Ola's electrified fleet second largest globally: ICCT

The study on electric vehicle adoption by ride hailing companies shows the aspiration of these companies in their transition to complete electrification of their fleets.

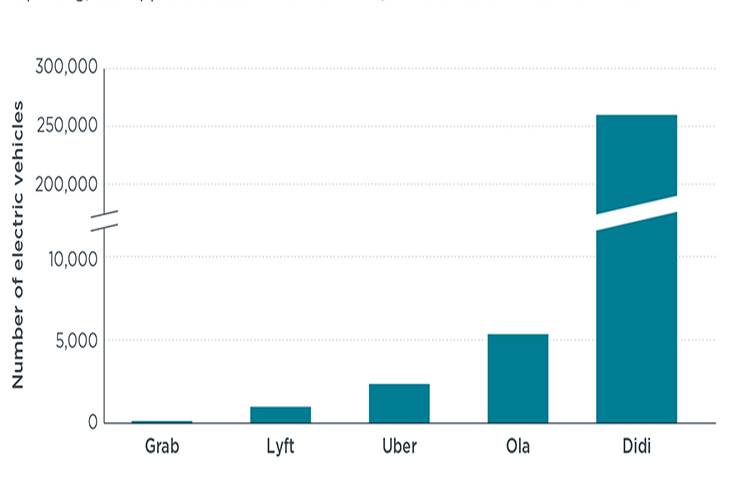

According to a report by ICCT (The International Council on Clean Transportation) on five of the world’s largest ride-hailing companies (Didi Chuxing (Didi), Grab, Lyft, Ola and Uber), electric vehicle use in company fleets ranges from several hundred to a few hundred thousand with Didi leading the pack with more than 260,000 EVs in operation at the end of 2017. The report reveals that Didi has around 1.3 percent of vehicles in its fleet electrified, followed by Ola with 0.6 percent and Uber, Grab and Lyft each having a 0.2 percent share. Uber and Ola are said to have about 2,500 to 5,000 EVs in their fleet.

In the report, the cumulative global EV sales through 2017 was about 3.2 million units. Didi accounted for around 8 percent of global purchase of electric vehicles through 2017. Didi’s fleet of more than 260,000 EVs through 2017 is 21 percent of China’s cumulative 120,000 over that same period.

Estimated number of electric vehicles in ride-hailing operations

Uber and Lyft launched their core services in 2012 and at the end of 2017 about 1 percent of Uber and Lyft vehicles – approximately 3,000 – were electric. The all-electric ride-hailing company CaoCao in China has about 16,000 EVs in its fleet as of mid-2018. Even though its fleet size is just 1 percent of that of Lyft, it has about 5 to 20 times more EVs in service than Lyft. Several taxi fleets around the world have partially or fully transitioned to the green vehicles; examples include Amsterdam’s Schiphol Airport fleet, London’s Black Cabs, Shenzhen’s local taxi fleet, Téo Taxi in Montréal, and others in Berlin, New York, Paris, and Washington DC.

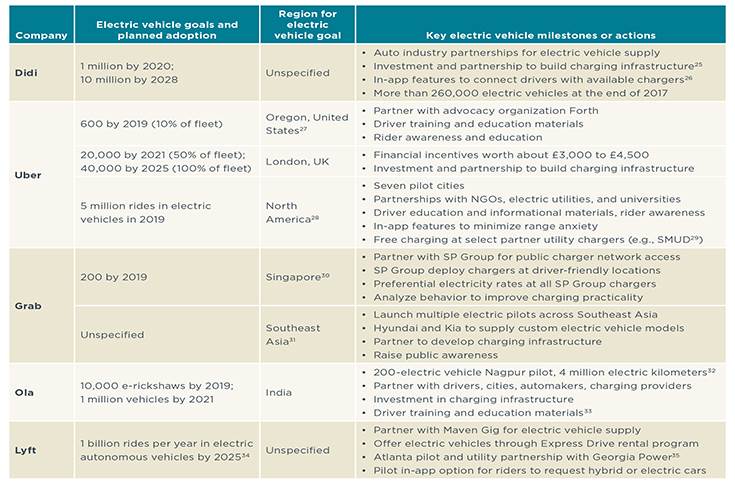

On assessing these companies’ future aspirations, some companies have region-specific targets whereas others have overall fleet goals. Some companies have set near-term targets for 2019 while others have longer-term targets for 2025 and beyond; and some companies seek to electrify a specific number of vehicles, a percentage of the fleet, or a number of trips.

