Indian components industry turnover down but headed for speedy growth

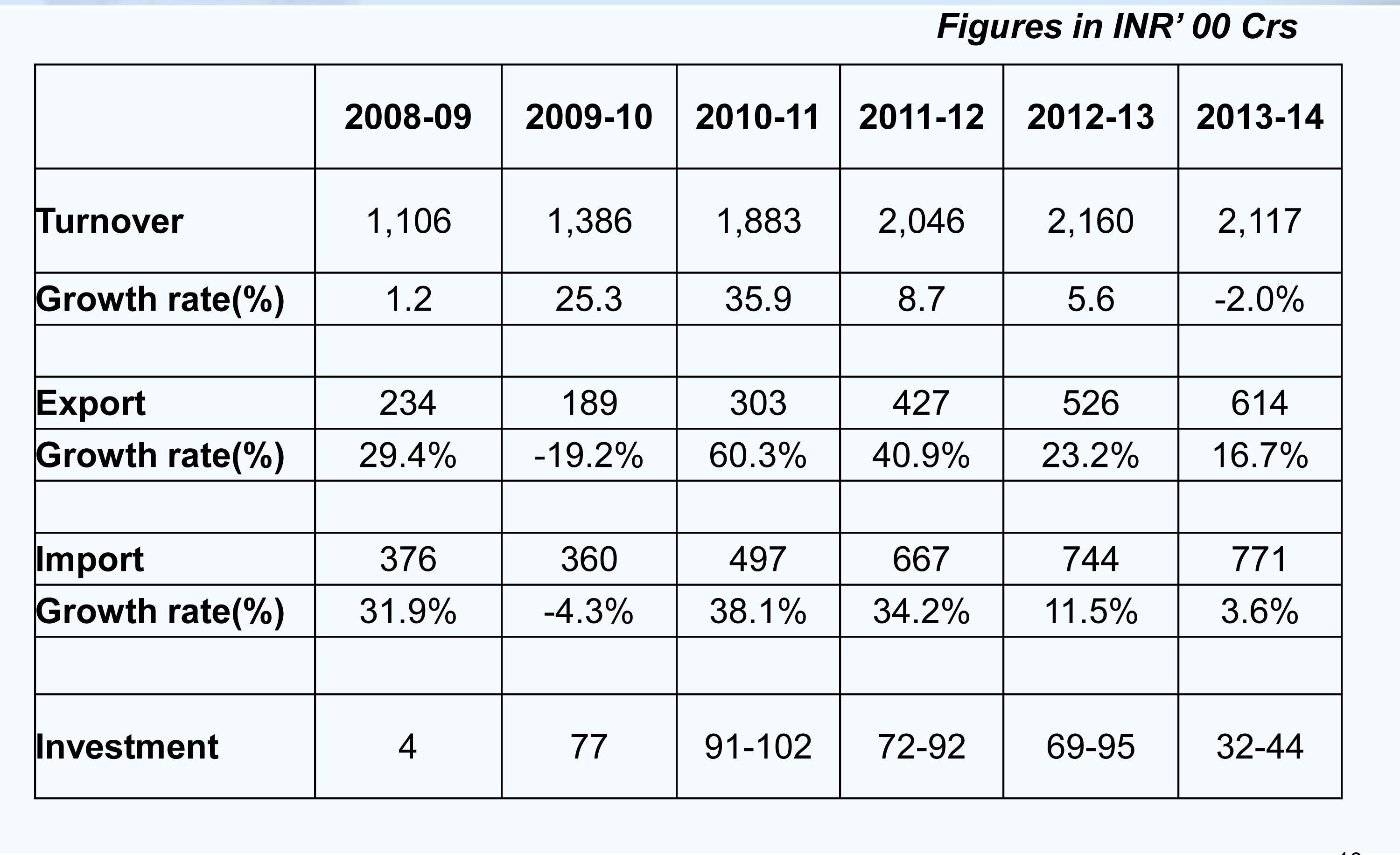

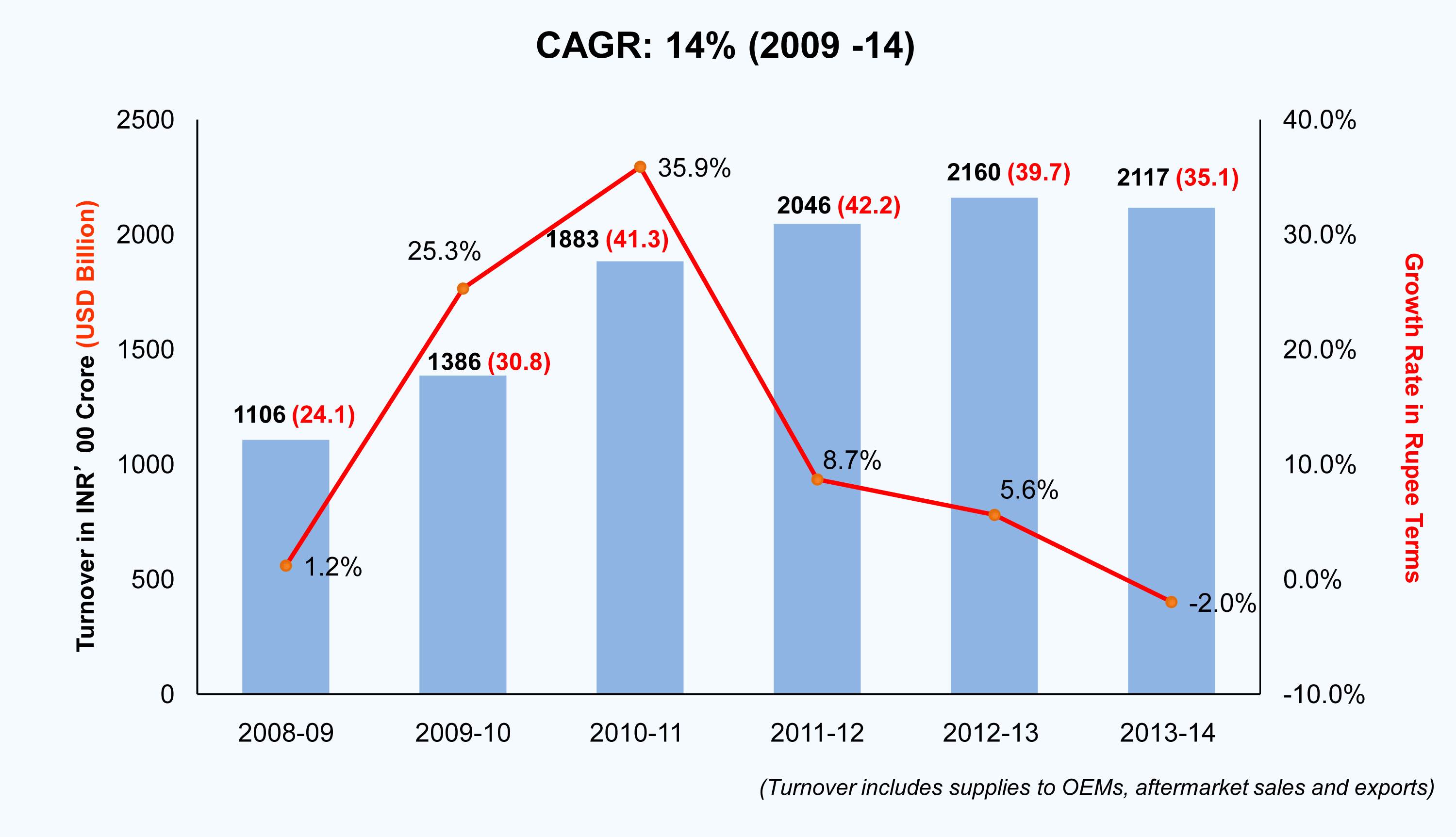

The turnover of the Indian auto component industry has recorded a decline of 2 percent in 2013-14 to Rs 211,765 crore.

The turnover of the Indian auto component industry has recorded a decline of 2 percent in 2013-14 to Rs 211,765 crore. The EBITDA (earnings before interest, taxes, depreciation, and amortisation) margins of about 100 listed component companies is also down from 12-10 percent. This was revealed at a media meet of the Automotive Component Manufacturers Association of India (ACMA) in New Delhi today to detail the performance of the component sector in the past fiscal.

Exports have shown a growth of 16.7 percent to Rs 61,487 crore from Rs 52,690 crore in 2012-13 and imports by 3.6 percent. The sector has recorded a CAGR (compounded annual growth rate) of 14 percent over the past six years. This data is inclusive of the industry’s supplies to the on-road and off-road vehicle manufacturers as well as the aftermarket, both domestic and overseas, from ACMA member and non-member companies.

