AVL India shows the way to a greener future

With just about 1,200 days to go before BSVI norms come into play in India, automakers are close to finalising technologies to reduce tailpipe emissions. Gurgaon-based powertrain system developer AVL India believes it has what it takes to deliver.

With the BS-VI emission regime less than four years away from enforcement in India, many OE manufacturers are in the process of finalising the technologies they would be roping in for after-treatment of tailpipe emissions, especially in diesel engines.

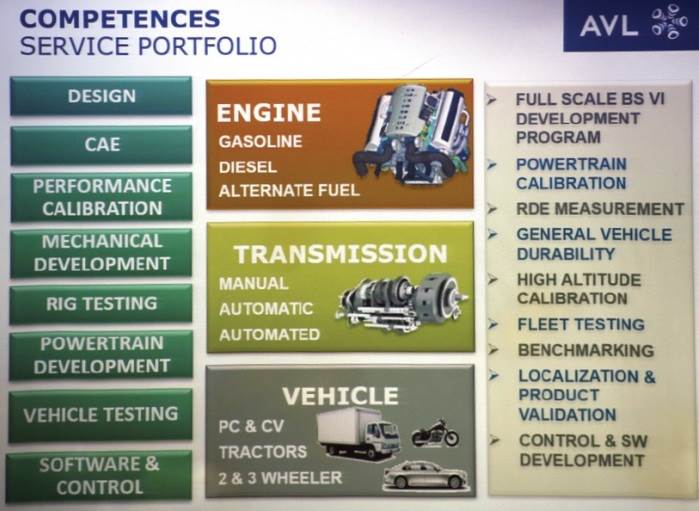

Helping them freeze the decision are powertrain and engine development companies like AVL India that play a key role in suggesting technological options best suited to their crop of vehicles, developing prototypes and enabling testing and calibration of automobiles to meet the new emission targets.

AVL India has already commenced work on engine-out emissions for meeting BS-VI norms which become mandatory on April 1, 2020, in India. While cutting tailpipe emissions is one route to a greener future, a key challenge would be to improve fuel consumption.

Shashi Singh, managing director of AVL India, told Autocar Professional on a recent visit to the company’s technical centre: “It’s not compatible to have lower emissions on one side and lower fuel consumption on the other. You can’t do both unless there is extensive engine development and research on it. If you cut down on emissions, there will be an increase in fuel consumption. That is physics. If you have to do additional work to meet existing fuel consumption norms, then there are a lot of methods available.”

At present, India does not possess the know-how for meeting BS-VI requirements. Till now, most of the after-treatment work was happening on BS-IV or on the BS-V emission roadmap. AVL, for instance, is procuring the technical know-how for developing BS-VI powertrains from its parent company in the US and in Europe for India. This will entail training of its local manpower to undertake the work in India. “You can’t do the work in Europe or America as it won’t work. So you have to undertake most of the work here, especially the calibration part. At the moment, we are working on this effort. We are training specific people in different areas; for example, we have taken on board 15-20 people and are training them here and in Europe for future calibration requirements both on the diesel and petrol side,” elaborates Singh.

Clean technology for the future

Transition to BS-VI without RDE is the current emission scenario for India.

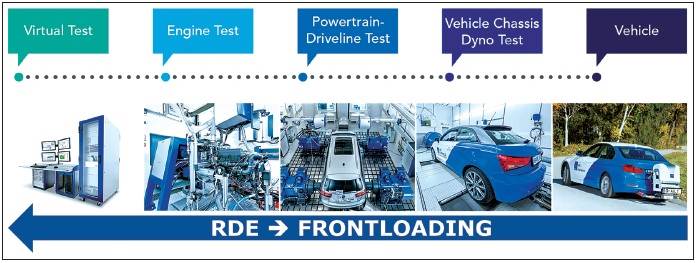

While BS-VI emission norms have been notified by the government, one grey area surrounds the concept of real driving emissions or RDE that is not expected to be implemented by 2020 as the government is yet to finalise its roadmap. So the transition to BS-VI without RDE is the current emission scenario for India. RDE is more complex and will require alternative technologies to be harnessed for meeting real-life conditions.

