India car sales down 4.65 percent in 2013-14, scooters, exports shine

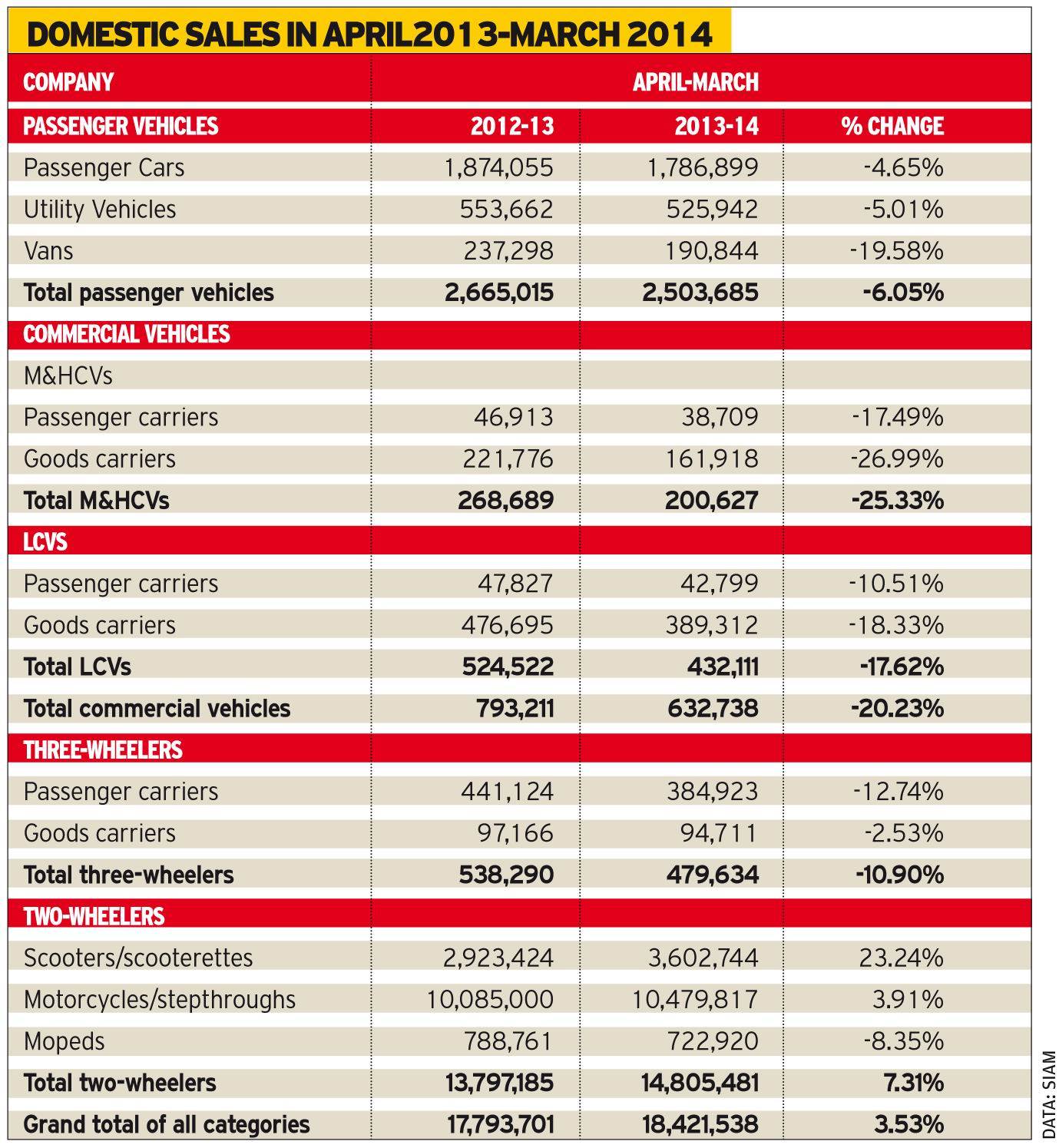

The Indian automobile industry continued to decline with passenger car sales down 4.65 percent in a passenger vehicle segment that slipped by 6.05 percent during FY 2013-14.

