Why Volkswagen's secret plan to buy Fiat-Chrysler failed

The Volkswagen Group had an ambitious plan to create the world’s biggest car maker by taking over Fiat Chrysler Automobiles – but it has all come unstuck.

Volkswagen Group's plans to incorporate Fiat Chrysler Automobiles has failed – here's why.

The Volkswagen Group had an ambitious plan to create the world’s biggest car maker by taking over Fiat Chrysler Automobiles – but it has all come unstuck.

Ferdinand Piech, chairman of Volkswagen’s supervisory board, has long wanted to see the Volkswagen Group become the largest auto maker in the world. It currently has 12 brands, whose production spans everything from city cars to heavy trucks.

The world’s largest car maker last year was Toyota with 9.98 million sales, followed by General Motors (9.71 million) and the VW Group (9.7 million).

Earlier this year, according to sources at VW, company strategists came up with a plan that would have seen the VW Group expand in size by around 50 percent and become the unassailable leader in the global car market.

The scheme was remarkably simple: it envisaged VW buying a controlling stake in Fiat Chrysler Automobiles (FCA) and folding the Italian and American brands into its ambitious global platform strategy.

The resulting 17-brand conglomerate would have sold nearly 15 million cars per year and would have been known as Auto Union.

However, this ambitious plan never got much further than the first stages of consideration. Insiders say that by the end of April this year, financial red lights had started flashing within VW’s Wolfsburg HQ.

Rather than being in a position to create the world’s biggest car maker and execute probably the most ambitious merger plan in automotive history, VW Group management is now involved in a major fire-fighting exercise.

Although it is selling huge numbers of cars and makes healthy profits, the core VW brand – which accounts for 5.9 million of the group’s 9.7 million sales – saw its profit margins slide below two per cent for the first half of 2014, with a risk of even lower margins next year.

With rivals Toyota and Hyundai making margins of over eight per cent with their mainstream cars, the mighty VW brand is, by comparison, in trouble.

According to industry reports, Volkswagen CEO Martin Winterkorn is looking at cost savings of £4 billion (Rs 40,964 crore) per year from 2017. These plans could see a number of ‘low profit’ models simply chopped. For example, the Eos (7,651 sales last year) and Scirocco (23,400 sales) could be axed.

The Up city car family will also come under scrutiny, because its expensively engineered NSF platform is shifting less than 200,000 units per year in VW, Skoda and Seat guises.

VW's NSF platform could have been used for the next-generation Fiat 500.

The next two years will be a whirlwind of activity at the wider VW Group as it struggles to rationalise product development, production and production costs. It is clearly in no position to attempt any kind of further mergers or acquisitions.

It’s a pity, because it is clear that the plan to create the new Auto Union could have worked. According to the auto analysts at ISI in London, VW’s production in 2020 should hit 11.8 million units. With Fiat-Chrysler rolled into VW’s production system (a tall order by 2020, says ISI), production would have hit 15.84 million.

The logic of VW’s strategists ran like this: the merger between Fiat and Chrysler is about to be rubber-stamped, ahead of a massive injection of cash to develop new models, including a range of rear-drive Alfa Romeos as well as new Fiats and Jeep models.

So, rather than see huge amounts invested in new Fiat-Chrysler products with no certainty of a profitable outcome towards the end of the decade, the logic went, FCA shareholders could cash in by selling up now to VW.

The VW strategists also figured that the Agnelli family – which still holds a 30 percent stake in Fiat – as well as other FCA shareholders could be convinced to sell up now. The Agnellis would almost certainly retain the Ferrari and Maserati brands, while happily letting go of the mass-market brands.

There would have been obstacles, though. The biggest would have been the huge time and effort required on the part of the management team to merge the two sides. The VW Group already produces around 65 model lines across its 12 brands. Integrating Fiat-Chrysler would add another five brands and perhaps another 25 model lines.

Fiat’s successful South American operation would have to have been sold off (probably to a Chinese buyer). Fiat is currently the number one brand and VW number two in that market.

What’s left of Italy’s car industry would also have been hit, because a future Alfa Romeo family would have been built in VW Group factories. The Seat brand, which has struggled to prosper, would probably have been wound down or sold.

Coming back to the here and now, the VW Group could yet pip Toyota to the title of biggest car maker in the world (it’s ahead of General Motors in the first half of this year, shifting 4.97 million units against GM’s 4.92 million).

But it might achieve this while relying on two of its premium brands – Audi and Porsche – for the majority of its profits and with its core brand making dangerously slim margins.

