Maruti, Tata and Honda post robust PV sales in a mixed-bag December

Surging customer demand for SUVs drives gains for these three players even as Hyundai Motor India and M&M feel the pressure of slowing sales. Nevertheless, industry seems set to notch record sales in FY2018.

As passenger vehicle (PV) manufacturers release their sales numbers for December 2017, it’s amply clear that the industry is pointedly driving towards record sales in the fiscal year 2017-18. Providing the charge is the country’s largest carmaker Maruti Suzuki India, which is also the bellwether for the industry.

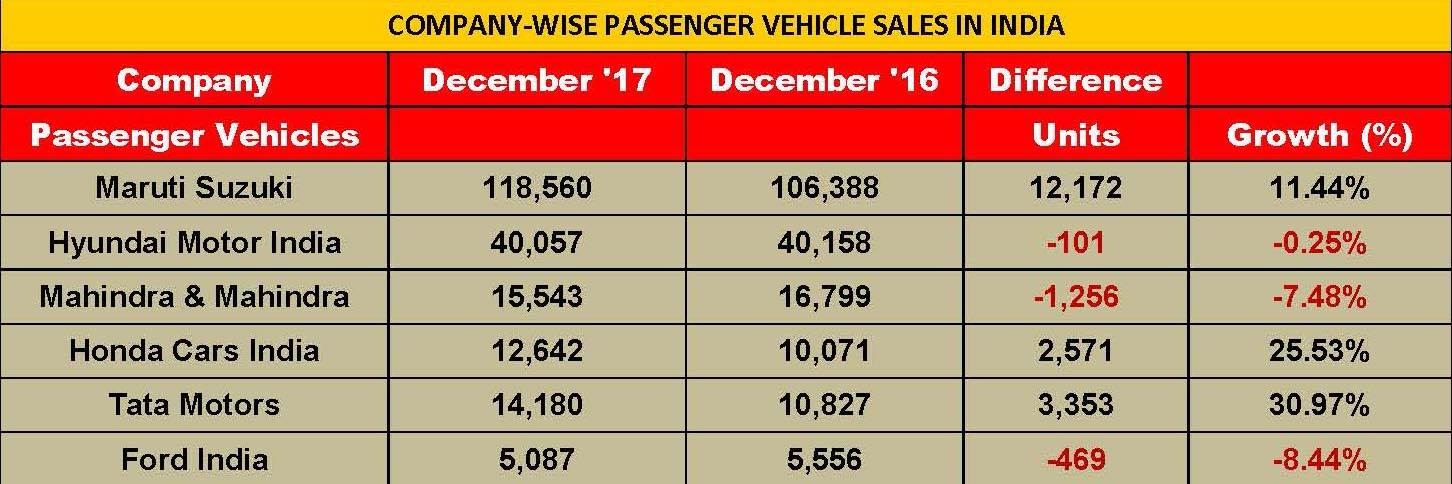

Maruti Suzuki India sold 118,560 units (+11.4%), compared to 106,388 units a year ago. With total sales (domestic and exports) between April-December 2017 totalling 1,317,801 units, a year-on-year growth of 14.2 percent (April-December 2016: 1,154,164), the carmaker is 250,802 units short of crossing its best-ever fiscal sales of 1,568,603 units achieved in FY2018. With three months left to go in FY2018 and given the current pace of its sales, Maruti should drive past this number with ease.

As is known, the company is gunning for 2 million sales annually by the year 2020. And it has 2.5 million sales in its crosshairs by FY2023. In an interview to Autocar Professional last month, Kenichi Ayukawa, MD and CEO of Maruti Suzuki India, said: "We are making good progress to our goal of 2 million annual sales in 2020. We are committed to double-digit growth. There are always challenges in business but I am confident we are on course." (The full interview is published in the December 15, 2017 issue of the magazine).

Let’s take a closer look at how the company fared in the domestic market in December 2017. Sales for the entry-level hatchback duo of the Alto and Wagon R, which sold 32,146 units point to slow growth of 2 percent (December 2016: 31,527). Acting as a strong buffer is the quintet of compact cars (Swift, Celerio, Ignis, Baleno and Dzire) and utility vehicles (Gypsy, Ertiga, S-Cross and Vitara Brezza) which continue to beef up overall numbers. At 53,336 units sold (December 2016: 43,295), the five cars posted 23.2 percnet YoY growth albeit much less than November 2017’s 32.4 percent growth. UVs, due to the overwhelming demand for the Vitara Brezza, sold 19,276 units, up 19.9 percent (December 2016: 16,072).

