INDIA SALES ANALYSIS: February 2017

From the looks of it, the Indian automobile industry, lead by the passenger vehicle segment, is putting the demon of demonetisation behind it.

The buying sentiment is back in the Indian automobile industry. As per data released by apex industry body SIAM, growth is gradually edging upwards to reach pre-demonetisation levels.

Total sales at 1,719,699 units, across all vehicle segments in February 2017, point to flat growth (0.94 percent) but an improvement over January 2017 (1,620,045 units, -4.71 percent), December 2016 (1,221,929 units, -18.66%) and November 2016 (1,563,665 units, -5.48%). Sales in October 2016 (2,201,571 units, 8.14%) and September 2016 (2,260,992 units, 20.16%), ahead of the demonetisation exercise, were the highest this fiscal.

How the segments fared in February

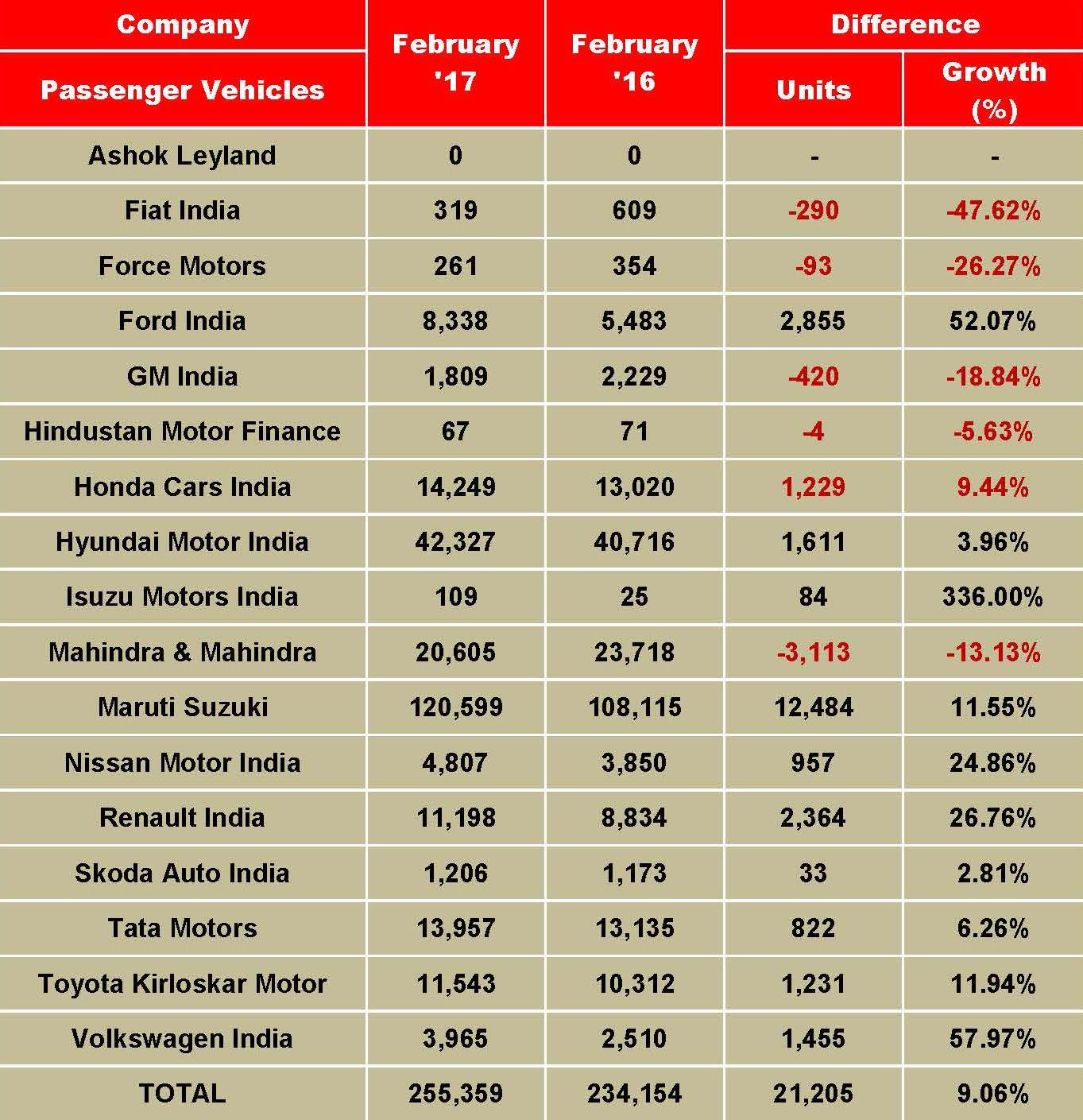

At 255,359 units sold in February 2017 (9.01 percent), the passenger vehicle (PV) continued to maintain growth albeit volumes were down compared to January 2017’s 265,320 units (14.40 percent) although the first month of the year typically sees pent-up demand from December fructifying. Passenger car sales rose 4.90 percent to 172,623 units while surging consumer demand for SUVs saw numbers grow 21.79 percent to 65,877 units. The month also saw 16,859 vans being sold, up 8.10 percent year on year.

