Automakers dominate 2016’s Best Global Brands study

Fourteen carmakers and Harley-Davidson are in this year’s Top 100 brands. While Toyota and Mercedes-Benz are in the Top 10, the others make sizeable gains. And disrupter Tesla debuts as a 2016 new entrant.

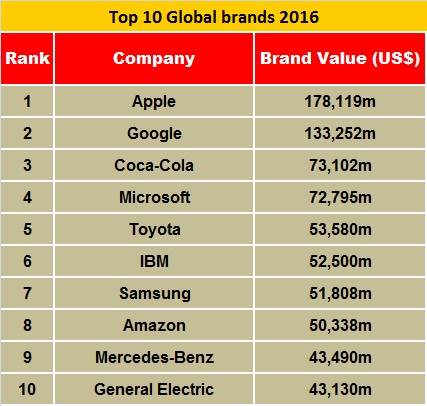

While Apple, Google and Coca-Cola have been named the three most valuable brands in brand consultancy, Interbrand’s 2016 Best Global Brands report, automotive with 15 brands and technology with 14 dominate the ranking.

“It’s clear the best global brands are not just weathering change, but driving it,” says Jez Frampton, Interbrand’s global CEO. “They understand their anatomy of growth is complex, unique and personal; they look inward and outward, expand into new markets, and create better experiences to grow their brands and businesses.”

For the fourth year in a row, Apple and Google claimed the top positions. Apple’s brand value grew by 5 percent to US$ 178,119 million, while Google’s brand value rose 11 percent to US$ 133,252 million. Coca-Cola, Microsoft, Toyota, IBM, Samsung, Amazon, Mercedes-Benz and GE round out the Top 10. Dior and Tesla enter the Best Global Brands report for the first time, at #89 and #100 respectively.

The world’s five Top Growing Brands include Facebook (48 percent growth), Amazon (33 percent), Lego (25 percent), Nissan (22 percent) and Adobe (21 percent).

With a combined 29 positions, automotive and technology brands dominate this year’s report. Retail is the Top Growing Sector, increasing 19 percent, followed by the sporting and luxury sectors — each experiencing a 10 percent increase. The Top 100 brands have a combined total value of US$ 1,796,384 million, an increase of 4.8% from 2015.

15 automakers in the Top 100

Automotive is the most dominant sector on this year’s table — made up of many top-growing brands — with Toyota and Mercedes-Benz in the Top 10, and growth for Nissan (+22%), Mercedes-Benz (+18%), Porsche (+18%), Audi (+14%), Ford (+12%), Kia (+12%), BMW (+12%), Land Rover (+11%), and Hyundai (+11%). And Tesla debuts as a 2016 new entrant. While these brands are rising, the focus is on sustaining growth as the way the world thinks about cars evolves.

Over the past few years, automotive companies have made major strides in terms of technology, innovation, and sustainability. And with 15 brands represented in this year’s Best Global Brands report, auto is the dominant sector by number.

Together, auto brands make up 13.7 percent (US$ 234,439 million) of the table’s total value, second only to the technology sector in collective worth. These are significant stats for an industry that is often seen as sluggish and which faces major challenges moving forward, due to evolving customer expectations and the changing role of driving.

Interbrands’ analysis of the 15 automotive brands in this year’s Top 100 offers key insights on why they’re holding strong — and what they need to do to stay on top.

Auto brands fueled by broad markets and vast economic impact

The auto industry is huge, with more than 60 million (and counting) cars sold this year, and is still cycling off levels that predate the financial crisis. For many buyers, cars are more than a mode of transportation: they are emotional investments, status symbols, or even a source of livelihood.

Auto companies also serve an increasingly large segment of the world’s population. Generating high returns and massive sales, they’ve become the backbone of both global and local economies. Though they are being consolidated on the holding-company level, giving them truly global scope, there are still many major, distinct brands, pulling millions of dollars in sales each year.

In emerging markets, the ambition to own a car is growing. A large part of the world’s population has remained carless, but as the middle class rises, brands such as Nissan, Ford and General Motors are expanding into new regions like India, China, and Brazil. In these newly developing areas of the world, automotive companies’ existing business models will likely still be relevant in 20 years, but in developed countries, staying competitive will call for significant evolution. Automotive companies will need to continue to invest in technological advancements to keep up with new and existing drivers who are preparing themselves for the next phase of mobility.

