INDIA SALES: Carmakers on a high, 2-wheeler OEMs report uptick, M&HCV sales slide in April

Riding on new models and refreshes, FY2017-18 has opened on a strong note for the passenger vehicle and two-wheeler segments albeit the heavy discounting before BS IV kicked for the CV sector saw buyers delay M&HCV purchase decisions.

Having ended FY2017 on a strong note with year-on-year growth of 9.23 percent and crossing the 3 million mark for the first time, the Indian passenger vehicle industry has begun the new fiscal on a robust note. From the sales numbers for April 2017 released by some OEMs, it’s clear that a combination of new models, refreshed variants and an uptick in consumer sentiment are driving increased footfalls in automobile showrooms and resulting in higher sales.

The forecast of a normal monsoon across the country by the Indian Meteorological Department and projection of 7.2 percent GDP growth by the International Monetary Fund are also

Maruti Suzuki India, the country’s largest carmaker, has taken off from where it left in FY2016-17 when it crossed the 1.5 million sales landmark for the first time ever.

In April 2017, the company has reported total domestic sales of 144,081 units, up 23 percent (April 2016: 117,045). Growth has returned to its entry level, bread-and-butter duo of the Alto and Wagon R, which sold 38,897 units, up 21.9 percent (April 2016: 31,906). Sales of the six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire posted robust 39 percent growth at 63,584 units (April 2016: 45,700). Maruti will officially launch the new, third-generation Dzire on May 18 in a bid to accelerate slowing sales of the compact sedan.

The Ciaz premium sedan, which is now sold only from the premium Nexa channel, went home to 7,024 buyers, up 23 percent (April 2016: 5,702). The two vans – Omni and Eeco – sold 13,938 units, down 28.6 percent (April 2016: 14,520). The sales decline in the vans is the only blemish for Maruti amongst its vehicle categories.

The company continues to post high sales in the UV segment, thanks to surging sales of the Vitara Brezza. Its total UV sales (Gypsy, Ertiga, S-Cross, Vitara Brezza) rose 28.6 percent YoY to 20,638 units (April 2016: 16,044).

And, Maruti’s Super Carry, its entry model into the LCV segment, sold a total of 411 units in April 2017.

On the export front though, Maruti has seen a sharp 29 percent decline. The company shipped a total of 6,273 vehicles in April 2017, compared to 9,524 units in April 2016.

Hyundai Motor India, the country’s second largest car manufacturer, sold 44,758 units in April, a year-on-year growth of 5.7 percent (April 2016: 42,351). Commenting on the April 2017 numbers, Rakesh Srivastava, director (Sales and Marketing), HMIL said, “Hyundai with a volume of 44,758 units continued its growth momentum on a strong base of last year driven by a tremendous response for the new Xcent and strong performance of the Grand i10, Elite i20 and Creta.”

Robust demand in the Indian market for SUVs is giving new momentum to automakers. Toyota Kirloskar Motor has reported strong growth of 52 percent in April 2017 – a total of 12,948 units (April 2016: 8,529). This growth, according to the company, is mainly attributed to the demand for the new Fortuner. In less than six months of its launch, the butch SUV has sold more than 12,200 units. The new Corolla Altis has also clicked with consumers and in just one month of its launch has clocked a growth of over 75 percent, thereby retaining its position as segment leader. Commenting on the monthly sales, N Raja, director and senior vice-president, Sales & Marketing, Toyota Kirloskar Motor, said, “We have been able to sustain robust growth in the month of April 2017. This growth has been propelled by the overwhelming response the new Fortuner has received. Ever since its launch in India in 2009, the Fortuner has been an undisputed segment leader. The launch of the new Fortuner has helped us up this ante as it has already sold more than 12,200 units in less than 6 months of its launch. Considering the segment in which the Fortuner is present, this is a great achievement for us.”

