ZF’s acquisition of TRW paying dividends

One year after completion of the acquisition, the integration between ZF and TRW is making rapid and constructive progress

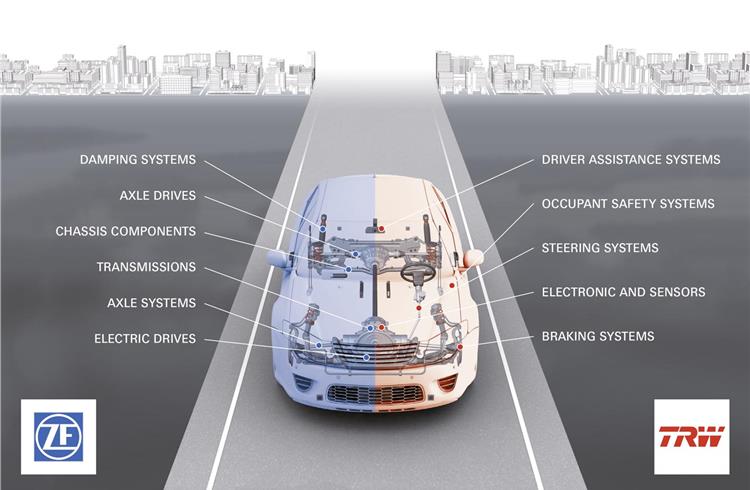

Exactly a year ago – on May 15, 2015 – ZF had announced the completion of its acquisition of TRW Automotive. Now, the integration of the company, known as the Active & Passive Safety Technology Division, is progressing constructively and faster than expected.

“The acquisition is a milestone within our long-term strategy,” says ZF’s CEO Sommer. “The timing was perfect – not only with respect to the financial framework but also in view of the market requirements. With the new structure, we are perfectly placed to become a truly global integrated systems supplier and hence are superbly equipped to shape the future automotive megatrends. The feedback from our customers continues to be very positive. We can demonstrate this each day with something new: the acquisition made absolute sense and is proving to be a success.”

Since the TRW acquisition, ZF has focused in particular on three particular activities: the digitisation of mechanical components, e-mobility, and reducing road accidents and emissions. “Safety is a major factor on the journey toward autonomous driving,” explains Sommer. “We’ll be facing a whole new set of challenges for which we’ll have to find the right answers and develop the right products. Our engineers are working vigorously to address these demands.”

Integration, which was scheduled to take three to five years, is progressing well. “A number of key stages have already been achieved during the first 12 months,” emphasizes Sommer. “Sales and Purchasing are fully integrated, and, as combined units, provide clear interfaces to customers and suppliers. Moreover, we have recreated the post of Corporate Market which is excellently occupied by Peter Lake, who brings many years of marketing know-how from the former TRW. We are also currently re-aligning our North American activities in the Detroit area and bringing our businesses together under one roof at the former TRW headquarters in Livonia. The former ZF headquarters in Northville will become a Sales and Engineering Center for the region.”

High on motivation

The Board member responsible for the North America market region and the Active & Passive Safety Technology Division – and hence for the integration activities – is Dr. Franz Kleiner. “The Group is full of highly motivated employees who know their products exceptionally well and are able to come up with great ideas for collaboration and new technical solutions,” says Kleiner.

Many project groups are already working on new volume production products and solutions in which the strengths of both sides complement each other to offer new product benefits. Only six weeks after the acquisition, ZF showcased its first integration milestone with the Advanced Urban Vehicle, a concept vehicle for urban mobility which combines the core technologies of both companies. At this year’s IAA Commercial Vehicles in Hanover in September, ZF will present the second Innovation Truck with combined products from ZF and ZF TRW.

Positive financial trend & cultural integration

The combined company also showed a positive financial trend in the first year: Group sales, which include TRW sales only since the acquisition on May 15, 2015, reached 29.2 billion euros; and earnings before interest, taxes, depreciation and amortization (EBITDA) were approximately 2.9 billion euros. Standard & Poor’s has acknowledged ZF’s €1.4 billion repayment of its debts last year – a repayment which was considerably more than expected – by upping ZF’s credit rating. The credit rating agency now classifies ZF with the rating BB+ and a stable outlook. The company’s debt reduction has considerably improved its own financial risk profile. “We are extremely pleased about this rating,” says ZF’s CEO Sommer. “It once again shows that the acquisition is solidly financed. We want to rigorously pursue this route.”

ZF places great importance on the cultural integration of both companies. “Integration for the sake of integration is not our intention,” explains Sommer. “We have decided to follow the route of identifying and understanding cultural differences and turn them into opportunities.” With ‘Best of both’ as its motto, the Integration Management Office (IMO) is guiding the integration process to make sure both organizations benefit from the acquisition. “Since day one, our employees have shown great commitment toward integration, while at the same time making sure that our customers are looked after in the right way,” says Sommer. “For this, they deserve our thanks and recognition. I am convinced that with such a team, the whole Group will successfully move forward together.”

RELATED ARTICLES

Ramkrishna Forgings to supply powertrain parts to USA’s largest electric carmaker

Indian manufacturer of rolled, forged and machined products marks its debut in the US electric vehicle market.

Hyundai and carbon fibre specialist Toray to develop lightweight, high-strength materials

Partnership aims to secure capabilities to develop lightweight and high-strength materials for environmentally friendly ...

Yamaha wins Red Dot product design awards for MT-09 and XMAX 300

The latest awards mark the 13th year in a row – every year since 2012 – that a Yamaha Motor product has received a Red D...

By Autocar Pro News Desk

By Autocar Pro News Desk

15 May 2016

15 May 2016

5260 Views

5260 Views