India PV sales hit record high in July at 298,997 units

With GST-driven price reductions drawing consumers, passenger vehicle sales clocked their best-ever numbers for a month. Now, with an additional 10 percent cess, things may slow down.

Given the right incentives, the Indian automobile industry can achieve its real market potential, showcase its might and spread out its wings.

Sales of domestic passenger vehicle (cars, UVs and vans) in July 2017 point at a record high for a single month. The month saw 9,645 vehicles being sold on each day last month. This could be attributed to the sizeable GST-driven tax reductions in vehicle prices which saw buyers throng showrooms.

The spanner in future growth is likely to be the additional GST cess, announced earlier this week.

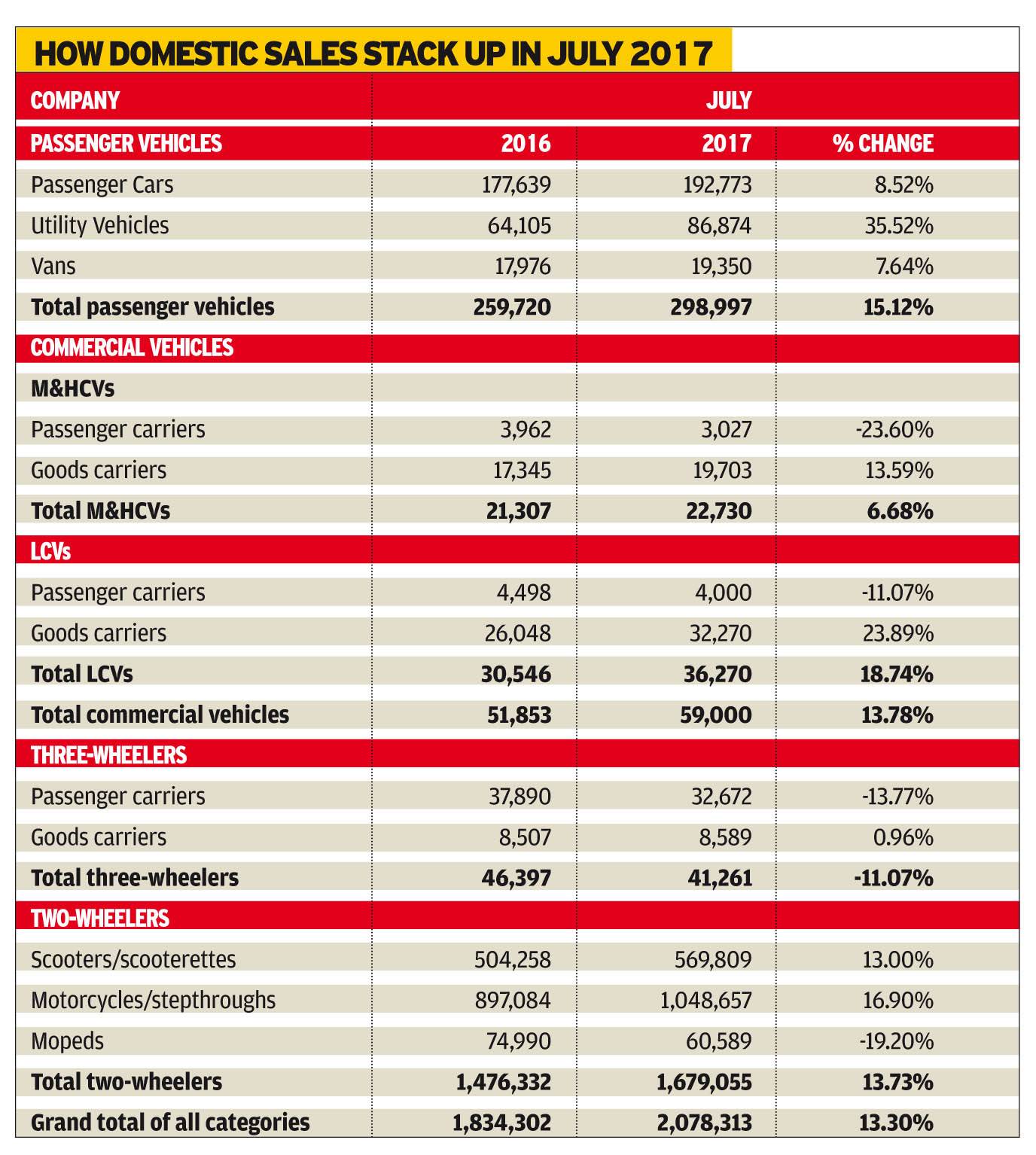

PV sales in July stood at 298,997 units, recording 15.12 percent growth YoY (July 2016: 259,720). The numbers, 1,003 units short of the 300,000 mark, have set a new benchmark in monthly sales figures, beating down the 282,519 units sold in the fiscal-closing month of March 2017.

