Two-wheeler OEMs on a high in January 2018

With sales of 1,684,066 units and year-on-year growth of 33 percent, the two-wheeler market is on fire. While growth has returned to the motorcycle segment, scooters are taking off on their own trajectory, notching 48 percent YoY growth.

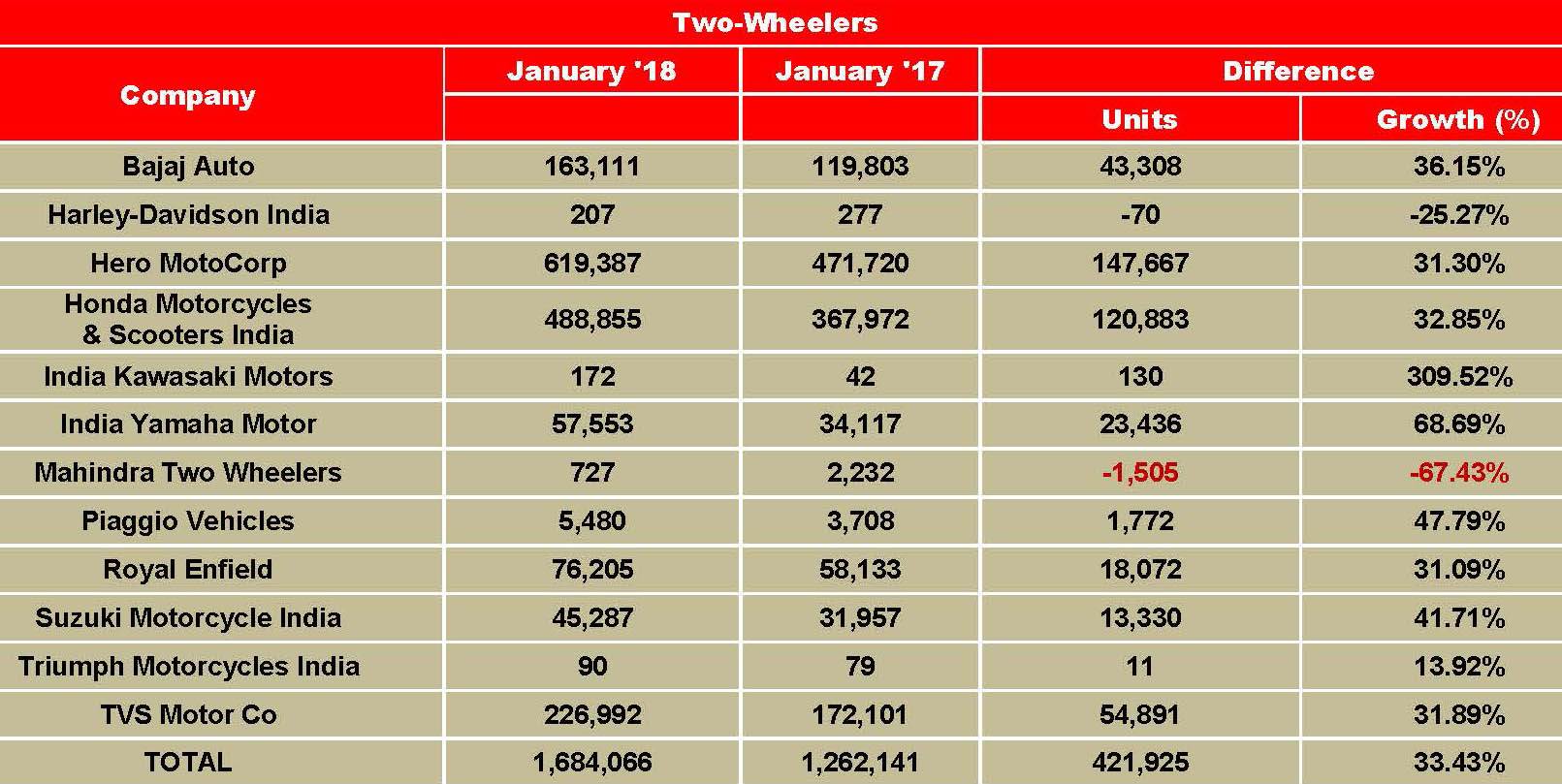

The Indian two-wheeler industry recorded impressive YoY growth of 33.43 percent in January 2018 at 1,684,066 units. Harley-Davidson India and Mahindra Two Wheelers were the only two OEMs that failed to report a positive growth. While scooters recorded the fastest growth of more than 48 percent YoY, motorcycle sales grew by 28.64 percent YoY. Meanwhile, the mopeds, category wherein TVS Motor Company commands a monopoly in the domestic market, saw YoY growth of 10 percent.

While Hero MotoCorp more than doubled its scooter sales in January (from 34,949 units in January 2017 to 76,062 units in January 2018), Honda Motorcycle & Scooter India (HMSI) stood out as the largest YoY volume gainer. Honda added sales volumes of 90,507 scooters (228,811 units in January 2017). In motorcycles, Hero MotoCorp stood out as the largest volume gainer with 106,554 sales added to its January 2017 volumes (from 436,771 units in January 2017 to 543,325 units in January 2018).

