Hella India Auto sets up dedicated team for 2Ws

The new team with a headcount of 30 engineers, is already catering to the market requirements of the growing two- and three-wheeler domains including the demand for critical parts under electric mobility.

In a bid to tap the growing demand for electrical and electronic parts in the two- and three-wheeler and electric mobility segments, Hella India Automotive has set up a dedicated team at its Pune-based engineering centre to put in focused efforts.

Hella India Automotive (HIA), the 100 percent subsidiary of the Germany-based 6.4 billion euro (Rs 51,471 crore) Hella KGaA Hueck & Co, has recently set up a dedicated team to tap the opportunities in the two- and three-wheeler segments at its Pune-based engineering centre.

The new team, which currently has a headcount of 30 engineers, is already catering to the market requirements of the growing two- and three-wheeler domains including the demand for critical parts under electric mobility.

Soumya Sinha: "We are developing two types of motor controllers, which have received customer nominations."

The team, which is headed by Soumya Sinha, the new director for the 2W/3W business segment, is working on a number of electronic parts and solutions that will be largely required under the incoming regulatory norms (safety, emissions) and technology trends such as electrification and connectivity.

Explaining the growing opportunities in these segments, Sinha elaborated, “Currently, India accounts for an almost 50 percent market share in the 2W/3W segments globally. Other important markets are ASEAN and China. The 2W/3W segments are going through a series of disruption in India due to the regulatory requirements and the customer demand.

The local OEMs and suppliers are looking to upgrade their current technical/development capabilities to meet future requirements. These disruptions will help enable Indian OEMs and suppliers to increase their competencies and consolidate their global position. Hella is uniquely placed in this period of change. Hella has formulated a separate 2W/3W unit (within HIA) with fully localised development and manufacturing to cater to these disruptions. To cater to the upcoming trends in this industry OEMs also need to elevate their technologies, and that’s where we can play a role to fill this gap.”

E-rickshaws a big market

Speaking to Autocar Professional, Sinha revealed that the market size of e-rickshaws is about 250,000 units per year. “Currently, there are more than 100 players in the e-rickshaw segment, which is largely an unorganised category at the moment,” he said.

He believes that as this market will shift towards the organised sector, the known and established players will gain further traction and become stronger. Meanwhile, the smaller players might fail to survive.

Sujit Sopan Barhate: "We aim to develop Hella India Automotive as the two-wheeler centre of competency in Hella world.”

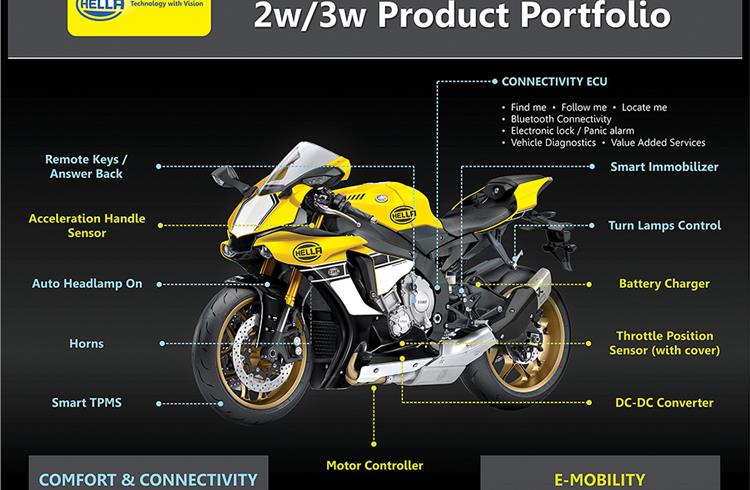

Hella India Automotive’s product line-up for tapping the opportunities under the two-wheeler and three-wheeler business include DC-DC converter, BLDC motor controller, battery charger, connectivity ECU, remote keys, throttle position sensor and horns among others. Other future products that the company is working upon are the battery management system (BMS) and the acceleration handle sensor (AHS).

Products under development

The young and aggressive team at HIA Pune-based development centre aims to be the complete system supplier of the electric powertrain for 2Ws/3Ws (except the battery).

