37% global EV miles penetration by 2040 requires Rs 17,055,900 crore investment: Morgan Stanley

The research study warns that any company or government targeting electric mobility without a concrete plan for creating infrastructure will be at a huge risk.

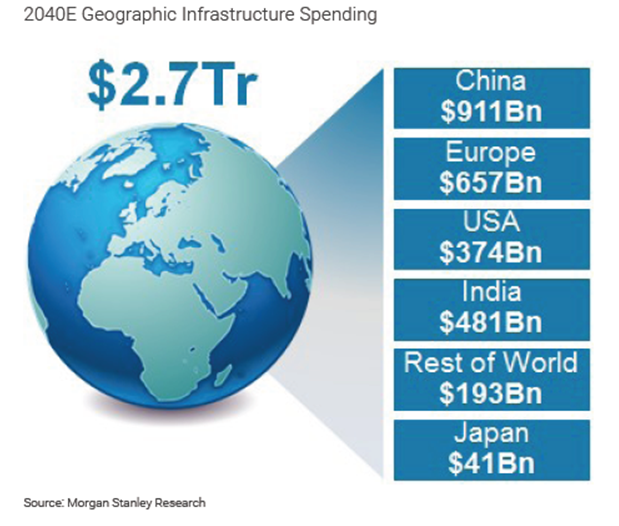

The global penetration of electric vehicles (EVs) compared to traditional internal combustion engine (ICE) vehicles still remains miniscule, but with increasing push by various countries towards electric mobility, including India, requires a huge paradigm shift in investment. As per a Morgan Stanley research, to enable 37 percent EV miles penetration, 526 million EV fleet, and 1,200,000 kilometre travel by 2040 will require an additional estimated investment of $2.7 trillion (Rs 17,055,900 crore).

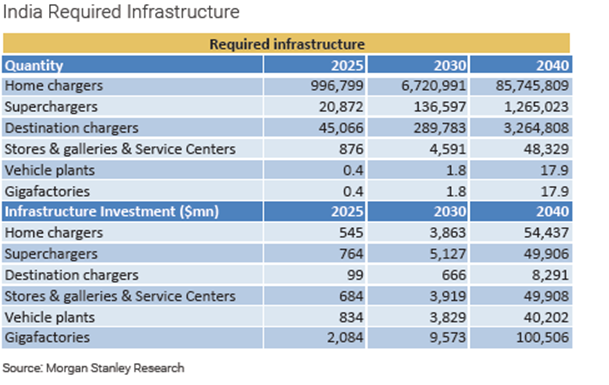

The research reflects upon the study of the American EV manufacturer, Tesla’s model for creating the much-needed EV infrastructure to enable EV penetration in the market. It warns that any company or government targeting electric mobility without a concrete plan for creating infrastructure will be at a huge risk.

Taking a cue out of Tesla’s physical footprint of creating charging stations, service centres, stores and galleries, assembly and gigafactory capacity is the basis of the assumption of the research for global sales, fleet and total distance travelled by EVs through 2040. The EV maker has invested around $8 billion (Rs 50,536 crore) to support its annual production volume of around 108,000 units and 300,000 vehicles in fleet. By 2040, it is estimated that Tesla will have an annual capacity of 2.4 million units and a global fleet of 32 million cars. Additionally to meet this huge demand it would require 473 million home chargers, 7 million superchargers, 18 million destination chargers, and around 172,000 service centres, 95,000 stores and galleries, 99 manufacturing plants and 99 gigafactories, that will see the EV maker make an accumulated investment of $1.7 trillion (Rs 10,738,900 crore).

Investing 10 bps of global GDP annually

To achieve 64 percent EV sales in global sales will require global EV industry to invest an average of $73 billion (Rs 461,141 crore) annually or roughly 10 bps of global GDP in manufacturing, charging and service infrastructure. The implied industry numbers get very big by 2040: 473 million home chargers ($635 or Rs 40 thousand each), 7 million superchargers ($39,000 or Rs 24 lakh each), 18 million n destination chargers ($2,500 or Rs 1.57 lakh each), 172,000 service stations ($1.3 million or Rs 8.21 crore each), 99 gigafactories ($5.6 billion or Rs 35,375 crore each) and 99 vehicle plants ($2.2 billion or Rs 13,897 crore each).

