INDIA SALES ANALYSIS: JUNE 2014

Things are finally looking up for the Indian automobile industry.

Things are finally looking up for the Indian automobile industry. Ten days before the much-awaited reveal of the Union Budget 2014 and five days after the finance minister’s market-lifting statement that excise duty cuts on vehicles across segments have been extended to December 31, green shoots of recovery seem to be sprouting, particularly across the troubled passenger car and commercial vehicle segments. Passenger car sales rose for the second month in a row as buyer footfalls increased in showrooms.

What also helped carmakers was a flurry of handsome discounts, new car launches and worried consumers expecting OEMs to hike prices from July 1. A good number of carmakers had, before the finance minister’s announcement, said that they were all set to hike prices. Renault India, however, has gone ahead and hiked prices by 1 percent on the Pulse, Scala and Duster from July 1.

Most OEMs believe that things can only get better from now onwards, notwithstanding the Rs 1.60 per litre petrol price hike and the 56 paise increase in diesel cost, effective from July 1, following the Iraq crisis. However, the threat of drought-like conditions across the country and continuing inflation could see a stretched recovery period.

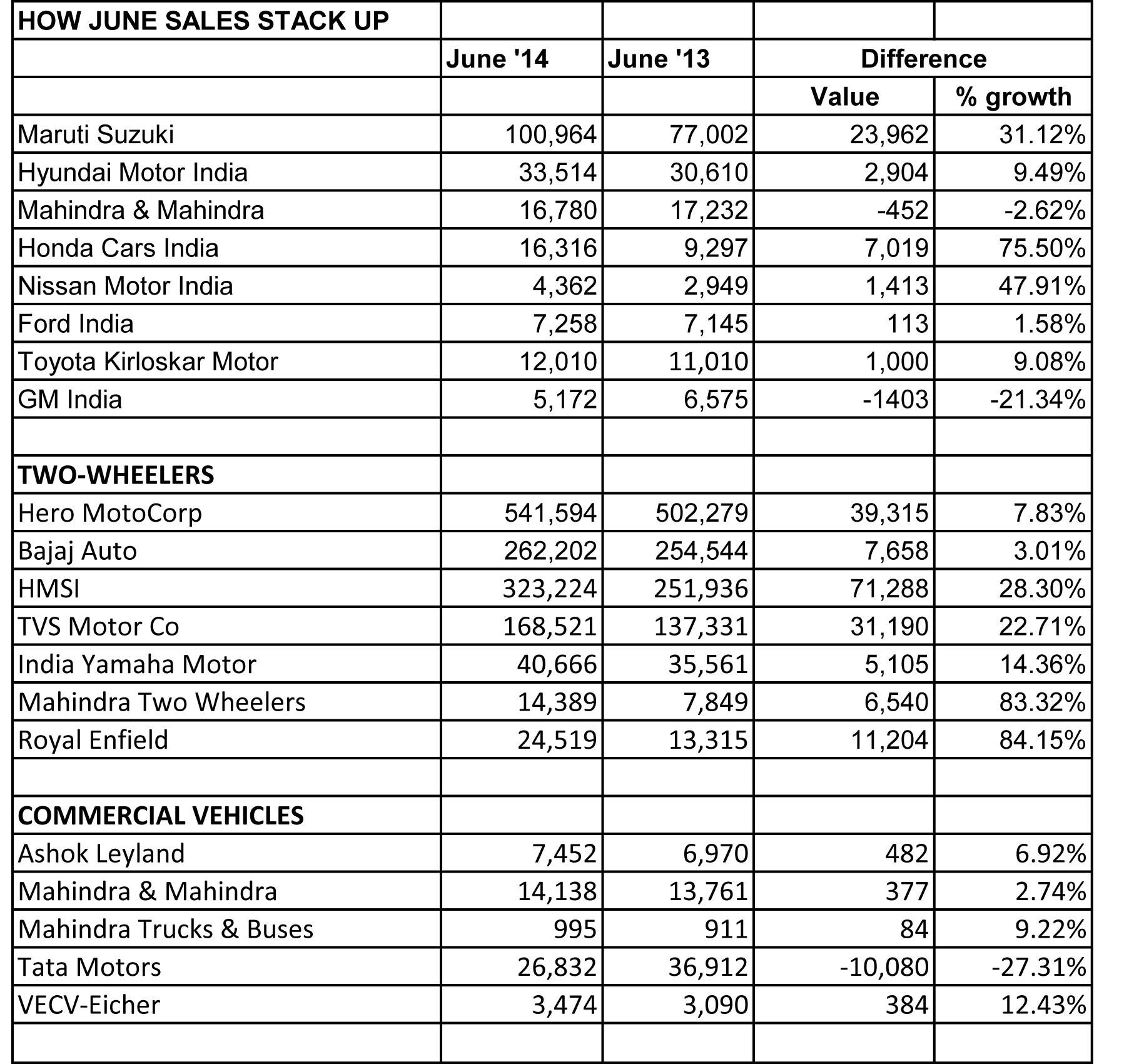

Maruti Suzuki India, the bellwether of the Indian automobile industry, has reported sales of 100,964 units in the domestic market, up 31.1 percent year on year (June 2013: 77,002). For Q1 (April-June 2014), the carmaker has posted sales of 270,643 units, up 10.3 percent (April-June 2013: 245,346).

In June 2014, the company’s quartet of entry level cars – Maruti 800, Alto, A-star and Wagon R – sold a total of 47,618 units, up 52.1 percent (June 2013: 31,314), while the premium compact cars – Swift, Estilo, Ritz and Celerio – sold 22,293 units, up 6.2 percent (June 2013: 20,996). The latter segment has notched the biggest growth of 21.2 percent over Q1, selling a total of 72,346 units thanks to the upsurge of demand for the AMT-equipped Celerio hatchback.

Meanwhile, the Dzire sedan continues to bring in the numbers for Maruti. The car sold a total of 15,990 units last month, recording 27.4 percent growth (June 2013:12,548). Over Q1, the Dzire has sold nearly 51,000 units. The SX4, which has been fast falling out of favour with buyers, sold only 322 units in June, and a total of 519 units in Q1, 2014-15, down 63 percent YoY.

The Omni and Eeco however have posted healthy growth of 42.5 percent in June 2014, selling 9,738 units (June 2013: 6,833).

