Bajaj Auto has global motorcycle market in its sights

India’s largest two-wheeler exporter plans to double its overseas motorcycle sales as compared to domestic volumes. Sumantra B Barooah finds out how Bajaj Auto plans to take on the world.

India’s largest two-wheeler exporter plans to double its overseas motorcycle sales as compared to domestic volumes. Sumantra B Barooah finds out how Bajaj Auto plans to take on the world.

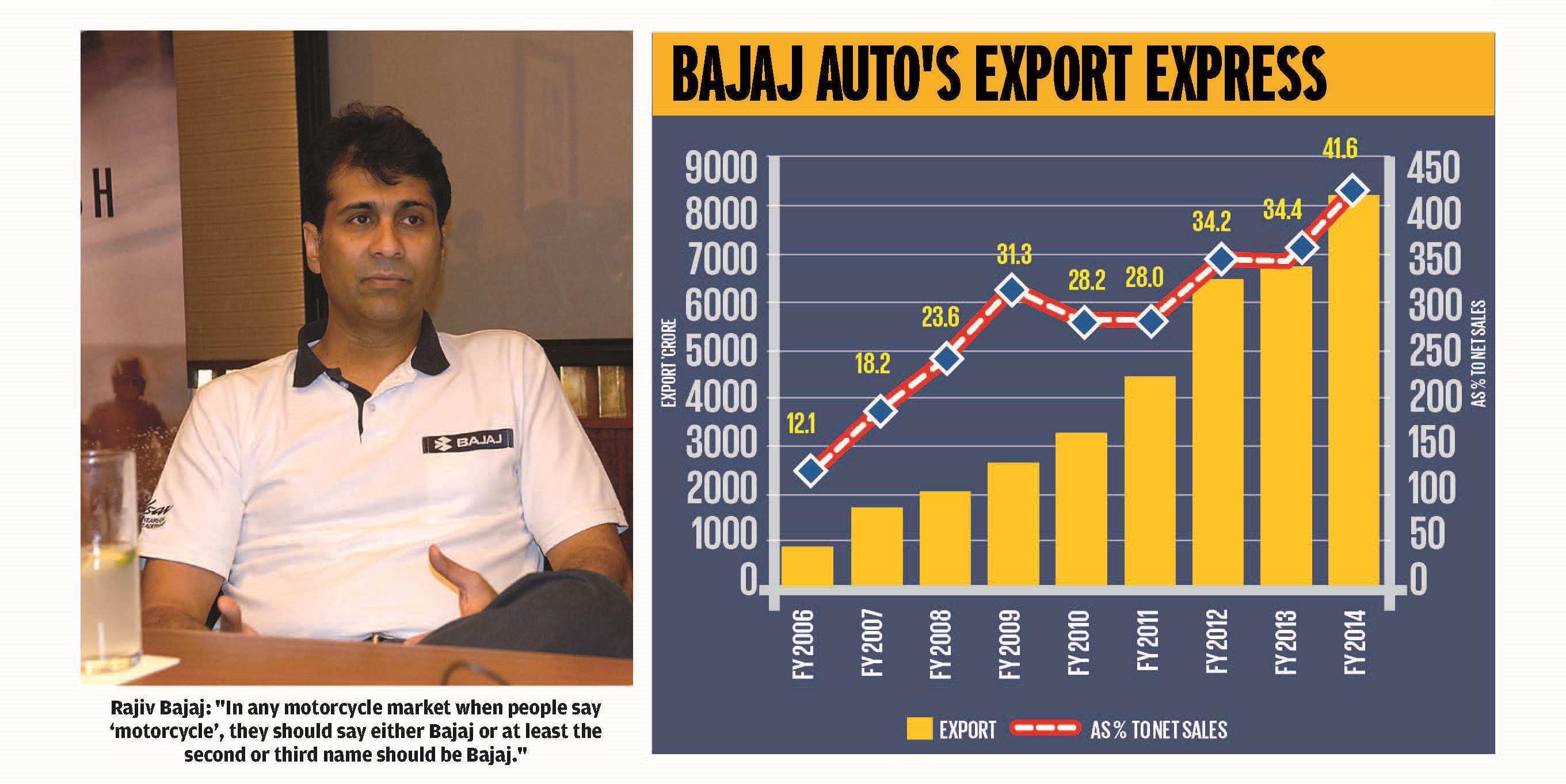

To be global, it’s important to be a specialist,” says Rajiv Bajaj, managing director, Bajaj Auto. Rajiv Bajaj, who has steered Bajaj Auto from a scooter and motorcycle maker to a purely motorcycle company, is now working on realising the first part of his statement. “The motorcycle market outside India is double that of the Indian market. That means if Bajaj sells 100 bikes in India, eventually it must sell 200 bikes outside India,” Bajaj told Autocar Professional. Currently, the ratio is moving towards 1:1. For the four-month April-July 2014 period, Bajaj Auto exported 527,000 motorcycles and sold 615,000 units in local markets.