For example, in Europe, the upcoming EU6d Emission Regulation is expected to implement real driving emissions as an additional type approval requirement within the 2017-2020 timeframe.

The RDE legislation adds the road as a new environment for emission testing and certification. Compared to current test environments, which are designed and optimised for perfect reproducibility and a removal of external influences, driving a vehicle on the road under real-life conditions will never be 100 percent reproducible.

The influence of the road profile, the ambient conditions and the traffic situation, as well as driver behaviour, will significantly influence the results. The RDE legislation will require engines to be clean under all operating conditions. This will impose significant challenges on the design and the calibration of engines. RDE will also necessitate adoption of alternative technologies as well as an alternative development process. But since RDE is not expected to come to India till around 2023, meeting BS-VI emission norms is the foremost priority for the automotive sector.

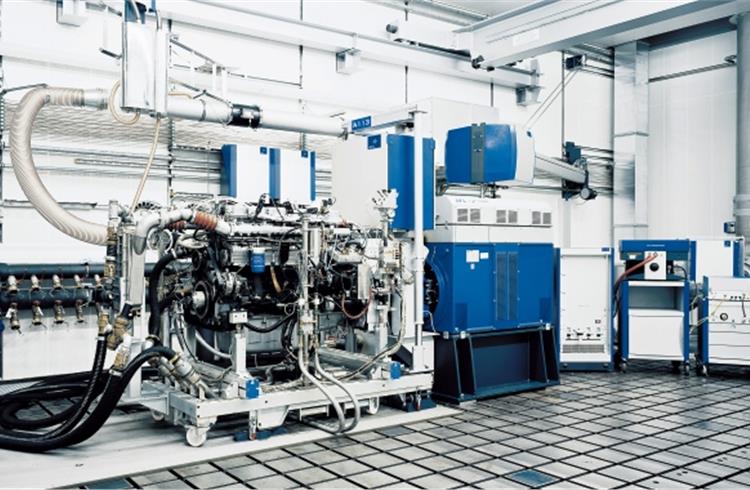

AVL India's tech centre in Manesar is fully equipped and ready to take on BS VI-related work.

So the moot question then is: which after-treatment tech would be best suited for meeting the BS VI emission regulations in India?

AVL officials maintain that it varies from engine to engine but most of the existing engines can survive the treatment. While petrol engines will require lesser work, there will be a need to increase pressures in diesel engines along with after-treatment. The complication in diesels is that the after-treatment device is much more severe as it needs adoption of the selective catalytic reduction (SCR) or diesel particulate filter (DPF) technology. In comparison, petrol engines require a normal catalyst. The size of the catalyst is likely to become bigger but it will be an overall simpler technology to adopt compared to the SCR and DPF controls and calibration in diesels. This constitutes a major task.

A huge challenge in exhaust after-treatment for BS-VI is the cost of the exhaust after-treatment systems as well as the 5-6 percent higher fuel consumption that ensues from lowering emissions. For cutting fuel consumption, the friction of the engine will have to be reduced besides which the turbocharger will have to be tweaked. NOx in engines, as well as particulates and CO2,are linked to fuel consumption.

While Europe took 15 years to transition from Euro 4 to Euro 6, India is attempting to do it in an ambitious four years. To reduce NOx, there are twin solutions – use the exhaust gas recirculation system to recycle the gas inside the combustion engine, or work on the NOx system with the storage catalyst or the lean trap, thereby lowering the particulate matter using the particulate filter that will clean up to 99.9999 percent of the particulates.

“In India, we are working to introduce these methodologies. To be sure, within the next four years, we will have all the diesel cars on BS-VI,” adds Singh.

