India Component Inc scales a new peak, takes on challenges

It has surpassed the US$ 50 billion mark for the first time ever in FY2018 and now they face the arduous task of BS VI, e-mobility, high GST and imported electronics.

Every passenger car has around 30,000 parts, counting every part down to the smallest screws, says Toyota, whose lean production system is said to be the most replicated process by automakers across the world. These 30,000-odd components use different raw materials and different manufacturing processes. Importantly, making high-quality components calls for much research and development and, therefore, are manufactured by companies that have expertise in their own fields.

In FY2018, a total of 4,010,373 passenger vehicles (cars, utility vehicles and vans) were produced in India. Do the math and you arrive at a cumulative figure of around 120 billion parts! And that’s only PVs. Add commercial vehicles, three- and two-wheelers and what you get is a humungous number of components that are the sum of all parts. Clearly, if the Indian automobile industry is currently firing on all cylinders, it has – along with its customers – the domestic component industry or suppliers a lot to thank for. The Indian auto components industry currently accounts for 2.3 percent of India’s Gross Domestic Product (GDP) and employs as many as 1.5 million people directly and another 1.5 million indirectly. It is broadly classified into the organised (which caters to the Original Equipment Manufacturers) sector which calls for precision goods, and the unorganised sector which produces comparatively low-valued products and caters mostly to the aftermarket category. Importantly, this sector contributes 4 percent to India’s overall exports. As a result of globalisation, the Indian auto components industry is set to become the third largest in the world, behind Germany and the USA.

Robust numbers

Last month, apex industry body, the Automotive Component Manufacturers Association of India (ACMA) announced its performance numbers for the fiscal year 2018 and, not surprisingly, given the robust performance of OEMs last fiscal, India Component Inc has done well for itself.

It has registered revenue of Rs 3.45 lakh crore (US$ 51.2 billion) for FY2018, which marks solid growth of 18.3 percent year on year (YoY). In comparison, the Indian automobile industry saw growth of 16.22 percent (including exports) in FY2018.

A total of 4,010,373 passenger vehicles (+5.49%) were manufactured in the domestic market in FY2018. Not surprisingly, they constitute the biggest demand drivers for the component sector.

ACMA says the FY2018 numbers represent the supply from the component industry (both ACMA members and non-members), on-road and off-road vehicle manufacturers and the aftermarket in India along with exports. It also includes captive component supplies to OEMs.

Commenting on the industry’s performance, Vinnie Mehta, director-general, ACMA, said: “The past year witnessed an upswing in the overall performance of the vehicle industry, despite it facing several regulatory challenges. The component industry, in tandem, posted an encouraging performance with significant YoY growth of 18.3 percent, registering turnover of Rs 345,635 crore. Furthermore, exports grew by 23.9 percent to Rs 90,571 crore (US$ 13.5 billion),” he said.

While the substantial growth has been on the back of domestic, exports as well as growing aftermarket performance, the peaking of all vehicle categories has led to the strong numbers.

PVs contributed 43 percent to the overall revenues, with two-wheeler and CV segments contributing 23 percent each. From a long-term perspective, the component industry has witnessed a 10 percent CAGR since FY2013, when it had clocked Rs 216,094 crore, marking growth of 5.6 percent.

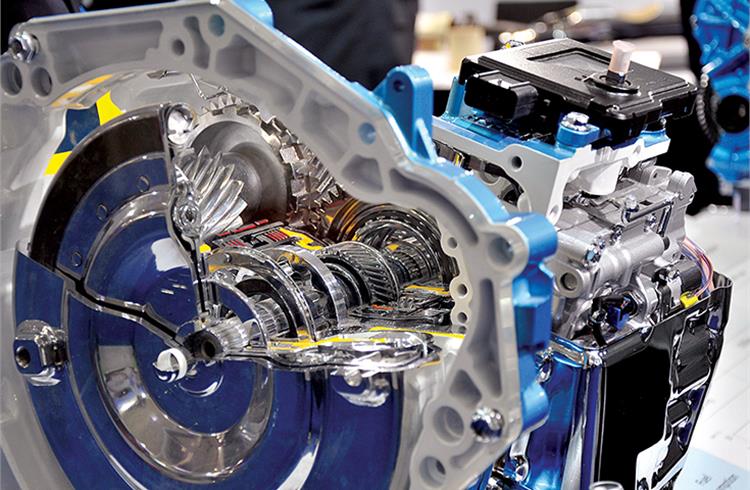

Manufacturing of powertrain components remains its top revenue source in FY2018 as well, with engine components contributing to 26 percent of the overall business. Body and chassis components (17%), suspension and braking parts (14%) and drive, transmission and steering systems (13%) came across as the other key areas, with the sector relatively lagging behind in terms of electrical and electronics, which stands to contribute roughly 10 percent to the total income.

Nirmal K Minda: "Currently, 60 percent of components attract 18 percent GST, while the balance 40 percent, the majority of which are two-wheeler and tractor parts, attract 28 percent. A benign rate of 18 percent will not only ensure better compliance, but will also ensure a larger tax base.”

