A steady approach in turbulent times

As the automotive sector faces what many are now describing as a global recession, there has also been an unprecedented downturn in the Indian market for heavy commercial vehicles.

Despite the downturn ArvinMeritor, the world’s largest independent manufacturer of heavy-duty truck and trailer axles, stays firmly committed to this market, in which it sees long-term opportunities for its products. “We’ve got a little bit of rough road to get through, but once the economy improves and infrastructure investments are resumed, our view is that the market is going to evolve fairly rapidly,” vice-president and MD (India) Larry Dowers declares.

In keeping with that commitment the company is investing in and expanding new product programmes to ensure it does not lose ground and is prepared for when the market recovers. “We have the widest range of commercial vehicle products in the industry from a technology viewpoint, and are preparing to bring them in as the requirements of this market evolve,” Dowers says.

In May the company announced its plan to spin off the Light Vehicle Systems (LVS) business to ArvinMeritor shareholders and to concentrate its focus on Commercial Vehicle Systems (CVS). Beginning 2009 the spun-off LVS business will be named Arvin Innovation, and CVS is expected to revert to the Meritor name the former Rockwell International’s automotive business assumed when it was spun off in 1997 till its merger in 2000 with Arvin Industries.

CVS operations in India consist of Meritor HVS (India) Ltd, a 51:49 joint venture with the Pune-headquartered Kalyani Group that is engaged in the design, development, and marketing of axles, brakes, and bogie suspensions; and Automotive Axles Ltd (AAL), the BSE-listed equal (35.52 percent) joint venture between the same two partners that is currently the largest independent manufacturer of rear drive axle assemblies in the country.

AAL is a purely manufacturing company with MHVSIL as its sole customer. Both are situated in Mysore, and supported by ArvinMeritor’s technical centre in Bangalore that also does engineering design and analysis for the parent company worldwide.

One of ArvinMeritor’s most immediate investments in India is going into an expansion of this centre with the addition of a new site by April where, in addition to its traditional engineering activity, it will also engage in benchmarking and light laboratory work. Then, in 2010, a full-fledged testing and validation (T&V) laboratory will be established here to augment the T&V capabilities of MHVSIL’s tech centre in Mysore with a view to developing products meant for Meritor’s Asia–Pacific and global markets.

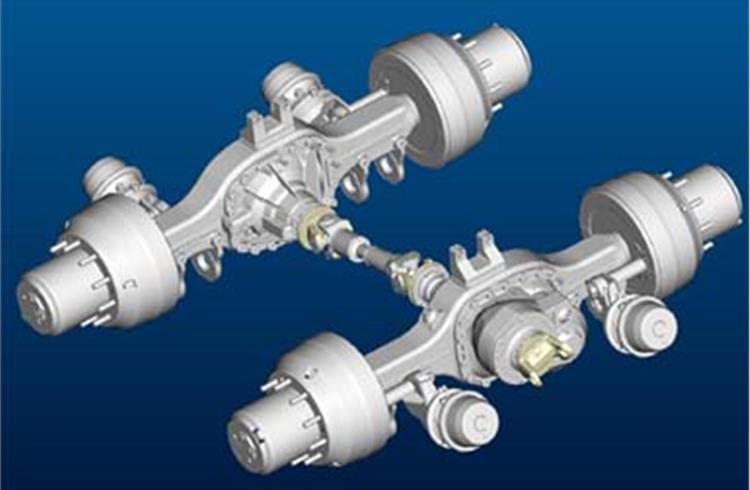

The Mysore facility itself has only recently been expanded with the addition of a Rs 8 crore axle dynamometer (see box). Talking about the dyno gets Dowers all excited. “I don’t think you will see this test equipment with any other supplier in India — in fact even the OEMs don’t have this,” he enthuses. When this correspondent visited recently, the dyno was being used to test the drive and rear axles of a new tandem axle the company plans to introduce in India shortly.