Highlighting his team’s ambition, Sinha said, “HIA aims to be a system supplier of powertrain for electric 2W/3W. We currently have BLDC motor controller, DC-DC converter, EV information management system and battery charger available for 48V 2W/3W. HIA is planning to invest in BMS, accelerator handle sensors and we are working on (potential) partnership for the localisation of motors. The upcoming auto policy of the government is expected to have functional safety requirements as per ISO 26262 guidelines for 2Ws/3Ws. The products we plan to launch in India (for 2W/3W) are comparable with safety, quality and process requirement standards.”

Offering his perspective on the newly formed team and roadmap ahead, Sujit Sopan Barhate, program management and design & development (2W/3W business unit), HIA, added, “We have created a separate business unit for 2W/3W. We are prepared for complete local development and production of 2W/3W products. Two of our products will be launched with OEMs in 2018 as part of the connectivity and electric mobility domains. We have plans to enhance our product portfolio in these domains which shall support IC and electric vehicles. We also intend to develop HIA as the two-wheeler centre of competency in the Hella world.”

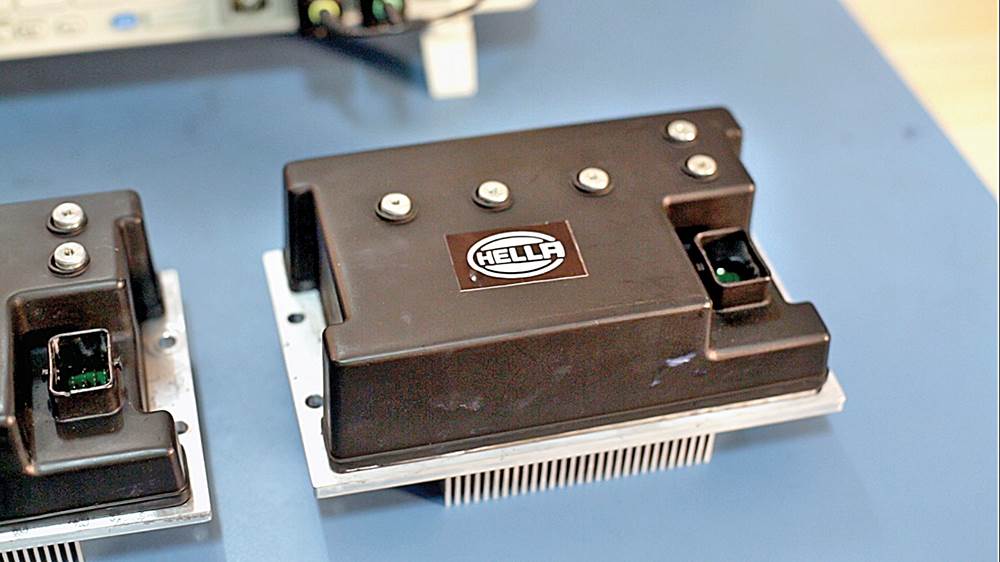

Motor Controller

The company is developing a motor controller as per IIT-M specifications that include J1939 and CAN 2(b) protocol. According to the senior officials, the J1939 specifications are being used for designing and developing the motor controllers for the electric rickshaws. These motor controllers can also be used in electric three-wheelers.

Explaining the standard specifications HIA is following, Sinha said, “We are using the global benchmarks to design and develop products for India. We are working on two motor controllers – 1kw and 3kw. The 1kw motor controller can be used in e-rickshaws with maximum speeds of below 25kph. Meanwhile, the 3kw motor controllers can be used in e-autos, which can have maximum speeds of up to 45kph. These products are under development as of now and we have already received customer nominations for both of them.”

Connectivity ECU

The onboard lithium-ion chargers for two-wheelers is yet another example of local product development. The onboard chargers are currently under development and the company aims to ready a working prototype by May 2018.

“The DC-DC converter has been a part of our portfolio for a long time. We are working to extend this technology for two-wheelers and three-wheelers,” added Soumya, while speaking about the future product pipeline.

The company has recently developed a smartphone connectivity app, which can display useful information about the vehicle on the phone. Speaking on this, Sinha stated, “The smartphone app is a tailored connectivity solution developed by us. EVs require a lot of vehicle-to-people communication such as battery charge level, running range, nearest charging station and other critical information. This app can be a cost-effective solution for any OEM looking to install smart connectivity features on their two-wheelers as it saves them (cost-wise) from putting big instrument display units on the vehicle. So, we have designed an ECU, which will fetch all the information and will show it on your phone.”