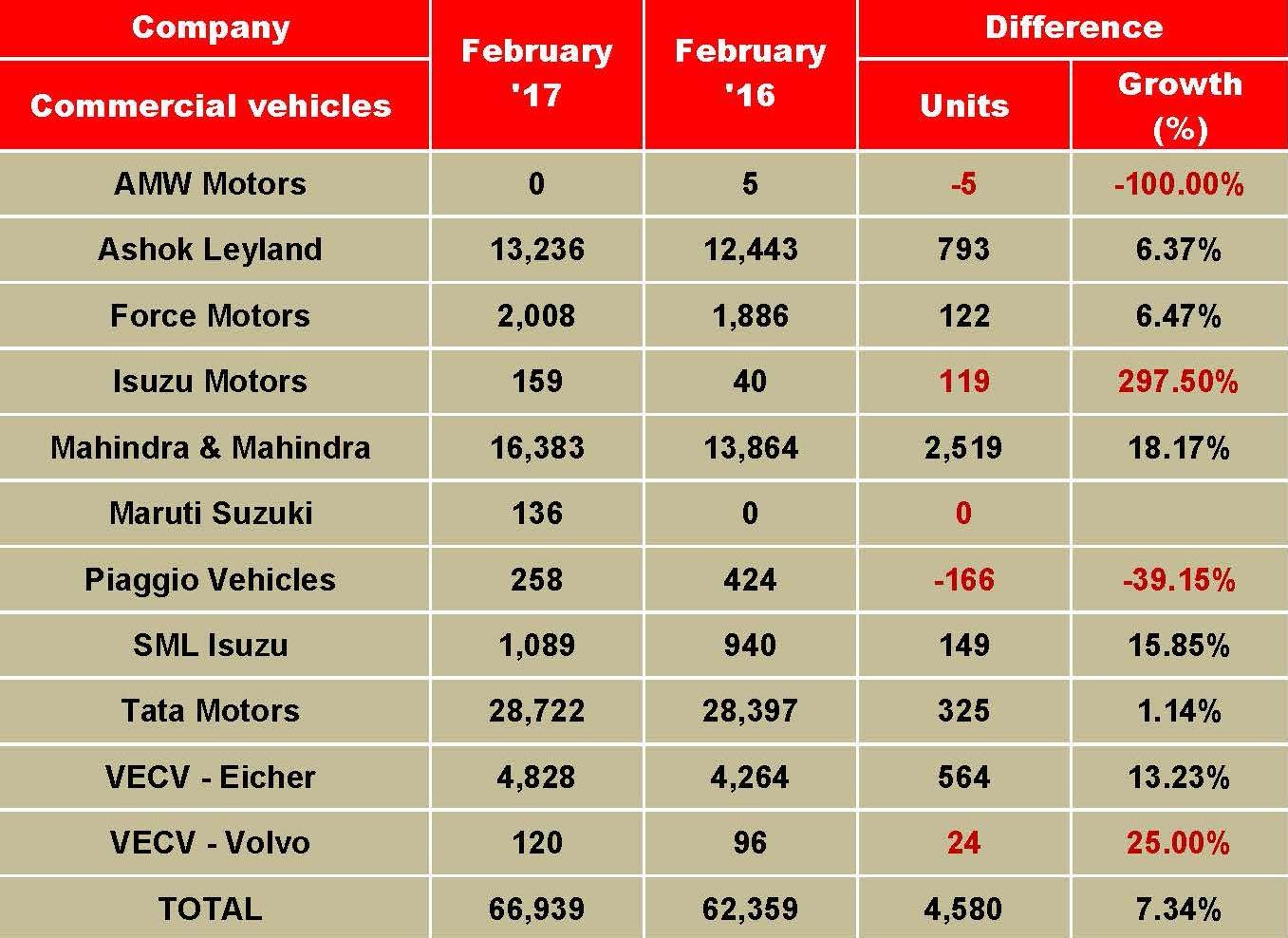

The commercial vehicle (CV) which, like the two-wheeler segment, will have to adhere to BS IV emission norms, saw a surge in sales. In fact, at 66,939 units, it has clocked its best-ever monthly sales for the fiscal year 2016-17. This is thanks to highest-ever sales of M&HCVs in a single month this fiscal – 30,521 units, a YoY growth of 5.02 percent, clearly pointing to considerable pre-buying of heavy vehicles before the BS IV deadline of March 31, 2017. The LCV sector too contributed to overall sector growth with sales of 36,418 units (9.38 percent).