Mahindra & Mahindra sold a total of 19,325 vehicles in April 2017, down 15 percent (April 2016: 22,655). Commenting on the sales numbers for April 2017, Rajan Wadhera, president, Automotive Sector, M&M, said, “We are hopeful that the new financial year will bring in positive sentiment for the automotive industry with the key demand drivers in place. Factors such as the ongoing infrastructure development initiatives, outlook for a normal monsoon and the expectation of a stable policy environment will fuel growth in the coming days. Going forward, we are looking for a good growth momentum with our planned refreshes during FY2018.“

Honda Cars India has reported domestic sales of 14,480 units in April 2017, up 38.1 percent (April 2016: 10,486). The Japanese carmaker says it has received a good market response for the recently launched WR-V crossover and new City sedan. While the City has received over 25,000 bookings since its launch in mid-February, the WR-V has seen 12,000 bookings since its launch in mid-March.

In April 2017, the City was the best-selling Honda car with 5,948 units, followed by the WR-V (3,266), Jazz (2,061), Amaze (2,029), BR-V (701), Brio (438, CR-V (36) and Accord Hybrid (1).

According to Yoichiro Ueno, president and CEO, Honda Cars India, said: “Honda’s sales continue to grow positively and we registered our higher-ever April numbers backed by strong demand for the new City 2017 and WR-V. The new fiscal year has begun on a positive note and we hope to continue the growth momentum.”

Tata Motors continues to see a resurgence in demand for its passenger vehicles. The company sold a total of 12,827 units in April 2017, a growth of 23 percent (April 2016: 12,230) which it says is due to an “encouraging response for its recently launched lifestyle UV, the Hexa” and the Tigor. Meanwhile, the Tiago hatchback continues to see a good sales uptick.

Meanwhile, Ford India continued its growth momentum in April with domestic wholesales of 7,618 vehicles, up 16.64 percent (April 2016: 6,531). “Ford continues to outpace the industry with a consistent double-digit growth in domestic sales, thanks to our capable and dynamic product portfolio. Our promise to deliver an affordable, transparent ownership experience is bringing scores of new customers to the Ford family,” said Anurag Mehrotra, executive director, Marketing, Sales & Service at Ford India.

In April, in a bid to accelerate sales, the carmaker introduced Sports Editions of its Figo hatchback and Aspire compact sedan.

During the month, Ford India also started a new campaign to sensitise car buyers on the importance of safety, urging them to make it a top priority. The campaign, titled 'The Uncomfortable Question', finds its roots in the research that shows safety in car buying decisions play second fiddle to every other parameter – be it looks or mileage and even convenience features.

“The safety of our customers and their loved ones is a top priority for Ford. Hence our entire portfolio in India today comes equipped with advanced safety features such as ABS, EBD, side and curtain airbags as well as industry-first knee airbag to keep vehicle occupants safe,” Mehrotra added.