A record, and then the crash

In June AAL recorded its highest monthly production in 27 years — 11,650 axle sets. This record included 300 of the MS06-100 (C100) model for LCVs (and 500 carrier sets), 300 of the MS08-120 (and 350 exported), 700 of the MS13-145 for buses, 4,000 of the MS13-1495 and MS14-1495 (plus 700 MT28-1495 tandems), and 100 of the MS14-160 for 6×2 trucks.

Also contributing to this figure were 2,000 sets of the “SQR” axle (similar to the MS13-145), consisting of front and rear drive axle pairs for Ashok Leyland’s Stallion assembled by the Vehicle Factory Jabalpur, and tandems designated MT26-108/109 for 160 hp tippers and for export to the European aftermarket.

Following the downturn, production nosedived to fewer than 1,000 axles in November, compared to 8,500-odd in the same month in 2007. This figure includes the third lot of a newly developed tandem version of the MS14-160, Meritor’s largest single-drive axle in India with an 18” differential carrier that it started supplying for Ashok Leyland’s 4930 tractor in September.

The company not only covers the loading, torque, and reliability requirements of the Indian market with these five base platforms, Dowers points out, but it can also rely on products from its operations in North and South America, Europe, and China.

“We have many products we can rapidly bring in as new applications emerge. An extensive array of modelling and simulation tools, over and above our years of application experience, give us the advantage of being able to offer customers optimised power density solutions for their specific drive axle requirements.”

Accordingly, MHVSIL is gearing up to introduce two new axles for the emerging 8×2 haulage segment that vice-president S. Raghunathan feels is an exceptionally good value proposition for the transport industry, and one for mining tippers, a more robust evolution of the traditional 2516 class of vehicles segmented according to engine rating —180 hp, 235 hp, 280 hp, and 300 hp.

“Tata Motors and Ashok Leyland together were making up to 30,000 vehicles of this type a year. This segment grew continuously till last August, after which it has taken a beating, probably because a number of infrastructure projects have been held up owing to cost escalation, and the fact that many more have not been cleared. But I believe it will grow, and it will get further segmented,” he says.

The traditional 160 hp models will remain restricted to surface operations and overburden removal, whereas the higher-powered variants, because of their superior gradability, will be bought for deeper mining or longer-duration projects, in which the truck will need to operate into and out of progressively deeper regions in the mine.

Growth in the 6×2 “multiaxle vehicle” haulage segment, by comparison, has substantially flattened over the last two years, primarily because of the ban on overloading, even though this has been relaxed somewhat over the last six months for political considerations. The 6×2s had found very good acceptance mainly because the additional axle gave higher overload reserves and hence better working economics.

The ban on overloading, which has the strong support of the Ministry of Surface Transport and industry bodies like ARAI and SIAM, really went into force in some states about a year back. This is a consequence of highway developments in the last five years under the BOOT scheme in which the contractor quotes for the maintenance of the road for an agreed period.

“Overloading damages the road and pushes up the maintenance cost. Thus the contractors feel the direct effect, and they protested to the government,” Raghunathan explains. “But more importantly, overloading hurts the vehicle industry in two ways: one, it shortens the life of the trucks, and two, it kills demand for new trucks. If the average overloading in the industry is 10 percent, that means 10 percent of demand is lost.”

An axle manufacturer like Meritor can do little about the situation but design and engineer its products to withstand the worst possible overload scenario, regardless of the axle weight regulations. That’s because the truck OEMs are loath [CORRECT SPELLING] to stipulate loading restrictions for fear of losing sales to the competition.

In the event of a failure it is often not possible, and certainly not desirable, for them to argue with the user that the product did not perform because of wrong application or abuse. Hence the vehicle, and indeed the axle, should perform for the intended loading needs of the customers. Not surprisingly, 60 percent of these are individual, one-time, and first-time buyers, for whom the initial purchase price and rapid return on investment are of paramount importance.

“When there is a performance issue in the vehicle due to non-performance of any component, the vehicle or component manufacturer cannot cite overloading as a reason, because the customer is sure to respond that he expected the axle to be designed for the way the vehicle is used. It is very difficult in the kind of competition the vehicle manufacturers have to dictate do’s and don’ts to the end-users,” he says.