On the export front, Maruti shipped 11,809 units in June, up 58.4 percent (June 2013: 7,453) and in Q1, 2013-14 a total of 29,251 units, up 38.7 percent.

Hyundai Motor India, the second largest carmaker in India after Maruti Suzuki India and the country’s largest passenger car exporter, has registered domestic sales of 33,514 units, which translates into growth of 9.49 percent (June 2013: 30,610). However, its exports are facing rough weather given that it saw a near-30 percent drop in June 2014 with despatches of 17,004 units (June 2013: 24,055).

Commenting on June 2014 sales, Rakesh Srivastava, senior VP (Sales and Marketing), said, “Hyundai with a volume of 33,514 units has grown by 9.5 percent over last year on the phenomenal success of the Xcent, Grand and Santa Fe. With the extension of excise duty benefit, we hope to maintain the growth in volume while strengthening our product portfolio and improving channel efficiencies.”

Mahindra & Mahindra (M&M) announced that its total sales, across vehicle segments, in June 2014 herald its first month of growth – albeit a flat 1 percent – after twelve consecutive months of fall in sales. The company sold a total of 38,471 units in June 2014 (June 2013: 38,092).

The passenger vehicles segment (which includes UVs, the Verito and Verito Vibe) sold 16,780 units, down 2.62 percent (June 2013: 17,232). Overall domestic sales were 36,457 units, up 0.69 percent (June 2013: 36,207).

While 4-wheeler commercial segment, which includes the Maxximo, Gio, Genio and Bolero Pickup, sold 14,138 units, marking a 2.74 percent growth (June 2013: 13,761), the 3-wheelers segment sold 4,544 units, up 6 percent (June 2013: 4,303). Interestingly, Mahindra Trucks and Buses clocked 9 percent growth with sales of 995 units (June 2013: 911).

Exports for the month stood at 2,014 units, up 6.84 percent (June 2013: 1,885).

Pravin Shah, chief executive, Automotive Division & International Operations (AFS), M&M, said, "We have achieved marginal growth in our sales during June 2014 and do hope that the auto industry will continue to stay in a positive zone. The recent announcement by the government of an extension in the lowering of excise duty will provide a fillip leading upto the festive season."

Meanwhile, for Honda Cars India, the Amaze and City sedans powered its sales in June 2014. The company has reported sales of 16,316 units in June 2014, notching 75 percent year-on-year growth (June 2013: 9,297). The Amaze and new City sedan have made handsome contributions to this total, selling 7,075 and 7,723 units respectively during the month.The Brio hatchback sold 1,438 units and the CR-V 80 units. For Q1 FY2014, Honda Cars India has sold a total of 40,718 units, marking a 40 percent growth (April-June 2013: 29,127).

