Yuan devaluation to impact Indian tyre and auto ancillary makers: ICRA

Rating agency ICRA says the recent devaluation of the yuan will adversely impact the tyre and auto component industries in India.

In a bid to boost its exports, China recently cut the value of its currency against the US dollar (yet again). While the move by the world’s largest economy will have a significant macro-economic impact on emerging markets like India, it is the direct impact on the Indian automotive component makers which is a cause for concern.

According to a report by rating agency ICRA, the devaluation of the yuan will have a negative impact on the tyre and the auto ancillary industry in India.

The Indian tyre industry, which is already suffering from dumping of cheap tyres from China, will now have to see even more pricing pressure as the yuan devalues.

During the past year, import of Chinese tyres into the Indian replacement market has increased sharply by 56% and by a further 58% during Q1, FY2016. Imported Chinese tyres are used in the domestic aftermarket space by price-sensitive medium and heavy commercial vehicle (M&HCV) and passenger vehicle (PV) fleet operators and two-wheeler (including cycles) consumers.

According to the rating agency, given the absence of any anti-dumping duties on tyres, the recent yuan devaluation has exacerbated the price differential between Indian-made and Chinese-landed tyres.

India auto parts to feel the brunt of dumping from China

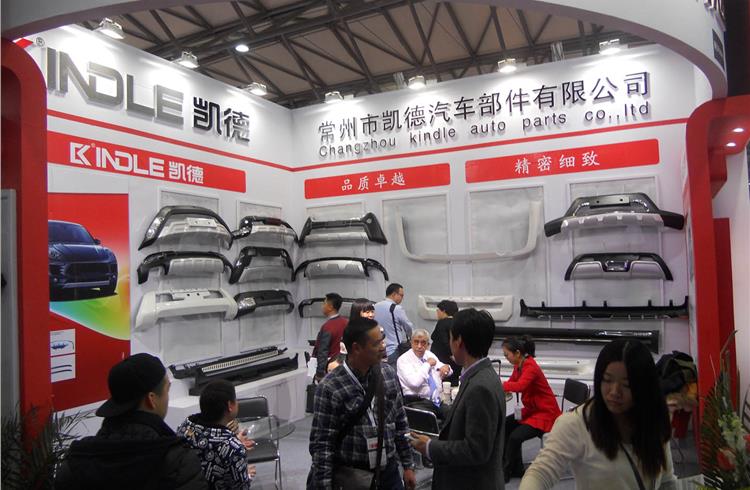

China accounts for about 23% of total auto component imports to India; this share has consistently increased over the past three years whereas exports to China have remained stagnant.

The Indian automotive industry imports multiple products from China namely bearings, axle beams, knuckles, glass, wheel rims, steering products, rubber components, and electronic chips to name a few.

From auto component imports worth Rs 10.9 billion in FY2011, the imports jumped to Rs 13.6 billion in FY2015. China’s share has grown rapidly over the last five years, from 18% to in FY2011 to 23% in FY2015.

Considering cheaper and local raw material availability, lower financing cost and economies of scale, imports from China are priced, on an average, 20%-25% cheaper than Indian components, posing a serious threat to domestic auto ancillaries, ICRA said.

Given the presence of localisation/sourcing centres in China, the continued devaluation of the yuan could lead to global OEMs continuing to use China as a sourcing point for India, instead of developing local Indian suppliers, it added.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Autocar Pro News Desk

By Autocar Pro News Desk

20 Aug 2015

20 Aug 2015

4174 Views

4174 Views