Industry watchdog puts 14 car OEMs in India under the scanner

The Competition Commission of India’s 215-page report says OEMs mark up parts and do not make spares freely available, thus affecting 20 million car owners. Brian de Souza reports.

The Competition Commission of India’s 215-page report says OEMs mark up parts and do not make spares freely available, thus affecting 20 million car owners. Brian de Souza reports.

The Competition Commission of India’s (CCI) decision to impose penalties on 14 OEMs comes a year after it first flagged off the issue of unfair pricing tactics by OEs (Last July, OEs were given a two-month grace period to rectify matters). Last fortnight, the CCI imposed penalties on 14 carmakers with Tata Motors attracting the highest fine amount at Rs 1,346.46 crore. Total penalties imposed were Rs 2,545 crore.

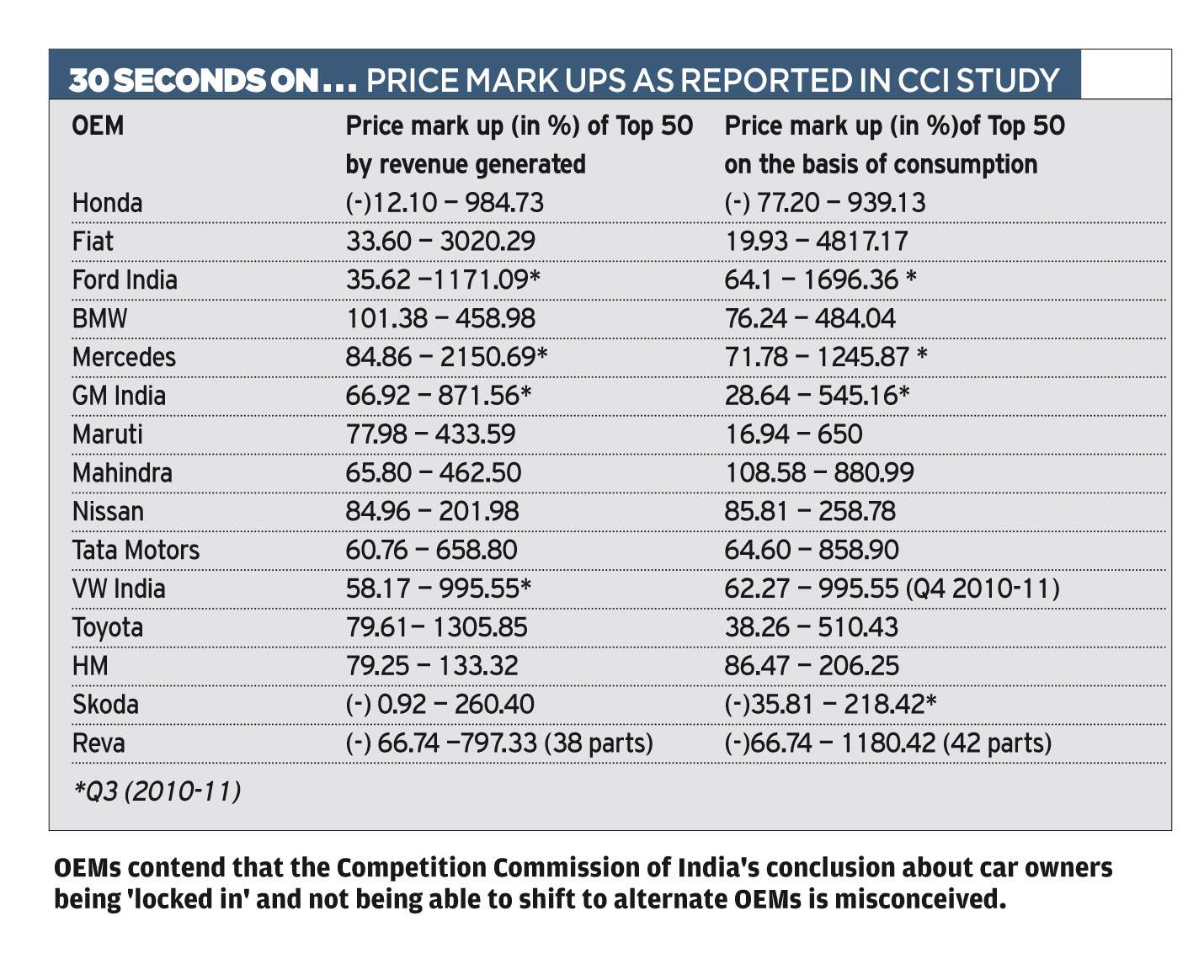

The Commission said 14 OEMs indulged in practices that effectively prevented car owners from getting car spares at better prices, i.e. they have had to pay an average mark up of more than 100 percent and in some cases as high as 5,000 percent (based on the top 50 parts by consumption) for spares. Moreover, the CCI said the car owners’ warranties were invalidated if a vehicle was repaired by an independent workshop, thus restricting consumer choice.

The CCI report marks the outcome of a complaint made in 2011 by a person who owned three different auto brands and who was unable to get genuine spares for any of them.

While the ruling has been welcomed, it is by no means clear that the issue is likely to be resolved. Tata Motors, Mahindra & Mahindra and Maruti Suzuki India have said they will contest the order. Honda Cars and Ford India said they will study the order. Experts say that companies like M&M, Maruti and Suzuki can say that they have a proper supply chain in the market and therefore question the logic of the assessment. In addition, they could say that since counterfeit parts are an issue, they didn't want genuine customers to be duped.

In a slowing market, OEMs have focused on aftersales/services to boost flagging revenues. But even before the slowdown, in 2010-11, CCI seems to suggest that OEs earned more from spares than on car manufacture.

This is ironical given that OEs always tout their efforts to keep total costs of ownership as affordable as possible. On ground, it appears things are different.

The list of OEs fined does not include Hyundai Motor India, Mahindra Reva Electric Vehicles and Premier for which CCI said it would pass another order after giving them a chance to make submissions in respect of the report and queries raised.

BRAND REPUTATION