Commenting on the month’s results, Jnaneswar Sen, senior vice-president – Marketing & Sales, Honda Cars India, said, “We extend our gratitude to customers for the continuing success of the Amaze and all-new City and are confident that we will continue to do well. We are very excited about the upcoming launch of our stylish seven-seater Honda Mobilio at the end of this month and are confident that it will attract Indian consumers with its strong desirable values.”

Honda also exported a total volume of 739 units during June 2014.

Nissan Motor India has reported a near-48 percent growth in its June 2014 sales of 4,362 cars (June 2013: 2,949). The Datsun Go contributed 1,097 units to this total, taking its overall Q1 FY14 sales to 6,268 units. For Nissan Motor India, Q1 FY14 numbers are 14,684 units as against Q1 FY13’s 6,268 units, a growth of 134 percent, albeit on a smaller total a year ago.

Ford India sold 7,258 cars in June, a flat growth of 1.58 percent (June 2013: 7,145). Together with exports of 4,677, it sold a total of 11,935 vehicles in the month, up 36 percent over the 8,771 total vehicles sold a year ago. “The government’s decision to extend the excise duty concession is a welcome move and will certainly uplift consumer purchasing sentiments as we head into the festive season over the next few months,” said Vinay Piparsania, executive director of marketing, sales and service at Ford India. “It reflects the government’s recognition of the importance of the manufacturing sector and its contribution to overall economic growth,” he said.

Toyota Kirloskar Motor sold 12,010 units in June 2014, a growth of 9 percent (June 2013: 11,010), thanks to increased sales of the new Corolla Altis and Etios Cross. According to N Raja, director and senior VP (Sales and Marketing), “We sold 922 units of the Altis and 626 units of the Etios Cross. We have received over 5,400 bookings for the Etios Cross and more than 3,000 for the Corolla Altis .The waiting period for the Etios Cross is over 3 months and more than 2 months for the Corolla Altis. We are currently working towards reducing the waiting period.”

General Motors India, which sold 5,172 vehicles in June, saw a 21 percent decline in sales (June 2013: 6,575).

TWO-WHEELER OEMS MAINTAIN THE GROWTH MANTRA

The two-wheeler sector has, for long, been the bulwark of the Indian auto sector, helping keep overall sales in positive territory despite the passenger vehicle and CV segments being down since the past year.

Hero MotoCorp (HMCL) has reported a jump of 7.82 percent by selling 541,594 units during June 2014 as against 502,279 units sold during June last year. Ending the first quarter (Q1 FY2014-15) on a high note, the company has registered a year-on-year growth of 9.99 percent on sales of 17,15,129 units. It had sold 15,59,282 units during Q1 of the previous fiscal.

The dispatches, during June 2014, were also made from HMCL’s Neemrana plant in Rajasthan, where it has reportedly commenced its operations. Bringing its fourth plant into action, HMCL has now added another 750,000 units per annum to its annual production capacity, which currently stands at 7.65 million units (including Neemrana plant). Last month, the company had also started operations at its global parts centre (GPC) at the same location (Neemrana). The GPC is known to be a hi-tech facility housing automated systems of storage, retrieval, automated packaging and sorting, on-line tracking of parts through warehouse management system (WMS), and lean manufacturing practices.

Bajaj Auto sold a total of 262,202 motorcycles, comprising both domestic market and export sales, in June. This is a 3 percent growth (June 2013: 254,544).

Honda Motorcycle & Scooter India (HMSI) recorded a sales increase of 28.29 percent during June 2014 when it sold 323,224 units (June 2013: 251,936 units). This total comprises 172,119 scooters and 151,105 motorcycles, which also included despatches made to foreign destinations. While the scooters marked a growth of 31.14 percent (June 2013: 131,250 units), motorcycles registered a growth of 25.21 percent (June 2013: 120,686 units) during the month. For Q1 FY2014-15, HMSI’s total sales add up to 992,892 units, a handsome 34.05 percent growth over Q1 FY2013-14 when the company had sold 740,687 units.

Notably, HMSI has managed to sell nearly a million two-wheelers in the first quarter. Assuming that it continues to sell at the same pace, it can conveniently record near-four million units of sales during this fiscal, close to its ambitious FY2014-15 target of 4.5 million units. This target will be helped by the upcoming Dream series variant (aimed at mass commuters) and a sporty 160cc bike (aimed at the premium commuter segment) scheduled for launch before the festive season.

