‘In 2016, we tripled our sales in India. If demand continues to grow, we will look at setting up a plant in India.’

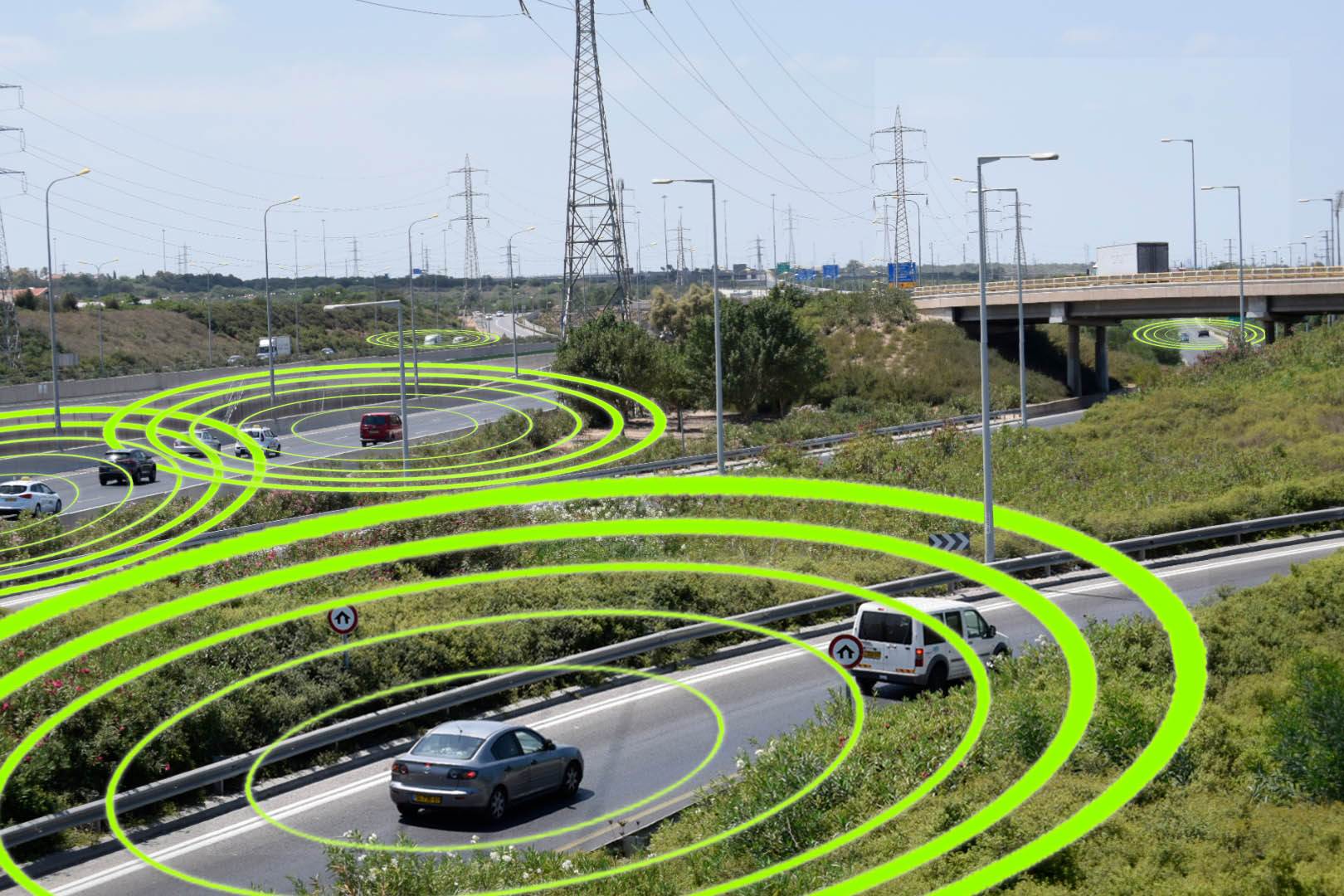

Vehicle security and GPS tracking solutions provider ERM Advanced Telematics is bullish on the India market and is pitching for increased sales of its telematics product portfolio.

Israel-headquartered electronics company ERM Advanced Telematics designs, develops and manufactures innovative vehicle security and GPS tracking solutions. A bullish-on-India Eitan Kirshenboim, Chief Marketing Officer, ERM Advanced Telematics, speaks to Autocar Professional’s Kiran Bajad on bagging a contract from a CV maker and working with Indian OEMs, wooing Indian bikemakers from Chinese products, and exploring potential for making and exporting from India.

How large is ERM Advanced Telematics’s product portfolio?

ERM is an Israel-headquartered designer and manufacturer of advanced telematics and vehicle security solutions. All our products are made in Israel and sold to over 50 countries. Established in 1985 as a vehicle security company, we ventured into telematics and the fleet management business in the year 2000.The security business is focused largely on Israel with a market leading position in the segment.

To the rest of the world, we provide telematics and fleet management solutions like those being offered in India. We have a wide product portfolio including deep analytics installation like OBD, all kinds of sensors, and solutions for third party devices like tyre pressure management interfaces.

