US vehicular emissions study group votes for BS VI norms in India

ICCT is known to be one of the first establishments globally to have technically analysed the feasibility and impact of the implementation of BS VI emission norms in India by 2020.

The International Council on Clean Transportation (ICCT), a US-based independent non-profit organisation involved in technical and scientific analysis of vehicular emissions worldwide, supports the implementation of the BS VI emission norms in India by 2020.

ICCT is known to be one of the first establishments globally to have technically analysed the feasibility and impact of the implementation of BS VI emission norms in India by 2020 when the same was recommended by an expert committee report under Saumitra Chaudhuri in May-June 2015.

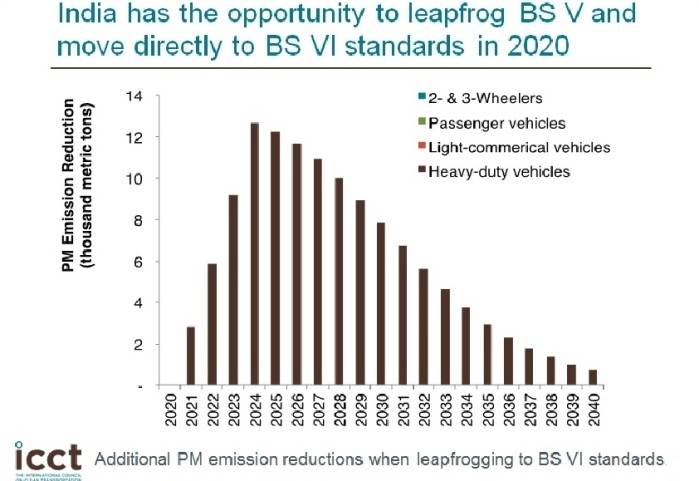

ICCT’s analysis of leapfrogging to the BS VI norms across India by 2020 for all-new vehicles is primarily supported by five main considerations that, if understood and correctly executed by the implementing bodies, have the potential to make maximum impact in terms of reducing air pollution and premature mortality.

The organisation finds the ‘case for expediting progress to Bharat VI standards, which are based on the European VI standards, persuasive.” The considerations, as mentioned in the ICCT’s position brief document, are as follows:

- Superior design of the Euro VI standards: For heavy-duty vehicles, Euro 5 standards have not achieved expected NOx emission reductions. While Euro 5 standards have resulted in dramatic reductions in particulate matter (PM) emissions from light-duty diesels, real-world diesel NOx emissions have continued to far exceed certification limits. Given the regulatory improvements that Euro 6/VI standards provide, ICCT recommends that all countries following emission standards modelled after European regulations should move directly from Euro 4/IV to Euro 6/VI standards.

- Measurement of in-use emissions reveals that Euro VI standards achieve a much greater reduction in NOx emissions from Euro IV / V levels than the emission limits alone would indicate: Heavy-duty vehicles built and certified in conformity to Euro 4 and 5 emissions standards frequently do not achieve the real-world NOx emissions required under those standards. Evidences claim that under Euro 6, NOx emissions are indeed meeting expectations, even in the most difficult operating conditions. Leapfrogging from Euro 4 (Bharat IV) to Euro 6 (Bharat VI) will achieve a larger NOx reduction than the 88 percent reduction in certification level would indicate. In practice this number is likely closer to 98 percent.

- By 2020, the emission control technology needed to meet Euro 6/VI standards will be in its fourth generation, with minimal impact on fuel efficiency: Euro 6 standards will require adoption of diesel particulate filter (DPF) along with selective catalytic reduction (SCR) technologies. The US experience in implementing both SCR for NOx control and DPFs for PM had significantly helped guide the European implementation. While the US and EU SCR and DPF emission control technologies are maturing, the accumulated experience (from the West) will inform the Indian manufacturers as they move into the deployment of SCR and DPF systems.

One outcome of this research is the improvement in engine efficiency reduction that may accompany advanced after-treatment systems. The DPF impacts fuel consumption by raising exhaust back-pressure, and by requiring intermittent injections of additional fuel to regenerate the filter when it is loaded with PM. Improvements in catalyst design and engine controls have reduced the need to regenerate the DPF.