“An investment of around US$ 2 billion (Rs 13,971 crore) is needed for automotive electronics and the semiconductor space. While a lot depends on government initiatives, sooner or later, we will start manufacturing these components in India,” said Nirmal K Minda, president, ACMA.

Exports on the upswing but rising imports a worry

Over the years, the quality of made-in-India auto parts has improved substantially and today Indian suppliers cater to virtually the who’s who of the vehicle manufacturing world across segments. From Aston Martin to Toyota, Daimler Trucks to Volvo Trucks, and BMW Motorrad to Husqvarna, virtually all leading automakers source parts from India.

In FY2018, exports of made-in-India components were up significantly by 23.9 percent to Rs 90,571 crore (FY2017: Rs 73,128 crore). Europe accounted for 34 percent of the exports, followed by North America (28%) and Asia (25%). The top 10 export markets are the USA (23%), Germany (7%), Turkey (5%), UK (5%), Italy (4%), Brazil (4%), Thailand (3%), France (3%), Bangladesh (3%) and Mexico (3%).

The key exported products include drive transmission and steering (34%), engine components (20%), body/chassis/BIW (16%), suspension and braking (11%). “The export performance has been very encouraging. Not only geographically, but every single export commodity that we are supplying has seen a uniform growth. It is the increasing credibility of Indian products that has led to a growth in exports,” said Vinnie Mehta.

However, compared to the exports’ performance, import of parts rose worryingly in the past fiscal. In FY2018, imports rose by 17.8 percent to Rs 1,06,672 crore from Rs 90,571 crore in FY2017. While Asia accounted for 60 percent of the imported components, Europe (30%) and North America (8%) were the next biggest suppliers. Within Asia, however, China accounting for 27 percent of the total imports is a worrisome factor. “While there is no Chinese OEM playing in the Indian market, imports from China ranking at the top is a matter of concern. We also have a lot of Chinese imports coming in directly to the aftermarket because there are no mandated norms for business in that space,” said Mehta.

“Large production capacities, a technological advantage in some product categories for instance electronics, and having a subsidy on selected raw materials makes procuring certain components from China cost competitive than manufacturing them locally,” added Minda.

The other nine biggest import markets comprise Germany (14%), Japan (11%), South Korea (10%), USA (7%), Thailand (6%), Italy (3%), UK (2%), Czech Republic (2%) and France (2%).

The industry continues to face challenges in the form of the need to upgrade worker skills at Tier 2 and 3 suppliers.

Nonetheless, from a balance of trade perspective, things are improving. “Even though the imports rank high this time around, the cumulative rate of growth is much higher at the export front, and hence we believe that slowly exports will overcome Indian component imports,” said Mehta.

Segment-wise, imports are led by transmission drive and steering parts (31%), engine components (17%), body/chassis/BIW (14%), suspension and braking (9%), electricals and electronics (9%), interiors - non-electronics (7%) and consumables and miscellaneous parts (7%).

Aftermarket biz shows promise

With nearly 25 million vehicles sold in India across segments in FY2018, and over 20 million units for each of the years preceding it, a rising vehicle parc spells good news for the aftermarket. This is reason why the aftermarket component supplies grew by 9.8 percent to clock Rs 61,601 crore in FY2018, up from Rs 56,096 crore generated in FY2017.

Most leading suppliers are developing solutions to cover combustion, hybrid and electric vehicles. BorgWarner is one of them, which is bullish on growth in India.

While supplies to the PV industry were the highest at 35 percent, the CV segment absorbed 33 percent with two-wheelers accounting for 20 percent. Transmission and steering systems (21%), engine components (18%), suspension and braking parts (15%) were the major components to be despatched to the aftermarket, both on the domestic as well as on the exports front.

Overall, with high fuel prices and a growing consciousness among vehicle owners to better maintain their steeds to achieve lower costs of ownership, the aftermarket business is set to thrive in the coming years.

New challenges and the need for uniform 18 percent GST

As the industry tackles a slew of disruptive forces set to transform the sector in a big way, there are challenges to growth aplenty, which are a cause of concern from a macro perspective. Hinting at the need for government intervention to sustain long-term growth in the auto component industry, Minda said: “The dynamics of the automotive markets are undergoing a significant transformation as the industry strives to become compliant with various regulations related to emissions, safety and environment including the transition from BS IV to BS VI. Key trends such as vehicle connectivity, electrification of vehicles, shared mobility and Industry 4.0 among others are also redefining mobility. To support the changing customer needs and to stay relevant, the auto component sector needs to be encouraged with supportive government policies.”

“One of the key demands of the industry has been a uniform 18 percent GST rate across the auto component sector. Currently, 60 percent of auto components attract 18 percent GST, while the balance 40 percent, the majority of which are two-wheeler and tractor components attract 28 percent.”

“The latter high rate has led to flourishing grey operations in the aftermarket. A benign rate of 18 percent will not only ensure better compliance, but will also ensure a larger tax base,” added Minda.

