Cars, UVs and scooters keep growth story going in April

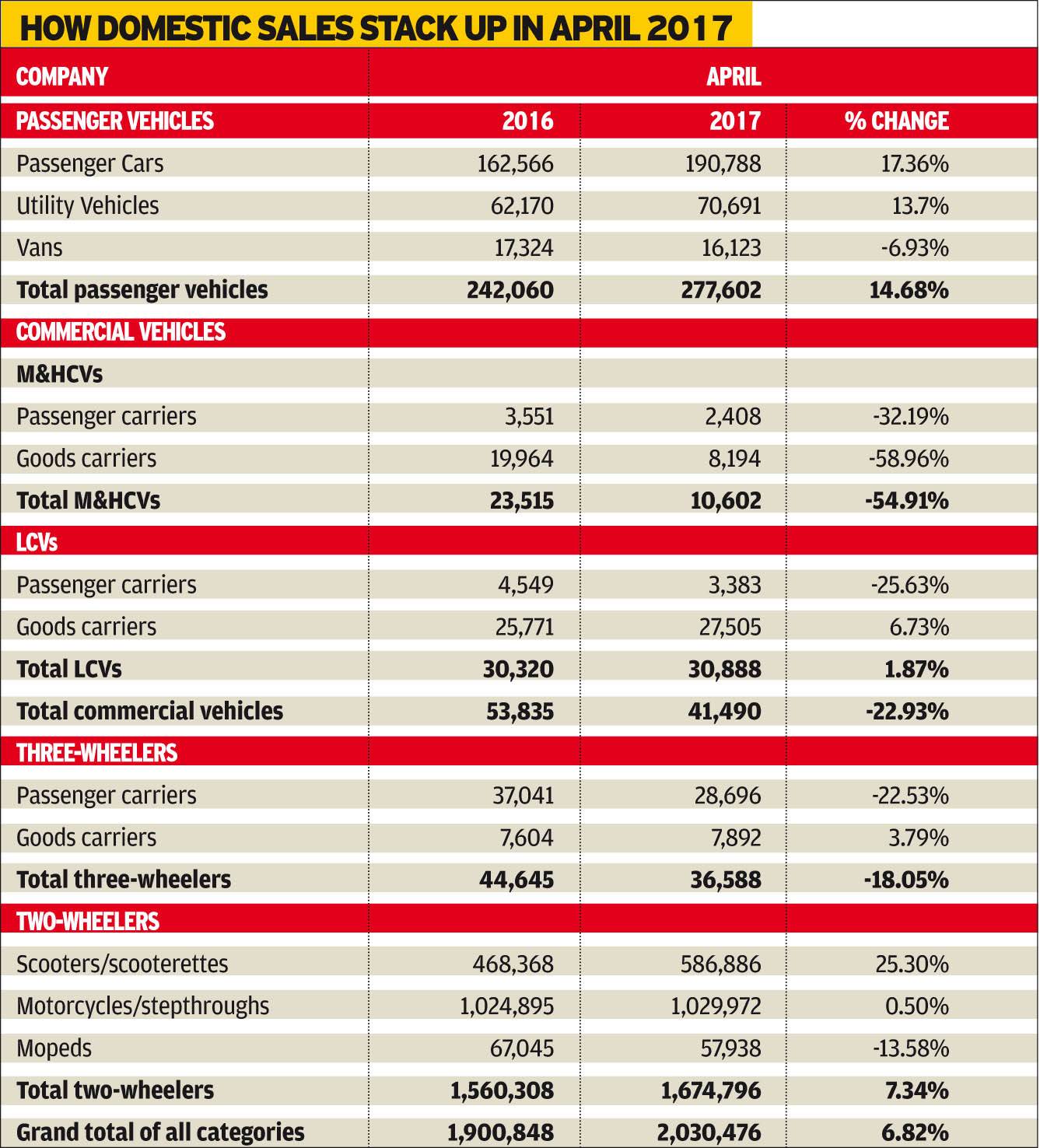

Sales of passenger cars (+17%), utility vehicles (+13%) and scooters (+25%) have saved the Indian automobile industry the blushes in April 2017, which sees the CV segment sales drop sharply and drag overall numbers down.

Sales of passenger cars, utility vehicles (UVs) and scooters have saved the Indian automobile industry the blushes in April 2017. As per the monthly sales numbers in the domestic market, revealed today by industry body SIAM, overall sales across vehicle segments totaled 2,030,476, up 6.82 percent year on year.

The passenger vehicle (PV) segment, which has been on a roll since the past year and crossed the 3 million sales mark for the first time in FY2017, sold a total of 277,602 units, up 14.68 percent. Of this, Maruti Suzuki accounted for 144,081 units or 51.90 percent, growing 23 percent YoY.

Barring Mahindra & Mahindra, other PV manufacturers including Hyundai Motor India, Honda Cars India, Toyota Kirloskar Motor, Ford India, Tata Motors, Nissan Motor India and Volkswagen India clocked good sales in April 2017.

Passenger cars, with the super-compact, mid-size and the executive sedan classes leading at the front, saw a growth of 13.71 percent, with sales of 190,788 units, than 162,566 units sold in April 2016.

While UVs also closed on a positive note, by selling 70,691 units (+13.71%), vans saw a slight decline of 6.93 percent to see only 16,123 units being sold, than last April’s 17,324 units.

