India’s motorcycle market returns to double-digit growth after 5 years

Demand in the domestic motorcycle segment in FY2018 was primarily driven by the popular models in the 100cc-125cc categories.

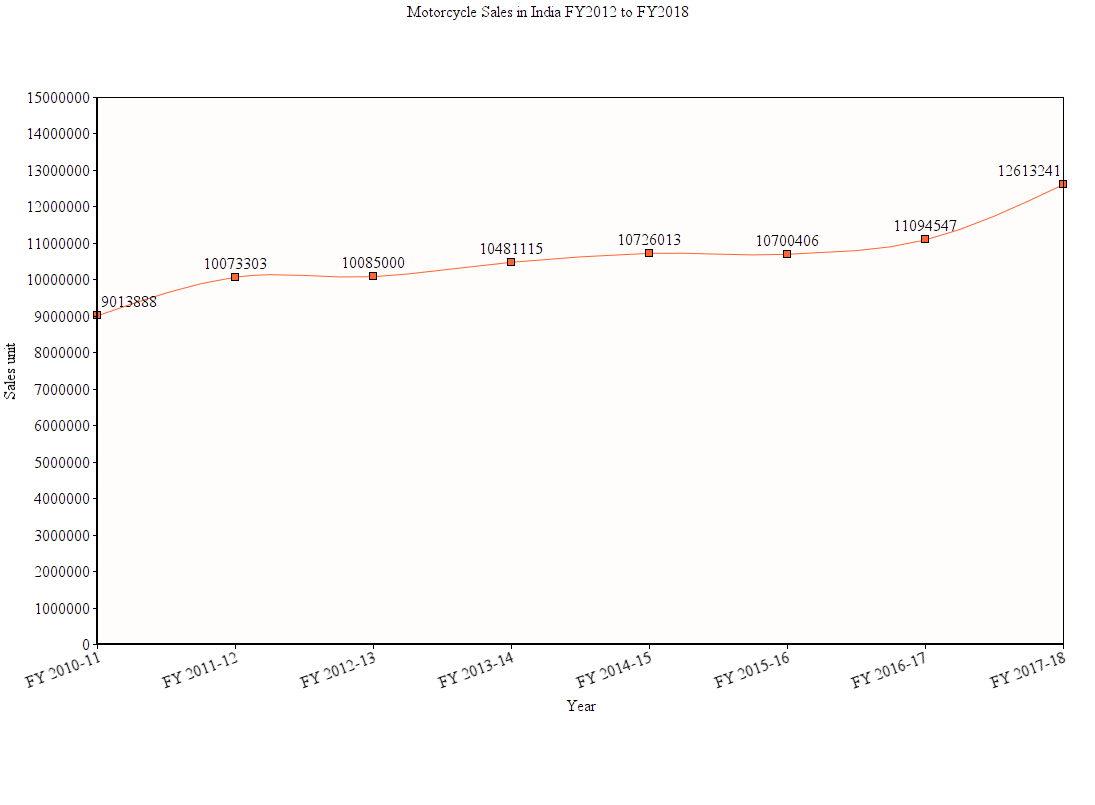

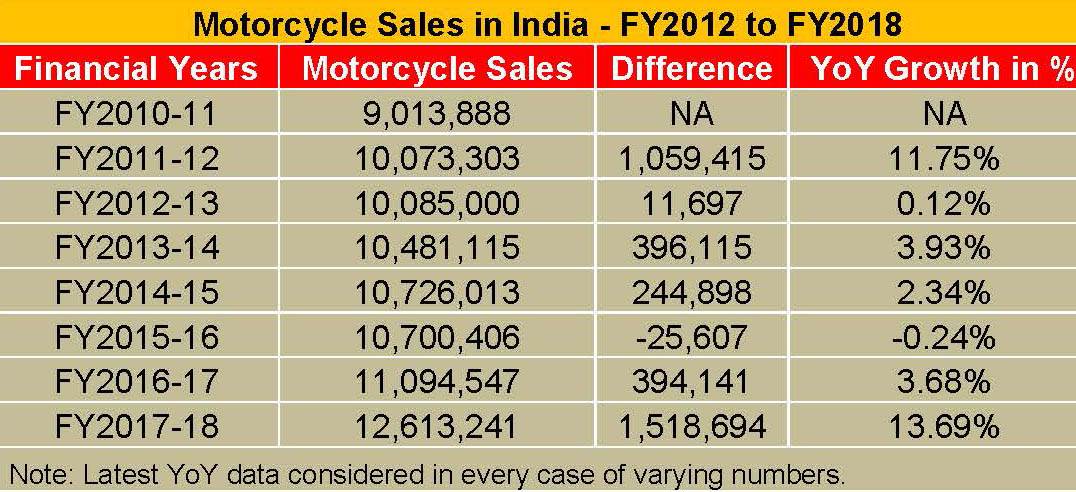

India’s domestic motorcycle market has finally returned to double-digit growth after five years in FY2017-18. Industry data, released by apex industry body SIAM, details that the cumulative motorcycle sales for FY2018 stood at 1,26,13,241 units, thereby recording a YoY growth of 13.69 percent.

