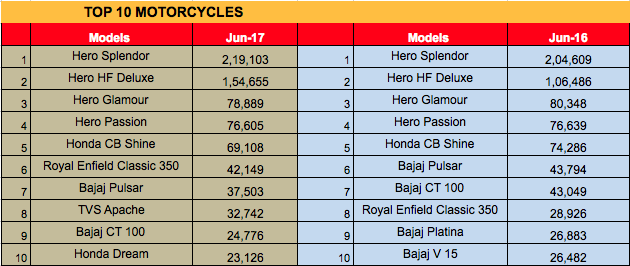

INDIA SALES – Top 10 Motorcycles: June 2017

While the Top 5 motorcycle brands continued to maintain their positions, Royal Enfield sold more Classic 350s than Bajaj Auto’s sales, indicating strong demand for the new Redditch models.

The top four best-selling motorcycle brands in India – Splendor, HF Deluxe, Glamour and Passion – belong to Hero MotoCorp, the country’s largest motorcycle manufacturer.

The Pawan Munjal-led company continues to dominate the 100cc-110cc mass commuter motorcycle segment with a market share of about 70 percent. Of Hero MotoCorp’s top selling brands, the Splendor, HF Deluxe and Passion portfolio largely constitutes 100cc-110cc motorcycles while the 125cc executive commuter motorcycle variants are positioned under the Glamour brand.

Hero MotoCorp sold 219,103 units under the Splendor umbrella in June, reflecting a YoY growth of 7.08 percent. The largest selling motorcycle brand was followed by the reliable HF Deluxe, which sold 154,655 units in June. The HF Deluxe recorded a YoY growth of 45.26 percent in the third month of the ongoing fiscal.

Hero’s 125cc bestseller Glamour stood at the third spot with sales of 78,889 units in June. The Hero Glamour, however, witnessed a flat YoY decline of 1.82 percent. According to the company, the dip in Glamour volumes was the result of supply constraints at the manufacturer’s end. The senior officials have communicated that the demand for the Hero Glamour remains robust in the domestic market as they aim to reinstate the leadership position in the 125cc motorcycle segment soon.

The Hero Passion, which stood fourth with sales of 76,605 units in June, reported a flat de-growth of 0.04 percent YoY. Monthly volumes of the Passion brand continue to slip for several months due to its aging portfolio and the absence of new model addition.

Interestingly, Passion continues to sell despite any visible marketing initiative by the company to promote the brand. The absence of a strong contender from the rivals in the commuter motorcycle market adds to this.

Honda’s popular CB Shine stood as the fifth largest selling motorcycle brand in June with sales of 69,108 units. HMSI had sold 74,286 units of the CB Shine in June last year. It ranked fifth in June 2016 too.

Notably, Honda’s CB Shine remains the number one 125cc motorcycle in the domestic market, outselling the Hero Glamour, during Q1 FY2018. Honda sold 256,532 units of the CB Shine in Q1 FY2018. Hero sold 209,117 units of the Glamour during the same period bagging the second spot in the 125cc segment.

It is to be noted that the Hero Glamour was the number one brand (beating Honda CB Shine for the second spot) in the 125cc motorcycle category in Q1 FY2017.

Royal Enfield’s bestseller Classic 350, which recently saw the addition of new Redditch variants (basically with new colour options – red, green, blue), has recorded new sales high in June. Bagging the sixth rank, the model garnered sales of 42,149 units in June 2017, which clearly indicates that the new Redditch shades are already a hit among the customers and RE aficionados.

Royal Enfield, which commands a strong brand positioning in the market, brought the Classic 350 Redditch series in January earlier this year. The intent was to create nostalgia around the brand and the town named Redditch (near Birmingham, U.K.) where Royal Enfield was born. The industry experts maintain that the marketing gimmick worked in terms creating a sense of pride in owning one of the world’s oldest motorcycle brands.

In June 2017, the RE Classic 350 registered a YoY growth of 45.71 percent (June 2016: 28,926 units). Furthermore, the RE Classic 350 has also outsold the Bajaj Pulsar, which ranked seventh in June with sales of 37,503 units, down by 14.36 percent YoY. Bajaj Auto’s retails about eight models (according to the company website) under its Pulsar umbrella, which had reported sales of 43,794 units in June last year.

TVS Motor’s Apache brand of premium commuter motorcycles (RTR 200, RTR 180 ABS, RTR 180 and RTR 160) ranked eighth with sales of 32,742 units in June. At the ninth position is Bajaj Auto’s 100cc mass commuter CT100, which sold 24,776 units last month. The monthly retail of CT 100 has reported an alarming decline of 42.45 percent YoY (June 2016: 43,049 units).

Honda’s Dream series of 110cc commuter motorcycles stood tenth with sales of 23,126 units in June.

Although the motorcycle segment grew by 3.44 percent YoY in Q1 FY2018, the industry is optimistic about further growth in Q2, thanks to above average rainfall and positive market sentiments. Many OEMs are also scheduled to launch new products during Q2 to build up demand during the festive season later this year.

RELATED ARTICLES

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

Maruti Suzuki tops PV exports for third fiscal in a row, VW, Honda and Toyota shine in FY2024

With its best-ever exports of 280,712 units, Maruti Suzuki retains PV exporter crown in FY2024; Hyundai with 163,155 uni...

30 Jul 2017

30 Jul 2017

10629 Views

10629 Views

Autocar Pro News Desk

Autocar Pro News Desk