SIAM lauds Union Budget scheme to promote EVs, hybrids

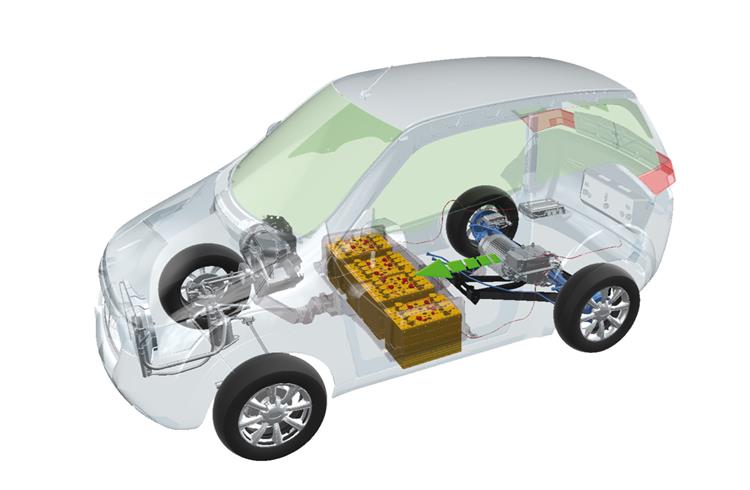

Apex industry body, the Society of Indian Automobile Manufacturers (SIAM) has welcome finance minister Arun Jaitley’s proposal to promote the use and manufacture of electric vehicles and hybrids.

Apex industry body, the Society of Indian Automobile Manufacturers (SIAM) has welcome finance minister Arun Jaitley’s proposal to promote the use and manufacture of electric vehicles and hybrids.

Vikram Kirloskar, president, SIAM, called the Budget “forward looking” and addressing both, the social sector as well as the industry in an “inclusive fashion”. Concessional customs and excise duties on select parts used in the manufacturing of electric and hybrid vehicles have been extended for a year, which is a positive move.

SIAM has lauded the finance minister for having accorded approval to the scheme on Faster Adoption of Electric and Electric Mobility (FAME). The industry body says that although the initial allocation of Rs 75 crore is very modest, it is hopeful that over the next a few months, more resources would be allocated for promoting this new and green technology area, which can be a game-changer for the automotive industry.

SIAM had earlier called for an increase in the customs duty on commercial vehicles from 10 percent to 40 percent. The 2015-16 Budget sees the effective rates increased to 20 percent, which is a welcome change. The reduction in excise duty on the chassis of ambulances from 24 percent to 12.5 percent is also a positive step.

According to SIAM, the re-affirmation of the date of implementation of GST from April 1, 2016 will help manufacturers develop more concrete long-term plans on their products and investments. The The reduction in corporate tax from 30 percent to 25 percent over the next 4 years is a move in the same direction.

The Budget’s focus on infrastructure development throughout the country will go a long way towards boosting the prospects of a wide range of industries including automobiles and particularly the commercial vehicle industry.

RELATED ARTICLES

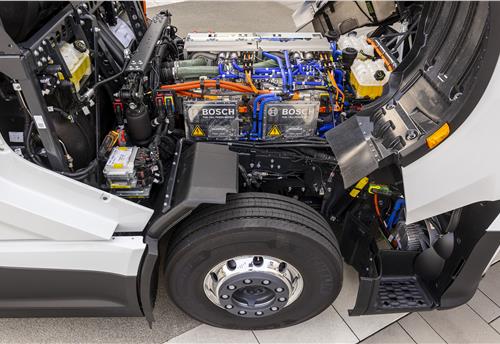

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Autocar Pro News Desk

By Autocar Pro News Desk

28 Feb 2015

28 Feb 2015

3334 Views

3334 Views