Spark Minda presses the growth accelerator

The Gurgaon-based Spark Minda, Ashok Minda Group, aims to consolidate operations in India and abroad. Along with capex plans of Rs 300 crore till 2018, it will also set up a greenfield plant in Mexico to cater to Volkswagen.

Sometimes business splits are enablers of new directions as individuals chart their own destinies. In 1995 when the combined Minda Group split, it was divided between the two brothers NK Minda and Ashok Minda as the UNO Minda and Spark Minda Groups respectively.

Set up by their father SL Minda in 1958, the company was first known as Minda Switch Auto in 1986. At the time of the split, the switch, light, horn and batteries division passed on to the elder brother, while the younger sibling Ashok Minda entered the domain of safety security and restraint systems, driver information and telematics systems and interior systems. These business demarcations ensured the two brothers did not compete with each other and facilitated each other’s independent growth.

DC Sharma, Group chief financial officer at Spark Minda, joined the Minda Group when it was still unified in 1991, soon after completing his chartered accountancy. He worked in the joint entity until 1995 after which he was transferred to the Ashok Minda entity where he is based till today. He recounts how the Group, which began as a fledgling Minda Switch Auto, transformed into Minda Corp, the listed arm of the Spark Minda Group.

In the first year of operations, the company chalked a topline of around Rs 75-80 crore. The same year, the budding firm struck its first joint venture with Huf Hulsbeck and Furst GmbH & Co of Germany to source technology for entering the four-wheeler security systems segment and began interacting with carmakers like Ford, General Motors, Maruti Suzuki, Daewoo and Mahindra & Mahindra.

Initially, Spark Minda had commenced operations with two-wheeler security systems, followed by the wiring harness and instrumentation portfolio for the same segment. In addition to the JV with Huf, another joint partnership with Stoneridge Inc of USA for four-wheeler instrumentation systems strengthened this bouquet though at present four-wheelers form a very small fraction of its total business with the majority servicing the two-wheeler segment. But Sharma maintains that the four-wheeler business is growing speedily, compared to other segments, and has great potential especially as the Indian auto industry is targeting five million passenger vehicles by 2020.

India abroad

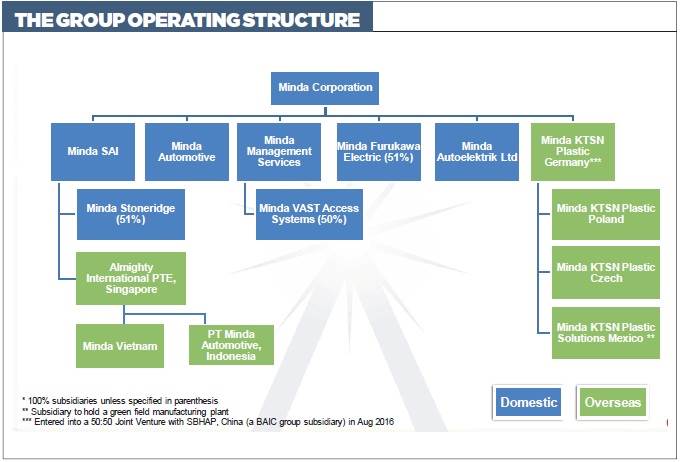

Minda Corp has three manufacturing facilities in Europe for plastic interiors, 27 plants in India and two in South East Asia.

Spark Minda’s journey till 2006 was marked by domestic growth but later it saw an opportunity in expanding its manufacturing footprint overseas, initially in South East Asia. The Minda brothers kick-started a combined greenfield project in Indonesia for lights, horns and security systems for two-wheelers and with the venture proving successful they replicated it in Vietnam as well. The following year, in a bid to further expand its product portfolio, Minda Corp terminated the JV with Huf due to issues over shareholding pattern and royalty, and hived off the four-wheeler security systems business into another company, Minda Valeo Security Systems following a JV with Valeo of France for the product line.

The following year, its inorganic growth got a head-start with the acquisition of KTSN of Germany in 2007 which was worth Rs 250 crore at the time. Earlier, Spark Minda had acquired Sylea Automotive in 2003 that made wiring harnesses for commercial vehicles and consolidated it into Minda Sai that was into manufacture of wiring harnesses for two-wheelers. In 2015-16, this company, which is a supplier to all automotive segments except passenger cars, clocked a turnover of Rs 550 crore.