UVs, however, stole away the limelight to register brawny 35.52 percent growth, clocking sales of 86,874 units (July 2016: 64,105), munching even further into passenger car volumes and increasing their share of the total PV sales to 29 percent (June 2017: 25%). The simple analogy for this hike comes from the fact that large SUVs have been a predominant beneficiary of the lowered taxation under GST.

Passenger cars, on the other hand, sold 192,773 units, up 8.52 percent (July 2016: 177,639) while vans clocked 19,350 units (July 2016: 17,976), to register 7.64 percent YoY growth.

The soaring numbers are majorly driven by pent-up demand from June to avail lucrative benefits brought in by the post-GST price reductions, announced across the board in most vehicle categories barring a few like hybrids.

On the whole, the PV segment is witnessing an ‘on-track’ performance, with sales for the April-July 2017 period standing at 1,026,655 units, a 7.29 percent growth over the CY2016 numbers for the same period, which closed at 956,874 units.

While the growth until now is in accordance to the 7-9 percent rate projected by SIAM on the onset of FY2018, strong demand on the back of downward price revisions post-GST is, however, set to bring a brighter hue to the canvas. But with the dust not having settled down completely, what with the additional 10 percent GST cess imposed earlier this month, the apex industry body is shying away from making any revised outlook projections, saying that the overall impact is going to be a positive one on the entire automotive sector, reducing a lot of cascading taxation effects in the entire supply-chain.

THE BIG CESS-MESS

Nevertheless, with a lot of volatility still in place, things could move in the wrong direction too. The recent shock came from the GST Council on August 7, which announced its clear intent to keep large / luxury cars (all cars above 4 metres in length and having engine capacities higher than 1.5L in diesel and 1.2L in petrol) away from being the recipients of the substantial price benefits with the new rates under GST, for a developing economy like India.

This has immediately dampened the sentiments, bringing in a lot of flak. “The new GST rates came after a lot of deliberation and thought process, standing true to the government’s assurance of moderating out multiple rates prevalent before GST, being welcomed by the industry open heartedly. But, a change coming in just within a month is out of bounds of understanding, when the cesses were not fixed abruptly in the first place,” said Sugato Sen, deputy director general, SIAM.

The catch is that government does not demarcate cars from even the lower and mid-size segments (Honda City and Bolero for example), but bearing the aforementioned dimensions and specifications, to be out of the luxury bracket, thus encompassing a wide variety of regular cars as well into the newly proposed revision of applicable cess.

With the notification already out, the GST Council just requires taking an enabling provision from the parliament to up the maximum cess limit on vehicles under the GST regime, which is currently pegged at 15 percent, and increase it further by 10 percent, capping the limit at 25 percent over and above the base slab of 28 percent GST.

The revision in cess will see the price cuts getting reversed and the midsize cars, if they are in the same category, will see their prices shooting up, even surpassing the levels at which they stood in the pre-GST times.

Vishnu Mathur, director general, SIAM, said, “While we just do not want multiple rates again, a saviour to prevent a lot of vehicles getting clubbed as luxury cars and falling on their faces could be a new categorisation in place, which could be value-based or even engine capacity based, but that has its own set of overlapping problems,” he added.

INDIA: A ‘RISKY’ MARKET?

According to Sugato Sen, “The recent four to five years has seen the automotive industry be on the receiving end of constant updates in tax slabs, going from 22 percent just for luxury cars to 27 percent and then to 30 percent of the applicable excise duty.”

“Since, the ‘penal’ duty structure across vehicle categories just didn’t provide any firm ground for the sector to be able to confidently chart out long-term plans, the government had assured to settle it for the better and bring in rationalisation with the GST,” he added.

Vishnu Mathur added, “The whole idea of GST then gets vitiated if multiple rates are again brought in, defying the entire purpose of tax rationalisation.”

“Just over the past one-and-a-half years, there have been a number of flip flops, which have portrayed India to be a very risky market for big global players in the industry. These have also overshadowed the good work done over the last 20-25 years of developing a conducive environment for doing business in the country. “

“The automotive industry contributes to almost 50 percent of the country’s manufacturing GDP (7% of overall GDP), supporting auto components, machine tools and other allied businesses, hence stable and predictable policies are a must for this investment intensive business,” he added.

The Indian automobile industry, even though seems to be growing in terms of the sales numbers, has only been moving at a marginal pace from a perspective of profitable growth. The CAGR for the PV segment settles only a shade over 1 percent from FY2013-14 to FY2015-16.

“The Automotive Mission Plan-II (AMP), chalked out along with the Ministry of Heavy Industries and set to target the tremendous shift in future technologies by 2025, is facing a lot of headwinds with the un-predictable nature of the country’s economic policies and needs stability to be able to take care and focus entirely on developing the technological disruptions required for the coming future,” concluded Vishnu Mathur.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

11 Aug 2017

11 Aug 2017

4071 Views

4071 Views

Autocar Pro News Desk

Autocar Pro News Desk