To reach its ambitious export goal, Bajaj Auto will have to enter many more markets than it does now. Some key markets it is targeting next are China, Brazil and USA. In addition, Pakistan and ASEAN are on the radar.

While a Pakistan entry will need the removal of its trade barriers with India, in ASEAN, Bajaj Auto is likely to replicate its successful overseas partnership model with Kawasaki which began in the Philippines a few years ago. Last year, Bajaj sold 95,000 bikes in the Philippines and both companies grabbed the leader position in the market. The Philippines is followed by Indonesia where Bajaj-Kawasaki have implemented the same business model. Bajaj feels it should also be carried over to Thailand, Vietnam and Malaysia, “step by step”.

THE KTM CONNECT

For the US and China markets, Bajaj Auto will partner with KTM, the company it bought equity in 2012 and in which it has a 48 percent stake. Autocar Professional first broke the news about Bajaj Auto's China entry plan in its January 15, 2014 issue. KTM has a JV with China’s Hangzhou-based CF Moto. In the US market, Bajaj will look at launching the bigger Pulsars (400cc), but that could be 2-3 years away.

The partnership strategy in global markets helps both partners. While it enables a swift entry into a new market, for KTM or Kawasaki the benefits are more footfalls in showrooms and better utilisation of production capacity, wherever that is.

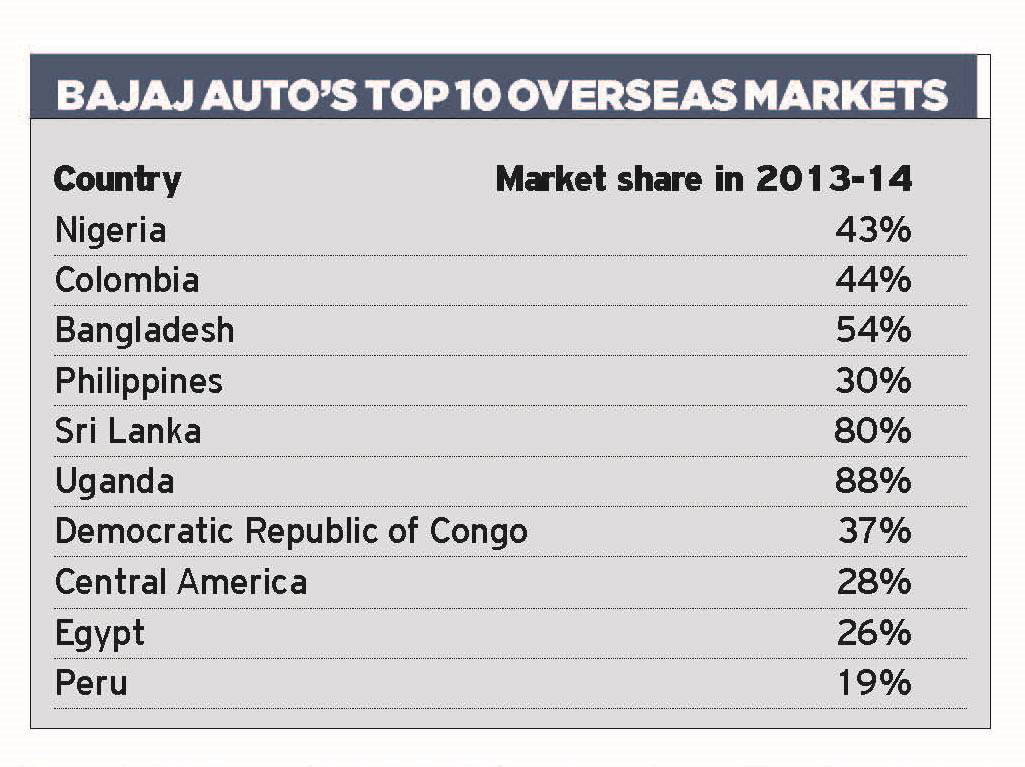

Bajaj Auto may have lost a few percentage points in market share locally but its exports strategy seems to yielding good dividends. Over the decade, its annual bike export volume shot up from 130,000 units to 1.3 million units, a CAGR of 30 percent. Last year, Bajaj Auto had a share of over 66 percent in motorcycle exports from India. “Some companies may want to be either a regional or domestic player. Each company has finite resources. We want to be a global player," says Bajaj.