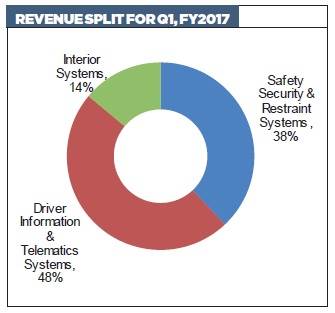

At present, the holding company of the Group – Minda Corp – has three manufacturing facilities in Europe for plastic interiors (Poland, the Czech Republic and Germany), 27 plants in India and two in South East Asia. About 48 percent of its business accrues from driver information systems and telematics, wiring harness and speedometers, 38 percent from safety and security systems with the balance 14 percent coming from plastic interiors. In the past four years, all Group companies have been transferred under it.

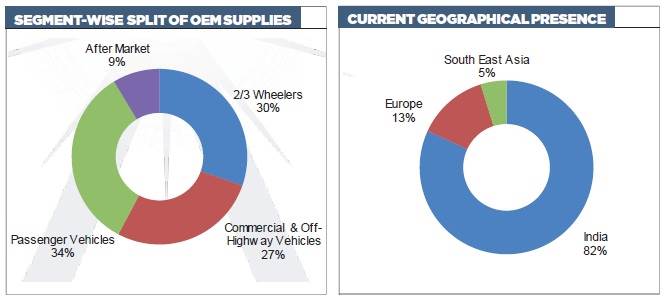

Overall, 34 percent business is contributed by passenger vehicles, 30 percent by two- and three-wheelers, 27 percent from commercial vehicles and 10 percent from the aftermarket. Of the total product portfolio, 90 percent of the supplies are to OEMs. While the domestic market accounts for 80-82 percent of the revenues, 13 percent accrues from Europe and five percent from South East Asia.

The Gurgaon-based Minda Corp makes security systems for two- and three-wheelers and CVs as well as die casting parts. Through Minda Vast, an equal partnership JV between Spark Minda and Vast of the US, it also makes four-wheeler security systems. Sharma claims the company ranks among the top three two-wheeler security system manufacturers in the world, the others being Sandhar Technologies and Honda. “We have very good expertise with an R&D centre for two-wheelers and develop a new product every year,” he adds.

The Group has an R&D centre in Japan as well that engages with Japanese customers from the concept stage. While the Indonesian and Vietnamese plants mainly supply to Suzuki, Yamaha and Kawasaki, with 80-90 percent of the products being security systems, Spark Minda is now pushing other products in those markets as well.

In 2015-16, Minda Corp, along with its 11 subsidiary companies, posted a turnover of Rs 2,450 crore and is targeting a 24 percent CAGR over the next five years. In line with this vision, in April this year, Minda Corp acquired 100 percent equity of Pan Alfa Autoelektrik of Haryana which manufactures starter motors and alternators for the tractor market.

Future growth strategy

Bawal plant of Minda Furukawa Electric, which makes wiring harnesses for four-wheeler Japanese OEMs. This product is one of the key growth areas.

In 2010-11, Spark Minda inducted Kotak as an equity partner, selling a 15 percent stake for Rs 125 crore. This fiscal (2016-17) Minda Corp will touch revenues of Rs 3,200 crore on the back of its aggressive merger and acquisition strategy. The past 5-6 years have seen it acquire three major companies – Pan Alfa Autoelektric, Minda Stoneridge which was earlier held by an investment company, PT Minda Automotive Indonesia and Minda Vietnam.

Going forward, the growth strategy is clearly charted out. “There was a time when we thought it was important to increase turnover as fast as possible but now we have realised that it is important to protect and improve the margins. We are looking at improving EBITDA margins by half percent every year for the next 4-5 years. Right now, the EBITDA is 10 percent,” says Sharma. Rival Motherson Sumi Systems Ltd (MSSL) has a higher margin of 14 percent, so Minda Corp is gunning for both the organic and inorganic routes to achieve speedier growth.

Organic expansion will mean mustering an annual growth of 8-10 percent. The company is determined that this be achieved by not holding lower than 30 percent share of business with any customer. Exports will play a key role as will expansion of the manufacturing footprint internationally. At present, rival MSSL exports about Rs 800 crore worth of products while Minda Corp’s exports are pegged at Rs 200 crore. Minda Corp foresees good potential of growing its wiring harness and die-casting business overseas and catching up with competitors in due course of time.

