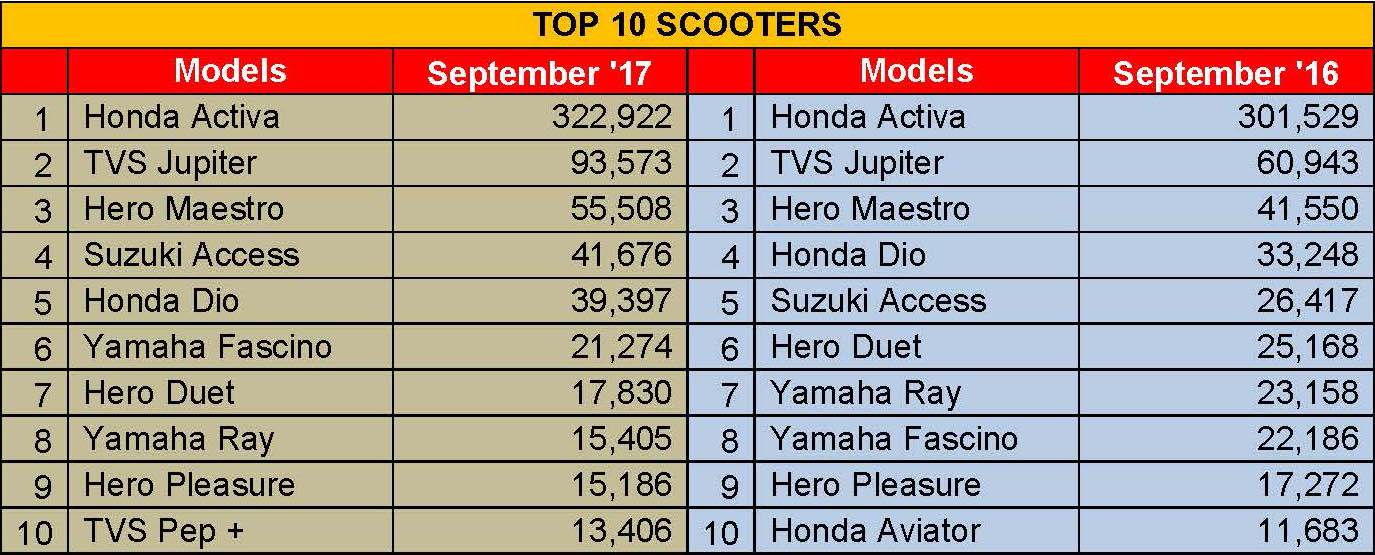

India Sales: Top 10 Scooters – September 2017 | Honda Activa reigns supreme, TVS Jupiter posts smart growth

While the Honda Activa remains unassailable,the much-in-demand TVS Jupiter is expected to soon breach the 100,000-unit mark in the coming months.

In the two-wheeler market, all the excitement seems to be in the scooter segment. There are about 21 models (and many more variants) currently manufactured and retailed by seven companies in India’s speedily-growing scooter market. The segment, which has outpaced motorcycles and mopeds in H1 FY2018, recorded total domestic retail sales of 3,577,421 units during the April-September 2017 period, up 17.26 percent YoY.

In H1 FY2017, the scooter market size stood at 50.49 percent of the motorcycle market and about 32 percent of the overall domestic two-wheeler market. For April-September 2017, the scooter market stands at almost 55 percent of the motorcycle market and 34.05 percent of the overall domestic two-wheeler market.

It is often asked how much more can the demand for scooters erode that of the motorcycles in the domestic market? Most industry experts until now have settled for a common forecast, which outlines that the total scooter market will grow up to 40 percent of the overall domestic two-wheeler segment in the foreseeable future. They anticipate that this growth will be fuelled by demand from not only the urban and semi-urban regions but also from the rural markets, thanks to various initiatives including the improving infrastructure, women empowerment, awareness and education, penetrating OEM networks and others.

Honda leads the charge

Honda Motorcycle & Scooter India (HMSI), the undisputed market leader in the domestic scooter segment, has been studying the rural customer and demand cycles for some time now. After establishing its scooter brands such as Activa, Dio and Aviator in the Tier 1, 2 and 3 cities, it now aims to drive scooterisation in rural India which is largely dominated by motorcycles.

According to YS Guleria, HMSI’s senior vice-president (marketing and sales), when Honda was working on a scooter model (110cc Cliq) for rural customers, it conducted a survey, which highlighted a few interesting points. These pointers included scooter price barrier, rural infrastructure, conformist behaviour and a clichéd mindset among potential rural customers.

“The price barrier meant that the weighted average of all commuter motorcycles available in rural markets stood about Rs 45,000 against a scooter’s average of Rs 48,000. Secondly, scooters offer a smaller wheel size, which is not conducive for comfortable riding on bad roads. Conformist behaviour stood for low confidence among rural buyers to purchase a scooter over a motorcycle, which dominate the roads. A clichéd mindset meant that they believe anything automatic is expensive,” he told Autocar Professional in a recent interview.

