B-series stays mech for BS3

As the April 2010 deadline nears, most commercial vehicle manufacturers are attempting solutions that will get the bulk of the engines in the trucks they sell countrywide to conform to the BS3 emission standard. The simplest and most popular means available, simply because it does not require a radical redesign of the engine, has been to use an electronically governed high-pressure fuel injection system such as an electronic distributor pump. Some OEMs are even known to be working on the more ad

The simplest and most popular means available, simply because it does not require a radical redesign of the engine, has been to use an electronically governed high-pressure fuel injection system such as an electronic distributor pump. Some OEMs are even known to be working on the more advanced common-rail and exhaust gas recirculation (EGR).

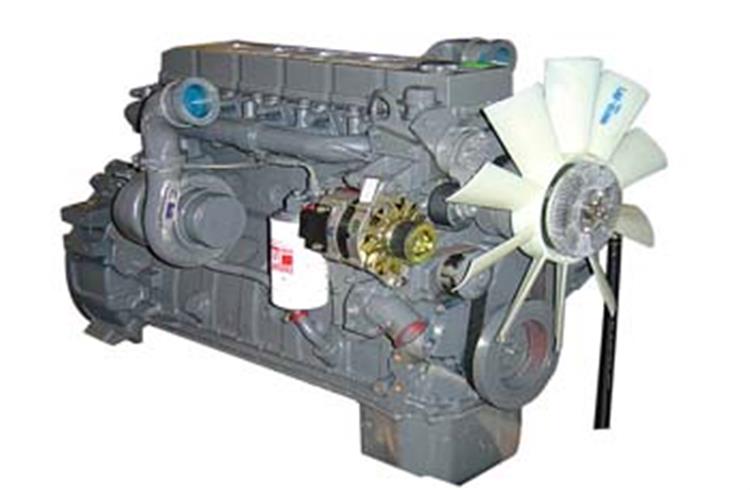

Cummins, on the other hand, decided to use a mechanical solution to make its 5.9-litre B-series engine BS3-compliant. “We took that mechanical solution when everybody thought it would be too difficult to do BS3 with that solution,” says Cummins India vice-president engineering Michael Lambert.

The programme was started in late 2004, and in February 2006 a 130hp version was put into production for city buses. The company now has a 180hp rating just ready for production, and an intermediate 150hp rating will be available in another six months. Cummins expects this engine to be the mainstay of its production from 2010 onwards.

Market analysis for a BS3 product began back in 2003–4, and at that time the choice of fuel system Cummins had was between the Bosch VP44 radial-piston electronic distributor injection pump, originally launched in Europe in 1996 for cars and LCVs, and the VP14 axial-piston mechanical pump. “The way we looked at BS3 was that the product needed to be service-friendly. In all of our analysis, which came up way on top as something that was very important for the Indian market,” says vice-president (automotive business) Arun Ramachandran.

The problem was, the electronic VP44 would need electronic service tools to support the engine, whereas Cummins’s idea was that a “shade tree mechanic” should be able to service the engine. So that, according to Ramachandran, was the premise with which development of the VP14-based product was begun.

“At that point the median power node in the Indian market was 145hp. And when we looked at the capability of our B-series, we found out that we could do anywhere from 130hp to 180hp. So that was the development target for us,” he explains.

“The median power node today has moved to approximately 160hp, maybe 180hp. So we are still there with the B5.9 mechanical product. For any higher power requirement our 6.7-litre ISBe full-authority electronic engine, from 185hp to 270hp, is production-ready.”

Way to go

For BS3 without exhaust gas recirculation, cam-driven systems like distributor pumps or inline pumps are the right way to go with respect to NOx reduction because of its characteristic injection rate, Bosch Ltd joint MD told this correspondent recently.

Accordingly, Cummins and Bosch together decided to base the fuel injection system on the mechanical Bosch pump, but Cummins developed a unique optimised solution itself to make it work. “It was a matter of getting an internal-to-the-engine solution on the combustion side. And it seems to have worked!” says Lambert.

The key challenge was to match the fuel injection equipment, particularly in order to overcome problems with the nozzles that arise if the engine is operating in an area where Bosch prescribes that combustion should not be happening.

“Since this is impacted by a lot of things in the fuel injection equipment, we got Bosch to develop a kind of unique in-between nozzle to ensure reliability and durability as well as meet the emissions and performance targets. And then we had to play around with the internals of the engine also – with the swirl and the camshaft timing and the compression ratio and the piston – to make all of that work,” Lambert explains.

Architecturally the engine is not very different from the BS2 engine, he says. “We didn’t want to go full electronic or to an electronic pump, so we asked the question, how can we optimise the combustion internally to make the solution work? There are some part number differences because the design of the part is slightly different, but in terms of the actual concept of the part, it’s all pretty much similar parts.”

The other major difference apart from the VP14 pump is the four-valve head, similar to that in the electronic ISBe 5.9 that was built in Europe at Euro 3. Apart from these it was a question of deciding the right compression ratios, the right swirl elements, etc, to optimise combustion for the lower pressures that obtain with a VP14.