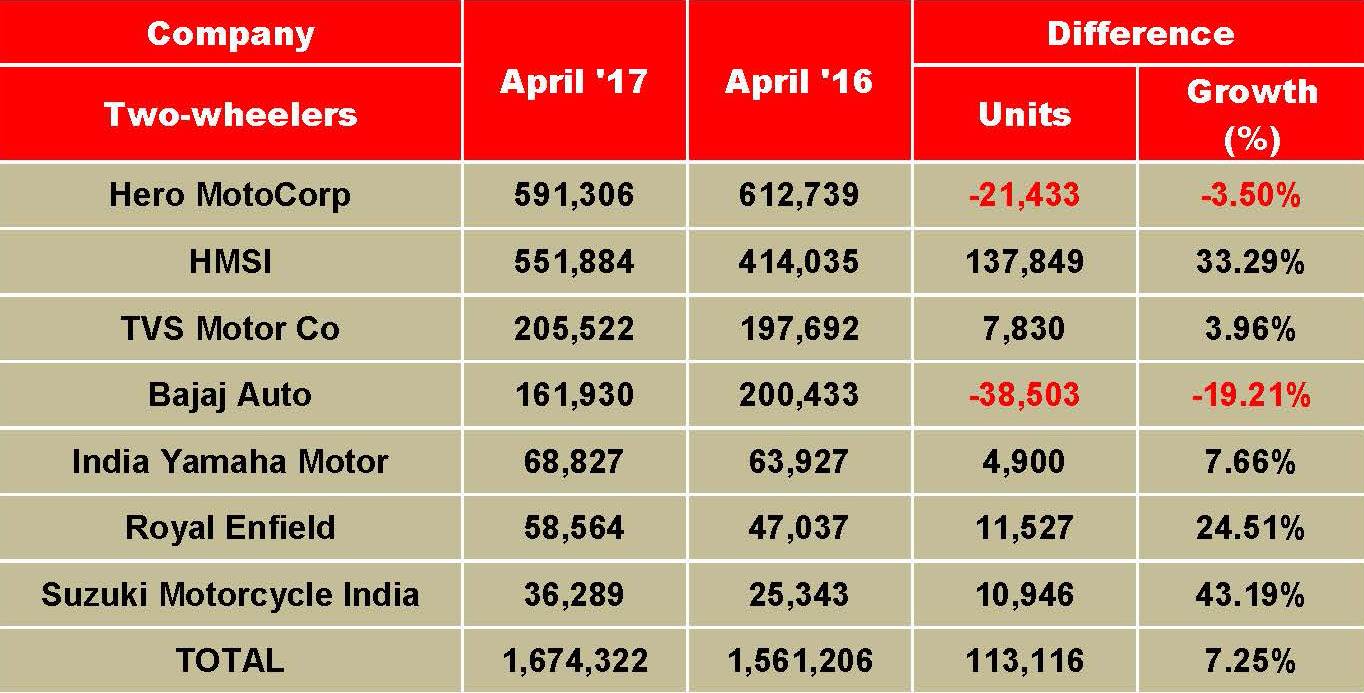

TWO-WHEELER OEMS OPEN FISCAL ON A HAPPY NOTE

April 2017 marks the closest-ever sales gap – less than 40,000 units – between Hero MotoCorp and Honda Motorcycle & Scooter India even as other OEMs report an uptick in monthly numbers.

The top seven two-wheeler manufacturers have reported total domestic monthly sales of 16,74,322 units for April 2017, which marks a year-on-year (YoY) of 7.25 percent (April 2016: 15,61,206).

Barring the home-grown Hero MotoCorp and Bajaj Auto, all other two-wheeler players have opend the new fiscal on a positive note. Honda Motorcycle & Scooter India (HMSI) stands out as the biggest gainer, adding 137,849 units to its April 2016’s sales to notch an impressive 33.29 percent YoY jump.

April 2017 also stands out in the context of the rivalry between the top two players. Autocar Professional understands that Honda has recorded its best-ever monthly sales, and its April 2017 sales are the closest to those of arch-rival and industry leader Hero MotoCorp. The monthly sales of these two two companies, also erstwhile partners, typically remain within a comfortable gap of 100,000-125,000 units or more; July 2016 was a rare month when Honda’s sales were 91,000 units behind Hero MotoCorp.

For April 2017, while Hero has reported sales of 591,306 units (including exports), Honda has recorded sales of 551,884 units, which clearly indicates that the latter has come very close to the industry leader. Honda trails by only 39,422 units to Hero’s monthly sales in April.

New trends in the domestic two-wheeler segment are defining new market dynamics wherein aggressive companies are eating into the market shares of their rivals. Rapid scooterisation is one of the biggest examples that clearly highlights the emergence of TVS Motor Company as the third largest two-wheeler player in India, surpassing Bajaj Auto in FY2014-15. Honda’s monthly sales reaching arm’s-length to that of Hero’s is yet another example.

In its official release, Hero MotoCorp maintains that the trend of robust sales will continue in May 2017 as well due to the ongoing marriage season. Hero MotoCorp, which has been recently acknowledged as the Indian MNC of the year by the All India Management Association (AIMA) for expanding its operations globally, has raised the prices across its portfolio in the range of Rs 500-Rs 2,200.

Honda, on the other hand, has crossed the 550,000 unit monthly sales milestone for the first time. According to the company, the rapid growth is driven by sales of its automatic scooter brands, which at 368,618 units in April, crossed the 350,000 units milestone for the first time. On the motorcycle front, Honda sold 183,226 units last month, up by 22 percent.

