Indonesia set to become ASEAN’s biggest car market

The gradual decline in vehicle sales in Thailand is continuing to drag overall ASEAN market sales downward.

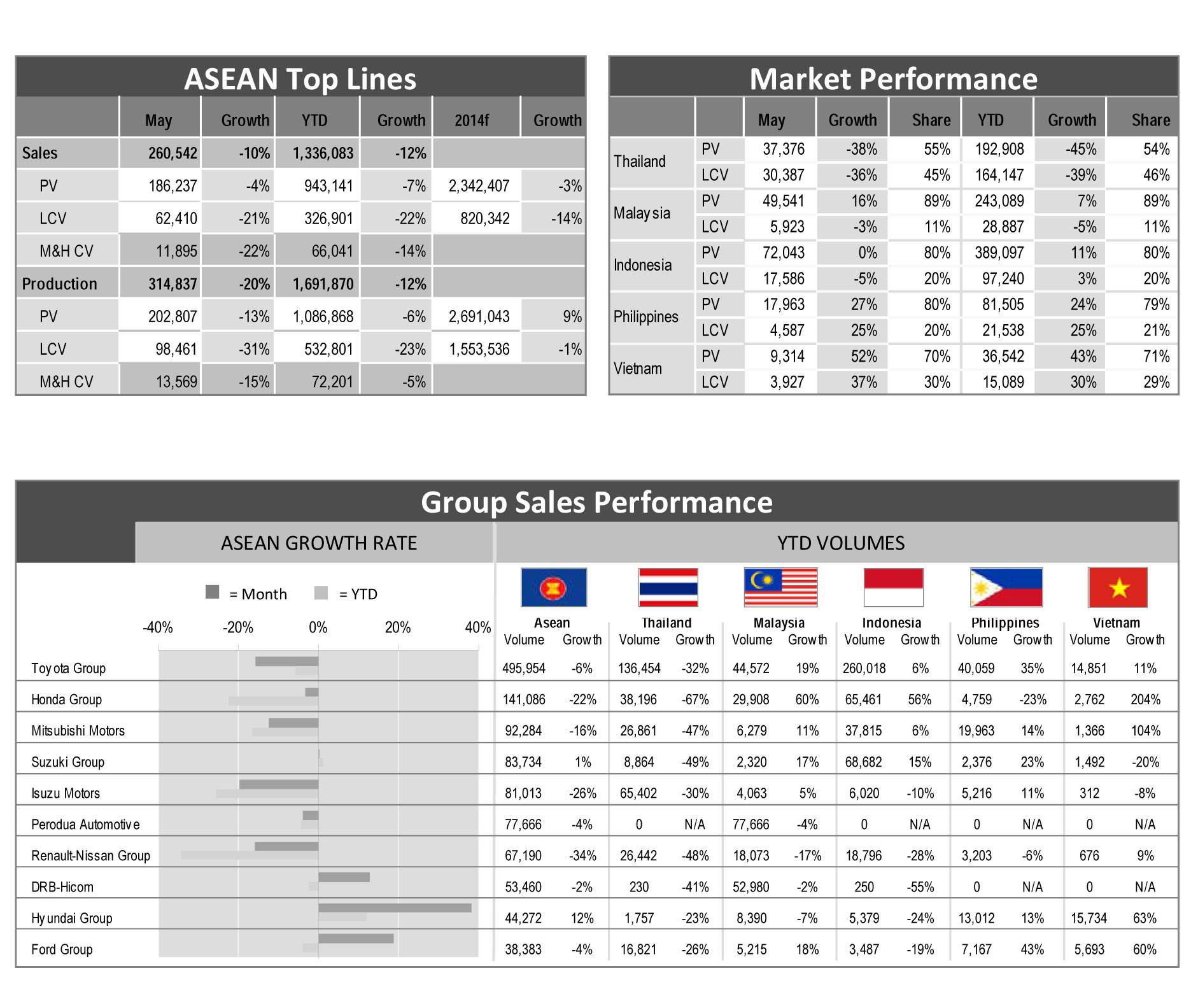

The gradual decline in vehicle sales in Thailand is continuing to drag overall ASEAN market sales downward. According to LMC Automotive, Total Light Vehicle sales in the ASEAN‐5 countries amounts to approximately 249,000, a 9 percent decrease year‐on‐year (YoY).

However, the decreasing rate is an improvement on the monthly average of ‐14% during the first quarter of 2014. This is largely the result of sales growth in other countries, and a comparatively lower base in Thailand towards the second half of 2013, once the impact of the 2012 First Car Scheme had tailed off. LMC Automotive says it has cut the regional outlook for 2014 to 3.16 million units from 3.20 million units previously.

The cut is made mainly for the Thailand market which stands reduced by 39,000 units and as a result, the outlook for 2014 falls to around 900,000.

The annual sales outlook for Indonesia is also cut slightly by around 4,000 units, but this is insignificant compared to the current total sales figure of 1.22 million units. This market is expected to surpass Thailand’s to become the biggest car market in the region for the first time. May 2014 sales, although lower by a few hundred, continued to show strength on the back of increasing demand for new models, particularly under the Low Cost Green Car project (LCGC) program.

The 2014 sales forecast for Malaysia is also cut by almost 6,000 units but here the number is somewhat significant in a market with a projected size of less than 669,000 units. The cut was made mainly to reflect weaker‐than‐expected sales in May at just above 55,000 units. LMC says the current outlook is still on the downside, considering the average YTD SAAR (seasonally adjusted annualized selling rate) is only around 668,000 units.

Meanwhile, sales in the Philippines and Vietnam reflect a positive momentum.

Sales in the Philippines are now expected to reach around 241,000, an increase of more than 4,000. The new forecast is still relatively low compared to the May SAAR, which achieved a record high of 265,000 and an average YTD SAAR of around 253,000. There is a distinct possibility that the figure will be added to in the near future. CAMPI, the local automotive association, had previously revised its outlook to 250,000, which included M&HCVs.

Sales in Vietnam are now expected to be just below 128,000 units, an increase of 8,000 units on the previous outlook. In fact, sales in May surpassed the 13,000-unit level for the first time since April 2008. The current outlook is still lower than the average YTD SAAR of 140,000 units. LMC Automotive says it is likely that it will further raise the forecast in the coming months. The VAMA, the local automotive association, has projected sales of 140,000.

RELATED ARTICLES

Kia displays EV5 and Sonet SUVs for Chinese market

Kia has unveiled a number of key models and new technologies for Chinese customers at the 2024 Beijing International Aut...

Nissan targets growth in China, unveils four NEV concepts at Beijing Motor Show

The two EVs and two plug-in hybrids are a joint effort with Nissan’s local partner Dong Feng and aimed to better address...

Lamborghini unveils Urus SE ahead of Auto China 2024

Electric-only range of 60km helps reduce emissions by 80%.

22 Jul 2014

22 Jul 2014

4315 Views

4315 Views

Autocar Pro News Desk

Autocar Pro News Desk