In reality this presents little difficulty for Meritor, whose designs, and the processes that have gone into them, are time-tested over almost 100 years and very robust, AAL director Ashok Rao points out. As a result they are able to withstand abuse, because the whole focus in this market is on abuse rather than use.

Rao likens the drivers and operators to children in their perpetual quest to find the outer limit of abuse the axle can take before it fails. “For example if, in an older truck, the gearset gave way at 80,000 km, and the operator realises that his new truck has not failed at 100,000 even though it’s been just as overloaded, he overloads it even more, by half a tonne at a time, just to see how far he can push the envelope. If, however, at 20 tonnes the new gearset also fails at 80,000 km, he immediately knows that this is the outer limit.”

This is something Meritor has to deal with only in India, he points out. “Here we are required design a 10.2-tonne axle – the legally permitted maximum load – for 13 tonnes, knowing full well that the operator is going to load it with 18 or 20. There’s absolutely nothing we can do about it. It’s a vicious circle. That’s how the OEMs sell their products. That’s how they spec their products, and that’s how they expect us to supply.”

But Raghunathan predicts that this will change as the transport industry consolidates, as point-to-point movement of goods gives way to hub-and-spoke distribution following the inroads made by organised retailing into semi-urban and rural areas. Then the bulk and heavy transportation from the manufacturers to the distribution centres will be handled by large fleets, while smaller groups and independent operators will handle last-mile deliveries.

In anticipation of this trend MHVSIL is preparing to launch a two-speed drive axle for 4×2 tractors and 6×2 and 8×2 rigids in April for OEM testing, and an intermediate between its MS13-1495 and MS14-160 for 4×2 tractors. This month itself it is expected to introduce a new tandem, sized between the SQR (used in Tata’s and Ashok Leyland’s 2516 trucks) and the MT26-1495, and meant for mining tippers in the 2518 category such as Tata and AMW produce.

The two-speed axle has a planetary reduction built into the differential itself, adjacent to the hypoid. The driver can either engage the regular ratio by electropneumatic control, or step the propshaft input down through the reduction. “Typically you can operate in a power mode when, for instance, you’re negotiating a steep gradient, and then switch to economy mode when you’re at grade,” Raghunathan explains.

This improves the flexibility of usage and yields better fuel efficiency and operating economics. This will of course entail an additional cost, but one he is convinced the market will readily absorb. “The price is not a constraint if the customer sees the value in it, especially as this value is going to be readily realisable in terms of fuel efficiency, starting from day one.”

While this design has already been tested and proved for the last seven years in Brazil and Mexico, the new tandem was developed entirely at MHVSIL in Mysore working together with the engineering centre in Bangalore. Commending the “experience, knowledge, and responsiveness” of the two teams, Dowers cites a powerful example of how all three Meritor entities worked together to build a programme for a customer in South Korea.

“The ArvinMeritor hub reduction housing was modelled and analysed at ArvinMeritor’s Bangalore engineering centre and validated at the tech centre in Mysore. The housing, suspension brackets, hubs and drums are now manufactured by Automotive Axles for this export customer. We now in the process of taking this same family of products to North American customers,” he says.

Dominant on the market

While Meritor’s primary purpose is to supply fully dressed axles, inclusive of hubs and drums, the two major OEMs have their own “time-tested and cost-trimmed” designs, their own axle assembly lines, and their own established vendor bases for these components, and hence often find it advantageous to procure the components at a beaten-down price and fit them on.

But Raghunathan points out that new entrants like Swaraj Mazda and Eicher would prefer buying fully assembled axles. In fact MHVSIL has already supplied the MS14-1495 model (an uprated version of the MS13-1495) to the former for its Isuzu Prestige bus. It also supplies the front steer axles and MT28-1495 tandems for AMW’s tractors and tippers, but that OEM is now preparing to take axle production in-house. Nevertheless, this is going to be an expensive exercise and Raghunathan is hopeful AMW will return as a customer.