In FY2016-17, as per SIAM data, Hero had a market share of 36.86 percent and, inching closer by the year, Honda had 26.86 percent. Following its strong sales in April, HMSI now claims that its market share stands at 33 percent, its highest ever.

With new president and CEO, Minoru Kato at the helm of affairs, HMSI is now gunning for a sales target of six million units in the ongoing fiscal.

Commenting on the record sales in April 2017, Yadvinder Singh Guleria, senior vice-president (Sales & Marketing), HMSI said: “April 2017 results mark a great entry for Honda into the new financial year. Honda sold a total of 578,929 two-wheelers with 34 percent growth on the back of customer demand for Honda’s upgraded BS IV portfolio. In the domestic market, Honda two-wheeler sales increased 33 percent to all-time high of 551,884 units with 33 percent market share for the first time ever. Within segments, automatic scooter sales led the momentum with 40 percent growth to cross the 350,000 mark for first time ever (368,618 units), while motorcycles sales recorded robust 22 percent growth. Not only domestic but exports also saw a jump of close to 60 percent over April 2016.”

Continuing to grow, albeit conservatively, TVS Motor Company reported YoY growth of 3.96 percent with sales of 205,522 units in April 2017. At 81,443 units (including exports), scooter sales grew by 28.6 percent in April 2017 (April 2016: 63,341). Motorcycles, on the other hand, marked a growth of 10.4 percent YoY for the last month at sales of 99,890 units (including exports). The company had dispatched 90,491 motorcycles in April 2016.

Autocar Professional recently reported that TVS Motor has now become India’s second largest scooter player (after Honda) for a complete financial year for the first time in FY2016-17. It surpassed Hero MotoCorp by a thin margin to achieve a market share of 14.74 percent in the domestic scooter segment during the last fiscal.

Hero MotoCorp’s scooter market share, on the other hand, stood at 14.10 percent for the same period. Notably, TVS Motor’s Jupiter’s scooter brand has played an instrumental role in helping the company achieve this feat.

At number four is Bajaj Auto, which has reported sales of 161,930 units in April 2017, down by 19.21 percent YoY (April 2016: 200,433). Its exports, however, have registered good growth of 44 percent YoY with sales of 132,002 units last month (April 2016: 91,465).

Bajaj Auto has had a good run in the last fiscal when it returned to cumulative sales of more than two million units after three years. The company’s aggressive product positioning and strategy resulted in strong sales from its Pulsar, CT100, Platina, Bajaj V and Avenger brands during the last fiscal. The company is also moving aggressively in the midsized motorcycle segment, now with the Dominar 400 and new KTM models (Duke 200, Duke 250 and Duke 390)

India Yamaha Motor sold 68,827 units in April 2017, up by 7.66 percent YoY (April 2016: 63,927). Yamaha is targeting total domestic sales of one million units in CY2017 and a share of 10 percent in the scooter market this year. To do so, the company is aggressively expanding its footprint in Tier 2 and 3 towns, and has recently launched its locally manufactured quarter-litre FZ 25 motorcycle in the domestic market. According to the company officials, the model is being received well in the domestic market.

Commenting on the company’s sustained growth, Roy Kurian, senior vice-president (Sales & Marketing), Yamaha Motor India Sales said, “The sale numbers bear testimony to Yamaha’s focus in growth, regardless of circumstantial challenges like what the industry recently confronted with the ban on BS III inventory. As the company is eyeing one million sales in 2017, it has introduced the FZ 25 streetbike to cater to the premium segments that mostly dominates the urban market. On the other hand, the company will remain vigilant to Tier 2 and Tier 3 markets that could see reasonable surge in scooter sales.”

Continuing its month-on-month growth, Royal Enfield has registered domestic sales of 58,564 units in April 2017, up by 24.51 percent YoY (April 2016: 47,037). Including exports, which stood at 1,578 units (up by 36 percent YoY), the company crossed the 60,000 unit mark for the first time in a month to hit 60,142 units.

