Early arrival of festive season accelerates demand for two-wheelers

Demand for two-wheelers is back on its growth trajectory, thanks to the festive season, above average rainfall and the positive sentiment prevailing in the market.

The demand for two-wheelers is back on its growth trajectory, thanks to the early arrival of the festive season this year, above-average rainfall across major parts of the country clubbed with the positive sentiment prevailing in the market. August 2017 has turned out to be one of the best performing months for the Indian wo-wheeler industry since the festive season last year.

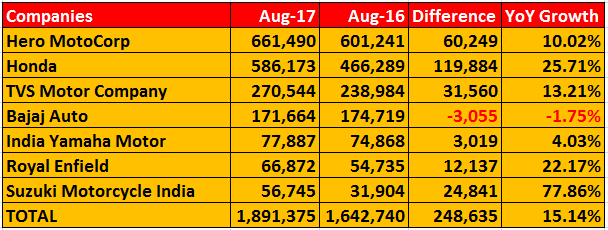

August sales as reported by the major two-wheeler companies indicate that the market has registered 15.14 percent growth YoY. The highlights of the last month’s performance include Hero MotoCorp (HMCL), Honda Motorcycle & Scooter India (HMSI), Royal Enfield and Suzuki Motorcycle India recording their best-ever monthly sales.

Bajaj Auto and India Yamaha Motor, however, reported numbers that are not at par with the current industry growth.

Hero MotoCorp has reportedly clocked its highest-ever sales for any single month in August 2017. It sold total of 678,797 units including exports (17,307 units) for the month. The domestic sales stood at 661,490 units, which recorded a YoY growth of 10.02 percent over the corresponding month last year.

According to the company, its previous highest monthly performance was recorded in September 2016, when the company had sold 674,961 units.

August 2017 marked the fourth consecutive month when Hero MotoCorp has managed to sell more than 600,000 units.

The company aims to further consolidate its position in the market during the festive months of September and October. It is learnt that the market leader has already started preparing for the required inventory levels to meet the surging demand.

Notably, Hero MotoCorp aims to launch about six new models that would include a 125cc scooter and 200cc premium motorcycle for urban commuting.

Recording its best-ever sales for any month, Honda Motorcycle & Scooter India (HMSI), has reportedly sold 622,180 units (including exports) in August 2017. Interestingly, this is the first time that the company has breached the 600,000-unit sales mark. On the domestic front, HMSI sold 586,173 units (growing by 25.71 percent YoY), which is also its best-ever performance in India.

The company claims that its scooter and motorcycle sales have recorded all-time high numbers in August, which marked the commencement of the festive season.

HMSI sold 191,944 motorcycles in August thereby recording a YoY growth of 48 percent. It had sold 129,926 motorcycles in August last year. On the scooter front, the company sold 394,229 units, up by 17 percent YoY. It had sold 336,363 scooters in August last year.

Commenting on HMSI’s August 2017 sales, Yadvinder Singh Guleria, senior VP - Sales and Marketing, said, “On the back of strong festival demand matched with new additional capacity coming at a very strategic time, Honda has breached the 600,000 units sales mark for the first time in August 2017. At the same time, our strong overseas demand momentum has resulted in exports crossing the 36,000-unit mark. On the domestic front, both scooters and motorcycles touched their highest sales mark. We are seeing increased footfalls at dealerships and are fully equipped to cater to the high demand during the festive period.”

Expanding its production capacity further, Honda has recently added the fourth assembly line at its Narsapura plant (near Bangalore). While this increased the annual production capacity from 5.8 million units to 6.4 million units, India has now become the largest production hub for the Honda’s global two-wheeler business.

TVS Motor Company, the third largest two-wheeler player in the domestic market, sold 270,544 units last month, up by a stable 13.21 percent YoY. Notably, scooter sales for TVS Motor grew by about 49 percent from 76,572 units in August last year to 114,354 units in August 2017. Motorcycle sales, on the other hand, were marginally down for the company. It sold 111,927 motorcycles last month as against 114,195 units in August 2016.