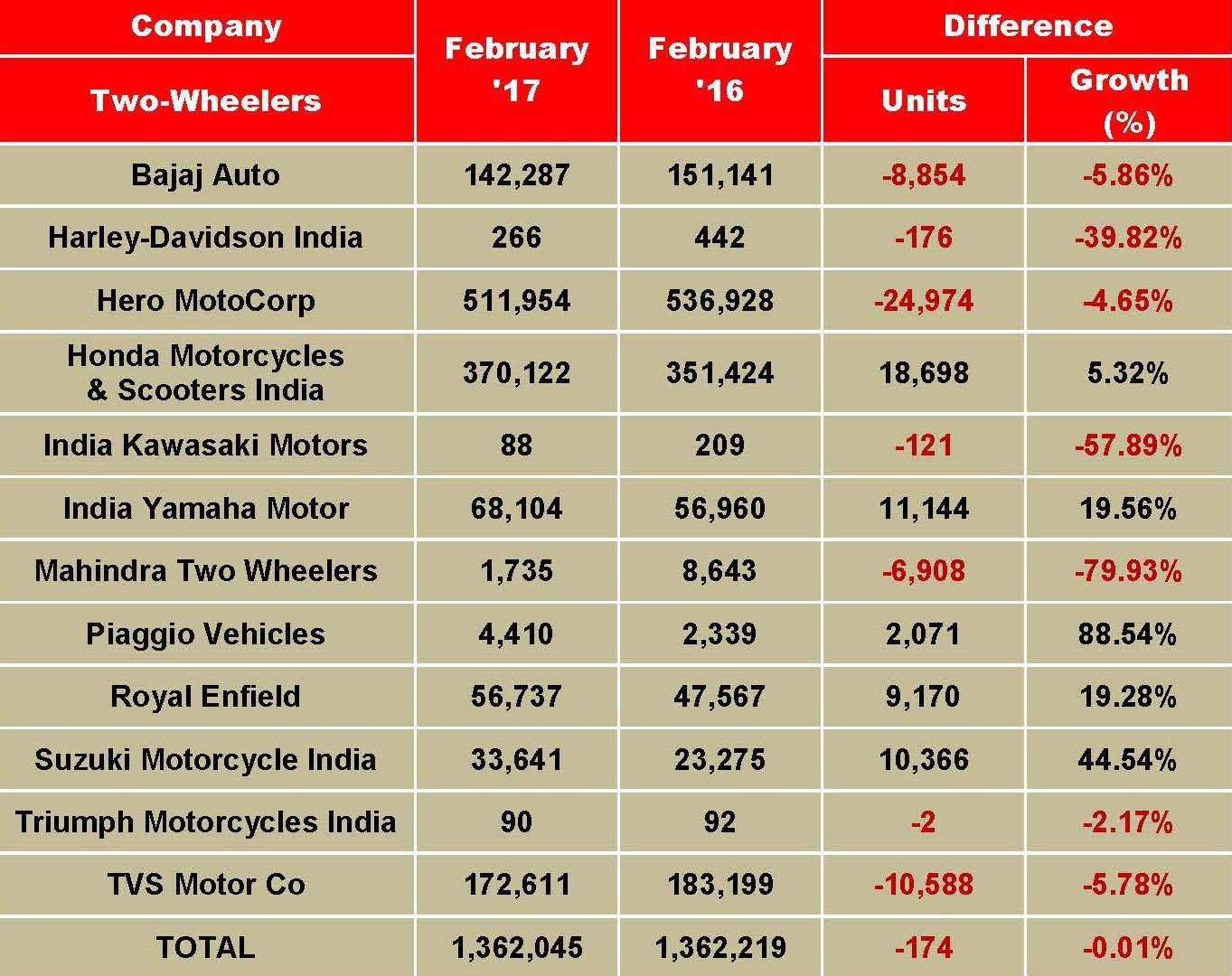

Sales of two-wheelers, which like CVs, were most impacted by demonetisation, are limping back to normalcy. Although sales at 1,362,045 units indicate flat YoY growth (-0.01 percent), they are much better than the low of December 2016 (910,235, -22 percent), November 2016 (1,243,251, -5.35 percent) and January 2017 (1,262,141, -7.39 percent).

Importantly, growth has returned to the scooter sector which saw 452,295 units being bought by new owners, a growth of 3.70 percent (February 2016: 436,163). Motorcycles, which bore the brunt of slowing sales over the past few months, particularly from rural India, sold a total of 832,697 units, down 3.13 percent YoY but the highest in four months. Meanwhile, mopeds continue to find flavour among buyers, selling 77,053 units in February 2017, up 16 percent YoY.

Three-wheeler sales were down 21 percent at 35,356 units.

MARUTI SUZUKI SETS THE SALES TONE

Maruti Suzuki India sold a total of 120,599 units in the domestic market, a year-on-year growth of 11.7 percent (February 2016: 108,115). The entry level, bread-and-butter duo of the Alto and Wagon R, sold 33,079 units in February 2017 (February 2016: 35,495), down 6.8 percent YoY. Sales of the six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire posted 9.4 percent growth at 47,002 units (February 2016: 42,970). The Dzire Tour, which is sold only as a taxi, sold 2,574 units, down 26.9 percent (February 2016: 3,522). The Ciaz premium sedan, which is now to be sold from the premium Nexa channel, went home to 5,886 buyers, up 14 percent (February 2016: 5,162). The two vans – Omni and Eeco – continue to give a fillip to overall sales numbers with sales of 14,195 units, up 13.7 percent (February 2016: 12,482).

Where Maruti is stretching the lead versus its competitors is in the UV segment. As a result of continuously surging sales of the Vitara Brezza, the company is driving a new growth paradigm in the segment. Its total UV sales (Gypsy, Ertiga, S-Cross, Vitara Brezza) zoomed 110.5 percent YoY to 17,863 units (February 2016: 8,484), the handsome rise thanks to the Vitara Brezza compact SUV which has crossed the 100,000 units sales mark in less than a year after launch on March 8, 2016.

Hyundai Motor India has reported domestic sales of 42,327 units, a year-on-year growth of 4 percent (February 2016: 40,716). The popular Creta, which recorded an all-time monthly high of 9,002 units, has given a new charge to the Korean carmaker. In the process, the Creta has also gone on to cross the sales landmark of 150,000 units in the domestic market, 21 months after it was launched.

Mahindra & Mahindra’s (M&M) passenger vehicles’ division sold 20,605 units in February 2017, down 13 percent (February 2016: 23,718). Commenting on the performance for February 2017, Pravin Shah, president and chief executive (Automotive), M&M, said, “The auto industry is seeing some positive trends emerging over the last two months. We also hope that the impending implementation of GST will provide a veritable boost to the auto industry and the economy in general.”

