Bajaj Auto targets 25% motorcycle market share in FY2020

Low-cost segment innovation, a sharp focus on exports and a tight control on costs has the motorcycle manufacturer bullish about increasing its domestic market share by 7 percentage points.

Despite the ongoing bloodbath across all vehicle segments in the Indian automobile industry, Pune-based Bajaj Auto has set its sights high on achieving growth and market share gains in FY2020.

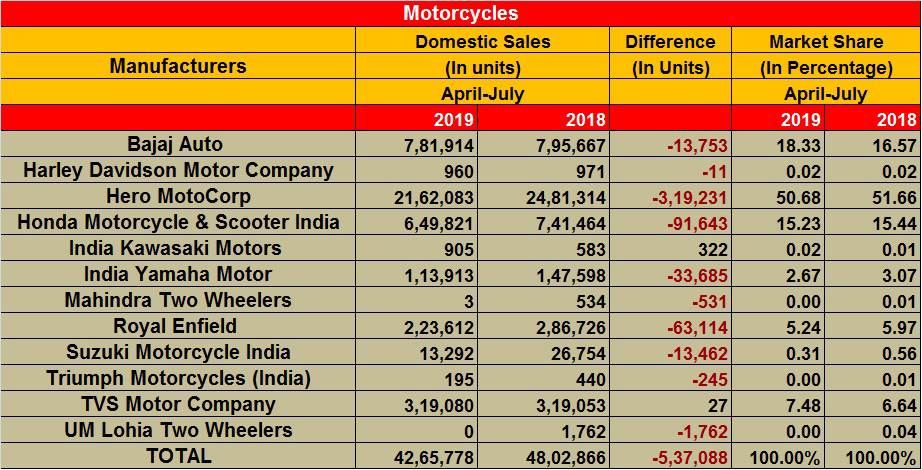

The world's third-largest motorcycle manufacturer, which currently has a domestic motorcycle market share of 18.33 percent (April-July 2019) is targeting a 25 percent market share by the end of this fiscal. "All this is happening thanks to segment innovation," said Rajiv Bajaj, managing director, Bajaj Auto, told the Hindu BusinessLine.

The company closed FY2019 with a market share of 18.69 percent (2,541,320 units), having notched 28.7 percent growth. The bike maker had a 15.69 percent market share in FY2018 (1,974,577 units).

In the first four months of FY2020 (April-July 2019), Bajaj Auto has clocked sales of 781,914 units (-1.73%). In the current depressed market conditions, that single-digit decline is better than what the three two-wheeler biggies are seeing right now: Hero MotoCorp - 2,317,005 (-14.93%), Honda Motorcycle & Scooter India - 1,798,615 (-18.21%) and TVS Motor Co - 920,121 (-6.24%). However, it is to be noted that these three OEMs also manufacture scooters (which Bajaj Auto doesn't), and are further impacted by the downturn in that segment too.

How Bajaj bikes have fared in first 4 months of FY2020

Between April-July 2019, Bajaj Auto despatched a total of 781,914 motorcycles, which marks a 1.73 percent YoY sales decline for the company. The entry level commuter motorcycle trio of the 99.27cc CT100, 102cc Platina and Discover 110 continue to bring in the numbers for Bajaj Auto. With 414,334 units (-6.89% YoY), they accounted for 53 percent of the company’s total sales.

In the 110-125cc executive commuter bike segment (115cc Platina, 124.6cc Discover, 125cc KTM Duke) sales are down 27 percent. However, there has been 8 percent YoY growth in the 125-150cc segment with sales of 229,350 units (April-July 2018: 212,220) in the form of the 124.6cc Discover and the 149cc Pulsar.

Demand for the Pulsars, which play in the 150-200cc and 200-250cc segments, which have seen sales of 73,969 units (10.34%) and 39,607 units (-3%) respectively remains strong. And in the 350-500cc segment, the Dominar 400 and KTMs have clocked 4.56 percent YoY growth with sales of 8,245 units.

Low-cost innovation, exports as a derisker, tight cost control

Rajiv Bajaj attributes the company's outperformance, compared to its rivals, to a carefully thought-out strategy -- segment innovation, sharp focus on exports, and a tight control on costs. This is helping the company to ride out the storm which continues to blow fiercely in the face of the industry.

Low-cost innovation has richly paid off handsomely, particularly in the 100-110cc commuter bike segment where the CT100 and the Platina have won favour with buyers.

In July 2019, in a bid to accelerate the CT brand sales, the company launched the new CT110, giving it the 115cc, single-cylinder, DTS-i engine as in the Discover and Platina. The CT100 is available in two variants – the kick-start (Rs 38,300) and electric-start (Rs 44,500) ex showroom, Pune.

Segment innovation is also in place with the recent rollout of the 125cc variant of the Pulsar, which is largely based on the Pulsar 150 Neon. It is powered by a 124.38cc, single-cylinder, two-valve air-cooled engine that develops 12hp and 11Nm.

New Pulsar 125 Neon is the most affordable model in Pulsar range.

Available in two variants (drum brake model at Rs 64,000 and front disc brake model for Rs 66,618. At this pricing, the new 125 becomes the most affordable motorcycle under the Pulsar umbrella, albeit by a small margin. What's more, the sub-125cc engine allows it to comply with the compulsory safety mandate with the use of CBS, thus avoiding the costs of a more expensive ABS unit.

The Hindu BusinessLine reports that Rajiv Bajaj was "thrilled to hear" that motorcycle aficionados feel the Pulsar 125 feels like a 150cc bike, complimenting the hard work of the company's R&D team.

Interestingly, Rajiv Bajaj credits Harsh Mariwala, chairman of consumer goods giant Marico, for the company's new low-cost innovation mantra to offer product differentiation with affordable innovation as a way forward.

Read more: Scooter market share in April-July '19

Passenger Vehicle market share in April-July '19

Utility Vehicle market share in April-July '19

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

16 Aug 2019

16 Aug 2019

43204 Views

43204 Views

Autocar Pro News Desk

Autocar Pro News Desk