Volkswagen may have started the year with a plan to become the clear global leader in car making through the Auto Union mega-merger, but it is now going to spend the next few years working flat out to save its own skin.

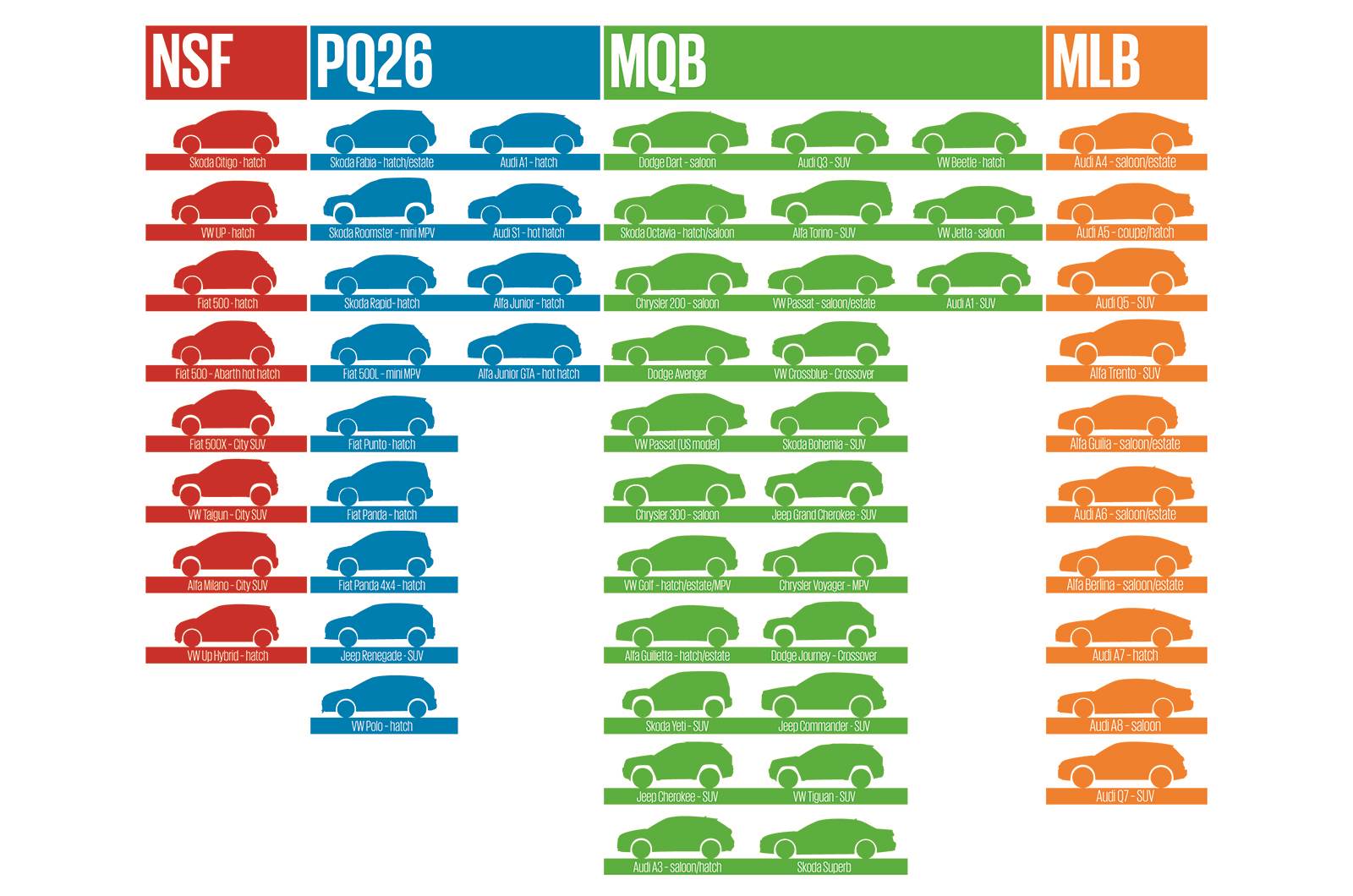

This chart shows how strategists could have proposed merging the two businesses.

How the merger could have worked

This is how we think strategists would have proposed merging Fiat-Chrysler into the existing VW Group. The business case for the expensively engineered NSF (Up) platform would have been boosted by using it to underpin the big-selling Fiat 500 family. Alfa Romeo and Fiat 500 versions of the Taigun SUV would have also made sense.