The company has recently ventured into the Brazilian market, which is also touted as the fourth largest two-wheeler market in the world after China, India and Indonesia. After Royal Enfield North America (RENA), the company has set up its second direct distribution subsidiary outside India, in Brazil, which is headquartered in Sao Paulo. Royal Enfield Brazil will be responsible for sales of motorcycles to local dealers, and other support activities including marketing and aftersales.

Royal Enfield’s selective global expansion is in line with Siddhartha Lal’s ambition of making the company as the world’s largest in the midsize motorcycle segment.

Suzuki Motorcycle India has reported sales of 36,289 units in April 2017, up by 43.19 percent YoY. The company is riding on the strong performances of its 125cc Access 125 scooter and its 150cc Gixxer motorcycle portfolio. Notably, the scooter sales constitute lion’s share in Suzuki’s monthly numbers.

On the premium motorcycles front, the company has grown well in the superbike segment in FY2016-17, as a result of local assembly operations of its iconic Hayabusa model. The company reported sales of 253 units in the 800cc and above categories during FY2016-17 as against sales of 149 units in FY2015-16. Suzuki has just added another two models to its litre-class line-up with the GSX-R1000 and GSX-R1000R. This is estimated to further consolidate Suzuki’s growing foothold in the superbike segment.

With average rainfall expected in the coming months, industry experts anticipate a good run ahead for the two-wheeler industry.

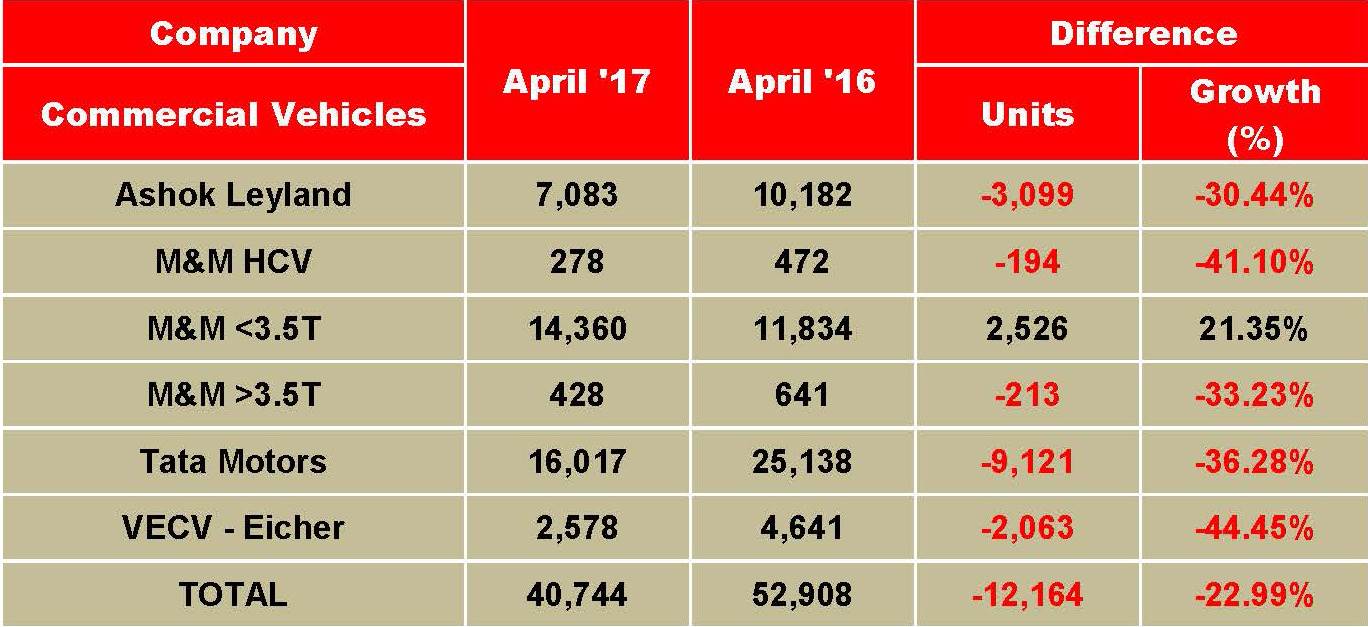

COMMERCIAL VEHICLE MANUFACTURERS FEEL THE HEAT AS M&HCV SALES FALL SHARPLY

Heavy discounting in March 2017 to clear BS III stock, a price hike for BS IV-compliant trucks from April 1 and delayed purchase decisions have resulted in poor sales of medium and heavy commercial vehicles.