In their defence, OEMs responses as they appear in the report, state that for durable products like cars, with ‘reputation effects’ means that setting a supra-competitive price for the secondary product would significantly harm a OEM’s profits on future sales of the primary product, and thus would not be economically prudent. Further, they contend that there is a high probability that an increase in prices for the aftermarket (spares) will be accompanied by a decline in profits in the primary market i.e. car sales. Hence, OEMs contend that a unified market comprising of the primary product and the aftermarket should be considered, which varies from the CCI's position.

OEMs also said that the CCI’s conclusion about customers in India are being ‘locked in’ and not being able to shift to alternate OEMs is misconceived. They contend that customers make choices fully aware expenditure he may have to incur on after sales service, repairs and maintenance. Also, due to a booming used car/second-hand car market for the OEM cars, existing owners can easily sell off their cars and switch to alternate OEM brands, without incurring substantial switching costs, the report mentions. OEMs have therefore stated that the relevant product market is the “market for sale of cars and its spare parts’.

The CCI also said that consumers usually do not undertake whole life cost analysis before purchasing durable consumer goods, including vehicles. The CCI relied upon empirical studies on lifecycle costs to establish that consumers have a high sensitivity to immediate and lump upfront costs as opposed to future and diffuse running costs, such that consumers do not properly account for lifecycle costs when purchasing durable consumer goods. In other words, consumers tend to buy cheaper models with high operating costs than those that would be efficient in terms of maintenance and aftersales service costs. The producers of the primary market are able to exploit such consumers.

The CCI’s findings come in the immediate aftermath of probes in China which have indicted some of the big luxury marques. Last month, evidence was found that Audi, Daimler and Mercedes-Benz among others manipulated prices for spares and aftersales service. They now face a stiff fine of up to 10 percent of sales revenue in the previous year. Companies subsequently slashed prices for parts and reportedly promised full cooperation with the authorities concerned.

RELATED ARTICLES

Branded content: HL Klemove inaugurates first Local ADAS Radar Manufacturing Unit in India, marks a significant achievement in “Make in India” initiative

The inauguration ceremony was held in the presence of Vinod Sahay, President and CPO of Mahindra & Mahindra Ltd. and Dr....

BluWheelz to 'Green Up' logistics sector

With their EVs-as-a-service solution, the startup is playing it smart with costs and looking to electrify the entire seg...

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

02 Sep 2014

02 Sep 2014

6421 Views

6421 Views

Autocar Pro News Desk

Autocar Pro News Desk