Aeris India: Tapping telematics, leveraging in-vehicle data aplenty

The US-based end-to-end IoT solutions provider eyes aggressive growth in the domestic market on the back of the growing digital connect in the automotive ecosystem.

With digitisation becoming an integral part of people's lives and also their vehicles, the rapidly evolving automotive industry is also undergoing immense transformation, what with its manufacturing systems, processes as well as products getting technology intensive with a high level of electronic componentry. Modern-day cars, apart from offering adequate levels of comfort, convenience and driving pleasure, have to also stand the test of rising consumer expectations of being connected 24x7.

Aeris Communications, which started as a mobile virtual network operator in the USA in 1998, is a pure machine-to-machine (M2M) connectivity provider, wherein the company, rather than being a licensed telecom operator itself, offers its solutions by tying up with different telecom partners.

Aeris set up its IoT business arm in 2007, when its vehicle connectivity system was tested and approved by Mitsubishi for application in its passenger vehicle models for the US market. This saw the company create a complete IoT system stack, including connectivity management and device management platforms, along with offering application building and data analytics capabilities within its own solution set.

While Mitsubishi will be switching over to Aeris’ AMP connectivity suite for all its models on sale in the US from January 2019, the Japanese carmaker will eventually expand the services to its customers in Europe and South East Asia as well, where Aeris will handle all the IoT-based connectivity features on offer.

Eyeing unique business opportunities

With in-vehicle connectivity witnessing a boom, Aeris has seen its IoT division expand and gain good traction in Europe, as well as in some Asian markets such as India, where it started its operations in 2016. At present, the Noida-based firm works with insurance companies, fleet operators, financiers and government agencies to provide the fundamental technology which would enable some innovative business opportunities in the vehicle insurance, logistics and financial services space.

The company aims to leverage the power of data by collecting it via multiple sensors at various positions within a vehicle and then bring them to a single location for analysis, which it believes holds good potential to drive new business models, especially in the automotive consumer services space.

Globally, Aeris inked an operating JV with Japanese investment banking firm, SoftBank, in June 2016. While it doesn’t seek any investment from the Japanese giant, it however will be utilising SoftBank’s relationships to expand its business across the world.

“Our key strength lies in the automotive sector, spanning across CVs, PVs, two-wheelers and now in e-rickshaws as well, where we are working with an OEM in India and are utilising digitisation to bring these low-cost vehicles offering last-mile connectivity under the ambit of insurance providers and financiers, so as to facilitate more and more micro-entrepreneurship,” says Dr Rishi Bhatnagar, president, Aeris Communications India.

Dr Rishi Bhatnagar: "We have won a number of deals already and we expect to run a good business in India."

Having initiated work with insurance companies in India, as well as with fleet operators outside in Vietnam, Indonesia and Africa, the company is optimistic about the future. “We have won a number of deals already and we expect to run a good business in India with a growing automotive market,” adds Dr Bhatnagar.

While the bulk of its business comes from fleet application, Aeris has also brought over 2,000 two-wheelers – scooters and motorcycles – onto its connected vehicle platform in India, and is now pitching its solutions to vehicle OEMs across segments to make these as part of the standard OE fitment in their connected future products. “We have a very scalable platform right now, which also offers the advantage of being multi-lingual, which is very beneficial for the Indian market,” affirms Dr Bhatnagar.

“In terms of penetration, India is far behind the West, which only points to huge growth potential. With the regulatory push from the government in the form of smart transportation like mandatory fitment of a GPS system in every CV as well as the compulsory presence of a panic button in cabs, all of these call for a connected vehicle,” he points out.

As a result, apart from a vehicle running a connected device and offering features such as real-time vehicle health diagnostics to its owner as well as to the OEM, Aeris India is also eyeing new business potential that vehicle telematics is throwing up – like insurance companies needing to screen fraudulent claims and financiers tracking their non-performing assets (NPAs), both of which are set to drive the connected vehicle ecosystem from a consumer services perspective.

“Only 16 percent of the total cars on sale in India today come equipped with vehicle telematics systems fitted at the OEM level itself. The balance 86 percent, which comprises the bulk of the mass-market volumes, is still averse to such a technological feature, which is not quite affordable for the segment,” says Dr Bhatnagar.