The Indian automobile industry continued to decline with passenger car sales down 4.65 percent in a passenger vehicle segment that slipped by 6.05 percent during FY 2013-14.

Scooters were the only saving grace in terms of domestic sales during the financial year. Piggyback riding on the 7.31 percent growth of the two-wheeler segment especially scooters, overall industry numbers grew 3.53 percent to a total of 18,421,538 units sold (2012-13: 17,793,701).

Two-wheeler OEMs sold 23.24 percent more scooters at 3,602,744 units against 2,923,424 units in 2012-13. The motorcycle segment, at 10,479,817 unit sales, saw a 3.91 percent growth (2012-13: 10,085,000). Moped sales however, fell 8.35 percent to a total of 722,920 units in the fiscal. The overall two-wheeler segment was the sole vehicle category to record positive growth (up 7.31 percent), with a total of 14,805,481 units sold.

Meanwhile, passenger car sales were 1,786,899 units (2012-13: 1,874,055), down 4.65 percent. Utility vehicle numbers fell 5.01 percent with sales of 525,942 units (2012-13: 553,662). Sales of vans declined 19.58 percent to 190,844 units (2012-13: 237,298). The overall passenger vehicle segment saw a drop of 6.05 percent with cumulative sales of 2,503,685 units (2012-13: 2,665,015).

The commercial vehicle sector continues to be in the doldrums with both LCV and HCV segments recording fewer numbers. The M&HCV segment saw sales fall sharply by 25 percent to 200,627 units in 2013-14 (2012-13: 268,689). The once-popular LCV segment has dropped 17.62 percent with sales of 432,111 units (2012-13: 524,522). Overall CV category sales dropped 20.23 percent to 632,738 units (2012-13: 793,211).

Sales of three-wheelers for 2013-14, at 479,634 units (2012-13: 538,290) were down 10.90 percent.

Promise of a better run in 2014-15

According to Vikram Kirloskar, president of SIAM and vice-chairman, Toyota Kirloskar Motor, FY’14 proved to be a difficult year with high cost of ownership and negative market sentiment impacting car sales. However, exports were not so badly affected with an improvement seen in CV, three-wheeler and two-wheeler exports in Q4 of FY’14.

The business environment, said Kirloskar, was marked by high interest rates that remained relatively stable, and rising commodity prices which affected manufacturer’s costs. In comparison, the US, China and the UK recorded good sales and growth, albeit most global markets saw sales decline. In 2013-14, Indian industry invested around Rs 20,000 crore towards launching 35 new models, 51 variants and many refreshed models and new technologies, he said.

According to Vishnu Mathur, executive director, SIAM, 2014-15 should see higher investment with OEMs spending on capacity expansion.

As regards the outlook for 2014-15, Kirloskar is bullish that the GDP will improve further as had seen in the past six months. However, inflation and interest rates are expected to continue on a high trajectory; some stability is expected in exchange rates but crude oil prices will continue on the same lines. “Positives are that commodity prices have increased but they are not going up sharply, the extension of the JNNURM scheme for bus purchases will help the bus segment. Tendering has already started; the rupee seems to be stabilising enabling manufacturers to plan better. Some mining activity has also started in Bellary, Karnataka, and infrastructure projects cleared in the last few months will go through financial closure and start picking up in the next six months. These are expected to step up demand in the HCV market.”

Kirloskar’s key concern though is the slow economic growth in India and also job security. The bulk of passenger car and two-wheeler sales are done through EMIs and the buyer’s job security determines the general market sentiment. “I don’t see much salary hikes unless there is significant improvement in GDP growth,” he said.

Another concern relates to excise duties that might be hiked to the level that existed prior to the last vote on account by the incoming new government. Overall, the industry is looking at reduction of taxes and excise duties by the new government as about 56 percent of a small car constitutes taxation.

RELATED ARTICLES

Bosch hydrogen engine tech-powered truck to be on Indian roads this year

The global supplier of technology and services is betting big on both electromobility and hydrogen. While announcing the...

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

11 Apr 2014

11 Apr 2014

6073 Views

6073 Views

Autocar Pro News Desk

Autocar Pro News Desk