The motorcycle segment had last posted growth of 11.75 percent YoY in FY2012, when its domestic sales stood at 1,00,73,303 units. Interestingly, the domestic motorcycle market had crossed the 10 million-unit-mark for the first time in that fiscal.

For the five financial years in between, the segment grew by 0.12 percent YoY in FY2013 when sales stood at 1,00,85,000 units; 3.93 percent YoY in FY2014 (sales: 1,04,81,115 units); 2.34 percent YoY in FY2015 (sales: 107,26,013 units); -0.24 percent YoY in FY2016 (sales: 1,07,00,406 units) and 3.68 percent in FY2017, when the total motorcycle sales stood at 1,10,94,547 units.

The demand in the domestic market in FY2018 was primarily driven by the popular models in the 100cc-125cc categories. This includes the models from Hero MotoCorp’s Splendor, HF Deluxe, Passion and Glamour range, Honda’s CB Shine, Livo and Dream series; TVS Motor’s Star City, Sport and Victor range and Bajaj Auto’s CT100, Platina and Discover range.

According to ICRA, a credit rating agency, “For the motorcycle segment that had witnessed stable to muted volume growth during FY2013-2017, FY2018 turned out to be a year characterised by secular growth across most sub-segments with overall domestic sales growing by 13.7 percent YoY during FY2018, a double-digit growth for the segment after a hiatus of five years. The growth has been driven notably by the 75-110cc sub-segment supported by general improvement in rural demand sentiment on the back of near normal monsoon.”

Commuter motorcycles drive numbers and how

The SIAM data reveals that motorcycles upto 110cc sold a total of 74,47,390 units in FY2018. This marked a YoY growth of 14.80 percent. Notably, Hero MotoCorp commands a staggering market share of 74.52 percent (in FY2018) in this category of the motorcycle sub-segment.

Motorcycles with engines bigger than 110cc and up to 125cc cumulatively sold 21,94,033 units (up 15.93 percent YoY) during the last fiscal.

Motorcycles with engines bigger than 125cc and up to 150cc is the only sub-segment with large scale volumes that recorded negative growth. This category registered total sales of 11,05,950 units, down by 13.37 percent YoY.

Meanwhile, the more premium category of motorcycles with engines bigger than 150cc and up to 200cc has witnessed an impressive YoY growth of 43.60 percent. This sub-segment sold total of 845,538 units in FY2017-18.

It is clear that given its growth pattern, this category may breach the million-unit-mark by the end of the ongoing fiscal. This clearly underlines the shift in the preferences of urban commuters who now aspire for products with more power and premium features.

In its analysis of the two-wheeler market, ICRA has also spotted this shift. It says, “Except for the 125cc-150cc sub-segment, that witnessed some demand transition to 150cc- 200cc driven by new products / variants by major OEMs with engines displacement of ~160cc segment offering higher power, all other sub-segments reported growth during FY2018. Moreover, the higher displacement premium motorcycles continue to expand their share in the domestic motorcycle pie and have accounted for 7 percent of the total volumes in FY2018 from mere 2 percent in FY2014. This trend is expected to continue with the premiumisation being driven by improvement in disposable incomes.”

Some of the popular motorcycles from the 150cc-200cc category include TVS Motor’s Apache range (except the recently launched RR 310), Bajaj Auto’s Pulsar range, Avenger 180 and the 200cc KTM models, Honda’s 160cc CB Unicorn, CB Hornet 160R and the recently launched X-Blade, Suzuki’s Gixxer series and its entry-level urban cruiser – the Intruder 150.

TVS Apache RTR 200. The Apache range is the biggest seller in the 150-200cc segment and sold 399,035 units in FY2018.

Interestingly, TVS Motor’s Apache range is the biggest seller in this category. The company has achieved a notable stronghold in the 150cc-200cc sub-segment with total sales of 399,035 units – all under its premium Apache brand. Sales of the 160cc-200cc TVS Apache models in FY2018 recorded a leap of 34.64 percent YoY. This also means that TVS Motor now holds a market share of 47.19 percent (for FY2018).

According to Anupama Arora, vice-president and sector head - Corporate ratings, ICRA, who forecasts a high single-digit growth for the motorcycle segment in FY2018-19, scooters will continue to outpace the overall domestic two-wheeler industry growth in the ongoing fiscal. And, as she underlines, the demand for premium motorcycles will continue to grow in the ongoing fiscal.

“Going forward, ICRA expects domestic two-wheeler volumes to grow at 8-10 percent during FY2019, on an expanded base of FY2018. In terms of segment-wise growth trend, we expect scooters to continue to outpace the overall two-wheeler volume growth in domestic market in FY2019. Motorcycles are expected to register high, single-digit growth in FY2019 with a broadbased volume recovery across various sub-segments with premium segment continuing to find favor,” she forecasts.

Also read: Top 10 Two-Wheelers – FY2018 | Honda Activa outsells Hero Splendor by over 400,000 units

Top 10 scooters – FY2018 | Honda Activa zips past the 3-million milestone

RELATED ARTICLES

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

Hyundai and Kia partner Exide Energy to produce LFP batteries in India

Partnership with Exide Energy enables Hyundai Motor and Kia to equip future EVs in the Indian market with locally produc...

20 Apr 2018

20 Apr 2018

23001 Views

23001 Views

Autocar Pro News Desk

Autocar Pro News Desk