New car sales in Europe up by 9% to 1.34 million in April

This is the best April performance since 2008 and the highest monthly increase over the last 13 months.

The European new car market has recorded its best April performance since 2008, with volume up by 9.0%. Over 1.34 million cars were registered, signifying that the industry has recovered strongly from the 5.2% decline it posted in March 2018.

This was the highest monthly increase since March 2017 and boosts the year to date figures to 5,607,856 registrations – an increase of 2.5% year on year.

The UK market returned to growth, with registrations in April up by 10.4%, its highest monthly increase since June 2015. However, as Felipe Munoz, JATO’s Global Analyst explains, “The reason for this is that were two additional selling days in April, and we saw the effects of the VED tax changes from 2017. In March 2017 many consumers purchased their vehicles ahead of the changes, boosting March’s results but causing a decline in the April 2017 market which has impacted April 2018’s year-on-year results”.

Switzerland was the only market to register a decline, whilst Germany recorded 314,055 registrations – boosted by the demand for SUVs, which were up 23% due to the strong performance of the Volkswagen T-Roc and Ford Kuga.

“April 2018 was an abnormal month, as many unusual factors helped to accelerate growth. However, these results show that there’s a positive mood among both consumers and car makers, as more models hit the market and more alternatives to diesel cars become available,” said Munoz.

Diesel down, SUV boom on

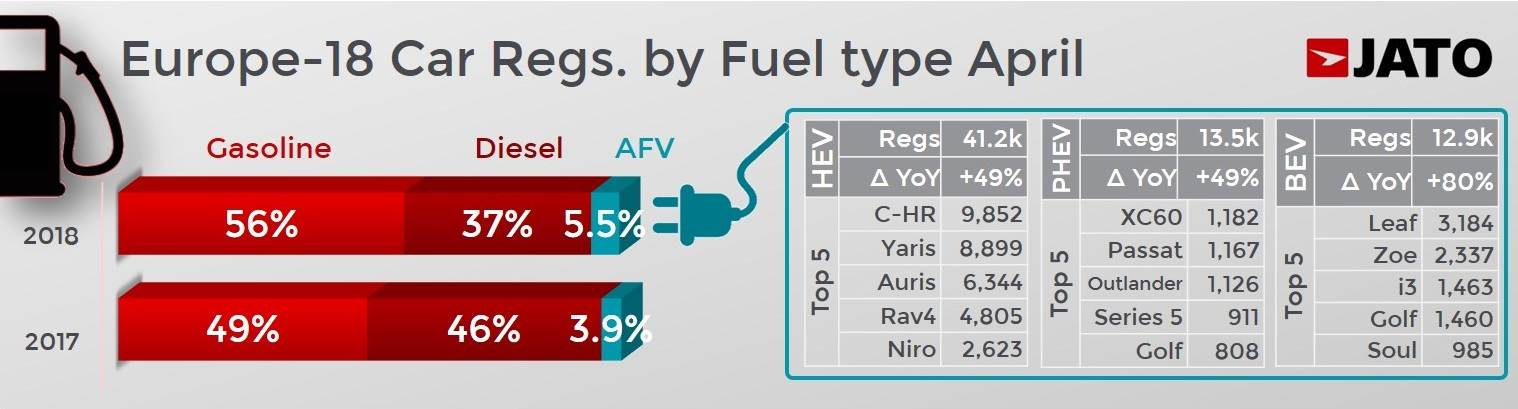

Results from 18 markets show that diesel registrations continued to fall in April, with volume down by 13.2% to 453,500 units – a market share of 36.7%. Meanwhile, diesel losses continued to be petrol’s gain, as strong demand increased their volume by 53.5% to 692,300 units – a market share of 56.1%.

Alternative Fuelled Vehicles continued to gain traction, with volume also up by 53.5% as they counted for 5.5% of total registrations. Among them there were 41,200 hybrid, 13,500 plug-in and 13,000 fully-electric registrations.