ICCT’s study, therefore, suggests that vehicle manufacturers in the West have mitigated the negative fuel impacts of DPFs by making efficiency improvements in other areas of the engine and vehicle.

That said, Anup Bandivadekar, passenger vehicles program director at ICCT, told Autocar Professional that “the Indian OEMs may not necessarily have to learn from the global OEMs as they already have the access to required technology. They (OEMs) will have to work with emissions control suppliers, most of whom are global players, to customise the solution for the Indian market, but there is plenty of time to do that between now and 2020.”

Indian OEMs already have access to BS VI tech

Indian automakers such as Tata Motors and Mahindra & Mahindra (M&M) are known to already have access to the BS VI technology that goes into cars and CVs. For example, M&M’s SsangYong has been selling Euro 6 vehicles in EU and Korea for the past few years. M&M is also known for exporting its flagship XUV5OO and other models fitted with DPFs in Europe. Tata Motors, on the other hand, sells Euro 6-compliant trucks under Tata Daewoo.

However, Bandivadekar does acknowledge that the vehicle industry will have to invest significantly in integration of diesel after-treatment technology with improved engines and on-board diagnostics (OBD). “This requires major engineering efforts, but is not a showstopper,” he added.

- A scrappage program for HCVs can create economic incentives necessary to alleviate automobile industry concerns about impact on vehicle sales: Stringent vehicle emission standards can reduce tailpipe emissions of new vehicles, but phasing in new-vehicle standards across the existing vehicle fleet takes time. Complementing new-vehicle emission standards with policy efforts focused on reducing in-use vehicle emissions can shorten this time lag.

ICCT suggests implementing a five-year program (2020-2024) to scrap older CVs and buses that would allow the country to adjust to higher vehicle costs while also reaping air-quality benefits. Under this scheme, heavy-duty vehicle owners can get a subsidy to replace their older (Bharat I, II or III), still-operational vehicle with a new Bharat VI vehicle at the price of a Bharat V-equivalent vehicle.

ICCT’s report conveys that while on the economic front, subsidies can offset the price rise of BS VI vehicles (for transporters and goods carriers), the environment side could see reduction of PM emissions by 99 percent by replacing old heavy commercial vehicles.

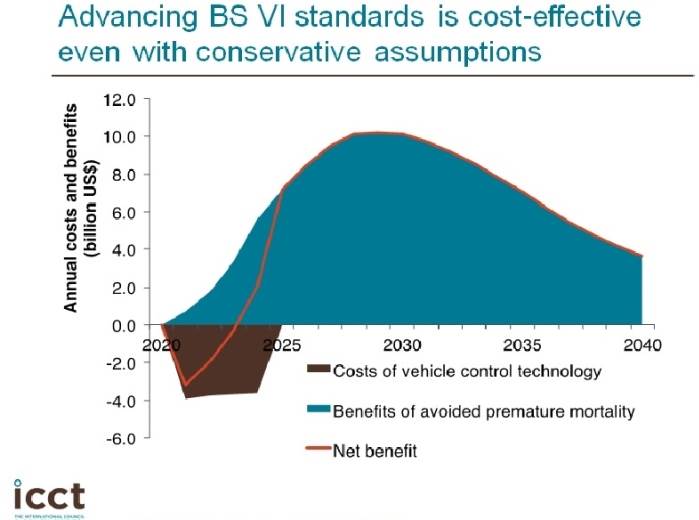

- Economic benefits of advancing Bharat VI standards far outweigh costs, and fully justify investments made in supplying ultra-low sulphur fuel: An early adoption of Bharat VI standards will generate corresponding reduction in premature mortality well in to 2040s. Considering the fact that Bharat V and VI emission standards are both based on supply of ultra-low sulphur fuels (ULSF, ≤10 ppm sulphur), availability of these ‘clean’ fuels nationwide by April 2020 would allow the country to take full advantage of the upfront refinery investments made to produce them.