Honda Cars India sold a total of 14,249 units in February 2017, up 9.4 percent (February 2016: 13,020). The new City sedan, launched last month, was the best-selling Honda with 6,318 units while the Amaze was the next best with 3,924 units. The City has received over 10,000 bookings in the first month of its launch. Meanwhile, hatchback sales comprised 2,758 Jazz cars and 521 Brios. Of the SUVs, the BR-V sold 703 units and the CR-V 25. According to Yoichiro Ueno, president and CEO, Honda Cars India, “The market has shown positive sentiment during February and Honda has also benefitted from it. Last month’s sales growth has been driven by an excellent response to the new Honda City 2017, which has received over 10,000 bookings so far.”

In February 2017, Tata Motors’ passenger vehicles, in the domestic market, recorded sales at 12,272 units, marking growth of 12 percent (February 2016: 10,728), as a result of continued strong demand for the Tata Tiago. The company has also received an encouraging response to its recently launched lifestyle UV, Tata Hexa. The company has recorded a 17 percent growth for cumulative sales of all passenger vehicles for the first 11 months of fiscal at 137,718 units, compared to 117,560 units in the year-ago period.

Toyota Kirloskar Motor has registered 12 percent YoY growth in its domestic sales with 11,543 units going home to new buyers during the month (February 2016: 10,312). Commenting on the monthly sales, N Raja, director and senior vice-president (Sales & Marketing), Toyota Kirloskar Motor, said, “Both the new Fortuner and Innova Crysta have been performing consistently, attributing to TKM’s domestic growth. The Fortuner which has a more than 70 percent segment share in the SUV segment, has sold 2,027 units in February, making it the highest ever sales for Fortuner in a month ever since its launch in India in 2009. The new Fortuner has sold over 8,200 units in the last four months. The Innova Crysta has also maintained its growth trajectory selling over 67,500 units since its launch last year. We are very happy with the way our customers have appreciated both the new Fortuner and the Innova Crysta. “We launched the new Prius and the new Camry Hybrid last month. The Camry hybrid which is the first and the only strong hybrid to be manufactured in India, has always been very well received by our customers and we are confident that our customers will appreciate the new Camry Hybrid as well. We are actively working to promote strong hybrid technology and other environment-friendly vehicles based on our stance that environment-friendly vehicles can have a positive impact on the environment only if they are used widely,” added N Raja.

Renault India, which has seen the Kwid give a new charge to its sales over the past year, sold 11,198 units, up 26.8 percent (February 2016: 8,834). Renault says it is substantially increasing its sales and network reach in India and achieved its target of 270 dealership network nationwide at the end of 2016.

Ford India’s domestic wholesales grew to 8,338 vehicles, up 52 percent from 5,483 units in February 2016. “The industry is seeing some green shoots, recovering from the impact of demonetisation. Ford continues to grow faster than the industry, which bears testimony to our three-pronged strategy of product-led transformation, busting the myth of cost of service and enhancing dealership experience,” said Anurag Mehrotra, executive director (Marketing, Sales & Service), Ford India. Nissan Motor India has reported domestic sales of 4,807 units in February 2017, up 24.96 percent year on year (February 2016: 3,850). The company attributes its sales performance in February to demand for the Nissan Micra and the Datsun Redigo. According to Arun Malhotra, managing director, Nissan Motor India, said, “Our growth story has been driven by the continued success of the Datsun Redigo.”

TWO-WHEELER OEMS RECORD FURTHER SALES RECOVERY

The top seven two-wheeler companies in India have reported flat growth in February 2017 as OEMs like Honda, Yamaha, Royal Enfield and Suzuki Motorcycles covered up for the deficits recorded by Hero MotoCorp, Bajaj Auto and TVS Motor Company. The seven players reported total sales of 1,374,536 units last month (including exports by few companies) as against 1,373,376 units sold in February 2016.

February 2017 saw flat growth of 0.08 percent YoY, reflecting that overall numbers are nearly level with year-ago volumes. While on one hand, this brings relief to the industry after a disastrous December, stakeholders remain anxious about the saleability of the BS III-compliant stock across dealerships.

