Indian CV OEMs defend turf as global players drive in

The well-entrenched Tata Motors, Ashok Leyland and Mahindra & Mahindra continue to maintain their dominance even as the overall CV domestic market has expanded.

Despite global commercial vehicle majors like Volvo, Scania and Daimler planning and implementing aggressive manufacturing operations in India over the past few years, Indian CV manufacturers are proving a tough nut to crack. The well-entrenched Tata Motors, Ashok Leyland and Mahindra & Mahindra continue to maintain their dominance even as the overall CV domestic market has expanded.

Strong brand equity with fleet operators, a well-established product portfolio and a widespread servicing network have been the key reasons for the dominance of Indian OEMs in the commercial vehicle market.

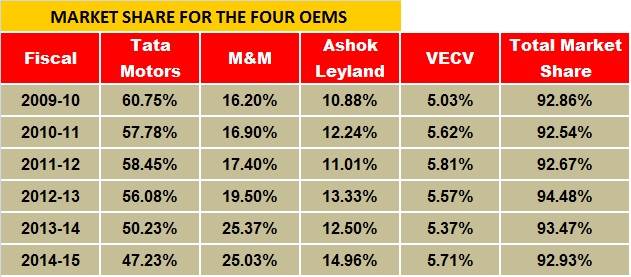

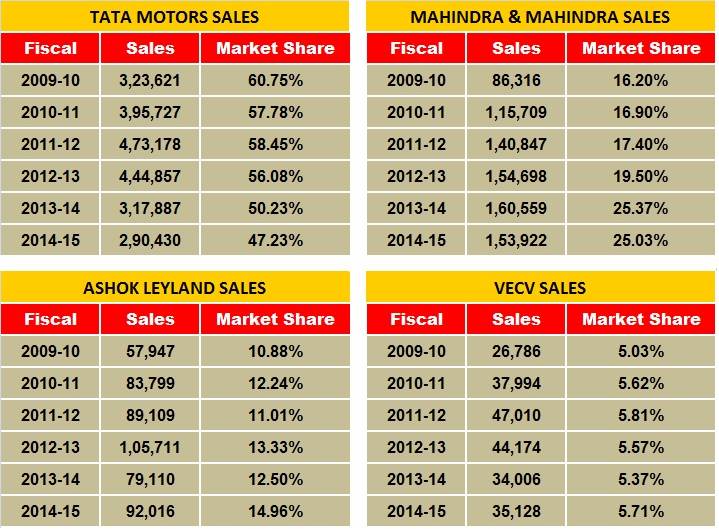

According to industry data available with Autocar Professional, the four largest OEMs in India –Tata Motors, Mahindra & Mahindra, Ashok Leyland and Volvo Eicher— account for an overwhelming 93% of the total commercial vehicle sales in the country.

HOW THE DOMESTIC PLAYERS FARE

Of the domestic players, market leader Tata Motors has commanded a share of over 50% for most of the last decade. However, with other domestic players driving new gains in recent years, the company’s share has fallen from 60.75% in 2009-10 to an all-time low of 47.23% in 2014-15.

In what many would consider as a strong growth story, Mahindra & Mahindra’s efforts to be a big name in the commercial vehicle industry have paid rich dividends. From a market share of 16.20% in 2009-10, it has captured a handsome 25.03% at the end of 2014-15, to claim the second spot in the overall CV market.

Chennai-based Ashok Leyland, which has given tough competition to market leader Tata Motors in the M&HCV segment, has maintained its third position and from a share of 10.88% in 2009-10, the company has managed to capture 14.96% share in the domestic market in 2014-15.

VE Commercial Vehicles, which sells trucks and buses in India under the Eicher brand, has also maintained its position. From a market share of 5.03% in 2009-10, the company has secured the fourth spot with a 5.71% share in 2014-15.

At present, the Indian commercial vehicle industry is witnessing a transformation across the spectrum. With fleet owners increasingly looking at total cost of ownership, fuel efficiency, improved safety driving and faster turnaround times, sales of modern CVs are picking up. While the M&HCV sector has seen continued growth since the past 12 months, growth is gradually albeit slowly filtering into the lesser priced light commercial vehicle segment, which is ubiquitously used for last-mile transportation.

Nevertheless, the entry of global CV giants like Volvo, Scania and Daimler is having its impact on domestic manufacturers who are increasingly looking to improve vehicle dynamics and even increased driver comfort through ergonomic cabins. Across the board safety is also being accorded greater importance than it was ever before while dealer facilities are being beefed up to provide a satisfying aftersales experience.

Mandatory ABS fitment to pep up sales

With the government mandating fitment of anti-lock braking systems (ABS) and speed limiters for all new commercial vehicles from October 1 this year, it is expected that most fleet operators will advance their purchases to August and September.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

By Shourya Harwani

By Shourya Harwani

14 Aug 2015

14 Aug 2015

7366 Views

7366 Views