This year it has bagged export orders for die cast parts worth Rs 50 crore per annum and expects to see a three-fold increase by 2018-19. These will be supplied to Poland for servicing customers like BorgWarner, which is the largest supplier of turbochargers to the automotive sector. Minda Corp has also bagged its first export order from Piaggio in Europe and Vietnam for supply of wiring harnesses. “The Spark Minda Group will touch a topline of Rs 8,300 crore by 2019-20 with all the new businesses,” affirms Sharma. Minda Corp will account for about Rs 7,000 crore of this revenue.

The auto components supplier is also bullish that its new business with Hero MotoCorp will multiply over the next 3-5 years. Interestingly, Minda Corp’s two subsidiaries Minda Sai, which supplies wiring harnesses for two-wheelers and CVs, and Minda Furukawa Electric (a JV with Furukawa of Japan) that also makes wiring harnesses for four-wheeler Japanese customers has one of its facilities located inside Tihar Jail for Maruti Suzuki while Minda Sai has a plant in Yerawada jail for M&M.

Wiring harnesses, being a labour-intensive business, require large manpower strength. A week’s training is imparted to select prisoners. As a result, the factory not only generates employment for prison inmates but hones their skills as well. The Central government has also offered a helping hand in this endeavour. This month Minda Corp also started a facility in Aurangabad jail for making security systems for Bajaj Auto.

Inorganic growth

Assembly of starter motors and alternators for the tractor market underway at the recently acquired Minda Autoelektric plant in Bawal, Haryana.

For 2016-18, Minda Corp has earmarked Rs 300 crore for growth, of which Rs 200 crore will be on fixed assets and Rs 100 crore has been apportioned for working capital needs. Each year, this capex is reworked based on product requirement and funding capacity. Funding will be based on a 1:1 debt equity ratio with surplus funds to be ploughed in acquisitions.

The inorganic growth plan will see sales of Rs 2,600 crore by 2019-20 starting this fiscal. Early in 2016, the company acquired 100 percent equity of Pan Alfa Autoelektric which was clocking Rs 75 crore revenues for its Indian promoter. By leveraging group synergies, this revenue is expected to get a fillip to touch Rs120 crore by the end of this fiscal. There are similar targets for other companies as well.

“We are currently exploring options of M&As with some European companies in electronics, wiper motors and wipers. We have submitted a bid with our investment to be around Rs 125-130 crore. We will acquire the company this year. Currently, we are present in wiper motors for the aftermarket but following this acquisition, we will enter the four-wheel OEM segment. The targeted company already has a manufacturing facility in India that we can utilise,” reveals Sharma.

By 2020, when the Group’s overall organic revenues nudge the Rs 5,600 crore mark, sales from overseas companies in Indonesia, Vietnam, Poland, Germany and the Mexico plant will pitch in with Rs 1,200 crore while Rs 600 crore will be contributed by exports.

New interiors plant to come up in Mexico

In terms of products, the car interiors business is set to get a boost from the current 50-53 million euros turnover to 100 million euros by 2019-20. Sharma confirms that this business has already been bagged for which Minda Corp has decided to set up a new plant in Mexico for car interiors that will generate a revenue of 26 million euros by 2019-20.

An investment of Rs 100 crore has been earmarked for the upcoming Mexico facility with 50 percent to be ploughed on fixed assets and the balance on working capital. About 50 percent of the funding will be through Minda equity and the balance through term loans.

The company has bagged an order worth 20 million euro from Volkswagen for plastic parts encompassing the dashboard assembly, cupholder, centre console, and inner trims of the car. Also in the pipeline is business for air vents that constitute some 12-14 units within the car.

Minda Corp, which already caters to BMW in Germany, is bullish of supplying air vents to the OEM from its Mexico plant.

The Mexico plant will come up on an 8,300 square metre site at Queretaro with the premises to be rented. The pilot products will be submitted to the German carmaker in December with production slated to commence from April 1, 2017. The plan is to upscale production steadily through 2017-18 so as to touch revenues of 26 million euros subsequently.

A new entrant in this geography, Minda Corp is looking to aggressively flap its wings with a bouquet of products including wiring harness and security systems after it consolidates its car interior business.

Nissan and Volkswagen have a large footprint in Mexico. The German carmaker utilises 35 percent of its production in this region and exports the balance out of Mexico, leveraging the region’s low cost base. VW supplies will target the Tiguan and the Jetta in Mexico where the manufacturing facility has a production capacity of 30 million euros or 2 million parts per annum with 80 percent of the orders being for VW and 20 percent being targeted from BMW.