If there is a growing concern for Maruti, then it would the declining sales of the Ciaz premium sedan. In November 2017, the Ciaz sold a total of 4,009 units, down a sizeable 26.2 percent (November 2016: 5,443). In December 2017, Ciaz sales have fallen even lower to 2,382 units, down 35.8 percent (December 2016: 3,711) Bringing up the rear are the two vans, the Omni and the Eeco which together sold 11,420 units, up 23.8 percent (December 2016: 9,224).

Compared to Maruti’s strong show, Hyundai Motor India saw flat growth and closed December 2017 with sales of 40,057 units (December 2016: 40,158). The sales are on account of demand for its hatchbacks, including the Grand i10, Elite i20, the Creta crossover and the Verna sedan. The new Verna, since its launch in August 2017, has cumulatively sold 19,285 and contributed to enhancing the company’s midsize sedan segment share by 30 percent. Hyundai registered its best ever domestic sales in the calendar year and sold a total of 527,320 units between January-December 2017, with a growth of 5.4 percent (January-December 2016: 500,304).

According to YK Koo, MD and CEO, Hyundai Motor India, “CY2017 has been a year of performance for Hyundai Motor India, surpassing its business plan of 2017, registering the highest-ever domestic volume of 527,320 units, posting growth of 5.4 percent on the back of strong performance of the newly launched Verna sedan, along with the Grand i10, Elite i20 and the Creta. The positive momentum in urban and rural retail sales supported with strong aftersales service and low cost of ownership has helped gain customer confidence.”

Home-grown UV specialist, Mahindra & Mahindra (M&M) registered PV sales of 15,543 units in December, recording a decline of 7.47 percent (December 2016: 16,799). The company sold a total of 14,514 UVs in December 2017, a 9 percent de-growth (December 2016: 15,957). On the other hand, its passenger cars including the KUV100, Verito and the Verito Vibe sold 1,029 units in total, posting 22 percent growth (December 2016: 842).

Japanese automaker Honda Cars India witnessed good sales in December and sold 12,642 units in the domestic market, registering positive growth of 26 percent (December 2016: 10,071). The City sedan and the WR-V crossover continue to be the shining stars for the company in CY2017, selling 4,365 units and 3,760 units respectively in December, with the WR-V also cumulatively garnering 29,011 units in nine months since its launch earlier in the year in March. The Brio hatchback continues to remain a slow seller and went home to only 291 buyers, while the Jazz hatchback (1,891), Amaze (1,415), BR-V (880) and the sole petrol offering in the mid-size premium SUV space, the Honda CR-V (40), together form the remainder sales for the company.

Commenting on the performance, Yoichiro Ueno, president and CEO, Honda Cars India, said, “2017 has been a milestone year for Honda Cars in India, as our best-seller Honda City completes two decades of success in India. The Honda City has emerged as the highest selling midsize sedan during 2017.

Tata Motors registered total PV sales of 14,180 units, recording notable 31 percent growth (December 2016: 10,827). The numbers are its highest ever wholesale sales in the last month of a calendar year, since CY2012. The popularity of its Tiago hatchback and the recently introduced Nexon compact SUV has also led the retail sales to be the highest ever in the last six years. Strong customer demand for crossovers and SUVs has led to Tata’s UV offerings including the Hexa, Safari Storme and the Nexon help augment its UV segment sales by 406 percent in December (albeit on a low year-ago base). Its cumulative sales for the first nine months of FY2018 between April-December stood at 129,229 units (April-December 2016: 112,539), posting growth of 15 percent.

According to Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, “We are happy to start the new year with a strong growth momentum. With a growth of 31 percent in December 2017, we have recorded highest ever December sales since 2012, backed by our robust portfolio of new-generation products like Tiago, Hexa, Tigor and Nexon. In December 2017, while total bookings were highest since 2012, retail sales grew 74 percent over last year – the highest since December 2011. The new year holds tremendous opportunity and we remain committed to turn around the business."

RELATED ARTICLES

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

Hyundai and Kia partner Exide Energy to produce LFP batteries in India

Partnership with Exide Energy enables Hyundai Motor and Kia to equip future EVs in the Indian market with locally produc...

02 Jan 2018

02 Jan 2018

6017 Views

6017 Views

Autocar Pro News Desk

Autocar Pro News Desk