Two-wheeler OEMs record improved numbers in February

While the impact of demonetisation exercise is wearing off slowly, two-wheeler OEMs remain concerned about sales of BS III inventory after April 1.

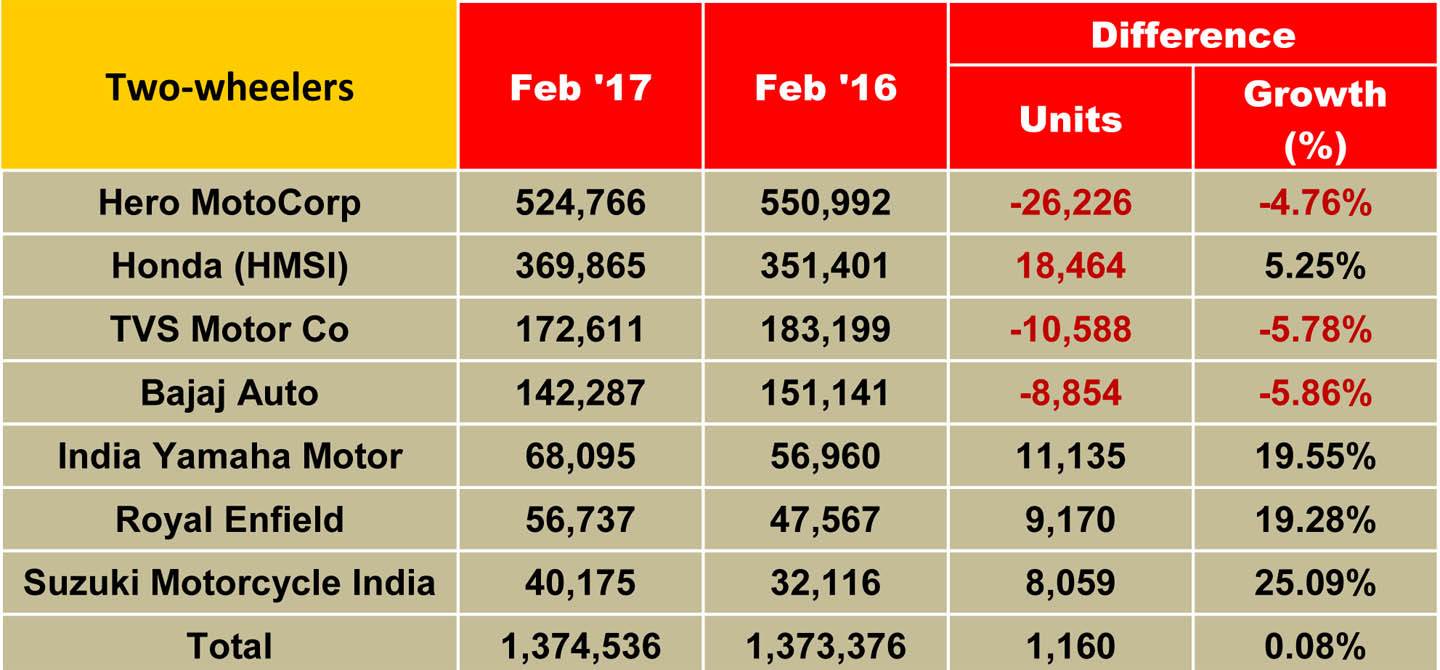

The top seven two-wheeler companies in India have reported flat growth in February 2017 as OEMs like Honda, Yamaha, Royal Enfield and Suzuki Motorcycles covered up for the deficits recorded by Hero MotoCorp, Bajaj Auto and TVS Motor Company. The seven players reported total sales of 1,374,536 units last month (including exports by few companies) as against 1,373,376 units sold in February 2016.

February 2017 saw flat growth of 0.08 percent YoY, reflecting that overall numbers are nearly level with year-ago volumes. While on one hand, this brings relief to the industry after a disastrous December, stakeholders remain anxious about the saleability of the BS III-compliant stock across dealerships.

Almost all major two-wheeler manufacturers have either switched or are in the process of switching their products to BS IV compliance. Although the mandatory upgrade to BS IV emission norms will result into an industry-wide hike in vehicle prices, research agencies expect this may temporarily draw customers to retail stores for hurried purchase of existing stock. Nevertheless, it is clear that the industry has bounced back, albeit not completely, and the industry players expect sales to grow further from here.

In February 2017, Hero MotoCorp, TVS Motor Company and Bajaj Auto registered negative YoY numbers. Honda, on the other hand, rallied up with growth numbers, followed by Yamaha, Royal Enfield and Suzuki.

According to Hero MotoCorp, it sold a total of 524,766 units last month, down by 4.76 percent YoY (February 2016: 550,992). An official communication from India’s largest two-wheeler manufacturer to the Bombay Stock Exchange conveys that the company has shifted to producing only BS IV-compliant two wheelers from March 1, 2017. “Majority of Hero two-wheelers had already been made BS IV- compliant quite some time back and the company has fully transitioned to producing only BS IV vehicles across the range from March 1, 2017,” quotes the company document.

