Indian carmakers with new models see good growth in February

The February 2016 sales numbers are out and carmakers with new models in their stable have benefited the most as consumers look to purchase a new set of wheels.

The February 2016 sales numbers are out and carmakers with new models in their stable have benefited the most as consumers look to purchase a new set of wheels.

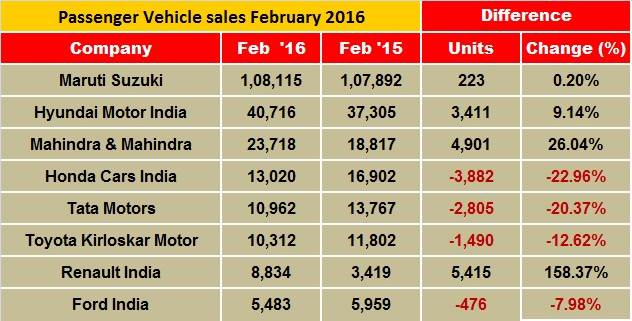

Maruti Suzuki India, the country’s largest carmaker, sold a total of 108,115 units in the domestic market, which constitutes only 0.2% year-on-year growth (February 2015: 107,892). It also exported 9,336 units last month which is a decline of 12.4% YoY (February 2015: 10,659). February 2016 saw the company’s production at the Gurgaon and Manesar plants disrupted by the reservation agitation, causing a temporary suspension of production. The company says total production loss due to this issue was over 10,000 units.

Saving the blushes for Maruti were sales of its utility vehicles and vans. While UVs (Gyosy, Ertiga, S-Cross) sold 8,484 units to notch 44.7% YoY growth (February 2015: 5,863), the vans (Moni and Eeco) sold 12,482 units, up 10.5% (February 2015:11,301). While the bread-and-butter entry level Alto and Wagon R hatchbacks sold 35,495 units, down 11.2% YoY (February 2015: 39,988), the compact car quintet of the Swift, Ritz, Dzire, Celerio and Baleno sold 42,970 units, up 0.4% (February 2015: 42,778). The premium Ciaz sold 5,162 units, down 4.6% (February 2015: 5,410).

With the Union Budget 2016 imposing an infrastructure cess of 1% on small (not over 4 metres long and engine capacity not exceeding 1200cc) petrol, CNG and LPG-powered cars; 2.5% on diesel-engined cars (not over 4 metres long and not exceeding 1500cc); and 4% on higher-engine capacity (read above 1.5 litre), SUVs and bigger sedans (read above 4-metres long), Maruti Suzuki India is among the carmakers which will feel the pressure of slowing sales in the coming year.

Hyundai Motor India registered domestic sales of 40,716 units in February 2016 (February 2015: 37,305), a YoY growth of 9.1 percent. Commenting on the February sales, Rakesh Srivastava, senior vice-president (Sales & Marketing), Hyundai Motor India, said, “Hyundai’s domestic sales grew by 9.1% on the strength of strong performance of the Creta, Elite i20 and Grand despite logistic challenges of transportation of vehicles to North India and loss of many business days of dealership operations across Haryana.”

Mahindra & Mahindra (M&M) has done well last month. Sales of its Passenger Vehicles segment (which includes UVs, cars and vans) comprised 23,718 units in February 2016 (February 2015: 18,817), a growth of 26 percent. Growing demand for Mahindra’s new models like the TUV300 and KUV100 have helped give a fillip to overall sales even as warhorses Scorpio and Bolero continue to provide the buffer with consistent demand.

According to Pravin Shah, president & chief executive (Automotive), M&M, “At Mahindra we are happy to have achieved an overall growth of 16% during February 2016 on the back of strong performance by our range of passenger and commercial vehicles. The imposition of an infrastructure cess of 1-4% for passenger vehicles, as announced in the Union Budget, would increase prices of automotive products immediately. An increasing number of duties levied on automobiles is a cause of concern and we see the need for GST sooner than later. However we need to take it positively, in view of the strong emphasis laid on rural, agri and infrastructure plans for sound, sustainable and inclusive growth in the economy and to spur the much-needed demand."

Meanwhile, Honda Cars India saw its sales declined 22.96% last month. The Japanese carmaker sold a total of 13,020 units in the domestic market (February 2015:16,902). Its best-seller for the month was the popular City sedan with 4,880 units, followed by the Amaze (4,069), Jazz (3,365), Brio (399), Mobilio (226) and the CR-V (81).

Cumulative sales for the April 2015-February 2016 period are 174,629 units, which point to a YoY growth of 5% (April 2014-February 2015: 166,366).

Toyota Kirloskar Motor sold 10,312 units in the domestic market last month, a decline of 12.62% YoY (February 2015: 11,802) growth. The carmaker says the Camry has seen an over 100% growth compared to sales in February 2015, with almost 90% attributed to the Camry Hybrid.

Commenting on the monthly sales, N Raja, director and senior vice-president (Sales & Marketing), Toyota Kirloskar Motor, said, “Our monthly sales for February have picked up when compared to January 2016. However, the ban on registration of diesel vehicles in Delhi and NCR still continues to affect our sales as the Delhi and NCR market constitutes 8-10% of our market share which comprises of both the Innova and Fortuner. Moreover, the unrest in Haryana has further impacted our business in that region with dealerships being closed for more than a week.”

Tata Motors’ passenger vehicles sales at 10,962 units were a decline of 20.37% (February 2015: 13,767). According to the company, sales of passenger cars were lower by 21% at 9,284 units (February 2015: 11,805) and UV sales declined by 14% at 1,678 units. For the 11-month period of April 2015-February 2016, cumulative sales of all passenger vehicles in the domestic market comprise 118,080 units, lower by 1% over the previous year.

Renault India has registered domestic sales of 8,834 units in February 2016 as against 3,401 units in February 2015, recording a robust growth of 158 percent. The sharp increase is thanks to the game-changing Kwid. The Kwid, Autocar India’s Car of the Year 2016, continues to drive Renault’s expansion plans in India with customer orders crossing the 100,000 mark. The company has ramped up the production capacity at its Chennai plant to meet the growing demand for the product apart from expansion of its product, network and customer engagement. Renault has also substantially increased its sales and service network reach in India, from 14 sales and service facilities in mid-2011 to 205 currently, and is targeting to reach 240 facilities by the end of this year.

Ford India sold a total of 5,483 vehicles, down 7.98% YoY (February 2015: 5,959). Anurag Mehrotra, executive director (Marketing, Sales and Service), said: “The Indian automotive industry continues to deal with weak consumer demand as witnessed by increasing levels of discounting in the market. The Union Budget should deliver on driving rural growth and infrastructure development. However, it lacks a clear roadmap for the automotive sector, which has for long been an engine of India's economic growth. Having said that, we continue to stay committed to our transformation plan which is based on product led innovation, communicating our strong cost of ownership proposition and delivering a differentiated customer experience.”

Recommended: INDIA SALES ANALYSIS -- FEBRUARY 2016

RELATED ARTICLES

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which has invested ...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

Kia Carens gets 3-star Global NCAP rating in fresh tests

The Carens MPV, which was tested twice under the new protocol, scored zero stars for adult occupancy in the first test.

By Autocar Pro News Desk

By Autocar Pro News Desk

01 Mar 2016

01 Mar 2016

3365 Views

3365 Views