With PV OEMs in India offering connected vehicle services such as Honda Connect, Nissan Connect and Suzuki Connect, to name a few, customers are being lured by some of the convenience and safety features on offer.

While features like real-time vehicle health monitoring, geo-positioning, geo-fencing, overspeeding and vehicle crash alerts do interest consumers from a safety perspective, there are, however, only a handful of takers for this at present, who actually use these and even then, not beyond the point when the novelty dies. On the other hand, a continuous beam of vehicle data is valuable to the OEMs, which could analyse it and improve upon their product parameters.

The growth in telematics devices then can seemingly be understood to come from the services sector, where, according to Dr Bhatnagar, “the future could see these devices being offered for free, either by the OEM, insurer, or the financier, to keep vehicle thefts or NPAs in check, and thus, offer focused and customised solutions to customers. Insurance companies can also reduce attrition by bundling a three-year comprehensive package along with a telematics device, in order to retain a customer, thus, securing its business as well.”

“With data being the goldmine of the future, whoever comes forward to invest, will drive the growth of telematics. I believe that even the telecom operators stand to play a big role by offering connectivity and by utilising their data centres, as well as their broad reach across the country. This data can be used by multiple agencies – like the government and the financiers – in multiple ways, given that they are ready to pay for it.”

“So, financiers, insurers and the telecom operators can create a group for data monetisation and see who would be buying what from whom,” says Dr Bhatnagar.

An end-to-end solution

The Indian government, with its policy changes, has given a boost to the telecommunications sector. From around 2 million cellular connections in 2001, there are over 1.18 billion mobile connections in the country as of May 2018. The target for 2022 is a humongous 5 billion connected systems, with 4 billion to be achieved by connected devices over the next four to five years and automotive contributing the largest with its scale and penetration.

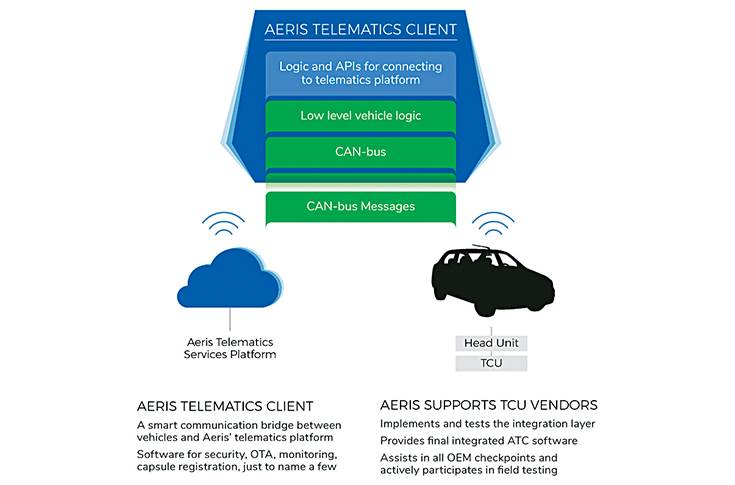

Aeris India is targeting that potential market and, just like its parent in the US, has tied up with cellular service providers here as well to offer a fundamental IoT platform, as well as the solutions including L1, L2 and L3 support to enterprises, thus providing an end-to-end IoT service set, making it easier for companies to hook onto a single network for their operations.

Aeris' platform claims to seamlessly merge with the vehicle architecture at the TCU level and beams overspeeding as well as crash alerts over the air.

With a regulatory and legal framework, foolproof technology, consumer awareness and the right set of skills being the prerequisites for data security in the rather tough scenarios of a digital and connected world, Dr Bhatnagar believes that while Aeris, being a global player, has had the advantage of conforming to cyber security laws, however, “both skills and technology to protect our data to the utmost level do not exist in India even now. But data security certainly is one of the threats of the highly connected world that we live in and we have developed built-in capabilities within our solution set to ensure that our data transmission adheres to the governing regulations in place.”