The increased numbers in both four-wheeler and two-wheeler space can very well be attributed to the 7th Pay Commission, which has brought in more spending power to consumers, as well as the re-stabilisation of the economy after the demonetisation speedbreaker last November.

Two-wheeler OEMs open FY2018 on a strong note

The two-wheeler industry has started off the new financial year on a good note by recording a YoY growth of 7.34 percent in April 2017. According to the latest SIAM data, the two-wheeler industry has registered total domestic sales of 1,674,796 units in April 2017 as against total sales of 1,560,308 units in April last year.

The growth was led by the rapidly expanding scooter segment, which has registered an impressive growth of 25.30 percent YoY at total domestic sales of 586,886 units last month. (April 2016: 468,368 units). Honda Motorcycle & Scooter India (HMSI) dominated the scooter category with a market share of 62.80 percent in April 2017. The new number two player in this segment, TVS Motor Company, reported a market share of 13.54 percent for April 2017, surpassing Hero MotoCorp’s share of 10.86 percent.

The motorcycle segment, on the other hand, remained flat with sales of 1,029,972 units in April 2017, up by 0.50 percent YoY. Motorcycles, also the largest category within the two-wheeler segment stood at 1,024,895 units in April last year. While Hero MotoCorp continued to dominate the motorcycle category with its commanding 50.67 percent market share, Honda emerged as the number two player with 17.79 percent market share, surpassing Bajaj Auto (15.72 percent) for the last month.

April 2017 possibly has become the first month ever for Honda to achieve the position of India’s second largest motorcycle maker.

On the front of the overall domestic two-wheeler sales, last month also stands out in terms of Honda inching closer to its arch-rival Hero, which has reportedly sold just 33,923 units more than Honda. While Hero MotoCorp has sold 585,655 units, Honda reported sales of 551,732 units in the domestic territory in April 2017.

Lastly, the mopeds category has recorded a decline of 13.58 percent YoY at sales of 57,938 units in April 2017. Total domestic moped sales stood at 67,045 units in April last year. April 2017 marks the second month in a row when moped sales are down YoY. In March 2017 too, this segment, which is owned by TVS Motor Company without any competition in the local market, had recorded domestic sales of 69,773 units, down by 1.61 percent YoY. (March 2016: 70,918 units).

Interestingly, prior to March 2017, the moped category had clocked growth for 13 continuous months. It had reported decline of 1.25 percent YoY in January 2016, when it had sold 53,849 units as against 54,531 units sold in January 2015.

An Autocar Professional analysis has identified that the moped sales grew during the months that were impacted by demonetisation woes. The growth in moped sales, however, turned negative as soon as the two-wheeler market recovered from the impact of demonetisation.

M&HCV sales slide 55%

The commercial vehicle industry has taken a huge hit in the first month of the new fiscal. Both the M&HCV and LCV segment sales have taken a deep dive. Heavy discounting in March 2017 to clear BS III stock, implementation of BS IV emission norms from April and the subsequent price increase in vehicles have resulted in the sharp fall.

In April 2017, total CV sales were 41,490 units, down 23% year on year (April 2016: 53,835 units). M&HCV numbers at 10,603 units are down 55% -- goods carriers, which are the largest in terms of volume and value, has seen a fall of 59% to 8,194 units while the M&HCV passenger carrier segment slid by 32% with sales of 2,408 units.

The LCV segment, which has seen strong growth in recent months, is down by 1.87% with total sales of 30,888 units. While the LCV goods carrier segment has maintained its sales momentum with 27,505 units (+6.73%) thanks to demand from rural areas and last mile connectivity, the LCV passenger carrier segment is down by 25% to 3,383 units in April.

Industry analysts expect the April-June quarter to be slow for the commercial vehicle sector albeit growth would likely pick up in with GST in place from July. It appears that fleet operators have delayed buying of new heavy trucks for the time being and the replacement demand is fading.

In its outlook for FY2018, rating agency ICRA says, “Industry is likely to witness 6-8 percent growth in FY2018 aided by higher budgetary allocation towards the infrastructure and rural sectors; potential implementation of scrappage program will also trigger replacement demand.”

ICRA estimates that during FY2018, “M&HCV trucks will grow by 6-8 percent by higher budgetary allocation towards the infrastructure and rural sectors, LCV trucks by 6-8 percent on replacement demand to continue following 3 years of declining trend and pick-up in demand for consumption-driven sectors, rural markets and e-commerce. Buses are likely to grow by 5-7 percent on orders from SRTUs to support sales in M&HCVs; and smart cities initiatives. Demand from the school and staff carrier segment remains stable and exports are to grow by 8-10 percent.”

“Profitability indicators of CV OEMs will moderate marginally because of recovery in material prices and gradual pass through of BS-IV costs,” says ICRA.

RELATED ARTICLES

IIT Bombay inaugurates Arun Firodia Research Floor

IIT Bombay, one of India’s top technical and research institutions, honours Kinetic Group chairman Dr Arun Firodia, one ...

Maruti Suzuki expands capacity at Manesar plant by additional 100,000 units

New assembly line at Plant A expands total manufacturing capacity at the Manesar plants to 900,000 units per annum. Alon...

Hyundai and Kia partner Exide Energy to produce LFP batteries in India

Partnership with Exide Energy enables Hyundai Motor and Kia to equip future EVs in the Indian market with locally produc...

09 May 2017

09 May 2017

4606 Views

4606 Views

Autocar Pro News Desk

Autocar Pro News Desk