Almost all major two-wheeler manufacturers have either switched or are in the process of switching their products to BS IV compliance. Although the mandatory upgrade to BS IV emission norms will result into an industry-wide hike in vehicle prices, research agencies expect this may temporarily draw customers to retail stores for hurried purchase of existing stock. Nevertheless, it is clear that the industry has bounced back, albeit not completely, and the industry players expect sales to grow further from here.

In February 2017, Hero MotoCorp, TVS Motor Company and Bajaj Auto registered negative YoY numbers. Honda, on the other hand, rallied up with growth numbers, followed by Yamaha, Royal Enfield and Suzuki.

According to Hero MotoCorp, it sold a total of 524,766 units last month, down by 4.76 percent YoY (February 2016: 550,992). An official communication from India’s largest two-wheeler manufacturer to the Bombay Stock Exchange conveys that the company has shifted to producing only BS IV-compliant two wheelers from March 1, 2017. “Majority of Hero two-wheelers had already been made BS IV- compliant quite some time back and the company has fully transitioned to producing only BS IV vehicles across the range from March 1, 2017,” quotes the company document.

The country’s second largest two-wheeler OEM, Honda Motorcycle & Scooter India (HMSI) reported sales of 369,865 units in February 2017, up by 5.25 percent YoY (February 2016: 351,401). Commenting on HMSI’s performance in February 2017, Yadvinder Singh Guleria, senior vice-president (Sales & Marketing), said, “With the continued momentum of recovery after demonetisation, Honda has emerged as the first choice of Indian two-wheeler customers. This recovery period has been favourable for Honda, as we continue to grow with a 1.4 percent increase in domestic market share of 27.2 percent.

For Honda, our market strategy is well placed and from March 1, 2017 we have started production of only BS IV models at all of our four plants.”

Earlier this month, HMSI launched the BS IV-compliant version of its bestseller, the 110cc Activa 4G, which also marks the fourth generation of the Activa in local markets. In accordance with the statutory mandate, it has also been equipped with the automatic headlamp on (AHO) feature, just like all other models. It can be recalled that Autocar Professional, in its report on the Activa 4G, had highlighted that the BS IV-compliant version is priced nearly Rs 2,000 more than the BS III-compliant Activa 3G first launched in February 2015.

Moving slow and steady, TVS Motor Company has saw domestic sales of 172,611 units in February 2017, down by 5.78 percent YoY (February 2016: 183,199). TVS has been consistent with its scooter sales, all thanks to the 110cc Jupiter model. The company is, however, understood to be readying an all-new scooter model for the 125cc segment. The upcoming scooter model is aimed at further propelling the growth and market share in the booming scooter segment.

On the other hand, it is also busy doing its ground work for rolling out the first product – G 310 R – under its alliance with BMW Motorrad soon. The incoming naked street motorcycle will take on the likes of KTM 250 Duke, KTM 390 Duke, Bajaj Dominar 400, Yamaha FZ 25 and DSK Benelli TNT 25.

Besides that, the company is also understood to be in the process of upgrading its existing products to BS IV emission norms. In an official communication to Autocar Professional, K N Radhakrishnan, president and CEO, TVS Motor Company said, “TVS Motor Company is a responsible corporate citizen and is fully supportive of a better environment for our customers, employees and stakeholders. We are fully geared up to meet the government’s new BS-IV emission guidelines.”

Pune-based Bajaj Auto has reported total domestic sales of 142,287 units last month, down by 5.86 percent YoY (February 2016: 151,141). The company, which became the first two-wheeler major to convert its entire existing portfolio of products to BS IV emission norms, is betting big on its recently launched premium midsized motorcycle – the 375cc Dominar 400.

Bajaj Auto is busy expanding the retail network for the Dominar 400, which was rolled out in January 2017 for commercial sales across only 22 cities. The company hopes to make the model available across 80 to 100 cities by end-March 2017. “That would mean the Dominar 400 would be available around 200 Bajaj Auto dealerships by end of this financial year,” Eric Vas, president, motorcycle business, Bajaj Auto told Autocar Professional recently.