“On the air side of it, the understanding of how all of that interacts was a known quantity within Cummins. But using that knowledge, along with the mechanical bit, wasn’t known anywhere, because we were trying it for the first time. In Europe we didn’t have a Euro 3 mechanical; we went electronic straightaway. The Euro 3 engine we launched in 1999–2000 was full-authority electronic because we ourselves didn’t think we could do a mechanical Euro 3,” says Lambert.

Besides, there was demand in Europe for more electronic features, which is not the case in India. For Cummins to go electronic at BS3 would therefore, from the commercial perspective, not have been the right solution, he adds; it had to develop a mechanical product meet the same requirement. “And it actually it turned out quite good, because it’s now one of the leaders on fuel economy!”

The entire development of the fuel injection system including sample preparation and hardware changes, was supported by Bosch from its global centre of competence for distributor pumps in Bangalore. The pump itself and the injectors are manufactured at Bosch’s factories in Jaipur and Nashik respectively.

Anjan Kumar R, deputy general manager for OE sales at Bosch Ltd, believes midrange engines like Cummins’ B-series, with a capacity of around one litre per cylinder, will dominate the volume market for the next five years at least. “From the point of view of power output they are unique to India and some of the emerging markets. For these markets this solution with the V mechanical pump is optimal from the cost point of view.”

However, this solution may not work if Indian OEMs follow the European trend of higher power outputs, he points out. Asked whether anyone else in the world has used a mechanical distributor pump as part of a Euro 3 solution, he says: “This was a unique situation in which a customer came out with a unique solution. You cannot relate it with any other market at the same emission level.”

Would Cummins continue with this mechanical platform going up to BS4 in 2014? Lambert admits the company is investigating the possibility of doing that and using aftertreatment. But the difficulty there, he point out, is that aftertreatment for both NOx and particulates will be needed. And then there’s the question of fuel economy, because there is a fuel economy advantage inherent in using a common rail system.

“You could probably meet Euro 4 using a mechanical engine, but whether that’s the best marketable solution is another matter. For one, you’ve got all these additional things to applicate on a vehicle and get sorted out. In addition you’re still using an older-level mechanical engine which will lose some fuel economy just because it’s an older design,” he says.

The mechanical BS3 engine’s lifecycle will end in 2015, Ramachandran says. “It is documented in the Auto Fuel Policy that India needs to move to a single emissions regime, and I would expect this engine to be phased out at that transition stage, everything moving to Euro 5 at that time,” he says.

Emission norms

Moving directly from BS3 to BS5 should not be a major issue for commercial vehicle manufacturers, he reckons, because the volume of BS4 engines they are going to require for the 11 or 13 cities in which that norm will be in force from 2010 will in any case be negligible compared to the requirement for BS3 engines. “However, if you were to look at the passenger car market, the volumes there would probably be in the ratio of 60:40,” he says.

The volumes of BS3 engines today are just 1.5–2 percent of the total volumes, Kumar points out. “What we are seeing today is that even though BS3 is relevant in 11 metros, the total volumes coming out of this market are very, very low. That means to say, you will see actual productionisable, saleable solutions only close to the implementation of BS3 across the country in April 2010 even though BS3 has prevailed for the last three years.”

“Today’s solutions are only fancy solutions for a niche segment, because BS3 buses are bought only by the state transport undertakings; all trucks are registered outside the cities. Close to 2010 is when you will see actual market-driven solutions coming out,” he elaborates.

This is where the significance of Cummins’s mechanical BS3 engine really lies. The engine has been in the market for almost three years now, whereas none of the major OEMs has come out with any of their mass-market solutions robust enough for the diversity of operating environments across the country, especially when it comes to truck applications.

But Ramachandran is not willing to cite sales projections, referring instead to recent production cuts at Tata and Ashok Leyland. “I haven’t seen anybody that’s been willing to bet any money on numbers. Our original projections were that we would be short of capacity next quarter, before the whole thing unwound. Right now it’s all shock. We don’t know what the situation is going to be — we have to look at it on a monthly basis, and then take decisions as we go along.”

Right now this has not impacted the investment in the new Tata Cummins plant at Cummins’ megasite at Phaltan near Pune, where the mech BS3 engine will also be built, he says. “But if the situation is expected to continue for a long time, we could decide to delay it some, to conserve cash.” Lambert, who is responsible for product and application engineering functions across Cummins India’s automotive, industrial, and powergen business units, has been in India only little over a year now, but was involved in “parts” of the project from Europe, right from the start.

He says Cummins in Brazil is interested in the engine because the market there is looking at the same engine size and similar applications. China too is looking at doing a version. But the issue there too might be the power level, he concedes. “We’re limited on this product to 180hp, so that would probably suit the lower end of the China market.”

RELATED ARTICLES

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fi...

By Autocar Pro News Desk

By Autocar Pro News Desk

05 Dec 2008

05 Dec 2008

7367 Views

7367 Views