GROWING BRAND BAJAJ ABROAD

The Pune-based OEM is focusing on strengthening its overseas presence. It has to, if it is to remain ahead of its home-grown competitors as well as race successfully against the big Honda in the global market. Hero MotoCorp, for example, has embarked on an aggressive plan to grow its exports business entering into Africa, which is one of Bajaj Auto’s biggest markets. Hero set up a CKD assembly last year and is also foraying into Latin America. TVS Motor Co, which also has a plant in Indonesia, could also embark on a stronger export strategy in the coming years. Some products co-developed with BMW Motorrad, the first of which is due next year, could lead that.

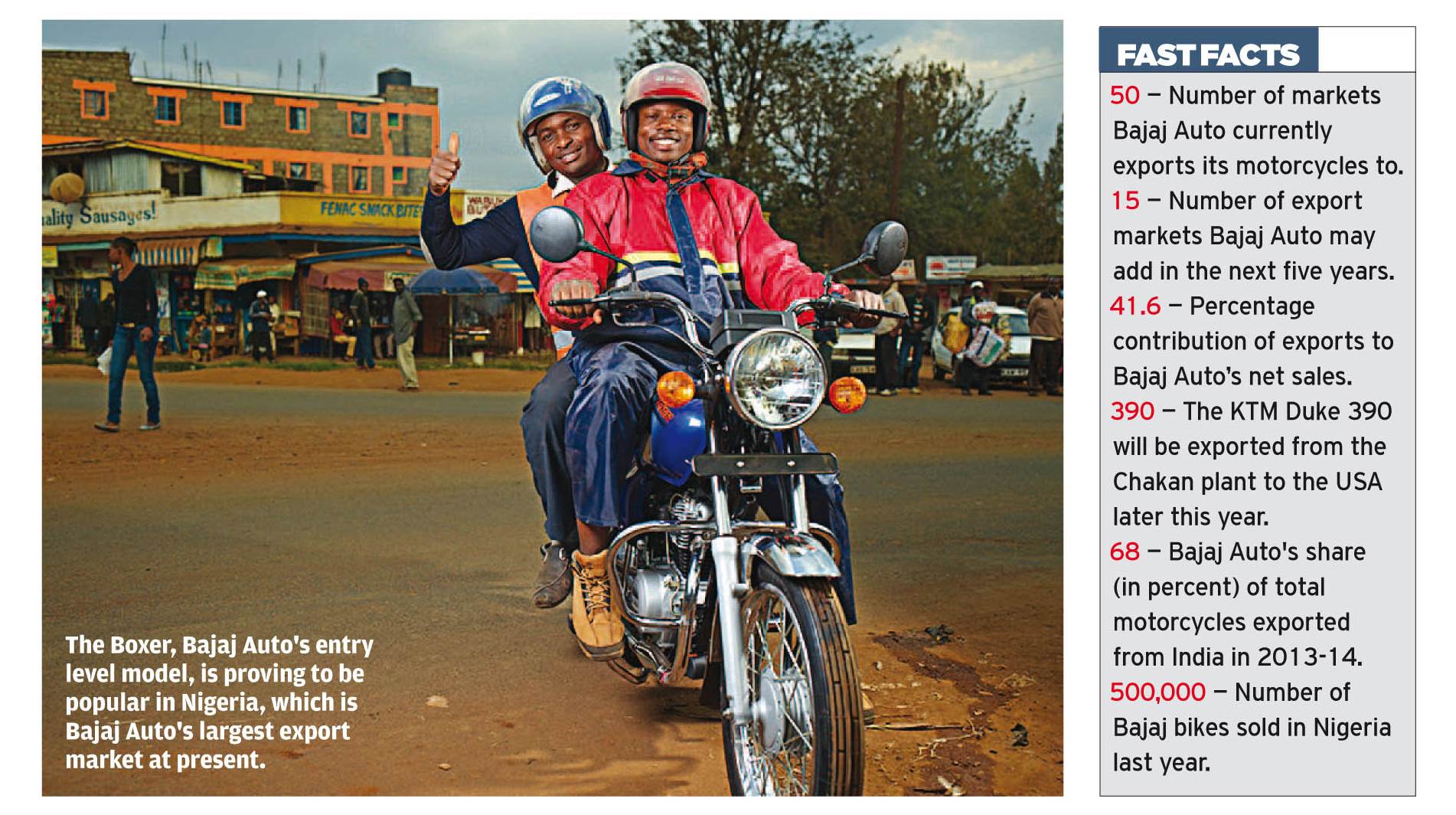

Unlike Hero, Bajaj does not have any plan to set up assembly operations in Africa as the cost of production in India is profitable enough for the company. Bajaj is in most places except South Africa which is a big bike market. Nigeria is its biggest market with 500,000 bikes sold in FY'14. The company is also the market leader in Kenya, Angola, Sudan and Ethiopia.

There are many countries where the market may be conducive for two-wheeler makers to participate in successfully. ASEAN is one of them. However, some also present a challenge for a motorcycle maker like Bajaj Auto. That’s because Indonesia and Thailand are dominated by step-throughs or Bebeks as they are known there. Bajaj Auto had a presence in the step-through segment many years ago but now it is confident that it can expand the motorcycle segment there. “It is like the good old story of the shoe salesman in a market where no one wears shoes. You can see it as an opportunity or a limitation. I will always look at it as an opportunity if there’s not much of a motorcycle market there but we have the Kawasaki Ninjas, KTM Dukes,

Pulsars, Discovers and Boxers,” says Bajaj. His confidence of success in ASEAN may well stem from the performance the company has had in Philippines, its first stop in the region and fourth largest export market.

DISCOVER-ING NEW STRENGTHS

On the home front, Bajaj Auto faces challenges, especially in the commuter segment from Hero MotoCorp and an aggressive Honda Motorcycle & Scooter India. Its domestic market share has fallen by a couple of percentage points to 22 percent mainly due to a drop in sales in the commuter bike segment where it has brand Discover. “We can do little better with the Discover,” admits Bajaj.