Speaking at the event, Harish Lakshman, president, ACMA, said, “The last fiscal has been one of the most challenging for the automotive industry in India – flagging vehicle sales, high capital costs, high interest rates, currency fluctuations and slowing down of investment in manufacturing have adversely impacted the growth of the auto component industry. However, with the automotive sector being a key driver of the economy and growth returning to vehicle consumption in the last couple of months, we expect the component industry to grow in the range of 4-6 percent in the current fiscal (2014-15).”

Lakshman underlined the need for collaboration between component manufacturers, OEMs, machine tool suppliers and the raw material industry to achieve a robust component base in the country.

“While we are confident of the medium- to long-term prospects of the auto component sector, to tide over the industry’s cyclicity and minimise risk, the component industry needs to consciously consider diversifying into adjacent markets including defence, aerospace and railways,” he added.

Nevertheless, he remains very confident of the Indian auto component sector’s growth potential. In an exclusive interview to Autocar Professional, he said: “I am extremely optimistic from a five-to-10-year perspective as India will be the fastest growing automotive market, even faster than China. The question is how soon will the revival happen. That will depend on the fundamentals of the economy. Internationally, while the growth rates are much slower at a global level, India’s ability to get more business from Europe and the US is increasing because of our competitiveness and quality. So hopefully you will see the business growing.”

According to ACMA’s industry performance review 2013-14, Europe accounted for 38 percent of exports, followed by Asia at 25 percent and North America at 21 percent. Exports to Europe rose by 14.5 percent over the previous fiscal while exports to Latin America and Asia grew by 16.5 percent and 5.4 percent respectively. Key export items were engine and transmission parts, brake systems and components, body parts, exhaust systems and turbochargers.

Demand for Indian components from Europe is expected to grow further. This is thanks to Europe’s new car market having had a strong first half (H1), posting 5.8 percent growth in the January to June 2014 period. Also, sales growth of 4.3 percent in June means that year-on-year sales increased for the 10th consecutive month there.

Revenue-wise, imports of auto components in India, while posting a lower growth of 3.6 percent, still continued to tower over exports at Rs 77,160 crore in FY’14 from Rs 74,463 crore in the previous fiscal. Asia and Europe contributed 57 percent and 34 percent of the imports respectively. Within Asia-China, Japan, South Korea and Thailand were the major contributors to imports while from Europe the major chunk of imports came from Germany, France, UK, Italy and Spain.

Undeterred by the market slowdown, the aftermarket chipped in with growth of 12 percent to Rs 35,603 crore in FY’14, up from Rs 31,788 crore in 2012-13.

In a worry for Indian auto component industry, investments in capacity expansion saw the steepest decline in FY’14; investments in 2013-14 were pegged at $0.5 -0.7 billion due to sluggish market sentiments and depressed vehicle sales. Capex in 2012-13 stood at around $1.2-1.7 billion. Lakshman said that during 2014-15, a similar or marginal increase in investments is expected as recovery is likely only around the third quarter (October-December 2014) when there is more clarity on the Centre’s policies. In addition, there is a lot of unused capacity lying idle which has to be first utilised before new capacity can be added. He is however bullish of fresh investments in 2015-16 once sticky issues like labour reforms are addressed by the new government at the Centre.

ACMA vice-president Ramesh Suri said, “With the recent Union Budget, the government has taken a pragmatic approach of encouraging MSMEs and investing in social and infrastructure sectors. We expect the new government to provide an environment conducive for growth and revive the investment climate particularly in the automotive sector. Further, with a new foreign trade policy on the anvil, we urge the government to announce long-term and stable trade policies and accord export incentives that are critical for sustaining industry in these times of global challenges.”

Read full interview with ACMA president, Harish Lakshman http://bit.ly/1tVftCT

RELATED ARTICLES

Kia Carens gets 3-star Global NCAP rating in fresh tests

The Carens MPV, which was tested twice under the new protocol, scored zero stars for adult occupancy in the first test.

Tata Elxsi-Renesas MCU for EVs enables cost optimisation, speedier time to market

Modular, scalable design of Motor Control Unit enables integration across diverse EV applications. Claimed to be reduce ...

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

17 Jul 2014

17 Jul 2014

11759 Views

11759 Views

Autocar Pro News Desk

Autocar Pro News Desk