“Further, considering the significant technological changes that the industry is undergoing, there is a critical need for creating a fund to support indigenous R&D and technology creation in the component industry as also for technology acquisition from other parts of the world.”

“Lastly, as we prepare for the introduction of electric mobility in the country, a well-defined, technology-agnostic roadmap with clear responsibilities of each stakeholder will go a long way in ensuring a smooth rollout as well as leading to creation of a local supply base for the same,” said the ACMA president.

With the domestic automobile industry well placed after four months in FY2019, having recorded 15.39 percent YoY growth, and exports up 26.56 percent, the component industry will no doubt benefit. Furthermore, the components sector will grow in sync with the foreseeable boom in vehicle sales in India, which is set to become the world's third largest PV market by 2021. “We will have a very good run till 2020 and the industry will average at around 15 percent growth rate. With an increase in crop MSPs, the demand from the rural areas for tractors and two-wheelers will see an uptick, along with a lot of pre-buying in lieu of the BS VI implementation. All these factors will see the sector pushing for growth,” said Vinnie Mehta.

Nonetheless, the industry continues to face challenges in the form of the need to upgrade skills at Tier 2 and 3 suppliers, rationalise GST to 18 percent across the board, the shift to BS VI from April 2020, the non-availability of indigenous technologies to meet upcoming safety and emission norms as well as for electric mobility, and also MSMEs lacking the capital to invest in technology development for both products and processes. Therefore, ACMA has recommended the setting up of a technology and R&D fund – grant-in-aid or interest subvention – to support to support industry. This fund could also be utilised for acquisition and assimilation of technologies through licensing agreements, JVs or acquisitions.

The industry, which has been fully focused on IC-engined vehicles, is concerned about the impact of vehicle electrification. ACMA has made recommendations for promoting local manufacture of xEV components. Its roadmap involves:

- Defining a ‘Technology Agnostic Roadmap’ for xEVs with well-defined roles and responsibilities for each stakeholder.

- Mandating local content for xEV manufacturers – 25 percent in the first year; 50, 75 and 90 percent in the second, third and fourth years respectively.

- Creating dedicated EV manufacturing zones/clusters in states with local incentives.

- Investment allowance/capital subsidy for battery/motors/ specified xEV components manufacturing (M-SIPS scheme of MEiTY).

- GST rate on EV components could be lower/at par with xEV R&D.

- Create a technology acquisition and development fund as also extend interest subvention for technology acquisition/development.

- Import duty exemption on capital goods for R&D for xEV component development.

- Define and mandate standards for components for xEVs.

- Charging stations to prevent cheap/substandard imports.

Also, the FAME-India Scheme is currently limited to subsidising xEV purchase. ACMA says its scope should be enhanced to include funding/grants for development of components for xEVs and for charging infrastructure.

Overall, here's an industry that's gearing up to handle the future capably and sustainably, when tomorrow comes.

Interview Vinnie Mehta, director general, ACMA

On the GST Council reducing taxes on lithium-ion battery packs and on fuel cells.

The understanding right now is that the most prevalent and mature technology is lithium-ion battery technology and in that sense, the lowering of the taxes doesn't point to the government being technology-agnostic.

Even as fuel cells also get included in the lowered tax slab, let us see how the policies evolve. Again, there is no last word on the technology and we do not know whether it would be hydrogen cells, lithium-ion

or other chemistries that would prove to be relevant in the future.

On the enhanced potential for Indian exports after BS VI adoption.

With a substantial 24 percent growth in exports, BS VI also offers a huge opportunity for the industry to expand its export business as it will enable a level- playing field with the global markets. It's not that the competence doesn't exist right now. The vehicles that are being exported from India right are already Euro 6-compliant and, by 2020, many more players would be ready as well, thus increasing the total percentage of manufacturers offering BS VI components and bringing mass upliftment of the sector.

On the need to incentivise R&D initiatives.

While there were incentives for vehicle manufacturers to produce electric vehicles in the FAME 1 scheme, ACMA believes that the government should extend the support to component manufacturers as well in the upcoming FAME 2 policy, in order to drive inclusive growth in the sector.

While the conventional industry has its hands full at the moment and we are in a happy state, however, there are emerging players like start-ups which are eyeing disruptive technologies from a developmental perspective and also conducting research in the space.

(This article was first published in the 1 September 2018 issue of Autocar Professional. Pick up the issue for in detail tables and charts)

RELATED ARTICLES

Branded content: HL Klemove inaugurates first Local ADAS Radar Manufacturing Unit in India, marks a significant achievement in “Make in India” initiative

The inauguration ceremony was held in the presence of Vinod Sahay, President and CPO of Mahindra & Mahindra Ltd. and Dr....

BluWheelz to 'Green Up' logistics sector

With their EVs-as-a-service solution, the startup is playing it smart with costs and looking to electrify the entire seg...

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

07 Nov 2018

07 Nov 2018

7029 Views

7029 Views

Autocar Pro News Desk

Autocar Pro News Desk