Minda Corp is also in talks with BMW for supply of air vents from Mexico for its e-car as it already supplies car interiors for the electric car in Germany and is bullish of winning this business in Mexico as well.

China also on the company's radar

Another geography where Minda Corp is in consolidation mode is China where key client VW is extending a helping hand to grow with an order for car interior parts. Minda Corp has struck out in China with an equal JV with the BAIC Group subsidiary this year. An investment of $ 12.5 million by both the partners is to follow with a target of growing to $ 35 million over the next 2-3 years. Among prospective customers, Daimler has evinced interest in the products coming out of the local facility in addition to VW which has a manufacturing footprint there. The production unit, located around 400km from Beijing, will go on stream within two years.

Expansion in India

Locally, the supplier is expanding its die casting business (acquired in 2009) by setting up another facility in Pune with an investment of Rs 70 crore.

Minda Autoelektric, the recently acquired entity, makes gear reduction starter motors and alternators for the entire tractor segment except TAFE, Punjab Tractors and Mahindra & Mahindra. The supplier is already providing wiring harnesses and security systems to M&M and is now set to bag the order (worth Rs 25-30 crore) for the new product line from the OEM as well. The auto component company has already won orders from PTL but is working on reducing costs and improving margins before commencing supplies.

The commercial vehicle sector is also on the radar but Minda Autoelektric is going slow on it as it wants to first develop excellence in both quality and delivery. A one-tonner for a CV manufacturer is on the scanner with supplies tentatively expected to commence in 2018-19. It is also scouting for a technical collaboration to diversify into high-end, next-gen alternators for which it is in talks with some overseas companies, says Gurpreet Singh executive director of the company.

The car interiors business is set to double from the current 50-53 million euro turnover to 100 million euros by 2019-20.

Earlier, Pan Alfa Autoelektric used to export Rs 25 crore worth of components to the Czech Republic with the domestic business generating Rs 50 crore but declining credit rating and rejection issues bogged it down. According to Sharma, following a meeting with the overseas customer and an assurance of quality products, an order of Rs 25-50 crore is in the pipeline this year.

The aftermarket contributes revenues of Rs 300 crore in India with a network of 500 partners present across the country. An additional revenue of Rs 120 crore is expected in 2016-17 and is billed to rise to Rs 600 crore by 2019-20.

Spark Minda is also opening a Spark Minda Technology Centre at Pune for developing electronics, an area in which it feels it could do with some expertise. The company has invested Rs 20 crore in the centre with a view to migrate from mechanical to electronics products over the next 4-5 years in view of the changing trends in industry. The centre, which will house world class testing and validation facilities, will be inaugurated in December 2016. The aim is to leverage the electronic system to improve the company’s margins and compete with rivals. “Unless we develop products in-house and change our technology, margins will not increase,” elaborates Sharma.

The tech centre, which is staffed with 25 engineers, is working on keyless entry for a two-wheeler maker and a passive entry passive system for four-wheelers. Spark Minda also has a design centre in Japan, which caters to Yamaha and Honda. Yamaha accounts for 90 percent of Minda Corp’s sales in Indonesia and 50 percent elsewhere. The company also plans to expand its base in Vietnam in wiring harness till 2019-20.

The slowdown in the past few years has seen the Spark Minda Group look at ways to trim personnel costs that hover around 16-17 percent compared to 14 percent of rivals. The aim is to trim one percent which would help the bottomline by at least Rs 30 crore. The company, recorded a 20-24 percent growth in the past three years.

Going forward, there is much to look forward to for the Spark Minda Group as recovery in the automotive sector picks up pace. On its part, the group is bullish on joint ventures and acquisitions, which will continue to play a major role in its overall growth game-plan.

This feature was first published in Autocar Professional's November 15, 2016, issue.

RELATED ARTICLES

Branded content: HL Klemove inaugurates first Local ADAS Radar Manufacturing Unit in India, marks a significant achievement in “Make in India” initiative

The inauguration ceremony was held in the presence of Vinod Sahay, President and CPO of Mahindra & Mahindra Ltd. and Dr....

BluWheelz to 'Green Up' logistics sector

With their EVs-as-a-service solution, the startup is playing it smart with costs and looking to electrify the entire seg...

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

By Shobha Mathur

By Shobha Mathur

04 Dec 2016

04 Dec 2016

81574 Views

81574 Views