The country’s second largest two-wheeler OEM, Honda Motorcycle & Scooter India (HMSI) reported sales of 369,865 units in February 2017, up by 5.25 percent YoY (February 2016: 351,401). Commenting on HMSI’s performance in February 2017, Yadvinder Singh Guleria, senior vice-president (Sales & Marketing), said, “With the continued momentum of recovery after demonetisation, Honda has emerged as the first choice of Indian two-wheeler customers. This recovery period has been favourable for Honda, as we continue to grow with a 1.4 percent increase in domestic market share of 27.2 percent.

For Honda, our market strategy is well placed and from March 1, 2017 we have started production of only BS IV models at all of our four plants.”

Earlier this month, HMSI launched the BS IV-compliant version of its bestseller, the 110cc Activa 4G, which also marks the fourth generation of the Activa in local markets. In accordance with the statutory mandate, it has also been equipped with the automatic headlamp on (AHO) feature, just like all other models. It can be recalled that Autocar Professional, in its report on the Activa 4G, had highlighted that the BS IV-compliant version is priced nearly Rs 2,000 more than the BS III-compliant Activa 3G first launched in February 2015.

Moving slow and steady, TVS Motor Company has saw domestic sales of 172,611 units in February 2017, down by 5.78 percent YoY (February 2016: 183,199). TVS has been consistent with its scooter sales, all thanks to the 110cc Jupiter model. The company is, however, understood to be readying an all-new scooter model for the 125cc segment. The upcoming scooter model is aimed at further propelling the growth and market share in the booming scooter segment.

On the other hand, it is also busy doing its ground work for rolling out the first product – G 310 R – under its alliance with BMW Motorrad soon. The incoming naked street motorcycle will take on the likes of KTM 250 Duke, KTM 390 Duke, Bajaj Dominar 400, Yamaha FZ 25 and DSK Benelli TNT 25.

Besides that, the company is also understood to be in the process of upgrading its existing products to BS IV emission norms. In an official communication to Autocar Professional, K N Radhakrishnan, president and CEO, TVS Motor Company said, “TVS Motor Company is a responsible corporate citizen and is fully supportive of a better environment for our customers, employees and stakeholders. We are fully geared up to meet the government’s new BS-IV emission guidelines.”

Pune-based Bajaj Auto has reported total domestic sales of 142,287 units last month, down by 5.86 percent YoY (February 2016: 151,141). The company, which became the first two-wheeler major to convert its entire existing portfolio of products to BS IV emission norms, is betting big on its recently launched premium midsized motorcycle – the 375cc Dominar 400.

Bajaj Auto is busy expanding the retail network for the Dominar 400, which was rolled out in January 2017 for commercial sales across only 22 cities. The company hopes to make the model available across 80 to 100 cities by end-March 2017. “That would mean the Dominar 400 would be available around 200 Bajaj Auto dealerships by end of this financial year,” Eric Vas, president, motorcycle business, Bajaj Auto told Autocar Professional recently.

India Yamaha Motors has registered sales of 68,095 units (including exports to Nepal) during February 2017, up by an impressive 19.55 percent YoY (February 2016: 56,960). Commenting on his company’s performance, Roy Kurian, vice-president (sales & marketing), Yamaha Motor India Sales, said, “In 2017, Yamaha continues to grow with a surge in February 2017 sales while concurrently ensuring government of India guidelines to introduce BS IV compliant models for all products.”

The company has recently rolled out its entry level midsized motorcycle – FZ 25, a single-cylinder, 249cc naked street model for a competitive price of Rs 120,000 (ex-showroom, Delhi). The model is company’s second global product in the booming midsized motorcycle segment, first being the YZF-R3, a race track-biased twin-cylinder, 321cc fully-faired model.

Yamaha, which is chasing its ambitious plan of achieving sales of one million units in CY2017, is aggressively working on its network expansion plans and marketing strategies to boost its scooter and motorcycle sales this year.

Royal Enfield reported sales of 56,737 units in February 2017, up by a decent 19.28 percent YoY (February 2016: 47,567). The company remains the only two-wheeler brand that remained unperturbed in the market despite demonetisation. This is thanks to its strong order book (including backlogs) that helped it report impressive monthly sales through the past 3-4 months.

Suzuki Motorcycle India registered total sales of 40,175 units in February 2017 (including exports), up by 25.09 percent (February 2016: 32,116). It had recently rolled out the BS IV-compliant Gixxer range and its 125cc Access 125 scooter adding new colour options for the buyers. According to the company, the new upgraded models have been well-received by the customers in the market.

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

07 Mar 2017

07 Mar 2017

5677 Views

5677 Views

Autocar Pro News Desk

Autocar Pro News Desk