Napino Auto readies to snap up new biz from BS VI and EVs

As a measure to derisk its business and achieve future sustainability, Gurgaon-headquartered Napino Auto & Electronics, which sees nearly 90 percent of revenues from the two-wheeler market, is already preparing for new opportunities in an era of disruption.

Napino Auto & Electronics is one of the very few names among the homegrown automotive component suppliers who are experts in the electrical and electronics domain, and confident of future growth as the industry stares at disruption and new technology trends.

The fast-increasing requirements of electronic content in vehicle development, supported by incoming mandatory regulations such as BS VI emission norms, the implementation of real-time driving cycles (RDE), safety (ABS and CBS) norms and, the biggest of them all, electrification of vehicles, is not just good news for a company operating in this domain. These technology trends, including the push for ADAS (Advanced Driver Assistance Systems), in-car and vehicle-to-vehicle connectivity among others, along with the scale of the India market, are all set to open up plum opportunities for companies like Napino in the coming years.

Napino Auto & Electronics, an around Rs 800 crore Tier 1 and 2 supplier to the automotive industry globally, is bullish about the growth it expects to record from FY2019-20. Notably, the two-wheeler industry currently contributes about 85 to 90 percent of the overall turnover of this company. The remaining business comes from the four-wheeler segment and the growing electric vehicle (EV) market.

In an exclusive interaction with Autocar Professional, Naveen Kumar, senior vice-president, Napino Auto & Electronics, says, “We are growing at around 8-10 percent as compared to the last financial year. Our growth is at par with the YoY growth of the two-wheeler industry. However, we are anticipating that our major growth will come after 2019. So, FY2019-20 will be a critical financial year for us in terms of big jump upwards.”

To begin with, Napino is anticipating big growth under implementation of the BS VI regime from April 2020. All two-wheeler manufacturers will be mandatorily required to upgrade to BS VI-compliant models (old and new). As part of that mandate, all 100cc (and bigger) models (mopeds, scooters and motorcycles) are expected to deploy EFI systems, which will replace carburetor units, to adhere with the stringent emission norms.

This sudden demand creation for EFI systems (April 2020 onwards) in the domestic two-wheeler market is estimated to be more than 18 million units per annum – a massive opportunity and an equally big challenge for suppliers of EFI system to scale up the manufacturing capacities of EFI and associated assemblies.

Napino aims to tap a substantial part of this demand as it aims to locally manufacture and begin the supply of the EFI systems to the two-wheeler OEMs in the country much before the deadline, which is less than 800 days away, nears. “The BS VI norms are a big challenge not only for us but also for the entire two-wheeler industry. We will upgrade some of the products from our portfolio for the BS VI norms (referring to the currently manufactured CDI systems). We are, therefore, gearing up for some new products, which will be used by the OEMs to conform to the BSVI emission norms,” states Kumar.

Early mover in e-mobility

Napino Auto & Electronics is among the few early movers who are aggressively preparing for the vehicle electrification drive. It is understood that its Japanese ally, Shindengen Electric Manufacturing Company, with whom it has a collaboration since 1998, is playing a pivotal role in the same. Notably, Shindengen Electric is one of the world leaders in the automotive electronics domain.

Speaking in this context, Kumar says, “Within the Indian automotive component industry, we are among the few early movers who are foraying into the products relevant for EVs. We have started manufacturing the products for EVs with electric rickshaws. That’s because there is hardly any other (visible) format of EVs in the market currently.”

The company’s R&D engineers have been developing products for EVs since the past 24-30 months. “For the last 24-30 months, we have been developing products for electric rickshaws; this has given us a lot of inputs in terms of, say, product liability. We are trying to develop similar products for the two-wheeler industry,” adds Kumar.