Pending price negotiations, the company is also gearing up to supply 300 a month of its MS14-160 to MAN Force Trucks for its 4×2 and 6×2 export trucks. It has not been able to make it onto the 25-tonne truck Mahindra Navistar plans to introduce next year – the OEM is currently testing a Dana design from competitor Axles India, – but he expects to be in the business for the heavier models.

Due to its existing relationships with both Eicher, which has used Meritor’s axle for its heavier applications, and Volvo, for whose locally assembled FM7 4×2 tractor AAL once produced the MS13-185 13-tonne axle, he is confident that when their joint venture VE Commercial Vehicles comes out with a product strategy “we’ll have a good space to play”. The more obvious advantage of course is the fact that Meritor produces a majority of Volvo’s axles in Europe at its plants in Lindesberg (Sweden) and Cameri (Italy).

In fact Meritor even worked on developing the cast axle for Volvo’s B7R coach chassis locally, but the local foundries were not able to deliver the price targets for the volume of 500 buses then, and Volvo found it cheaper to import them from Sweden, where it buys axles in bulk volumes from Meritor in Lindesberg and the economies of scale help it to get a very good price.

Raghunathan reveals MHVSIL is also working closely with Ricardo, which is developing the light-duty truck platform for Daimler Hero, on applicating its MS08-120 and the MS13-145 for a 9- and a 12-tonne model respectively. This month it will also deliver the first prototype axle, with wheel ends and drum brake, for a heavy truck Magna Steyr in Pune is developing for Daimler Hero for later introduction.

The company recently won an order from Tata for 1,600 deep-drop front axles for its Marcopolo low-entry buses to be supplied to the Delhi Transport Corporation under a recent tender. In the first phase deliveries will start with an imported batch in April, followed by 200 locally assembled axles a month till December.

Tata has used ZF axles till now, but these were significantly more expensive as they were imported from Germany. MHVSIL’s advantage here is that the axle beam, the most expensive part, is already forged locally by Bharat Forge and exported to ArvinMeritor.

Adding to its price advantage will be the Meritor ELSA225H air disc brake that is already being assembled in India for buses by Brakes India Ltd, which also supplies many components of this model to Meritor in the UK (the ZF model comes with Knorr disc brakes from Germany).

While Tata subsidiary HV Axles has developed an equivalent to the MT26-108 that the OEM has all along bought from Meritor for its 2516 tippers, Raghunathan says Tata has committed that it will continue to take the same number of axles – as many as 40,000 a year before the downturn – but rely on HV Axles for additional growth.

The growing organisation of the trailer market presents Meritor with another significant opportunity. Right now it supplies a rectangular-section tag axle to Ashok Leyland that is also available to the trailer market, Dowers says, and it has a large capacity set up in China to draw on if needed. Why it has not pursued this business aggressively till now is, Raghunathan explains, because trailer builders want a completely assembled axle but are not willing to pay the price for the non-asbestos brakes that sister company KTMS produces.

Products for the future

As for the future, the company plans to bring in its hub reduction axles mentioned above for 8×4 tippers and 6×4 tractors, though the exact strategy – whether this will be the existing product or local hybrid – has yet to be decided. The next product could be propeller shafts, Dowers reveals. “In the US we make have lube-free, long-life drivelines too, but that isn’t what the market here has been looking for” — not yet, he concedes.

The company is still evaluating the prospects for bogie suspensions and air suspensions. The former, first displayed at the Auto Expo in 2006, has been delayed because of a late decision to commonise it for the BRIC markets so as to avoid the cost and effort of having to validate the product for each individual market.

The air suspensions, because of their proprietary technology, will take longer to bring in, while Meritor figures out its non-axle product strategy for this market. “Such a sophisticated product needs a very elaborate design and validation effort for each vehicle application. And unless that’s supported by volumes, in the form of a long-term contract, or cooperation with the customer, it won’t be viable for us to manufacture it locally,” says Raghunathan.

