INDIA SALES ANALYSIS: FY2014-15

Riding on the back of a gradual uplift in market sentiments, excise duty cuts continuing through to December 2014 and the opening up of the mining and infrastructure sectors,

The Indian automobile industry is finally seeing an uptick in sales. FY2014-15 numbers reveal all vehicle categories other than CVs are in positive territory and passenger car sales have returned to the black after three years.

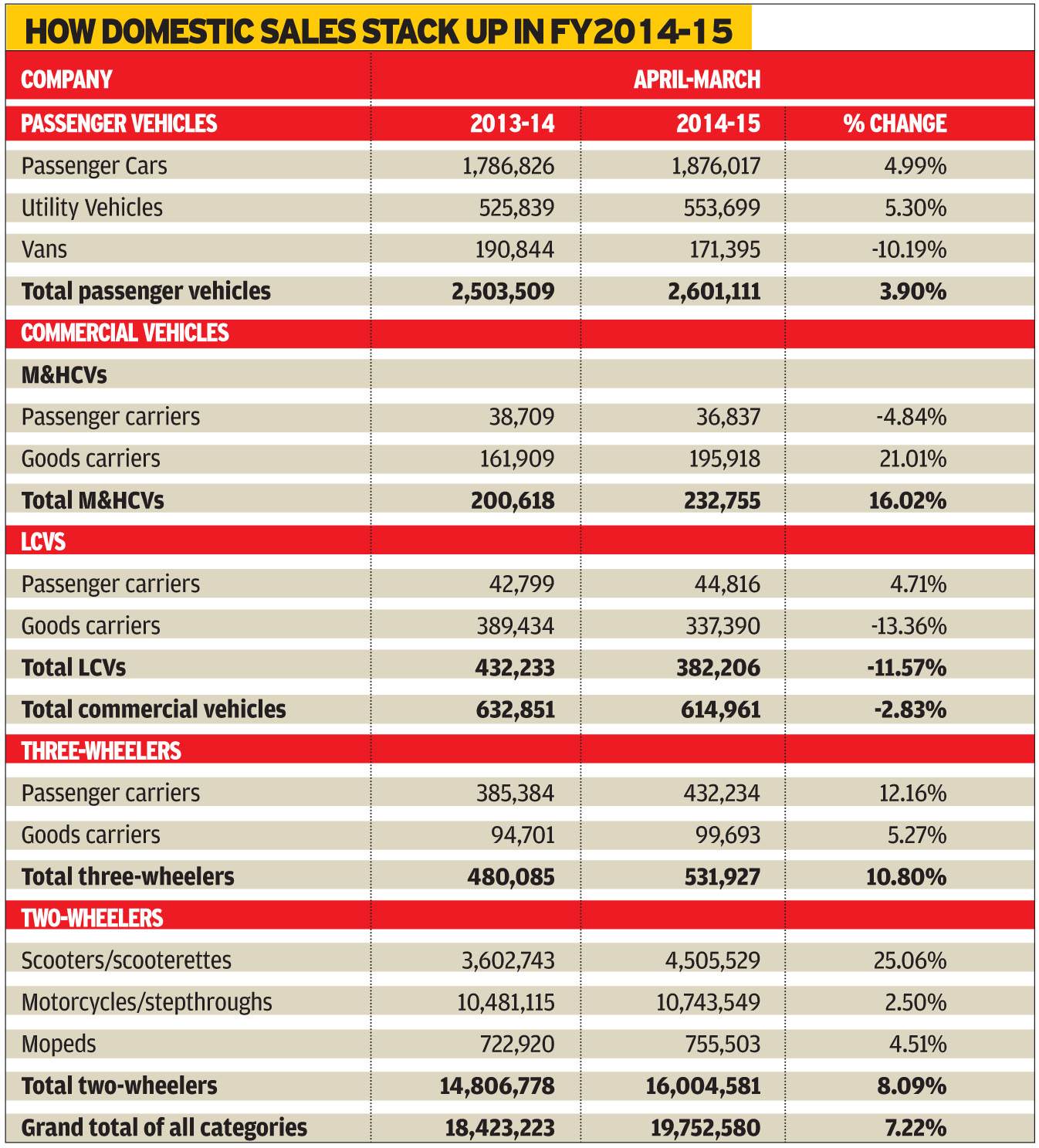

Riding on the back of a gradual uplift in market sentiments, excise duty cuts continuing through to December 2014 and the opening up of the mining and infrastructure sectors, the Indian automotive industry posted an overall growth of 7.22 percent in fiscal year April 2014-March 2015, marking an improved performance over the previous fiscal. FY2013-14 had seen growth of 3.53 percent, mainly due to a good performance by the two-wheeler sector.