Growth for Hero MotoCorp, which sold 619,387 units in January 2018 (+31.30%), was partly fueled by the sharp rise in its scooter dispatches (about 118 percent) and partly by the 20 percent YoY growth recorded by its 100cc-110cc motorcycles (albeit on a large base of 387,209 units).

Picking up some action lately, the Pawan Munjal-led company has unveiled a number of facelifts, new models and concepts in the past few months. This includes the Super Splendor, which borrows the 125cc engine from Glamour, the 110cc Passion Pro and XPro, the production-ready Xtreme 200R, 125cc Duet and Maestro scooters and the adventure bike concept XPulse 200, among other low profile product launches.

Honda Motorcycle & Scooter India sold 488,855 units, up 32.85 percent. Of this, while scooter sales comprise strong volumes of 319,318 units (65 percent of overall sales), motorcycle sales contributed the remaining 169,537 units. The company, which has found initial success in its recently launched 125cc Grazia scooter, has updated its prime product – the 109cc Activa 4G – with a new model under the Activa 5G moniker. It has also unveiled its fourth motorcycle in the 150cc-160cc category where it has tasted runaway success in the last few years at the 2018 Auto Expo. Honda unveiled the X-Blade, which borrows its 160cc powertrain from the CB Unicorn and CB Hornet 160R, targeting young urban buyers. Notably, the X-Blade is Honda’s tenth model in its commuter motorcycle portfolio. It is expected to hit the showrooms in March.

TVS Motor Company has reported total sales of 226,992 units in January 2018, up by a fair 31.89 percent YoY. In terms of volume additions made, the company’s motorcycle portfolio seems to have done better than the scooters this time. While it sold 66,543 motorcycles (Jan 2017: 35,994 units), its scooter sales stood at 84,140 units (Jan 2017: 66,734 units) in January 2018. The remaining sales of 76,309 units came from mopeds, which continues to visibly fetch solid numbers for the company.

The company has recently forayed into the 125cc scooter segment with its NTorq 125. Priced at Rs 58,750 (ex-showroom, Delhi), the TVS NTorq 125 will rival Honda’s 125cc Grazia and Activa along with Suzuki’s Access 125 and Aprilia’s SR 125.

Bajaj Auto recorded sales of 163,111 motorcycles in January, thereby registering YoY growth of 36.15 percent. Pumping new life in its Discover brand, the company recently rolled out Discover 110 and Discover 125. The company has equipped the new Discover models with newer features that include LED DRLs, longer travel (front) suspension units and other cosmetic additions. Along with that, the company has also updated its V series and the Avenger line-up with 2018 editions. While this is aimed at boosting sales at one end, these updates keep the model at / above par with the incoming competition.

To keep up the sales of its premium offerings, the company has recently added new colour options to its Pulsar RS200 and the Dominar.

Bajaj Auto also offered one-year free insurance scheme on a number of its models that included Platina, Discover, Pulsar, V and Avenger range. Although it is learnt that the scheme is now no more available, it is estimated that it has helped the company push its sales at the retail level.

Royal Enfield, which has become India’s fifth largest bikemaker surpassing India Yamaha Motor, has reported sales of 76,205 units in January 2018. It grew by 31 percent YoY last month. The company’s projections for the market demand in the domestic as well as international markets remain bullish as it prepares to bring its most premium 650cc, twin-cylinder motorcycles – Interceptor 650 and Continental GT 650 later this year.

India Yamaha Motor sold 57,553 units last month, up 69 percent YoY. This included sales of 29,941 scooters (January 2017: 9,803 units) and 27,612 motorcycles (January 2017: 24,314 units) in January 2018. The company has launched the YZF-R15 Version 3.0 for Rs 125,000 (ex-showroom, Delhi) and has re-launched the now BS VI-compliant YZF-R3 for Rs 348,000 (ex-showroom, Delhi) at the 2018 Auto Expo.

Meanwhile, Suzuki Motorcycle India has reported sales of 45,287 units in January 2018, up by 42 percent YoY. It has recently unveiled three models at the 2018 Auto Expo which included the naked street midsize GSX-S750 (powered by 750cc, four-cylinder, liquid-cooled engine) and the Access 125-based Burgman Street scooter (125cc). According to company officials, SMIL’s clear strategy for growth in India market is to stick to the premium and performance segments. Notably, India is the fastest growing market for Suzuki’s global two-wheeler business.

In the big bike segment, among the companies that report their monthly sales to apex industry body SIAM, Harley-Davidson continues to rule the roost. The iconic American motorcycle brand reported sales of 207 units in January, down by 25.27 percent YoY. Japanese big bikemaker Kawasaki, on the other hand, has sold 172 units last month, recording a massive jump of over 300 percent YoY.

Meanwhile, British motorcycle brand, Triumph Motorcycles India reported sales of 90 units in January 2018, up by a decent 14 percent YoY.

The big bike companies are estimated to benefit from the reduced custom duty to 50 percent (on now all CBUs) from 60 percent (800cc and smaller CBUs) and 75 percent (bigger than 800cc CBUs) respectively. The duty relief to these premium bike makers comes as good news as the market continues to mature year-on-year.

Also read: 2018 opens on a strong note for Indian OEMs

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

16 Feb 2018

16 Feb 2018

24202 Views

24202 Views

Autocar Pro News Desk

Autocar Pro News Desk