Festive month lights up two-wheeler OEMs' sales in October

The return of rural market demand, much-improved consumer sentiment and a rash of new models drive sales in the festive month of October.

If both the passenger vehicle OEMs and the three-month-in-a-decline M&HCV sector can post handsome gains in October 2016, the buoyant two-wheeler segment cannot be different. With a bountiful monsoon giving a new surge to rural market demand, most commuter motorcycle manufacturers have seen an uptick in their sales numbers. And, the scooter market is maintaining its accelerating act.

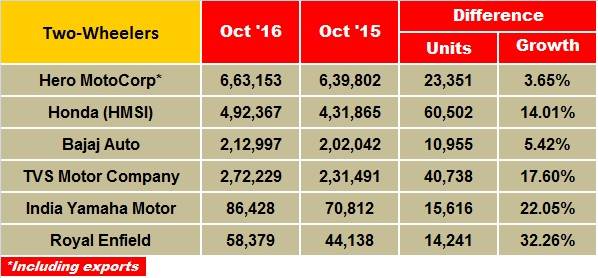

Two-wheeler majors continued to register impressive growth in October 2016 on the back of Navratri, Dhanteras and Diwali. While Hero MotoCorp, TVS Motor Company and Royal Enfield recorded their best monthly sales in October 2016, Honda Motorcycle & Scooter India (HMSI) packed a mean punch. However, Bajaj Auto and India Yamaha Motor registered a sub-par performance when compared to their sales in September 2016.

Hero MotoCorp, the largest two-wheeler manufacturer by volumes, recorded its best month with sales of 663,153 units (including exports) in October, growing 3.65 percent YoY (October 2015: 639,802). The company, which recorded its third consecutive month of over 600,000 sales, claims to have sold more than a million units during this year’s festive season even before the Dhanteras day (October 28, 2016). An official release says, “This has overall been a record festive season for Hero MotoCorp. With this performance, the company’s dealer inventories have come back to normal levels.”

Hero MotoCorp has now recorded five months of over 600,000 unit sales in the first 10 months of CY2016.

Honda Motorcycle & Scooter India (HMSI) recorded total despatches of 492,367 units (including exports) during October 2016, less than its domestic sales in September (539,473 units). The company, however, registered a growth of 9 percent YoY over October 2015 when it had sold 431,865 units.

Domestic sales stood at 470,488 units, which comprised 302,946 scooters and 167,542 motorcycles. It is interesting to note that Honda has now sold more than 300,000 scooters consecutively for four months including October 2016.

The company has also breached one million unit-sales mark during this year’s festive season (September and October) with total sales of close to 1,250,000 units. This includes a dominating contribution by its top two bestsellers – the Activa scooter with over 700,000 units and the 125cc CB Shine motorcycle with over 200,000 units.

Commenting on his company’s performance during the period, Keita Muramatsu, president and CEO, HMSI said; “To meet the overwhelming demand this festive season, we started our preparations almost six months ago. We have been consistently growing month-on-month this year. As a trend, automatic scooters are clearly driving the two-wheeler industry growth and with the new scooter-only plant in Gujarat (HMSI’s fourth plant in India) achieving peak production capacity in September, Honda strategically met festive demand with seamless dispatches over two months. This planning resulted in Honda’s record performance and we acquired more than a million customers in the two festive months. What is more encouraging is that we have added 260,000 customers only on the Dhanteras day.”

On the cumulative sales front, Honda has recorded an industry leading growth of 21 percent YoY between April-October 2016. “With advanced preparations, aggressive marketing, new additional network and ensuring availability of products right up to the last-mile network, Honda’s festive retails grew a phenomenal 25% to stand at 1,250,000 units in the festival. Moreover, Honda also closed its April to October 2016 YTD despatch with 21% growth which is nearly double that of the 12% industry growth,” said YS Guleria, senior vice-president (Sales & Marketing), HMSI.

The company has now sold more than three million units (3,301,297 units) during the April-October 2016 period. Notably, while Honda’s scooter sales surpassed sales of two million units during this time frame, its motorcycle sales too delivered sales of more than one million units.

HMSI’s YTD sales include sales of 2,101,168 scooters (26 percent growth YoY) and 1,042,301 motorcycles (12 percent growth YoY) in seven months.