Asked how Meritor can help OEMs meet higher and higher emissions and performance standards in this market, Dowers’ immediate reply is that there is no question that “we will see rapid product evolution in India”. He says the work Meritor has done in other markets on product optimisation and efficiency will help it respond quickly, pointing out that its European and North American customers have long been efficiency-minded and focused on vehicle running cost-optimisation.

For example, the advanced 17X axle developed for the European market uses a differential case welded to the ring gear using the latest in laser welding technology. While many of the components of that axle, such as the gearsets for some of the high running ratios, are supplied by AAL in Mysore, Dowers doesn’t see it coming to India soon, since the service requirements here prefer a bolted design. “But the technology will nevertheless be there and be proven ahead of time for when it is required in the Indian market,” he says.

For the immediate needs, the present designs already use the latest in gear and lubrication technology available in Meritor products worldwide that contribute to fuel efficiency, Dowers points out: “Whereas some people rely on a pump, which is another part, which is a reliability question, we’ve done exotic lube studies and forced the lube through the axle without the need for a pump. This enhances the reliability of the axle.”

Staying ahead

Though there have been competitive moves from other manufacturers, Raghunathan points out that these putative competitors are not in the heavy duty segment yet. “As we add high-value products I think we’ll be able to maintain our lead. In any case our strength has always been that we’ve had capacity and products ahead of the market, and we want to maintain that,” he says.

Accordingly, AAL is assiduously positioning itself to make the most of the upturn when it happens. Its recent efforts at consolidation include a rigorous TPM implementation that allows it to substantially increase its capacity and introduce new products with minimal additional capital expenditure.

In pursuit of his goal of significantly improved throughputs at reduced costs, Rao and his team are being both ruthless and relentless in eliminating waste in every aspect of operations, and are already beginning to see what he calls “multiplying effects”.

For example, the old Gleason 5-cut equipment took more than eight hours to set up. This resulted in longer runs, higher inventory, and the associated inflexibility. So the team took one cell of pinion-cutting machines, consisting of two roughers and two finishers, as model machines to study and achieve a breakthrough in setup time and overall productivity.

The elements of the setup time were then studied and categorised as removal, fixing, and adjustment times. The adjustment steps were studied in great depth for elimination. In parallel, the removal and fix steps were studied for reduction.

“Today, after completion of the first-phase actions, the setup time stands at 50 minutes. On this cell we get an additional 6+ hrs of production per setup, which dissolves the myth that the old 5-cut machines cannot be flexible. Now a horizontal deployment is in progress,” Rao explains. “The singular focus on cutting out losses in every aspect of operations throws up the possibility of improvements where earlier you thought you could get nothing,” he says, citing a few more examples of benefits the company derived, none of which entailed any investment.

These included a setup time reduction on the centreless grinding machines for axle housings from two hours to 30 minutes, making the shot blasting machine a zero-leak machine, a 50-percent-plus reduction in power consumption for the swaging operation, and an equally drastic reduction (40 per cent plus) in paint consumption per assembly.

If everything works as it should, Rao says it will open up lots of incremental capacity without actually having to invest in floor space or in equipment — or manpower.

“That would basically cover all our existing range of products. For those new products that have certain additional operations that require something we cannot handle with our existing equipment, we will incrementally invest. But at that point the investment are required to make will be quite marginal and our returns will definitely be protected, because our asset base is not really going up dramatically,” he concludes.

RELATED ARTICLES

BRANDED CONTENT: Eliminating the worries of battery charging with smart solutions

The charging infrastructure is the backbone of electric mobility but is also one of the key perceived barriers to EV ado...

The battery-powered disruptor

Greenfuel Energy Solutions is planning to shake up the EV battery market with the launch of a portfolio of specially eng...

SPR Engenious drives diversification at Shriram Pistons & Rings

The engine component maker is now expanding its business with the manufacturing of motors and controllers through its wh...

By Autocar Pro News Desk

By Autocar Pro News Desk

06 Jan 2009

06 Jan 2009

6927 Views

6927 Views