A vexing issue though will be tweaking of small diesel engines and micro-turbochargers. To maintain existing fuel consumption in a vehicle, a lot of work related not only to the system but the engine, transmission, vehicle, calibration of the engine and the entire vehicle with after-treatment devices will have to be undertaken. This is where AVL says it helps customers.

Calibration will play a significant role in the switchover to BS-VI and will be necessary for both petrol and diesel engines. When NOx is reduced, the level of particulate rises and vice-versa due to chemistry. Hence, while cutting particulate matter, further combustion has to be considered that involves the use of calibration for raising injection pressure. By injecting diesel at high pressure in the combustion chamber, better emissions can be arrived at so that combustion is uniform. Burnt gas is then re-circulated to eliminate NOx so that there are low levels of NOx and particulates.

Calibration works on the particulate filter, trapping the low level of particulates and the NOx storage catalyst also reduces. Therefore, the calibration effort from BS-IV to BS-VI will be increased.

While a scooter moving from a carburettor to fuel injection will see a price hike of Rs 4,000-6,000, a diesel CV with an SCR and DPF after-treatment device would cost Rs 75,000 more.

“For diesel, the after-treatment is more complex and will necessitate some tweaking of the engine and some work on the vehicle as well. The challenge is to not compromise on the driveability or fuel economy, and still meet BS-VI norms,” maintains Manoj Kusumba, GM and head of department – Diesel Engine Development, AVL India.

Overall, meeting petrol challenges will be that much easier than diesel with the biggest issue relating to calibration. When small cars migrate from BS-IV to BS-VI, tweaking will be needed to relocate the fuel injection system that is being used at present, then recalibrate it and also look at a low-cost utilisation of the catalyst. Two-wheelers would necessitate a technological shift in fuel handling that involves a shift from the use of the carburettor to the direct fuel injection system.

AVL is working on OEMs’ objectives in meeting emission norms, mostly on the engine improvement side and not so much on the transmission side as OEMs have not asked for it.

While the right type of after-treatment device and calibration work is still being mulled by carmakers, OEMs also have to take a call on how to address the emission requirements of several variants of a car model since each variant will have to be individually calibrated. “Most of the work for the variants will have to be redone and that will be an uphill task,” says Gerrit Van Den Oever, vice-president of the AVL Technical Centre in Manesar. “It will be a tough time, especially for small diesels with the coming of RDE, since people will start switching to petrol and electrification.”

RDE will require a greater effort as it will entail improving the entire engine platform. Meeting just BS-VI standards with all model variants is itself a major task by end-2019 and then working on RDE will be a bigger challenge.

But AVL claims that its USP is its tools that differentiate it from competitors like Bosch and Delphi among others. It offers the right solution to its customers. Development time for after-treatment devices for the engine and calibration typically ranges between 2-3 years but could be still more if a lot of changes are made in the engine and prototypes are developed.

In addition, it would lead to vehicle price escalations as well. While a scooter transiting from a carburettor to a fuel injection system would see a price hike between Rs 4,000-6,000, fitting a diesel-engined commercial vehicle with an SCR and DPF after-treatment device and then calibrating it would cost around 1,000 euros or Rs 75,000, say AVL officials.

What is of note is that exhaust after-treatment technologies in a commercial vehicle cut NOx by 60-70 percent and particulates by 50-70 percent.

LNT technology

In after-treatment, a less costly technological option is available in the form of Lean NOx-Trap (LNT) technology, which can be coupled along with DPF for a diesel vehicle of the smaller variety. But LNT in future will not be able to survive RDE, necessitating another development a few years later.

Therefore, small cars fitted with LNT cannot survive after 2023. “Today it is cheaper and SCR is more expensive but as demand for SCR rises, prices will come down. With LNT, it is not the same as the surfacing matters and the cost of precious metals is only going to increase. LNT is also very sensitive to sulphur, due to which the effect of emission controls will end. Once RDE comes in, people will move to petrol and electrification as electrification will also be the future,” remarks Singh.