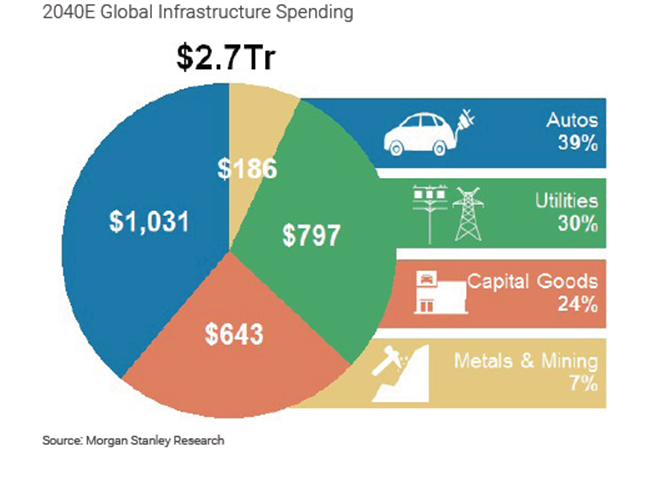

Enabling EV penetration will also additionally require $1.7 trillion (Rs 10,738,900 crore) direct investment, $797 billion (Rs 5,034,649 crore) investment in electric utilities, and further $186 billion (Rs 1,174,962 crore) investment in metals and mining, taking the total to $2.7 trillion (Rs 17,055,900 crore). Commenting on the huge investments required, the report comments, “This is a big number, and we believe it will require a combination of private sector capital expenditure and public funding across both regions and sectors.”

Fuelling the EV dream

Currently, the bulk of the cost in an EV is made up by the cost of batteries. To see an increased number of EVs on road, will require more number of lithium-ion battery manufacturing to take place. To meet the forecasted 526 million EVs by 2040 will require 34,000 GwH of global battery production or 230 times more of the present production, representing growth at 27 percent CAGR in the coming 23 years. At over $550bn (Rs 3,474,350 crore) in aggregate spend, battery production capacity represents the single biggest investment in the electric infrastructure.

The research paper comments, “The implied infrastructure expenditure is so large in magnitude that we see it forcing innovation in all aspects of the applied technology both inside and outside of the battery.”

On a positive note, the research estimates the cost of batteries to come down significantly as new investments take place. By 2020, the battery cost to come down to around $100 (Rs 6,317) per KwH.