Addressing this mild decline and to ensure that its motorcycle sales pick up as the festive season approaches, the company has now rolled out the updated version of its 110cc mass commuter motorcycle, TVS Star City+. It primarily competes with Honda’s Dream series and Livo models, Bajaj Auto’s Platina range, Hero’s Splendor iSmart 110, Yamaha Saluto RX and other models.

TVS Motor, the flagship company of the US$ 7 billion TVS Group, is finally planning to launch its first-ever hybrid vehicle in December this year followed by pure electric vehicle(s) by March – April 2018. The company is also understood to be readying up atleast two all-new two-wheeler models – 125cc scooter and 310cc motorcycle based on its alliance with BMW Motorrad for launch in the ongoing fiscal.

Bajaj Auto, the fourth largest two-wheeler company in India, recorded sales of 171,664 units, marginally down by 1.75 percent YoY. The company had sold 174,719 units in August last year. To boost its domestic sales, Bajaj has recently rolled out the electric start variant of its 100cc mass commuter CT100, which sits in the entry-level segment. Bajaj Auto’s CT100 models are also one of the most affordable 100cc motorcycle models in the domestic market.

The company is also understood to roll out the updated Pulsar line up later this year to boost its domestic sales.

India Yamaha Motor has reported sales of 77,887 units (including Nepal) in August, up by 4.03 percent. Focusing on the premium category, the company has recently launched the single-cylinder, 249cc, 20bhp Fazer 25, which borrows the powertrain from FZ 25 launches earlier this year.

Commenting on the company’s sustained growth, Roy Kurian, senior VP, Sales & Marketing, Yamaha Motor India Sales, said, “The industry expects further surge in demand and Yamaha is upbeat with its network, marketing and service functions to drive its growth. Yamaha’s clear direction articulated through unique product line up including the newly introduced Fazer 25 has received encouraging comeback from the customers. Yamaha’s focus will continue to grow in the tier II and III markets, offering distinctive brand experience and customer engagements.”

Talking to Autocar Professional on the sidelines of the Fazer 25 launch in Mumbai on August 21, Kurian revealed that the company has revised its annual target for CY2017 from one million units to 900,000 units. Subsequently, Yamaha has also revised its previous target of achieving 10 percent market share in the domestic scooter segment this year. However, he is upbeat about the upcoming festive season and hopes that Yamaha will record its best-ever performance during September and October.

Continuing its streak of month-on-month growth, Royal Enfield has now registered its best-ever sales of 66,872 units in August 2017, up by 22.17 percent YoY. The company had sold 54,735 units in August last year. The company has recently commenced production at its third manufacturing facility at Vallam Vadagal near Chennai. Royal Enfield’s combined production capacity now stands at 825,000 units across the three plants for FY2017-18.

The growth in RE’s sales on the export front, however, is relatively slower at 12 percent YoY in August 2017. It exported 1,105 units last month as against the sales of 986 units in August last year.

Suzuki Motorcycle India too has reported its best-ever monthly performance in August 2017. The company has clocked sales of 56,745 units last month, up by a commendable 78 percent YoY. According to the company, it has already accumulated sale of 223,552 units during the April–August 2017 period.

Suzuki Motorcycles’ performance for the said period has reported YoY growth of about 55 percent. Notably, the company is targeting an annual sale of half a million units in FY2017-18 in the domestic market. Suzuki has evidently done well so far this fiscal, thanks to its bestselling models, Access 125 and the Gixxer range.

Speaking on this performance, Sajeev Rajasekhran, EVP, Sales and Marketing, SMIL, said, “Our performance in August has been consistent with the rapid strides that we continue to take in FY2017-18. With the introduction of new Gixxer ABS variants and the Gixxer Special Edition this month, we can now offer our customers new, exciting options across all product categories. Not only does this augur well for us, but ahead of the festive season, has injected a renewed confidence in our efforts to best serve our customers.”

The industry is expecting further growth in the festive months of September and October. It remains to be seen how Hero and Honda’s rivalry shapes up, if Bajaj Auto manages to restore its domestic growth, and whether Royal Enfield breaches the 75,000 unit mark for the first time during the forthcoming festive season.

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

06 Sep 2017

06 Sep 2017

8977 Views

8977 Views

Autocar Pro News Desk

Autocar Pro News Desk