India business boost could see Benecke-Kaliko think local

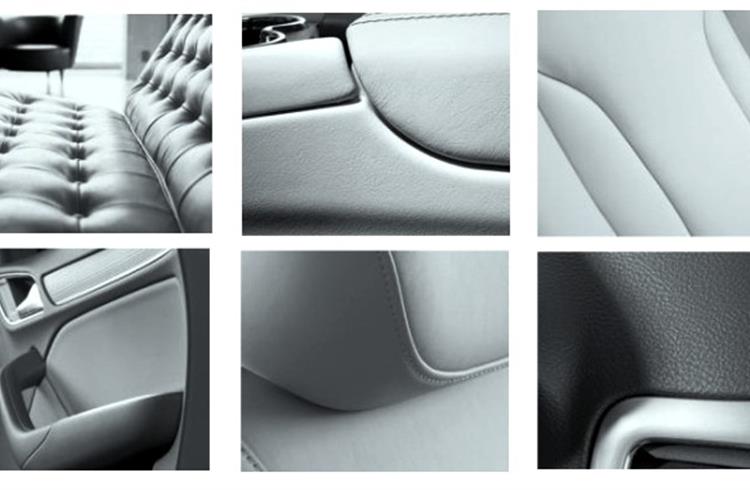

With a total of 72 million sq m of decorative interior materials produced globally and revenues of nearly 550 million euro in 2015, Benecke-Kaliko is among the world’s largest automotive suppliers of interior materials.

A rich heritage and experience in the manufacture of decorative materials along with the backing of the Continental Group has seen Benecke-Kaliko become one of the most preferred automotive interior material suppliers for carmakers globally.

Now with the evolution of the Indian passenger vehicle market, and changing preferences of the average Indian buyer towards more premium interiors, the company is betting big on the country and hopes to establish a local manufacturing facility in India as well.

Speaking to Autocar Professional, Dr Alexander Jokisch, executive director (Business Development and Marketing), shed light on the company’s plans for the Indian market and the fast-changing interior decorative trends from around the world.

Set up in Hanover, Germany in 1718, Benecke-Kaliko has close to three centuries of experience in manufacturing surface products. It has been in India since 1997. “We started the India business in 1997, and are soon going to complete 20 years in the country. Asia Trucks was our first client and our first biggest milestone came when we acquired the Tata passenger car business in 2008 and supplied interior materials for the Tata Safari,” recalls Jokisch.

A part of Continental Group’s ContiTech division, Benecke-Kaliko, which has largely been a supplier for premium vehicles in the country, set up its local sales and engineering office at Chakan, Pune in 2012. Thanks to the growing business, it expanded the facility in 2014.

“In India, Mahindra & Mahindra, Maruti Suzuki, Force Motors, Skoda, Renault, VW, Tata Motors and Honda are among our key clients and a lot of ramp up is happening, given the slew of new products these companies are coming up within the country. At the moment, all the material we supply is imported either from one of our plants in Europe or in China, but we have a clear strategy in accordance with Make-in-India to set up a production facility here,” elaborates Jokisch.

However, even as the company is looking at local manufacturing in India, it still lacks the volumes required to justify setting up shop in the region. Till 2015, the company acquired a business of 1.5 million square metres from Indian manufacturers. According to Jokisch, this figure needs to go up till 6 million square metres at least in order to set up local manufacturing.

“Right now local production is challenging because it is very expensive and requires large machinery investments. The plant that we have recently set up in China required investments of 40 million euro. To justify such a huge investment, we have certain scale requirements,” he explained.

However, the company has a clear strategy to tap the changing preferences of Indian buyers towards more premium interiors for the next round of growth.

Evolving Indian car interiors

“Typically car sales in India are rising and the interiors of cars are also improving significantly. The market is also evolving now and more and more buyers are shifting from entry level cars to midsize sedans and premium hatchbacks and compact UVs. Due to congestion and traffic, people are spending a lot more time inside their cars now and the value of interiors is all the more important now," says Jokisch.

This trend is clearly visible from recent sales data which reveals that market share of small and budget cars in India fell to 20 percent in 2015-16 from 30 percent in 2010-11, while that of the premium segments like compact and super compacts grew to 45 percent from 39 percent and that of UVs has risen to 22 percent from 13 percent, in the same period.