India Yamaha Motors has registered sales of 68,095 units (including exports to Nepal) during February 2017, up by an impressive 19.55 percent YoY (February 2016: 56,960). Commenting on his company’s performance, Roy Kurian, vice-president (sales & marketing), Yamaha Motor India Sales, said, “In 2017, Yamaha continues to grow with a surge in February 2017 sales while concurrently ensuring government of India guidelines to introduce BS IV compliant models for all products.”

The company has recently rolled out its entry level midsized motorcycle – FZ 25, a single-cylinder, 249cc naked street model for a competitive price of Rs 120,000 (ex-showroom, Delhi). The model is company’s second global product in the booming midsized motorcycle segment, first being the YZF-R3, a race track-biased twin-cylinder, 321cc fully-faired model.

Yamaha, which is chasing its ambitious plan of achieving sales of one million units in CY2017, is aggressively working on its network expansion plans and marketing strategies to boost its scooter and motorcycle sales this year.

Royal Enfield reported sales of 56,737 units in February 2017, up by a decent 19.28 percent YoY (February 2016: 47,567). The company remains the only two-wheeler brand that remained unperturbed in the market despite demonetisation. This is thanks to its strong order book (including backlogs) that helped it report impressive monthly sales through the past 3-4 months.

Suzuki Motorcycle India registered total sales of 40,175 units in February 2017 (including exports), up by 25.09 percent (February 2016: 32,116). It had recently rolled out the BS IV-compliant Gixxer range and its 125cc Access 125 scooter adding new colour options for the buyers. According to the company, the new upgraded models have been well-received by the customers in the market.

CV NUMBERS UP BUT BS IV PRE-BUYING YET TO KICK OFF IN A BIG WAY

The green shoots of recovery, after the speedbreaker of demonetisation, in the Indian commercial vehicle sector are being seen. All major CV manufacturers have registered buoyant sales in February 2017. Some segments like tippers and buses have posted rapid growth albeit sales growth is yet to expand across sub-segments. While LCV sales remain largely positive, M&HCVs have begun to travel on the road to growth.

However, anticipated strong demand from pre-buying ahead of the introduction of BS IV emission norms from April 1, 2017 has not happened yet and sales have muted. It is likely pre-buying could happen in the last two weeks of March. Overall industry growth indicators seem positive and the CV sector is expected to register growth of 8-10% in FY2016-17. According to CARE Ratings, in 2017-18, the industry will witness a gradual pickup in demand as the effect of demonetisation begins to moderate. Also, demand is expected to improve on back of various initiatives taken by the government in the Union Budget 2017. Higher allocation for infrastructure and transportation segment is likely to benefit demand during the coming year.

In February 2017, Tata Motors’ overall CV sales declined marginally by one percent to 30,407 units. M&HCV Cargo segment demand has picked up due to BS IV pre-buying – overall sales at 15,031 units were a YoY growth of 1 percent. Bus sales continued to grow (+30 percent), driven particularly by STU orders and supported by intercity and staff application segments. Demand from schools is also gaining momentum.

Tata Motors’ small CV and LCV sales were grew to 15,376 units in February 2016.

Ashok Leyland’s total sales remained in positive lane, up 5 percent YoY with total sales of 14,067 units (February 2016: 13,406). Similarly, the M&HCV segment grew 5 percent to 11,329 units (February 2016: 10,801). LCV sales were up by 5 percent with sales of 2,738 units (February 2016: 2,605).

Mahindra & Mahindra’s total CV total sales were up by a good 18 percent to 16,383 units (February 2016: 13,864). While M&HCV numbers rose 49% with sales of 716 units (February 2016: 479), the below-3.5T GVW products recovered strongly to notch 17 percent growth at 15,094 units (February 2016: 12,919). Products in the above-3.5T GVW segment did well to record 23 percent growth with sales of 573 units (February 2016: 466).

VE Commercial Vehicles’ registered 13 percent growth in February with sales of 4,828 units (February 2016: 4,264).

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

07 Mar 2017

07 Mar 2017

29742 Views

29742 Views

Autocar Pro News Desk

Autocar Pro News Desk