The SUV boom continued in April, as it came out on top as the best-selling segment in 24 of the 27 markets. Their volume grew everywhere across Europe, with double-digit growth recorded in 25 markets and a huge 116% increase in Croatia. Over the last three years, the market share of SUVs has grown rapidly, jumping from 21.4% in April 2015 to 33.3% in April 2018.

Small SUVs were the biggest driver of growth in the segment, with 166,700 registrations. Their volume was up by 45% as they were boosted by new arrivals like the Volkswagen T-Roc, Dacia Duster, Citroen C3 Aircross, Opel Crossland, Seat Arona, Kia Stonic and Hyundai Kona. Compact SUV’s volume increased by 27%, which equates to 40,000 more units than in April 2017. They remain the top-selling type of SUV in Europe, and their April volume was boosted by double-digit growth by the Peugeot 3008, Ford Kuga, Toyota C-HR, as well as new arrivals like the Skoda Karoq, Jeep Compass and Opel Grandland.

Subcompacts were also responsible for increasing market growth, with volume up by 6.9% to 273,000 units. Likewise, executive cars also posted a good month in April, as registrations were up by 15.8% to 37,100 units, with 11,400 of these registrations stemming from the Mercedes E Class. MPVs posted the highest drop, continuing their poor performance from Q1, with volume down by 21.5% to just 81,900 units.

VW Group and Hyundai-Kia gain market share

For the second consecutive month, Volkswagen Group gained the most market share across Europe, growing from 24.9% in April 2017 to 25.7% in April 2018. This was due to the strong performances of Skoda, Seat and the Volkswagen brand. SUVs counted for 26% of the group’s registrations, more than any other segment.

Hyundai-Kia posted the second largest market share gain, as its volume grew by 17.4% to 88,400 units. It was the sixth largest car maker in April, however there was only a marginal gap between them and FCA, who recorded 89,100 units and came in fourth place. Toyota also performed well in terms of market share gain due to the strong performance of its hybrid range.

Premium car makers like the BMW Group and Daimler lost ground as a result of double-digit falls in their midsize and compact models. Their market share also suffered as a result of minimal growth in the premium car segment, which increased by only 1.7% in April to 297,800 units.

Whilst the VW Golf was once again the most popular model in Europe, the new T-Roc continued to climb the rankings and recorded the highest volume from the market’s newest additions. The small SUV recorded 12,950 registrations and was the 26th best-selling car in Europe during April, outperforming other big players like the Audi A4, Renault Megane, Fiat Panda and Toyota C-HR.

Other models that performed well in April include the Ford Fiesta, Dacia Sandero, Renault Captur, Ford Focus, Peugeot 3008 and Toyota Yaris. Further down the rankings, the Toyota C-HR, Mercedes GLC, BMW 5-Series, Ford Ecosport and Renault Scenic also posted good months and increased their volume.

Among the market’s newest launches, the Citroen C3 Aircross was the 45th best-selling car in Europe, whilst the Opel Crossland and Seat Arona came 53rd and 54th, respectively. Meanwhile, the Opel Grandland came 77th, the Kia Stonic came 94th and the Hyundai Kona came 99th.

Other recent launches include the new Volvo XC40 with 3,316 units, Jaguar E-Pace with 2,513 units, BMW X2 with 2,272 units, Range Rover Velar with 2,122 units, and the DS 7 Crossback with 1,576 units.

RELATED ARTICLES

Marelli Talbros Chassis Systems wins Rs 1,000 crore business from European OEM

The order, to be executed over an eight-year period, is for the supply suspension arms tailored for both conventional in...

Kia launches customised NBA display themes for North American market

Display Themes is a customised service that supports a personalised vehicle experience, allowing users to customise the ...

Antolin and VIA Optronics unveil versatile vehicle cockpit concept

The Sunrise vehicle concept cockpit, which is engineered for seamless transitions between manual and autonomous driving ...

By Autocar Pro News Desk

By Autocar Pro News Desk

23 May 2018

23 May 2018

643 Views

643 Views