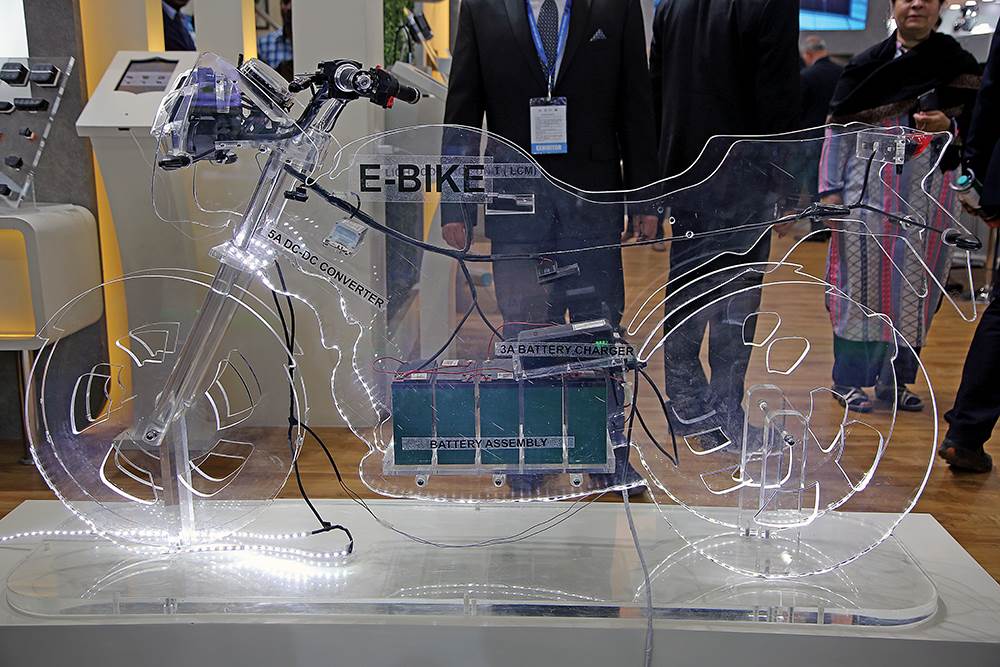

“Our target is to become a system supplier for EVs; we don’t want to be only known as component suppliers. We want to supply the eco-system around EVs right from the batteries, battery management system, DC-DC converters and even the EV charging equipment. So we are getting into the complete EV ecosystem,” reveals an ambitious Kumar. Not many suppliers are thinking that way.

Call for capex

While refusing to share the details on the investments earmarked by Napino to not only scale up its manufacturing capacities but also boost R&D under the electric mobility vertical, Kumar says, “We are making way for a joint venture with a global company. We won’t be able to share the investment details as it is a matter of confidentiality. But let me tell you that the investment numbers will be huge as there will be a very remarkable increase in the capital expenditure to (only) meet the requirements under the BS VI norms.”

Hinting at an all-new product line, Kumar guardedly remarks, “We are coming up with an innovative transmission technology, which will boost the operational efficiency of the vehicle. This product will have a huge market in India.”

Reports suggest that Napino has recently forged an alliance with the US-based Fallbrook Technologies, wherein the former is licensed to develop, manufacture and supply NuVinci-optimised transmission systems for two-wheelers. Fallbrook is the inventor of the NuVinci continuously variable planetary (CVP) transmission technology. The company, however, has not spoken about the NuVinci technology to this publication.

Napino, which also aims to grow its business in the passenger vehicle segment, has a keen eye for supporting and endorsing start-ups on several angel investor forums. According to senior company officials, Napino is open to investing into innovative technologies relevant to the future of the automotive industry. It's another move which will also help the company's sustainability in the long term.

(This article was originally featured in the 15 March 2018 issue of Autocar Professional)

RELATED ARTICLES

BRANDED CONTENT: Serving India’s EV ecosystem

Shimnit Integrated Solutions Pvt. Ltd. (SISPL), a subsidiary of Mumbai's leading high-security number plate supplier, Sh...

Driving EV business with agility and flexibility

CEOs from the EV startup ecosystem met in Bengaluru and Pune to discuss the challenges and business opportunities.

BRANDED CONTENT: SM Auto and Gotech energy inaugurate their first battery pack assembly plant in Pune

Pune-based SM Auto Engineering (SMA), a leading automotive component system manufacturer and its partner Gotech Energy (...

12 May 2018

12 May 2018

18394 Views

18394 Views

Autocar Pro News Desk

Autocar Pro News Desk