Mahindra & Mahindra maintains leadership position in pick-up segment in April-July

Mahindra & Mahindra (M&M) commands a 71.75 percent of this segment alone in first four months of this fiscal (April-July 2015) with products like the (now-discontinued) Genio, Bolero Maxi Truck and Bolero Camper.

Mahindra & Mahindra (M&M) is keeping its leadership position strongly in the largest LCV goods carrier (2- to 3.5 tonne pick-up) category by volumes. The company commands a 71.75 percent of this segment alone in first four months of this fiscal (April-July 2015) with products like the (now-discontinued) Genio, Bolero Maxi Truck and Bolero Camper.

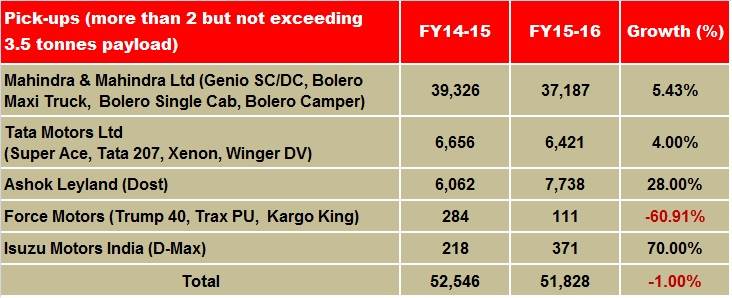

M&M sold a total of 37,187 units during the four months as against 39,326 units sold in April-July 2014, a YoY fall of 5.43 percent. This can be due to the consistent decline in the overall LCV segment due to overcapacity in the market and unavailability of finance.

In FY14-15, with total sales of 127,755 units in the 2- to 3.5 tonne pick-up category, M&M’s market share stood at 73.25 percent. For the same fiscal, the domestic market size for the stood at 177,134 units. So despite the overall fall in the category, M&M continues to dominate the category with a higher market share.

During April-July 2015, the company sold a total of 47,621 commercial vehicles, a decline of less than one percent (April-July 2014: 47,930).

Ashok Leyland which has a single product in this category – the Dost small CV designed for a payload of 1.25 tonnes –sold 7,738 units, a YoY growth of 27.64 percent.

Tata Motors, which has a range of products in this category like the Super Ace, Tata 207, Xenon and Winger, registered total sales of 6,421 units in April-July 2015 against 6,656 units it sold April-July 2014, a dip of 3.5 percent YoY.

Tata Motors, in a bid to boost its market share in this category, launched the Super Ace Mint in March this year. The company has had a product in this vehicle category. The Super Ace is powered by the 1.4-litre DICOR common-rail BS IV engine with 1.25 tonne payload. Its successful Ace SCVs are sub-1-tonne payload carriers.

LCV market growing, albeit slowly

The overall LCV segment has been down over the past two fiscals. During FY13-14, sales slid 17.60 % to 432,000 units and by 11.57% to 382,206 units. For the April-July 2015 period, total LCV sales are 114,415 units, down 5.23 % YoY. This is indicative of the rate of decline slowing down.

With the M&HCV segment posting growth for the past 12 months, it is expected the improved market sentiment will help the overall LCV segment to turn positive over the next 8-10 months.

Meanwhile, M&M has recently strengthed its presence in the segment with launch of its new small commercial Jeeto replacing the Gio to boost the last mile distribution. With 8 difference variants, 2 engine options and 3 decks is targeted at sub one tonne segment most notably the Tata Ace.

RELATED ARTICLES

Tata Elxsi-Renesas MCU for EVs enables cost optimisation, speedier time to market

Modular, scalable design of Motor Control Unit enables integration across diverse EV applications. Claimed to be reduce ...

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

24 Aug 2015

24 Aug 2015

11372 Views

11372 Views

Autocar Pro News Desk

Autocar Pro News Desk