Sales march for most carmakers in last month of FY2015-16

Maruti Suzuki India and Hyundai Motors India have set the tempo for last month, both clocking handsome sales for the month and the overall fiscal year. Joining them in the sales spree is Mahindra & Mahindra.

If January and February 2016 sales numbers were tepid, then March sales have given most of the biggies reason for cheer.

Maruti Suzuki India and Hyundai Motors India, the top two carmakers in the country, have set the tempo for last month, both clocking handsome sales for the month and the overall fiscal year. Joining them in the sales spree is Mahindra & Mahindra.

For the just-ended 2015-16 fiscal year, the sales figures of the top three passenger vehicle (PV) makers in the country indicate that the Indian PV industry seems to be on track for posting healthy growth. Maruti Suzuki India and Hyundai Motor India, the top two players in the country, reported their best-ever domestic sales for the fiscal ended March 31, with growth of 11.5% and 15.1% respectively. Third in terms of market share and the largest UV maker in the country, Mahindra & Mahindra also reported a 6% rise in sales after two consecutive double-digit declines in the last two fiscals. As of February, the top three manufacturers constituted 72.61% share in the PV market. During FY 2014-15, the top three manufacturers in the country – Maruti Suzuki India, Hyundai Motor India and Mahindra & Mahindra –had sold a total of 1,815,338 units. In 2015-16, these manufacturers have sold 2,026,282 units, registering a YoY growth of 11.62%. A slew of product launches, softening interest rates and benign fuel prices played a big role in driving consumer demand for passenger vehicles throughout 2015-16. However, a challenging regulatory environment and fluctuating policy decisions during the last quarter of the fiscal did cap the overall growth potential for the industry.

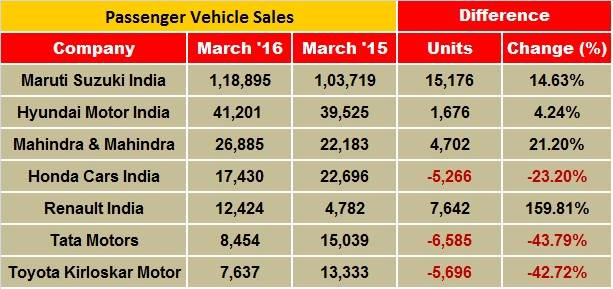

Here’s looking at how some PV makers fared in March 2016.

Maruti Suzuki India sold 118,895 units in March 2016, up 14.6% year on year (March 2015: 103,719) with new models like the Baleno and Vitara Brezza making their impact. While the entry level duo of the Alto and Wagon R sold 36,678 units, down 8.7 percent (March 2015: 40,159), the compact car quintet of the Swift, Ritz, Dzire, Celerio and Baleno sold 46,786 units, up 20.9 percent (March 2015: 38,710). Demand for the premium Ciaz sedan is on the rise, having sold 5,480 units, up 28.9 percent (March 2015: 4,251). Another solid contribution came from Maruti’s UVs – the Gypsy, S-Cross, Ertiga and Vitara Brezza – which together sold 13,894 units, up 123.4% YoY (March 2015: 6,218) – and also the Omni and Eeco vans, which sold 12,896 units, up 9.6 percent (March 2015: 11,768).

Also read: Surging Maruti Vitara Brezza demand leads to 5-month delivery time for top-end variant

With this, the company has ended 2015-16 with its highest-ever sales of 1,305,351 units, a growth of 11.5% YoY in the domestic market (2014-15: 1,170,702). Yet another high is that, for the fourth year in a row, the top four best-selling models in in the country are from Maruti cars: the Alto, Dzire, Swift and the Wagon R. On the export front too, the carmaker has notched its highest numbers yet: 123,897 units, up 1.8% (2014-15: 121,173).

Hyundai Motor India, which like Maruti, clocked its highest-ever financial year domestic sales of 484,324 units to notch 15.1 percent YoY growth and sold 41,201 units in March 2016, up 4.24 percent (March 2015: 39,525).

Commenting on the March numbers, Rakesh Srivastava, senior vice-president (Sales and Marketing), Hyundai Motor India, said, “For FY2015-16, Hyundai has achieved its all-time highest volume and highest-ever market share of over 17 percent thanks to the strong performance of models like the Creta, Elite i20 and Grand i10."