The crucial passenger car sector has posted an increase of 4.99 percent with sales of 1,876,017 units, marking the return of growth to the sector. Car sales were down 7.74 percent in 2012-13 and 4.65 percent in 2013-14. In 2011-12 carmakers had seen growth of 2.96 percent and highest-ever sales of 2,031,306 units.

As per the vehicle sales data revealed by apex industry body Society of Automobile Manufacturers (SIAM) today, FY2014-15 has shown marked improvement across all vehicle categories except for commercial vehicles (which are gradually moving into positive territory).

Double-digit growth two years away

The forecast for 2015-16 is similar or marginally better outlook albeit double-digit growth might still remain elusive, according to S Sandilya, past president, SIAM and Group chairman of Eicher Motors (seen above with Sugato Sen, deputy director-general, SIAM, and Vishnu Mathur, director-general, SIAM).

With the government’s ‘Make in India’ initiative boosting manufacturing and moderate growth in GDP (estimated to be 7.95 percent during the current fiscal) spurring industry, commodity prices under control and growth in industrial activity visible – all being indicators of a positive outlook – the Indian auto sector is set for a better ride this fiscal.

Sandilya is of the view that buoyancy in the industry and a return to the former 2011-12 highs will be witnessed only after another two years though the industry will show significant improvement over this period.

In FY2014-15, passenger car and utility vehicle sales were up 4.99 percent and 5.30 percent respectively, pushing overall passenger vehicle sales up 3.90 percent. Van numbers however dipped 10.19 percent. In FY2013-14, PVs had declined 6.05 percent and all three segments – cars, UVs and vans – had seen a downturn.

The overall CV sector’s numbers are down in FY2014-15 mainly due to a below-par performance by LCVs, which de-grew 11.57 percent and pulled down CV sales by 2.83 percent year on year.

In 2013-14, the CV segment fell sharply by 20.23 percent with M&HCVs sliding 25.33 percent and LCVs by 17.62 percent. In 2014-15, M&HCVs have grown 16.02 percent due to revival of construction and roadbuilding activities as well as mining activities.

Slackening rural demand hits hard

“The rural demand is not there due to which motorcycles, tractors and LCVs, which are mostly used in this region, have not done well. Unseasonal rainfall has put pressure on food prices and continuation of high interest rates for vehicles has kept the rural buyer away from the markets,” added Sandilya.

However, sales of three-wheelers are up 10.80 percent with passenger carriers and goods carriers growing 12.16 percent and 5.27 percent.

The two-wheeler industry continues to do well. The overall segment grew 8.09 percent, which notched 25.06 percent growth while motorcycles grew marginally at 2.50 percent; mopeds grew 4.51 percent in 2014-15.

In comparison, in FY2013-14, two-wheelers saw 7.31 percent growth with scooter sales up 23.24 percent, bikes at 3.91 percent and mopeds down 8.35 percent.

According to Sandilya, implementation of infrastructure and mining projects at the ground level will fast-track growth in the Indian automobile sector. Vehicle rates are still high though it is expected that the Reserve Bank of India will cut the repo rate by another 50 basis points that will make funds more affordable. The rollback of excise incentives from April 1, 2015, has affected demand but an increased pace of launches of new models across vehicle categories should see consumers returning to showrooms. (2014-15 saw 37 variants, 26 refreshes and 27 new models being launched).Another positive for the auto sector has been the slide in global crude oil prices.

“If the GDP grows between 8-9 percent, demand for M&HCVs and motorcycles will pick up. The second half of this fiscal year will see an improvement. A further jump in economic growth and at least 1-2 percent increase in GDP will be witnessed with the enforcement of GST from 1 April 2016. All the indications are positive for 2015-16,” he concluded.

Vehicle exports up 15%

In April-March 2015 overall auto exports have also risen 14.89 percent with PVs, CVs, three-wheelers and two-wheelers up 4.42 percent, 11.33 percent, 15.44 percent and 17.93 percent respectively. This performance is much higher than the shipments in FY2013-14 where overall growth was 7.21 percent.

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

10 Apr 2015

10 Apr 2015

24017 Views

24017 Views

Autocar Pro News Desk

Autocar Pro News Desk