Yamaha Motor India Sales has reported 14.36 percent growth by selling 40,666 units in June 2014 as against 35,561 units sold in June last year. The company claims that its latest scooter model, the Alpha has been contributing substantially to the growing monthly sales numbers. While scooters have been raking in sales, Yamaha has recently launched new variants of its 150cc stylish premium commuter bike, called the FZ V2.0 series to ensure a similar push to its bike sales.

With a clear focus on improving fuel efficiency and tech features, Yamaha’s upgraded segment top-sellers now come with a marginally downsized engine displacement, fuel injection (which replaces the carburettor), edgier design language as some of the main changes. Commenting on Yamaha’s June 2014 performance, Roy Kurian, vice-president (sales & marketing), Yamaha Motor India Sales said, “The incessant growth numbers are a sign of Yamaha’s robust business plan and strategic customer engagement programs. While the month has ended on a very positive note for us, this is indeed the revival times for the industry thanks to an industry-friendly government at the Centre.”

TVS Motor Company reported total sales of 193,758 units (including exports) during June 2014, up by 23.14 percent on 157,351 units sold in June last year. Riding on the success of TVS Star City+, the company registered sales of 168,521 units in the domestic market, marking a healthy growth of 22.71 percent on 137,331 units sold in June 2013. The company’s R&D centre is known to be buzzing with a number of programs, the quarter liter bike being a prominent project in the lot.

Reporting its best-ever monthly sales, Chennai-based Royal Enfield has reported sales of 25,303 motorcycles (including exports) during June 2014. The monthly sales for domestic market stood at 24,519 units, which marked a handsome 84 percent growth over the 13,315 motorcycles sold in June 2013.

Contributing substantially to the market demand, the company’s new facility at Oragadam, near Chennai, has been reportedly producing over 10,000 motorcycles a month from the first quarter of CY2014. The iconic brand, under the leadership of Siddhartha Lal, MD and CEO, Eicher Motors, is known to be aiming for a leadership position in the global mid-sized (250-800cc) motorcycle segment.

Mahindra Two Wheelers (MTWL) sold a total of 14,389 units in June, up 83.32 percent over June last year, when it had reported sales of 7,849 units. The Centuro A big contributor Viren Popli, chief of operations, MTWL complimented the sales of commuter bike Centuro.

INDIAN CV MAKERS UPBEAT AS M&HCVs POST GROWTH IN JUNE

The good news from rising passenger car sales in June 2014 seems to be spreading to the commercial vehicle sector. Amid the positive sentiment returning to the Indian economy, thanks to the new stable government and anticipation of bigger infrastructure spend and larger reforms through the upcoming Union Budget, most CV players have reported improves sales for last month. This underlines the fact that recovery, albeit slow right now, is on its way and manufacturers are anticipating a turnaround in the near term for the beleaguered CV sector.

In June 2014, rentals of the heavy duty prime mover segment (35, 40 and 49-tonners) recovered notably by 20 percent. This is the segment that was first impacted by the slowdown three years ago and now there is renewed confidence among fleet operators towards buying new vehicles. Truck rentals on trunk routes during May 2014 were up by 4-5 percent.

In terms of specific sales numbers, leader Tata Motors’ sales slid 27 percent with the company selling 26,832 units (June 2013: 36,912 units). The LCV segment, once the big-seller for Tata, continues to see lower volumes and dropped by 33 percent –17,212 units against 25,778 units in June 2013. M&HCV sales declined by 14 percent to 9,620 units compared to 11,130 a year ago.

Ashok Leyland posted positive sales numbers in the month with its M&HCVs selling 5,542 units, up 17 percent (June 2013: 4,717). However, its once-popular Dost LCV saw a 15 percent fall with sales of 1,910 units (June 2013: 2,253.

VE Commercial Vehicles posted a 12.4 percent growth in the domestic market in the 5-tonne and above category, selling 3,474 units (June 2013: 3,090).

Mahindra Trucks and Buses sold 995 units, up 9 percent (June 2013: 911). While Mahindra & Mahindra’s three-wheelers division sold 4,544 units, up 5 percent (June 2013: 4,303), the four-wheelers passenger and cargo carriers saw sales of 14,138 units, a growth of 3 percent (June 2013: 13,761).

RELATED ARTICLES

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

SCOOP! TVS Motor begins exporting made-in-India BMW CE 02 e-scooter

TVS Motor Co, which has a longstanding strategic partnership with BMW Motorrad since April 2013 for manufacture of the 3...

02 Jul 2014

02 Jul 2014

12675 Views

12675 Views

Autocar Pro News Desk

Autocar Pro News Desk