Bajaj Auto has now launched the Discover 150, which is a more powerful bike than other commuter offerings and comes with added features. The way he puts it, to tackle increased competition, the options are either a better price (read lower) or a better product. He says he has chosen the latter.

Bajaj says he is "happy" with the 100cc Platina (even as he wants to see this segment fade away), and "very happy" with the Pulsar's sales performance. The Pulsar segment has seen a comeback during the last two to three months. In fact, Pulsar sales grew 15 percent in July 2014. “Our business is in six verticals – Platina, Discover, Pulsar, KTM, three-wheelers and spare parts. Five out of six doing well at any point of time is good enough,”

he says.

Bajaj is taking the blip in his stride as he eyes the global marketplace. “From the 50 countries we participate in, there may be a country or two every year that does not do as well as you would like it to. Sometimes it is Indonesia, sometimes it is Egypt, or even India,” he says.

It will take some time to know if the strategy to counter domestic competition with the new Discover 150 clicks. But Bajaj Auto’s global strategy appears to be on a good wicket. It’s not surprising since the company has a clear goal to achieve a dominant position in the markets it operates in.

“There are brands which in most markets are very predominantly associated with a certain category. So, what I want is that tomorrow, in any motorcycle market, when people say ‘motorcycle’, they should say either Bajaj or at least the second or third name should be Bajaj. I think if we achieve that, while achieving good sales, good profit, good quality and good customer satisfaction, then I think we have achieved our purpose.”

RELATED ARTICLES

BRANDED CONTENT: Eliminating the worries of battery charging with smart solutions

The charging infrastructure is the backbone of electric mobility but is also one of the key perceived barriers to EV ado...

The battery-powered disruptor

Greenfuel Energy Solutions is planning to shake up the EV battery market with the launch of a portfolio of specially eng...

SPR Engenious drives diversification at Shriram Pistons & Rings

The engine component maker is now expanding its business with the manufacturing of motors and controllers through its wh...

24 Sep 2014

24 Sep 2014

66739 Views

66739 Views

Autocar Pro News Desk

Autocar Pro News Desk