At present, electrification work is underway to benefit from government subsidies for the 12 Volt vehicle but serious work will kick in in the 48 Volt space now. Electrification will follow for city buses and also for haulage trucks with the real electrification work to start in a year’s time in India. The coming of RDE will force many to opt for electrification.

Meanwhile, AVL is working extensively with Mahindra & Mahindra on electrification of powertrains and believes that the next couple of years will see a lot of work on batteries and trimming of costs of e-motors. The biggest problem though relates to battery cost which hikes car costs by Rs 70,000 to Rs 100,000 per unit.

The future is expected to witness a considerable shift from the combustion engine to electrified motors but combustion engines are not expected to be phased out for the next 25 years. “We at AVL use a lot of new AVL tools which make a dramatic difference in the work we are doing for BS-VI which companies are seriously looking at,” explains Singh. AVL has an integrated tool chain used during engine design and the development process encompassing some software tools.

In addition, measuring equipment is utilised during engine development and testing. The company claims it has been the pioneer in using both simulation and development tools. Now AVL has gone a step further and merged these different technologies with the software by using computers as well as measurement equipment while testing engines or vehicles. Now different simulation tools and software are used on the testbed itself. Earlier it was not possible but now with the availability of the knowhow, this technology is being merged to minimise the development time and to make the process more efficient.

The company has virtual engine testbeds which can simulate entire engines and transmissions and also calibrate sans engine and vehicle. This cuts down development time by a few months. After this, the process moves to the real hardware.

AVL India's laboratory in Manesar is equipped with chassis dynamometer to test passenger cars and two- and three-wheelers.

Interestingly, European OEMs including German carmakers’ future strategy is to replace small diesel engines below 1.5 litres with petrol motors or move to electrification over the next five years. This is due to the additional costs of after-treatment that are on par with engine costs and hence not cost competitive. Bigger diesels above 1.5 litres will stay and will find a huge market in the commercial business where there is no replacement of the current diesel technology, says Oever. They will find a huge market for non-auto applications as well. Simultaneously, fuel efficiency on gas engines will be improved by the optimisation of the complete powertrain, transmission ratios, overall friction of the car and weight reduction.

This is expected to become the trend with all car brands and Oever maintains that Toyota is a trendsetter in new powertrains and hybridisation of powertrain which means the combustion engine and electric-driven powertrain parts will work in sync. Once zero emissions are reached by 2030 in any country, it will trigger a sea-change in powertrain, resulting in an overhaul of all production technologies.

In Europe it is estimated that for introducing electric base models, the cost hovers around 30 billion euros for switching production technologies.

New materials such as carbon fibre and magnesium that is lighter than aluminium but more dangerous in manufacturing, ceramic-based materials for engine and vehicle parts could be an option for lightweighting vehicles.

The India act

AVL India's technical centre has a manpower strength of 150 with 15-20 resident engineers. It has three test beds for emission development, five for mechanical development and mobility testing and one special powertrain test bed where engines, transmissions and axles are developed and tested. In addition, there are three chassis dynamometers – one for cars and the others for two- and three-wheelers.

The centre has a protoshop, cold chamber, engine preparation area, soak rooms for emissions fully compliant for BS-VI and equipped with the latest test and measurement equipment. Since the years up to 2020 will see movement towards electrification in mild hybrids, hybrids and full electrics in some segments in India, AVL is upping its facilities and competencies in this area. With the evolving emission regime, AVL India is ensuring it has the right solutions to meet OEMs' needs in time.

RELATED ARTICLES

Branded content: HL Klemove inaugurates first Local ADAS Radar Manufacturing Unit in India, marks a significant achievement in “Make in India” initiative

The inauguration ceremony was held in the presence of Vinod Sahay, President and CPO of Mahindra & Mahindra Ltd. and Dr....

BluWheelz to 'Green Up' logistics sector

With their EVs-as-a-service solution, the startup is playing it smart with costs and looking to electrify the entire seg...

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

By Shobha Mathur

By Shobha Mathur

13 Dec 2016

13 Dec 2016

16473 Views

16473 Views