“If you think about the evolution of interiors of cars in India, back in the 1970s and 1980s, there were steel interiors. Over the next few decades, it evolved to plastics but that has changed much to softer material like fabrics which is our forte and we are looking to benefit from that. We are working on a broad customer basis and are targeting all OEMs in India, so we are confident that we will be able to reach our target of 6 million square metres,” Jokisch believes.

Interview with Dr Alexander Jokisch, executive director (Business Development & Marketing), Benecke-Kaliko

In terms of market potential, where do you see India?

At the moment if you compare our total revenues of Benecke- Kaliko, then, of course, it’s a small number. But nevertheless, the automotive market in India is one of the fastest growing in the world. So this alone is a big potential. In addition, a growing middle class, the clear trend from entry level to mid-size to utility vehicles and also a change in the customer behaviour is pretty much important with respects to interiors of a car. We foresee big potential here for our soft- touch materials.

Which car segments are you targeting in India?

For us, the target segments are the ones which employ softer interior materials. Of course, in a mid-size and a high-end car, you will have more soft surfaces so our primary segments are these. However, we are also developing products for the affordable entry-level cars, which will provide premium-ness to vehicles in these segments and thus give us more volumes as well.

What are the upcoming car interior trends?

In the case of materials, the big trends that we see are the growing demand for lightweight, ultra-lightweight, ultra-low emission and durable materials. We see this in the whole automotive world.

The other is design supporting individuality. At the moment, there are so many different cars in the market that there is a need for differentiation. Each car-line targets a specific customer group, so the interior of the car has to match and supplement it. So individuality of design is one such big trend from our perspective.

Another is improving technology. New tech like digital printing is improving the design of interiors significantly. Then there is the use of exterior stitch lines and material contrasts. Customers want more lighter colours in their car interiors. We see this trend in India, China and now in Europe and North America too. This is a clear interior trend coming from Asian customers.

A major emerging trend is 'illumination'. It is the next step of functional integration into decorative surfaces. You see more and more cars sporting illuminated interiors and it’s not just for decorative purposes but also provides more functionality to the interior surface.

These days we have been seeing higher material authenticity than in the past. A material should look like what it is to give that authentic feel. These days we also have a lot more mixture of different materials in one module to keep costs optimal. But this leads to challenges in terms of harmonising all these material within one panel. It is extremely important because a human being only feels well in an environment where he feels harmony.

How will the design of car interiors in future evolve with connected cars and autonomous driving?

For us, the trend of autonomous driving cars is very important because the main consequence is that the occupant in the car has much more time to enjoy the interior of the car.

We believe the interior of the car will change completely as compared to today and we will move towards a more living room kind of environment as compared to today. A living room also means much more comfort, soft-touch value and individualism along with functional integration. Additionally, we also know that in the future there will be no clear separation between the interior surface and functionality.

In future, everything will be integrated and this is something that we at Benecke-Kaliko are working very closely with our colleagues at the Continental Group, which is one of the big market leaders for displays and electronics and connected cars. We are working very closely together to bring experts together to create future solutions.

A very concrete example that I can tell you is that we have developed Acella Lux (a concept product) which changes colour depending on the light source. So if the material is black and if you put a light source behind, it is no longer black as it changes colour. This is one such example but we are working on a host of new products like these for future vehicles.

Do you see concepts such as these being acceptable in India?

I think they (Indian OEMs) are as interested as all the other OEMs and today I think everybody is at the starting point. Indian OEMs are also working on these concepts and they are also slowly targeting other markets. It is not only that other OEMs are entering the Indian market but Indian companies are also entering foreign markets and that is actually a great thing.

RELATED ARTICLES

BRANDED CONTENT: Serving India’s EV ecosystem

Shimnit Integrated Solutions Pvt. Ltd. (SISPL), a subsidiary of Mumbai's leading high-security number plate supplier, Sh...

Driving EV business with agility and flexibility

CEOs from the EV startup ecosystem met in Bengaluru and Pune to discuss the challenges and business opportunities.

BRANDED CONTENT: SM Auto and Gotech energy inaugurate their first battery pack assembly plant in Pune

Pune-based SM Auto Engineering (SMA), a leading automotive component system manufacturer and its partner Gotech Energy (...

By Shourya Harwani

By Shourya Harwani

28 May 2016

28 May 2016

10581 Views

10581 Views