TVS Motor Company, the third largest OEM in the two-wheeler industry, sold 272,229 units last month, up 17.6 percent YoY (October 2015: 231,491). The company, which sells scooters, motorcycles and mopeds, sold 121,550 motorcycles (up by 14.48 percent YoY) and 92,417 scooters (up by 1.08 percent YoY) in October 2016, with both numbers including export business.

The 110cc Victor commuter motorcycle, which was launched in Q1 CY2016, has contributed impressive numbers to overall motorcycle sales. The Victor, which primarily competes with Honda’s Dream series and Livo, Hero’s Splendor iSmart 110 and Yamaha’s Saluto RX, has cumulatively sold more than 100,000 units within eight months of its rollout.

Bajaj Auto, the No. 4 player, despatched 212,997 motorcycles in October 2016, up by 5.42 percent YoY (October 2015: 202,042). This is slightly below its domestic performance in September 2016 when it recorded sales of 230,502 units.

Although the company is expected to roll out its 375cc model under an all-new brand later this month, it now has the Avenger and V as independent marques that are already garnering respectable monthly sales besides the popular Pulsar line-up.

The company expects to lure existing as well as new buyers of the mass (100cc) and executive (125cc) commuter motorcycle segments to the bigger 150cc and 180cc displacement categories by offering value-for-money models. The 150cc Avenger 150 and V15 are examples of this strategy. The company continues to dominate the 150cc-200cc motorcycle category in the Indian two-wheeler market.

On the year-to-date (YTD) front, although the exports have remained a sore area for Bajaj Auto, the domestic despatches have recorded an impressive 16 percent YoY growth. The company had sold 1,341,422 motorcycles during the April-October 2016 period as against 11,57,190 motorcycles sold during April-October 2015.

India Yamaha Motor reported sales of 86,428 units in October, up by 22.05 percent YoY (October 2015: 70,812). The company, however, scored relatively lower than its September 2016 sales, which stood at 89,423 units. The two festive months put together have delivered very good results for the company, which registered over 100,000 unit sales (including exports) for both the months for the first time ever.

Commenting on the monthly performance, Roy Kurian, vice-president (Sales & Marketing), Yamaha Motor India Sales, said: “October started with a positive sentiment for the two-wheeler industry. We continue to build on the growth momentum by reaching 86,428 units of sale during this festive season. Additionally, the good monsoon has also added growth to sales. Yamaha has received a fantastic response for its line-up of scooters like the Fascino, Cygnus Alpha (disc brake variant) and newly introduced Cygnus Ray-ZR.”

Burgeoning demand for scooter models and the 150cc FZ series comprise major volumes for Yamaha. The company is targeting a million unit sales in CY2017 and according to company officials plans to aggressively expand its all-India distribution network. Interestingly, Yamaha has silently rolled out its three-cylinder, 847cc naked MT-09 over the previous months. The model, which Yamaha globally positions as a lightweight midsize motorcycle, was earlier unveiled during the Auto Expo in February 2016. According to the company, it took a few months to have the model cleared by the authorities for commercial sales in the domestic market. Nonetheless, powered by robust growth, scooters remain the focus area for the company for the remaining part of the year.

Royal Enfield reported domestic sales of 58,379 motorcycles in October 2016, marking its highest ever for any month. The company registered YoY growth of 32.26 percent, reiterating the fast-moving brand’s resurgence in the market. It had sold 44,138 units in October last year. Royal Enfield’s September sales stood at 56,958 units in the domestic market.

On the other hand, RE exports almost doubled for the last month at 748 units. The company had exported 384 units in October 2015. Beating growth estimations, Royal Enfield has now neared monthly despatches of close to 60,000 units. These volumes were earlier forecasted for February-March 2017 period by the company officials. Meanwhile, Royal Enfield continues to expand its production capacity to cater to the exploding demand.

Additionally, selectively expanding its global footprint, it has now reportedly opened three retail stores in Spain with footprints in Barcelona and Valencia.

Recommended: Detailed India Sales Analysis for October 2016

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

By Amit Panday

By Amit Panday

03 Nov 2016

03 Nov 2016

11201 Views

11201 Views