Didi Chuxing' (Didi) fleet of cars in China

Didi is targetting 1 million EVs in its fleets by 2020 and 10 million by 2028. This is said to be approximately aligned with China’s new energy vehicle goal of 20 percent new vehicles to be electric by 2025. Uber had announced that 10 percent of its Oregon fleet will be electric by 2019 and more than half of its fleets in the United Kingdom will be electric. It also aims for 5 million electric rides by 2019 in North America. Ola aims to add 10,000 electric rickshaws by April 2019 and targets 1 million electric vehicles on its platform by 2021. While Grab will add 200 EVs in Singapore by 2019, Lyft has envisioned 1 billion annual rides in electric autonomous vehicles.

ICCT assumes a modest simple growth rate of 10 percent per year for future years for the overall company fleets. It has been projected by Bloomberg new energy finance (BNEF) that EVs will represent 11 percent of new global light duty vehicle sales in 2025 and 28 percent in 2030.

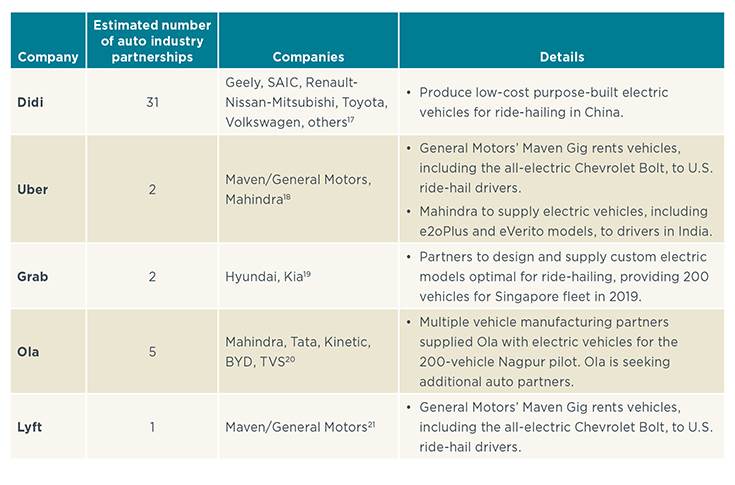

Each of the five companies have at least one partnership with an OEM to supply EVs to its drivers. These programs typically mean that drivers have access to EVs via short-term lease agreements at lower costs than would otherwise be offered in the absence of a partnership. Didi has partnered with dozens of vehicle manufacturers such as Geely, SAIC, Renault, Nissan-Mitsubishi, Toyota, Volkswagen and others to supply low-cost purpose-built electric vehicles for its operations in China. Mahindra has tied up with Uber and Ola in India while Ola has partnerships with Tata, Kinetic, BYD and TVS too. Hyundai and Kia is preferred by Grab and General Motors’s ride sharing spinoff Maven Gig is preferred for Uber and Lyft.

Infrastructure-wise, Didi has a JV to construct Didi-branded charging stations for its fleet. Although charging dynamics and options vary by city, many drivers can choose to use Didi-branded chargers, public chargers, or home chargers. Ola has a similar but smaller program to increase charging stations for its drivers in India. Uber is working to increase charging infrastructure availability in London; the company has partnered with multiple charging providers to increase driver-partner access to home chargers and public rapid chargers, and it is using Uber trip data to learn about driver charging patterns and behaviour.

The Maven Gig partnership with EVgo, although not specific to Uber or Lyft, allows participating Uber and Lyft electric vehicle drivers to use dedicated EVgo stations in several US markets for free for a limited time. Grab has partnered with Singapore electricity provider SP Group to make DC fast and regular charge points available to drivers and the company is analysing driver patterns to improve charger access, utilisation, and inform future installations at optimal locations such as coffee shops and food outlets.