HIA has also received two customer nominations for this app-based 2W connectivity solution.

The optimistic company officials estimate that electric mobility has already started to penetrate in the local market via electric rickshaws for last-mile connectivity. They forecast that two-wheelers could be the second segment to catch up as they offer lesser range anxiety and lesser reliance on the charging infrastructure (when compared to cars).

With penetration in these two segments, EVs, the senior company management foresees, could start seeing acceptance in the market.

With its hands full of projects and a buzzing order book, HIA already plans to double up its 2W/3W team in the next three years.

Q&A: NAVEEN GAUTAM, Member of the Executive Board, Business Division - Electronics, Hella KgaA Hueck & Co

How do you see the convergence of energy and automotive domains as electric mobility gains traction worldwide?

When we speak of electric mobility, it is understood that the (lithium ion) batteries will be there at the centre. If in India we are able to break through the battery cell manufacturing and assembly operations, it will revolutionise the industry.

So what will be the enabling technologies in future? I see solar energy cost (of panels) sharply declining. So anything on which you invest today where the costs are sharply declining, you will regret two years later. We might be on the verge of becoming the second cheapest location for producing solar power in the world. That will enable decentralised charging stations; so anyone can install a solar panel and start providing power to vehicles. You can create your own business. On the contrary, to set up a gas station, you need big political influence. So the decentralised power charging stations will become very frugal initiatives even in the rural India.

We will grow the industry that will complement electric mobility. Indigenous technologies around batteries, charging and motors will be areas we see growing. Three years will be a good testing time to see what results these areas generate.

The growth (e-mobility) will be retarded by the growth of infrastructure. This means that we anticipate 10 percent growth in the sales (of vehicles), then the roads must also grow by 10 percent or else the traffic will increase.

Typically suppliers in India wait to secure the business before making investments. OEMs, on the other hand, complain that there is no ecosystem for e-mobility in India, which clearly points at the supplier community not being ready to supply parts. What is your perspective on this?

Somebody has to take risk. But it’s also true that the early bird gets the fruits. So whoever gets into this business first, they take maximum risk. But they also get the maximum return. This is the nature of business. Whether a Tier 1 supplier take risks and develops products for e-mobility for OEMs or whether the OEMs will pay Tier 1 suppliers in advance to develop products, this will be seen over the next two to three years.

My perspective is those who are big enough to take the risks, will benefit. What can Hella do? We are an old company but we have created a division, which works like a start-up, to focus on electric mobility (and 2/3 wheelers). We have a good plan and we give enabling freedom (to the 2/3 wheeler team), which is required to run an independent company within a company.

Do you think subsidies can play an important role in developing the ecosystem for electric mobility?

History says subsidies are good as long as it is for a limited period. To give a jump-start to anything, subsidy is good to get little volumes quickly. Beyond that, it is charity, which is neither scalable nor sustainable. Without these subsidies, a lot of electric rickshaws are getting sold, a lot of three- wheelers will also be sold.

The government can buy some fixed volumes or they can also create leasing option for the batteries or give subsidies. These are all different forms of giving a jump-start in the industry. It can provide support in the form of charging stations or even incentivise charging stations. However, historically, subsidies have been misused. So, I think, it has to be done for a limited time.

(This article was first published in Autocar Professional's March 1, 2018 Two-Wheeler Special issue)

RELATED ARTICLES

BRANDED CONTENT: Eliminating the worries of battery charging with smart solutions

The charging infrastructure is the backbone of electric mobility but is also one of the key perceived barriers to EV ado...

The battery-powered disruptor

Greenfuel Energy Solutions is planning to shake up the EV battery market with the launch of a portfolio of specially eng...

SPR Engenious drives diversification at Shriram Pistons & Rings

The engine component maker is now expanding its business with the manufacturing of motors and controllers through its wh...

14 Apr 2018

14 Apr 2018

22110 Views

22110 Views

Autocar Pro News Desk

Autocar Pro News Desk