The first month of 2017-18 has not been a positive one for the commercial vehicles sector. All the manufacturers have recorded negative growth in the month, and the medium and heavy commercial vehicle (M&HCV) sector is clearly under pressure as sales have fallen as high as 35 percent. Heavy discounting in March 2017 to clear BS III stock, implementation of BS IV emission norms from April and the subsequent price increase in vehicles has resulted in sharp fall in sales.

Market leader Tata Motors saw its overall sales fall by 36 percent in April. The company says this is an unusual decline, in exceptional circumstances and expects production, wholesales and retails to pick up in May and June. Ashok Leyland and Mahindra & Mahindra have registered almost 43 percent and 41 percent declines in their M&HCV sales respectively in the month. Likewise, VE Commercial Vehicles’ total domestic sales slid 44.5 percent in April.

Industry analysts expect the April-June quarter to be slow though growth would likely pick up in with GST in place from July. It appears that fleet operators have delayed buying of new heavy trucks for the time being and the replacement demand is fading.

In its outlook for FY2018, rating agency ICRA says, “Industry is likely to witness 6-8 percent growth in FY2018 aided by higher budgetary allocation towards the infrastructure and rural sectors; potential implementation of scrappage program will also trigger replacement demand.”

ICRA estimates that during FY2018, “M&HCV trucks will grow by 6-8 percent by higher budgetary allocation towards the infrastructure and rural sectors, LCV trucks by 6-8 percent on replacement demand to continue following 3 years of declining trend and pick-up in demand for consumption-driven sectors, rural markets and e-commerce. Buses are likely to grow by 5-7 percent on orders from SRTUs to support sales in M&HCVs; and smart cities initiatives. Demand from the school and staff carrier segment remains stable and exports are to grow by 8-10 percent.”

“Profitability indicators of CV OEMs will moderate marginally because of recovery in material prices and gradual pass through of BS-IV costs,” says ICRA

How the OEMs fared in April

In the monthly sales, Tata Motors’ overall CV sales in April 2017 declined by 36 percent to 16,017 units. According to Tata Motors, CV sales were affected by the Supreme Court judgement announced on March 29, with the ban on BS III sales leading to the need for a higher quantity of BS IV stock for April sales. The higher demand at short notice was not met in production, as vendors struggled to meet with the higher demand, especially in the M&HCV segments. Moreover, after the strong pre-buying of BS III vehicles in March, and the price increase of BS IV vehicles (especially in M&HCVs and buses at 8-10 percent), demand for BS IV vehicles was also weak.

Ashok Leyland’s total sales declined 30% YoY with total sales of 7,083 units (April 2016: 10,182 units). Its M&HCV sales have seen a sharp correction – down 43 percent to 4,525 units (April 2016: 7,873 units). LCVs were down 11 percent with sales of 2,558 units (April 2016: 2,309 units).

Mahindra & Mahindra’s total commercial vehicles total has gained 16% with sales of 15,066 units (April 2016: 12,947 units). The M&HCV sales dropped 41% with sales of 278 units. (April 2016: 472 units). The below-3.5T GVW products maintain strong double digit growth with 21% increase in sales with 14,360 units sold. (April 2016: 11,834 units), while those in the above-3.5T GVW segment declined by 33% with sales of 428 units (April 2016: 641 units).

VE Commercial Vehicles’ domestic sales declined by 44.5% with total sales of 2,578 units (April 2016: 4,641 units).

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

04 May 2017

04 May 2017

10703 Views

10703 Views

Autocar Pro News Desk

Autocar Pro News Desk