Some of these companies have also devised driver training programmes. Ola’s pilot project in Nagpur includes training and education to help drivers understand vehicle maintenance, refuelling, and in-car technology. As part of Uber’s 'EV Champions' initiative in North America, it provides online EV resources in some local markets.

Some ride-hailing companies have also developed in-app features to facilitate electric ride-hailing on their platforms. Uber, for example, introduced long trip notifications to provide drivers information on distances for trip requests to help EV drivers avoid running out of charge during rides. Electric Uber drivers also can request to be matched with passengers traveling to destinations near available charging stations, thus minimising additional travel needs to reach a charger. Lyft is piloting an in-app option for passengers to choose a green option (hybrid or electric vehicle). Didi’s driver app shows nearby available charging stations, thereby providing a one-stop-shop for driving and charging.

Some of these companies have conducted some sort of EV pilot or research. In May 2017, Ola began testing 200 electric vehicles in Nagpur, India, to identify challenges and opportunities to grow its electric vehicle fleet. Didi has multiple research laboratories in China and expanded to California in March 2017, opening Didi Labs to develop advanced transportation technologies including electric and autonomous vehicles.

Grab launched a fleet of 30 BYD electric taxis in Singapore in 2014 and expanded the program in February 2017 by adding 100 BYD e6 vehicles. Uber conducted a 6-month trial in London in August 2016 to study the challenges of electric ride-hailing and better understand opportunities for the wider adoption of electric vehicles.

Toyota invests $1 billion in Grab

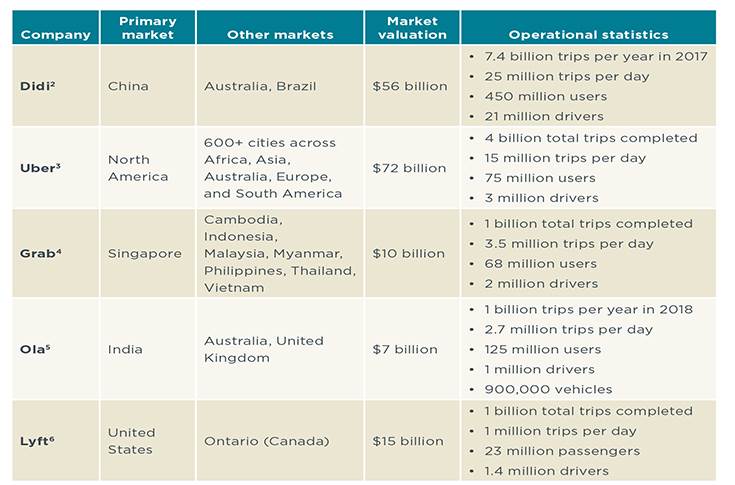

Ola, which primarily operates in India had approximately 1 billion trips per year in 2018, 2.7 million trips per day, 125 million users, 1 million drivers and around 900,000 vehicles. Didi, the segment leader, had 7.4 billion trips per year in 2017, 25 million trips per day, 450 million users and 21 million drivers. Uber, with the highest market valuation of $72 billion (Rs 512,460 crore) and operational in more than 600 cities across North America, Africa, Asia, Australia, Europe and South America had completed around 4 billion trips, with 15 million trips per day, 75 million users and 3 million drivers.

Data and Infographics: ICCT

The assessment from ICCT is based on the limited publicly available information found in company releases, announcements, blogs, publications, interviews and media stories.

Also read: Ola plots a million EVs on Indian roads by 2021

RELATED ARTICLES

Kia displays EV5 and Sonet SUVs for Chinese market

Kia has unveiled a number of key models and new technologies for Chinese customers at the 2024 Beijing International Aut...

Nissan targets growth in China, unveils four NEV concepts at Beijing Motor Show

The two EVs and two plug-in hybrids are a joint effort with Nissan’s local partner Dong Feng and aimed to better address...

Lamborghini unveils Urus SE ahead of Auto China 2024

Electric-only range of 60km helps reduce emissions by 80%.

By Autocar Pro News Desk

By Autocar Pro News Desk

22 Feb 2019

22 Feb 2019

20130 Views

20130 Views