Industry speak

Thus far, there have been mixed responses from the automotive industry with a few having reservations against the early deadline of implementation of BS VI norms while others have shown some support. For instance, Abhay Firodia, chairman, Force Motors, who spoke to Autocar Professional on the sidelines of an ACMA event in Pune yesterday, said: “Removing old vehicles from roads will do more good to the air pollution than the early rollout of BS VI emission norms.”

Expressing his views, N Raja, senior VP and director (marketing and sales), Toyota Kirloskar Motor, who agrees that it would be a challenging task to technologically upgrade all models across its portfolio for compliance, said: “We are ready to meet the new emission norms and support the government’s environmental plans in the long-term. But what we want is that the plans should be frozen without changes.”

Roland Folger, managing director & CEO, Mercedes-Benz India, has also voiced his support for the government’s decision to leapfrog BS V standards and switch directly to BS VI emission norms by 2020. “The decision to move for introduction of Bharat Stage VI norms in 2020 is something we can really applaud because it gives us – basically most of the manufacturers that sell or produce anything in Europe or for the European market – a chance to contribute something,” he said in a recent interview to Autocar Professional.

On the supplier side, BorgWarner Emissions Systems, a company which currently supplies exhaust gas recirculation technologies to leading OEMs in India including Maruti Suzuki, also supports the government’s decisive move.

Brady Ericson, president and general manager of BorgWarner Emissions Systems, said: "BorgWarner fully supports implementing BS VI emission standards in India by 2020. The country is facing significant air quality challenges. If fuel can meet the required quality levels across India, automotive technologies are already available to meet the accelerated timeline. BorgWarner’s technologies are specifically engineered to help automakers improve fuel economy, emissions and performance. With our local testing and validation capabilities, BorgWarner is well positioned to help our customers meet new requirements with fast-to-market solutions."

Tenneco Automotive India, a Tier 1 supplier of emission related products (catalytic converters, tailpipes, SCR systems) to OEMs, locally designs, engineers and develops the DPF (diesel particulate filter) systems for M&M’s export-bound SUVs.

“On the CV segment, working with our colleagues in Europe, Brazil and China not only gave us valuable experience to custom-engineer a cost-effective solution for the OEMs in India. Tenneco enjoys leadership positions in terms of sales and product development in the developed markets of US and EU. There are global engineering centres in both these locations which leverage, challenge and enhance our learning of the exhaust system and shock absorbers,” revealed Sagar Hemade, managing director, Tenneco Automotive India.

Boosting its production capacities to take on the upcoming opportunities by way of legislations, the company had commenced operations at its all-new plant at Sanand last year, and is also beefing up its Chakan facility with a world-class testing and validation centre.

“We will be in a position to validate all our designs at the component level at this site (Chakan) by mid-2016,” he added referring to the development of the emission-related components that it manufactures at both these locations.

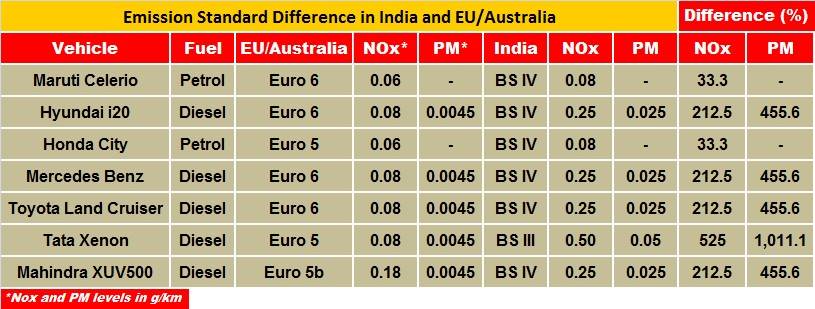

A detailed chart, made by ICCT (and depicted below), has picked up a few common car models that are sold in India as well as abroad. It draws a clear comparison between the PM and NOx emissions by these models sold in India and in EU/ Australia. It highlights how much more these models are polluting here.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

By Amit Panday

By Amit Panday

14 Jan 2016

14 Jan 2016

4530 Views

4530 Views