How long has ERM been present in India?

We have been in India since the past four years with a sales and product management team. We ship the devices as parts from Israel for assembly in India. We are working with couple of OEMs in India and we send them products directly.

Recently, we have partnered with one commercial vehicle OEM in India, which will have our product fitted with all their trucks in India. We are also working with some other OEMs in India but I can’t disclose their names as yet as their contracts are not yet signed. We work with major OEMs like Kia and Hyundai in Africa. We are also having initial talks with Harley-Davidson in the US for a small portion of product offerings in that market.

What is the market response from Indian consumers to your products?

The Indian market is very cost conscious and most challenging. We are not competing in the entry level market served by Chinese players. We can’t match their prices and we are not going to compete with them. We pitch our products against medium and high solutions markets, which are catered to by western manufacturers from the US, Europe and Israel.

Telematics is an emerging area for the Indian automotive industry as manufacturers are trying to bring them as standard solutions in trucks and buses? What opportunities you foresee in India?

The Indian automotive market is big with high growth potential with most of the global OEMs present in the market. But in India, most of the demand is for vehicle tracking systems which track the location of the vehicle. Only 18-20 percent of the market is really interested in advanced telematics, for which we have a wide range of products.

We also have solutions for vehicle tracking but that is not our major business. We are trying to develop demand for recognising driver behaviour and black box, which see huge sales across the world. We design and manufacture with full control over the product technology and quality; this offers us a competitive edge in the market.

We are collaborating with OEMs in India by understanding what they have and what their requirements are and working around to introduce those solutions.

Today, in India, OEMs have telematics solutions from their existing partners but have realised that they are not good enough. They have started looking at aftermarket solutions and that’s where we come into the picture.

By end-2017, we will have at least two OEMs as customers in India and are looking to work with others. While some OEMs in India already have products, we are working with them to offer our products solutions.

Are your telematics solutions OEM fitments or aftermarket products?

ERM is basically an aftermarket manufacturer; we do have OEMs as customers but it is a small portion of our operation. Hopefully, it will grow in the future but today we work mostly in the aftermarket. Ours is an aftermarket company which works with telematics and fleet management providers. We partner these service providers to install telematic devices in their customer vehicles.

ERM is partnering an independent telematic and tracking devices services provider in India who installs telematic hardware for its customers. In India, most telematics service providers offer only entry level services and tracking; ERM is not addressing that market but instead looking at services providers who are offering more besides tracking, fuel management, tyre management and engine diagnostics. These require more sophisticated technology and we foresee strong demand for these products in India with good market opportunity.

In India, our solutions are offered in many applications like mining trucks, commercial vehicles like buses, haulage trucks, personal vehicles, taxis and even rickshaws, which is a very interesting project.

India being a cost-conscious market, what strategies does ERM employ to address this parameter?

We do everything with full control on our products and do not need to pay royalty to third parties. We can also work on these low-priced products to a certain point. We offer higher advanced solutions which is something we can play in. The entry level market is where devices are lower end due to their low price and are difficult to compete in. We are very competitive in the advanced telematics market.

What is your road-map for the Indian market in the near-term?

In 2016, we tripled our sales in India and want to triple it again in 2017. Thanks to OEM business, we have lot more to offer in India. We are looking at local manufacturing plant in India to make everything in India and look for export from India in the region including Middle East, Singapore and Africa. In the next three years, if our volumes increase in India, then we will start local manufacturing.

Does this mean you expect India to be one of key markets in the next few years?

Yes, India is a very strategic market for us and the only place where we work with the local team with people in Pune and New Delhi. There is no other country where we have a local team. All the countries we work are with our partners to introduce products in those countries but in India we have a team for sales, marketing, assembly and technical support managed by ERM. I see huge opportunities in India for telematics and the fourth-generation cellular network will probably allow much better detailed solutions from mobile device in buses and trucks in the next couple of years.

School buses are yet another area of growth where these telematics solutions are going to be used widely for monitoring. All mining vehicles are going to be sold with telematics and also for security and safety of the driver; we have solutions for these areas too in India. What’s more Ola, Uber and other taxi service providers are expressing interest in telematics, which means this market is growing very fast. All these areas offer us huge growth

Motorcycles are another interesting market – the high-end bikes, not commuter bikes. We have solutions dedicated for motorcycles and are waiting for some new demand from this market which is controlled by Chinese devices. These devices are very low quality, which we are trying to replace.

RELATED ARTICLES

BRANDED CONTENT: 'We aspire to be among the leading sensors and electro-mechanical products manufacturer'

P. Parthasarathy, Founder & Managing Director, Rotary Electronics Pvt Ltd shares the company's commitment and vision to ...

‘Big opportunity for startups lies in products in India’: Detlev Reicheneder

As electrification levels the playing field, the focus on tech and R&D to bring innovative products is the mantra for st...

'I hope my journey makes people say — I can do this too'

Ranjita Ravi, Co-founder of Orxa Energies — the maker of Mantis e-bikes — shares the challenges of building a startup an...

14 Feb 2017

14 Feb 2017

9910 Views

9910 Views

Autocar Pro News Desk

Autocar Pro News Desk