Power Generation

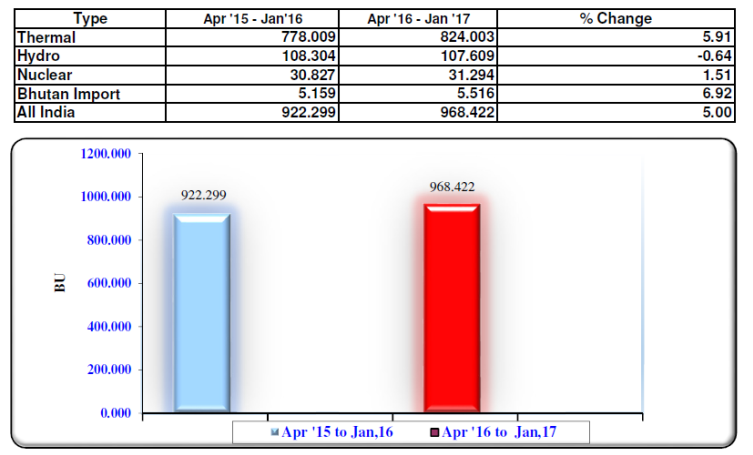

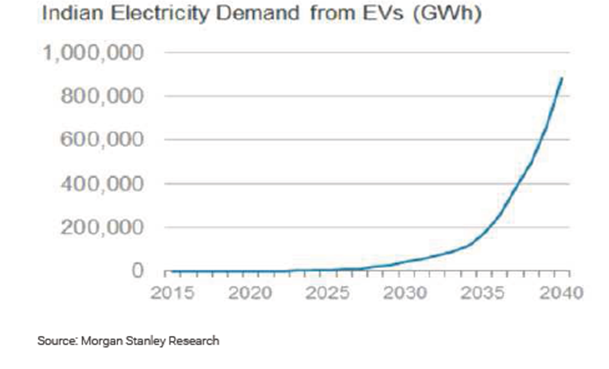

With the present miniscule penetration of EVs does not make up for a case of finding additional means of power generation, globally. But for a country like India, where electricity generation is still relied on traditional non-renewable sources as well as electrification has not reached 100 percent of its geography, the challenges remain manifold.

Source – Ministry of Power

A look at the current power generation in India, gives a big clue towards the challenges for meeting the additional demand for energy in the world’s second most populous country. As more EVs mean requirement for more charging points that will require additional utility equipment to enable power to flow to electric vehicles. And greater electricity demand will require investment in new generation resources.

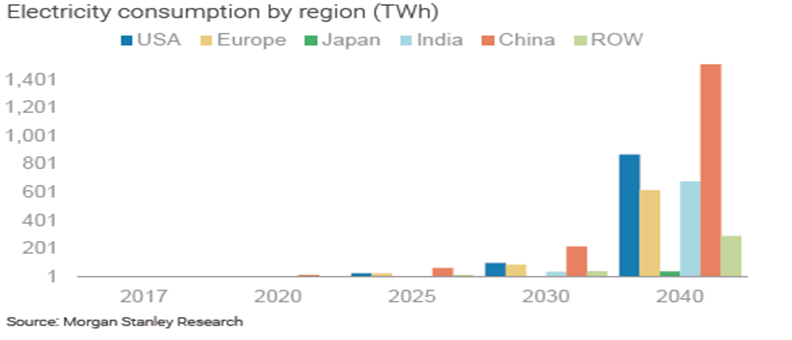

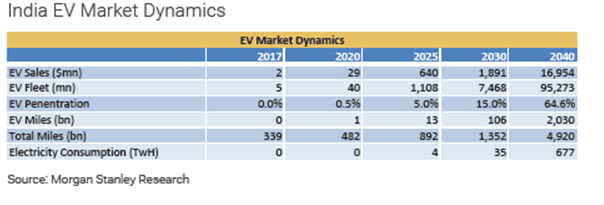

Geographically, China is expected to be the largest market for EV miles - roughly the size of the US and Europe combined. We also expect Indian EVs to result in more than 677 TWh of incremental electricity demand by 2040, just below the size of US EV demand at that time (866 TWh).

India’s EV Dream

India the fastest growing but the most infrastructure constrained EV market, Morgan Stanley expects that India will see the most delayed growth i.e 20-fold EV miles growth between 2030 and 2040. As electric infrastructure remains a major bottleneck that needs to be addressed – EVs estimated to contribute 25 percent increase in electricity demand.

The Indian scenario currently sees only one domestic automobile manufacturer Mahindra & Mahindra, selling EVs in the country. On the back of the lacklustre demand in one of the lowest per capita vehicle market, there is a huge potential that EVs could witness.

Morgan Stanley reports, that the momentum started by the government through the EESL’s tender for purchasing 10,000 EVs along with 3,000 alternating current charging points and 1,000 direct current charging points is a small number globally. But, on the other hand the order is the largest ever in the country along with the size is more than all the EV cars sold in the country till date, gives a case to be optimistic about.

RELATED ARTICLES

Kia displays EV5 and Sonet SUVs for Chinese market

Kia has unveiled a number of key models and new technologies for Chinese customers at the 2024 Beijing International Aut...

Nissan targets growth in China, unveils four NEV concepts at Beijing Motor Show

The two EVs and two plug-in hybrids are a joint effort with Nissan’s local partner Dong Feng and aimed to better address...

Lamborghini unveils Urus SE ahead of Auto China 2024

Electric-only range of 60km helps reduce emissions by 80%.

11 Oct 2017

11 Oct 2017

7523 Views

7523 Views

Autocar Pro News Desk

Autocar Pro News Desk