Differentiation and relevance will drive continued success

As brands across the board become more focused on individuals’ needs, the auto sector — with its especially broad market — faces two distinct challenges: differentiation and relevance. Auto brands used to be highly differentiated, but now buyers are more interested in individual models and how those vehicles fit into their lives. With so much information at consumers’ fingertips, brand awareness is not enough — organisations need to not only innovate products but to create a truly differentiated brand experience.

Top 10 brand Toyota, for example, is tapping into smart technologies like its Intelligent Transportation System (ITS), which enables the real-time exchange of data between vehicles and infrastructures. And Korean brand Hyundai is figuring out how to tailor its brand message to diverse global audiences by creating localised social media experiences that enhance individuals’ interactions with the brand.

As the average age of new car buyers climbs to 51.7 and the number of driver’s licence applications among millennials declines, there is a concern about decreasing relevance within the automotive sector. In the race to increase their presence in people’s lives, connectivity is key, as carmakers integrate with customers’ devices, homes, and things. Relevance also means rolling with changing preferences—automotive brands must learn how to harness new technologies to anticipate the needs of diverse drivers.

Future of auto sector revolves around ownership and mobility

To do this, auto companies must shift their focus from selling products to delivering a service, as driving itself begins to look different. As the current car-buying generation begins to retire, how will the behaviours of upcoming generations of buyers change? Major shifts in this sector will revolve around two pillars: ownership and mobility.

Car ownership might not be as relevant in the future as conversations evolve around fractional (i.e., shared) ownership models and ride-sharing grows with increasing speed. Since its launch in 2010, for example, Uber’s staggering statistics reveal that it now has more than eight million users in over 290 cities around the world and is expected to process US$ 10.84 billion in bookings in 2015. In its home city of San Francisco, Uber is now tripling the revenue of the local taxi market, at about US$ 500 million per year.

Major auto brands like Mercedes-Benz and Ford are also beginning to enter and experiment in the ride-sharing space. Nissan likewise announced plans to supply cars to college students through a campus car-sharing venture with Enterprise Rent-A-Car.

While many auto companies are harnessing new vehicle technologies to stay ahead of the curve, a true test of innovation is whether or not these advancements can actually change driving behaviors. In an attempt to lead the driverless-car revolution, Mercedes-Benz, Audi and BMW collectively spent US$ 3 billion to acquire Nokia’s HERE, a service comparable to Google Maps.

The auto sector also faces the impending entry of nontraditional car manufacturers — Apple’s Project Titan and Google’s self-driving car project both represent strategic investments by technology giants in autonomous driving’s future. While increasingly feasible, the large-scale adoption of autonomous driving rides on major regulatory considerations and customers’ behavioral shifts.

In the meantime, however, auto brands are also working toward the future of smart mobility. Mercedes-Benz, for example, has adopted moovel, which integrates car2go, mytaxi, Flinkster, train services, public transport, and bicycle data all into one simple app that guides users on the smartest path through any city.

In a letter to Business Life, economist Ross Parker wrote, “I would not be surprised if today’s car becomes tomorrow’s horse: a recreational pleasure, sporting discipline, and an increasingly rare sight on the road.”

This prescient view underlines the changing role of vehicles, as cars move away from being functional necessities to becoming tech-enabled extensions of personality, shareable assets, or even sources of entertainment. Powerful automotive brands will have to take a more holistic view of mobility to maintain their stronghold and balance their strategies to meet desires in diversified markets — that are moving at much different speeds.

Here's the 2015 list of top 100 global brands

Data: Interbrand

RELATED ARTICLES

Kia displays EV5 and Sonet SUVs for Chinese market

Kia has unveiled a number of key models and new technologies for Chinese customers at the 2024 Beijing International Aut...

Nissan targets growth in China, unveils four NEV concepts at Beijing Motor Show

The two EVs and two plug-in hybrids are a joint effort with Nissan’s local partner Dong Feng and aimed to better address...

Lamborghini unveils Urus SE ahead of Auto China 2024

Electric-only range of 60km helps reduce emissions by 80%.

By Autocar Pro News Desk

By Autocar Pro News Desk

06 Oct 2016

06 Oct 2016

5830 Views

5830 Views