The Creta, launched in July 2015, became a true game-changer for the company in India and took the SUV market by storm. With average monthly sales of around 7,000 units, the Creta has been a regular feature among the top 10 most sold cars in the country throughout the year and established Hyundai as a force to reckon with in the fast growing SUV market in India.

Mahindra & Mahindra (M&M) seems to have found its mojo on the sales front. The company reported a 6 percent rise in total domestic passenger vehicle (PV) sales for 2015-16 to 236,307 units. This growth comes after two consecutive fiscals of double-digit decline for the automaker. In 2014-15, the company had sold 223,968 units in the domestic PV market with a dip of 11.94%, which was preceded by a decline of 18.14% in 2013-14, with sales of 254,344 units.

M&M reinvented its product strategy in 2015-16 by launching a total of nine new products and variants during the fiscal. This renewed strategy paid rich dividends for the company and strong market response for new products like the TUV300 and the KUV100 helped the automaker post positive numbers for the year. M&M had reported its best ever domestic PV sales in 2012-13, when the company sold 310,707 units with a growth of 26.46 percent. In March 2016, M&M’s passenger vehicles segment (which includes UVs, cars and vans) sold 26,885 units as against 22,183 units during March 2015, a growth of 21 percent.

Meanwhile, Honda Cars India recorded annual domestic sales of 192,059 units in 2015-16, a 2 percent growth over the previous fiscal (2014-15: 189,062). In March, the Japanese carmaker sold 17,430 units in March 2016, down 23.2 percent YoY (March 2015: 22,696). The City sedan was the best-seller with 5,662 units, followed by the Amaze (5,223), Jazz (3,683), Brio (2,158) and the Mobilio (610).

Commenting on the sales, Jnaneswar Sen, senior vice-president – Marketing & Sales, Honda Cars India, said, “2015-16 was an eventful and rewarding year for Honda Cars India and marks the fourth consecutive year of annual sales growth. The new fiscal year holds tremendous opportunity for our further growth as we will enhance our product line-up with the launch of new models and expand our dealer network. We are excited about the upcoming launch of the Honda BR-V which will mark our entry into a new product segment.”

Renault India registered a robust growth of 160 percent, albeit on a low base, with monthly domestic sales of 12,424 units in March 2016 (March 2015: 4,782). Driven by strong sales momentum of its new cars, the company cumulatively sold 29,289 units during January-March 2016 as against 11,404 units sold during the same period last year, posting a growth of 157%. The Kwid also made a comeback in the top 10 passenger vehicles in February with sales of 7,544 units. Further, the company has ramped up the production capacity at its Chennai plant to meet the growing demand for the product apart from expansion of its product, network and customer engagement.

Speaking on the company’s sales performance, Sumit Sawhney, country CEO and managing director, Renault India Operations, said, “Renault is one of the fastest growing automobile brand in India. In a short span of time, we have exponentially grown our reach in terms of sales and network expansion. In March 2016, we recorded our best ever sales figures in India, and we will continue to maintain this positive momentum as we strategically work towards increasing our market share in India.”

Tata Motors’ passenger vehicles division recorded sales of 8,454 units, a decline of 44 percent (March 2015: 15,039). Sales of the passenger cars in March 2016 were at 6,876 units lower by 47 percent over March 2015 sales, UV sales last month were lower by 23 percent at 1,578 units.

Toyota Kirloskar Motor sold a total of 7,637 units in the domestic market in March 2016, down 42 percent on the year-ago sales (March 2015: 13,333). The decline is reflective of the ban on registration of diesel vehicles in Delhi and NCR, one of the top sales markets for the carmaker in India. However, the Camry has notched 46 percent growth in 2015-2016 when compared to FY 2014-2015. More than 90 percent of this growth is attributed to the increasing acceptance of the Camry Hybrid in the Indian market.

According to N Raja, director and senior vice-pesident (Sales & Marketing), “The success of the Camry hybrid indicates the willingness of the market to accept alternative fuel technology like hybrid which not only benefits the environment but also conserves fuel. We would like to thank the government which has encouraged our efforts to promote hybrid technology in India. This includes the VAT reduction by the Delhi government in the recent Budget, which would give a further impetus to the growth of hybrid vehicles in India.

We also think a reduction in import duty will further encourage manufacturers to import hybrid cars in India through the CBU route which will therefore encourage more customers to consider hybrid cars as a purchase option.”

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Autocar Pro News Desk

By Autocar Pro News Desk

04 Apr 2016

04 Apr 2016

3854 Views

3854 Views