While there are global giants like AT&T, Cisco-Jasper, AWS, IBM, PTC-Thingworkx and Cumulocity, “none offers an end-to-end IoT stack, transmitting over 2 billion messages between machines on a daily basis, which is what makes us unique and allows us to be attractive to our customers,” remarks

Dr Bhatnagar.

While Aeris is working to submit its proposals for future connected vehicle projects from some Indian automobile OEMs, it views the current cost of the technology to be a hindrance to growth. The company used to import its devices from China, but has now localised its hardware by tying up with suppliers based in Maharashtra, Tamil Nadu and Andhra Pradesh.

According to Dr Bhatnagar, “Right now, the price points of the hardware are too high, with the cost of the radio module, chipset and other constituent components being on the higher side. Where material (silicon) will continue to remain one of the key contributors of high cost of the hardware, there is an innate need for R&D in material technology, and for hardware manufacturers to drive cost efficiency in these connectivity devices.”

“From Aeris’ perspective, we are waiting for that to happen and then there would be a boom in the vehicle telematics space. While the policy is driving implementation in the CV space, on the other hand, there is a need at the enterprise level for the market leaders to offer such devices into their vehicles, and also bring the costs down with economies of scale,” he adds.

Industry 4.0 for India

Sensors and interconnectivity hold immense potential when it comes to improving efficiencies on the shopfloor, given that technology can significantly cut down on the time consumed in critical tasks such as maintaining logistics, handling inventory and controlling parts.

“However, even though Industry 4.0 ensures higher productivity and efficiency, factors such as cheap labour costs and a youthful population tend to significantly impact the logic of its implementation in the Indian context, considering that the return on investments would be too slow in comparison,” says Dr Bhatnagar.

Still, Aeris India is capable of offering a host of connectivity and Industry 4.0 solutions to the Indian manufacturing sector as “our solution is cost-effective than what the global giants would be offering, and this is exactly suitable for an emerging market like ours and for the rest of the South East Asian region as well,” adds Dr Bhatnagar.

Connectivity functions such as geo-fencing and geo-positioning in two-wheelers are of high value to insurers to hedge their insurance on these theft-prone vehicles.

Typically, transitioning to Industry 4.0 for OEMs and suppliers would call for much consultancy and training; Aeris aims to facilitate this by offering employee and machine tracking systems. It is also working on collaborating with an Industry 4.0 specialist in the near-term to drive growth in this area.

As digitisation looks set to envelope the industrial ecosystem, with regulatory changes, increment in data bandwidths with 5G, as well as connectivity devices seeing lowering of costs some years down the line, what lies at the horizon is an untapped mass, which offers tremendous scope of business for technology companies to be entering India and leaping forward with a sound footing in the Indian automotive market.

The company, which currently employs 127 people at its technology and business centre in Noida, primarily developing software and strengthening the backbone of its integrated IoT stack, aims to grow aggressively over the next few years. While Aeris India plans to enlarge its team to over 250 people by the middle of 2019, it is eyeing serious transformation which is already underway in the automotive industry and aims to cater to the sector's fast-growing connectivity needs, which can only grow a lot more.

“The government’s ‘Digital India’ initiative has, in literal terms, forced companies like ours to enter into India, invest and create more jobs in the country. While we grew at 128 percent between Q1 and Q2 of FY2018 (Jan-Dec fiscal), we see a huge market out there and expect growth to keep soaring in the near future,” concludes Dr Bhatnagar.

(This article was first featured in the 1 September 2018 issue of Autocar Professional)

RELATED ARTICLES

BRANDED CONTENT: Spearheading the EV revolution in India

Jio-bp is a joint venture between Reliance Industries and BP PLC where both entities have married international expertis...

Qualcomm devises cost-effective ADAS chip for India

The American technology giant is enabling connectivity in modern cars and aims to tap into the price-conscious Indian ma...

Renault-Nissan Alliance rebooted

The Franco-Japanese alliance is all set to unveil an ambitious SUV line-up amidst fresh investments of Rs 5,300 crore in...

17 Nov 2018

17 Nov 2018

8172 Views

8172 Views

Autocar Pro News Desk

Autocar Pro News Desk