Honda considered addressing these concerns by launching the Cliq model priced below the weighted average of the commuter motorcycles. Targeted at rural customers, Honda has sold about 20,000 units of the 110cc Cliq in four months (until September) under its phase-wise retail supply.

The 110cc Cliq model and the 110cc Navi, which was the company’s attempt to bring new young customers on board, together garnered sales of more than 11,000 units in September alone. This was more than Piaggio’s scooter sales under Vespa and Aprilia brands put together for the month.

Without measuring such attempts in terms of monthly volumes, it can be said that they contribute in exposing customers to new choices and gradually help in building up the market, besides providing insights about customer behaviour and demand.

Honda’s Activa scooter took nearly 15 years to become India’s largest selling two-wheeler as it continues to register consistent growth every month. “In 2001, we had only one scooter model – the Activa,” recalled Guleria.

In September 2017, Honda registered sales of 322,922 scooters under its Activa brand, which marked a YoY growth of 7.09 percent despite its large base. On the cumulative front, the Honda Activa has sold 1,781,063 units in H1 FY2018. This also means that the popular scooter brand would have achieved the landmark of selling two million units in October, in the seventh month of this fiscal. Market analysts forecast that Honda will gun for sales of around 3.5 million units in the domestic market from brand Activa alone in FY2017-18. Honda’s total scooter sales stood at 3,86,456 units in September (up 8.65 percent YoY) and 20,98,354 units (up 16.68 percent YoY) in H1 FY2018.

TVS Motor Company has been recording good scooter growth on the back of demand for its bestselling two-wheeler – the 110cc Jupiter. The model, which sold 93,573 units in September, registered YoY growth of 53.54 percent for the month. The TVS Jupiter, which stood as the fifth largest selling two-wheeler in September, is expected to soon breach the 100,000-unit mark in one of the coming months.

TVS Motor’s scooter sales appear to be at its all-time high as the company has reported sales of 118,174 units in September (up 50.47 percent YoY) and 566,362 units (up 41.31 percent YoY) in H1 FY2018. Its market share in the scooter segment has jumped from 13.14 percent in H1 FY2017 to 15.83 percent in H1 FY2018. Importantly, TVS has gone ahead of Hero MotoCorp to take second place in scooter market share.

Hero MotoCorp’s Maestro, which is ranked third in the Top 10 scooters list in September, sold 55,508 units, up 33.59 percent YoY. India’s largest two-wheeler manufacturer, which is the third largest scooter player in the domestic market, sold 88,524 scooters in September (up 5.40 percent YoY) and 4,43,321 scooters in H1 FY2018 (down 1.12 percent YoY).

Suzuki Motorcycle India’s Access 125 is another success story in the surging scooter market. The model, which was re-launched last year after the Auto Expo, revived sales for the company. At number four, it recorded sales of 41,676 units in September, growing by an impressive 57.76 percent YoY.

Suzuki Access 125’s H1 FY2018 sales stand at 194,431 units, up 67.11 percent YoY. Suzuki’s total domestic scooter sales for the same period stood at 202,771 units, up 61.81 percent YoY. This also underlines how the Access 125 singlehandedly drives scooter sales for the company in the domestic market. The company is a major gainer in terms of market share in the scooter segment. Its share jumped from 4.11 percent in H1 FY2017 to 5.67 percent in H1 FY2018.

Honda’s Dio, positioned at young urban, college-going students, sold 39,397 units in September (up 18.49 percent YoY) thereby ranking as the fifth top-selling scooter.

Due to its (large) scale and country-wide presence, all three Hero scooter models regularly feature in the Top 10 bestselling scooters list. For example, the Hero Duet has ranked seventh with sales of 17,830 units in September (down by 29.16 percent YoY).

Hero Pleasure, on the other hand, stands as the ninth top selling scooter model with sales of 15,186 units in September. Its YoY volumes are down by 12.08 percent though.

Yamaha’s Fascino continues to be a performer. It sold 21,274 units in September to take the sixth position. Its Ray sibling, powered by the same air-cooled, single-cylinder, 113cc engine, sold 15,405 units during the month and ranks eighth in the list.

Yamaha’s September scooter sales stood at 40,459 units (down 22.12 percent YoY). In H1 FY2018, the company has reported sales of 226,249 units (down 5.03 percent YoY). The company has underperformed in a surging segment and as a result its market share has fallden from 7.81 percent in H1 FY2017 to 6.32 percent in H1 FY2018.

TVS Motor’s Pep+ Scooty closed on the tenth position with sales of 13,406 units in September, beating Honda’s 110cc Aviator by a thin margin. Honda’s Aviator had sold 13,046 units in September.

It can be estimated that Honda’s Cliq is the 12th largest selling scooter in the domestic market (September), followed by the TVS Zest, TVS Wego and Honda Navi, all in that order.

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

03 Nov 2017

03 Nov 2017

33619 Views

33619 Views

Autocar Pro News Desk

Autocar Pro News Desk