2013 Automotive Retail & Marketing Special - From a supporting role to vanguard

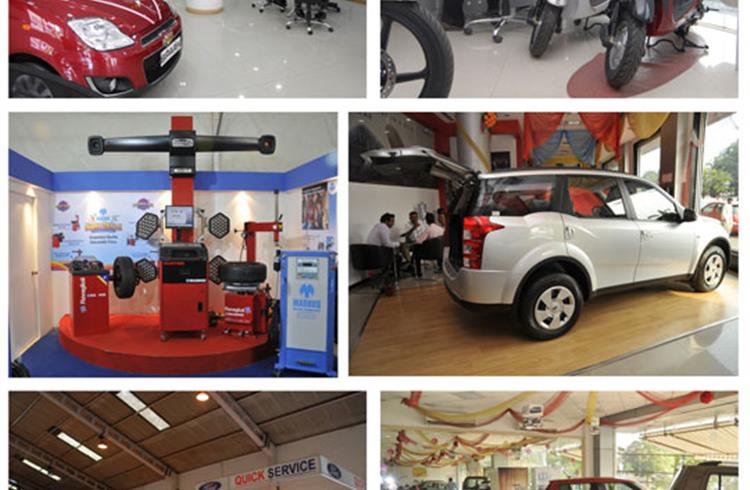

Retail is now priority for OEMs and vendors as vehicle makers struggle with poor sales and fewer footfalls. Can it keep the ship afloat and help industry drive through?

As potential buyers hold on to their existing vehicles or postpone buying decisions, their existing cars need servicing and spares which many dealers are looking as an important source of revenue to balance out the decline in footfalls. In addition, companies are, perhaps for looking seriously beyond the markets in the metros and Tier 1 cities and even in rural areas.

It is estimated that rural markets have grown by 24 percent in the April-September 2013 period, thanks to saving habits on the one hand and the availability of a plethora of discounts on the other. Among the companies targeting these ‘new-found’ markets is Maruti Suzuki that has conducted over 10,000 events in rural markets with an average of 250 events organised daily. Whether the upcoming festive season will give this a further boost remains to be seen but with good monsoons, OEs have focused their resources on these segments. It is also important to mention that the tractor segment has been already on a roll for most of this year and good rains will translate into added sales.

This is as far as the organised retail goes. However, the market is much larger and varied. According to ACMA, the aftermarket in India is estimated at Rs 33,000 crore of which Rs 8,200 crore comes from the service or labour part and the rest from sales of vehicle components.

ACMA says that the market for servicing comprises four categories that includes OEM-authorised networks, multi-brand networks, semi-organised centres and unorganised garages. The last-mentioned category accounts for 60-70 percent of the share as per ACMA’s primary study while the multi-brand service chains account for 1-2 percent. The organised players include the likes of Mahindra First Choice, My TVS, Carnation Auto and Bosch Car service which have outlined ambitious plans. This is not only indicative of the potential that exists but also highlights the need to offer competitive AMC packages and rates in order to ensure that buyers of cars which come equipped with the latest technologies go to equipped garages. Dealers are of the opinion that existing buyers may be even opting to get their cars serviced at non-OEM outlets in a bid to lower expenses.

As the Indian market for aftermarket servicing matures, the challenges that it will face are many and that includes the sheer growth in vehicle sales, improvements in road infrastructure, rising fuel costs and increasing vehicle sophistication.

A 2012 study on the Indian aftermarket by ACMA says that the garages that have been serving India for a long time are now in the process of modifying their business. This has been motivated by the need to remain profitable while many are becoming franchisees of organised service chains. This brings in investment as well as inputs for service and customer care that earlier they did not have. This has not yet hit the garages in smaller towns but will do and as per ACMA’s prognosis, may well face a period of consolidation.

As far as dealers go, even as the OEs focus on spreading their networks, this is clearly challenging time. At the FADA annual convention in early September, chairman Mohan Himatsingka said the organisation is trying to help dealers and among the many initiatives it is taking include getting the State Bank of India to provide lower finance rates as also to give incentives to dealers of commercial vehicles.

Retail creates jobs at various levels with varying skillsets requirements. Recently, the Melboure-based Sewells Group inked a tie-up with the National Skills Development Corporation to open and operate up to 40 technical training centres across the country. But retail has its own unique challenges- the need for skillsets and training and also the challenge of creating brands and retaining the OE brand in the consumer’s mind. While the current slowdown has perforce made automakers train their sights on retail, it is at the end of the day an area that cannot be neglected even during a boom.

BRIAN DE SOUZA

RELATED ARTICLES

BRANDED CONTENT: Eliminating the worries of battery charging with smart solutions

The charging infrastructure is the backbone of electric mobility but is also one of the key perceived barriers to EV ado...

The battery-powered disruptor

Greenfuel Energy Solutions is planning to shake up the EV battery market with the launch of a portfolio of specially eng...

SPR Engenious drives diversification at Shriram Pistons & Rings

The engine component maker is now expanding its business with the manufacturing of motors and controllers through its wh...

By Autocar Pro News Desk

By Autocar Pro News Desk

07 Nov 2013

07 Nov 2013

2718 Views

2718 Views