VW’s budget PQ26 family of platforms would have been the perfect home for the next-generation Fiat Panda and a revived Punto (a model that still sells in good numbers). Audi’s upgraded version of PQ26 is used for the A1 and could have underpinned an A1-based Mini rival for Alfa Romeo.

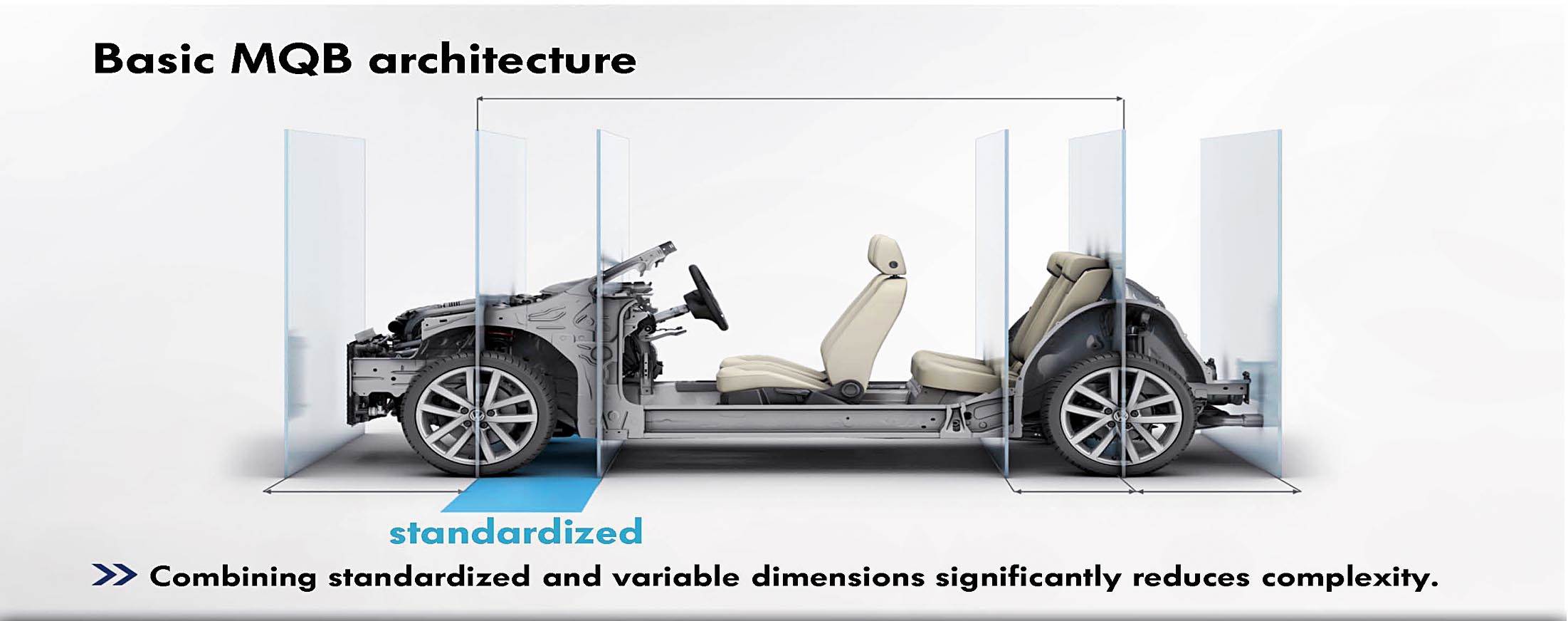

The MQB platform would have absorbed the core of Chrysler-Jeep production – growing considerably in scale in the process – and Audi’s upcoming MLB-Evo platform would have been the ideal basis for high-quality Alfa executive models.

VW’s MQB platform would be used to underpin new Chrysler and Jeep models.

RELATED ARTICLES

Kia displays EV5 and Sonet SUVs for Chinese market

Kia has unveiled a number of key models and new technologies for Chinese customers at the 2024 Beijing International Aut...

Nissan targets growth in China, unveils four NEV concepts at Beijing Motor Show

The two EVs and two plug-in hybrids are a joint effort with Nissan’s local partner Dong Feng and aimed to better address...

Lamborghini unveils Urus SE ahead of Auto China 2024

Electric-only range of 60km helps reduce emissions by 80%.

04 Aug 2014

04 Aug 2014

7058 Views

7058 Views

Autocar Pro News Desk

Autocar Pro News Desk