, Honda sales crossed the 4,000,000 mark in November. While it took nearly eight years for Honda to achieve this mark, the latest 40 lakh customers have joined the Honda family in just eight months.”

TVS Motor Company clocked cumulative sales of 203,138 units, up 6.1 percent (November 2016: 191,499). While scooter sales stood at 78,397 units, growing 7.2 percent (November 2016: 73,135), motorcycles sold 93,202 units, registering a notable growth of 37.3 percent (November w016: 67,896). The company is all set to continue this momentum in its motorcycle sales and will launch the highly anticipated TVS Apache RR310, developed in conjunction with BMW, on December 6 in India. The bike will directly compete with the likes of the Bajaj Dominar, Kawasaki Ninja 300 and the KTM Duke and RC siblings.

Bajaj Auto saw its sales remaining near flat at 141,948 units being sold, a marginal growth of 2 percent (November 2016: 139,765). The Pulsar continues to be its sales driver, aloing with the CT100 in the commuter segment.

Royal Enfield registered cumulative sales of 67,776 units, posting growth of 21 percent (November 2016: 55,843). The company also recently showcased its new 650cc twin-cylinder motor at the EICMA 2017. The engine will formulate two newly developed products in the mid-size category, the Interceptor INT 650 and Continental GT 650. Once introdued next year, Royal Enfield will be gunning for the midsize segment in India, as well as in mature markets, including Europe, Australia and North America.

Suzuki Motorcycle India posted sales of 42,722 units, growing 39 percent (November 2016: 30,830). The cumulative numbers between April-November 2017 stand at 3,80,950 units, putting the company to be on a grwoth trajectory of 38 percent (April-November 2016: 2,75,513).

According to Sajeev Rajasekhran, EVP, Sales and Marketing, SMIPL, “The consistent growth is a testament to the successful fructification of the new product strategy at Suzuki Two-Wheelers where we have aligned our focus on the premium segment of scooters (125cc and above), and premium motorcycles (150cc and above). Under this renewed focus, we also launched the much-awaited Intruder motorcycle, a 150cc modern cruiser in November. We are expanding our touch-points in regions which clock sales of over 1,000 units each month, in these two product categories. With a sound go-to market strategy in place, along with a robust and aggressive product roadmap; we are confident that Suzuki Motorcycle India’s best days are ahead of us.”

That’s a vision that most companies would want to have as the market gears up for December.

RELATED ARTICLES

Maruti Suzuki’s SUV and MPV production jumps 100% to 58,226 units in January 2024

Utility vehicle market leader’s two plants in Haryana along with Suzuki Motor Gujarat’s facility hit a record monthly hi...

Car and SUV users in Bengaluru and Pune took over 27 minutes to travel 10km in CY2023

Traffic remains a challenge worldwide as life returns to pre-pandemic levels. Four Indian cities are among the 80 cities...

Indian car and 2W OEMs recall 284,906 vehicles in 2023 and 5.35 million since 2012

CY2023 saw three two-wheeler manufacturers proactively recall 122,068 motorcycles and five car and SUV producers recall ...

05 Dec 2017

05 Dec 2017

15385 Views

15385 Views

Autocar Pro News Desk

Autocar Pro News Desk