INDIA SALES ANALYSIS: SEPTEMBER 2015

As October dawned, automakers began announcing their September 2015 sales numbers and what seems amply clear is that the ones with recently launched new models have seen good sales come their way.

As October dawned, automakers began announcing their September 2015 sales numbers and what seems amply clear is that the ones with recently launched new models have seen good sales come their way.

New models drive India car sales in September

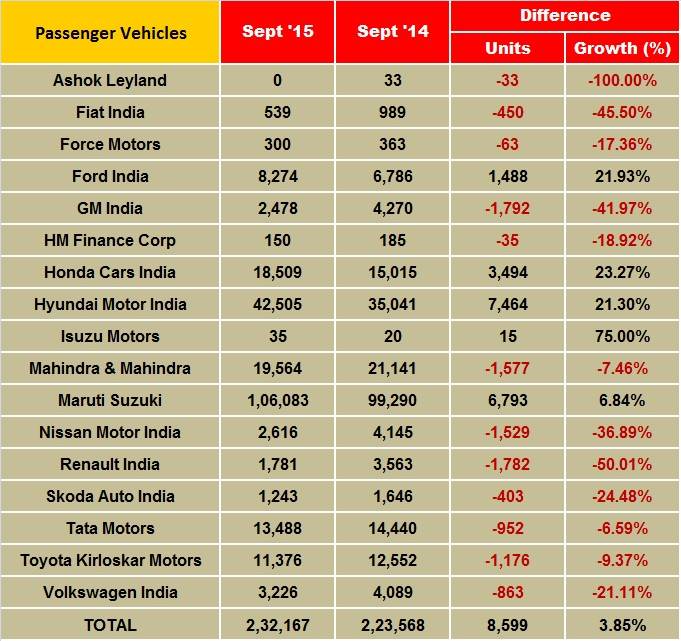

According to data from seven of the country’s largest passenger vehicle manufacturers, sales in September were up 6.8 percent to 218,110 units against 204,255 units in September 2014. Overall numbers could have been better though, given reduced fuel prices, low inflation and the onset of the festive season.

Maruti Suzuki India, the largest carmaker in the country and with an overwhelming 53 percent market share in April-August 2015, saws its sales grow 6.8 percent in September to 106,083 units (September 2014: 99,290 units). A slower-than-anticipated offtake of the S-cross coupled with weak growth in sales of the entry level mini segment, which comprises the WagonR and the Alto, capped the automaker’s sales last month.

The recent trend of customers opting for larger cars was highlighted as sales of the company’s mini segment, which comprises the Alto and the WagonR, remained flat at 35,570 units. Sales of utility vehicles –S-Cross, Gypsy and Ertiga–grew by only 5.9 percent in September to 6,331 units against a near 43% rise to 7,836 units in August 2015. Sales of compact cars, which include models like the Swift, Ritz, Celerio and Dzire, grew by 3.5% in September to 44,826 units.

On the upside, demand for the Dzire Tour (for cabs and fleet operators) remained strong and the company sold 3,229 units as compared to 1,221 units in September 2014.

The premium segment Ciaz sedan, with a new diesel hybrid model, drew more buyers and the company sold 4,291 units. The Ciaz comes under the mid-size segment and was launched in October last year.

Sales of the vans segment, which comprise of the Eeco and the Omni, fell marginally to 11,836 units against 11,863 units a year ago.

On the export front, Maruti Suzuki saw de-growth in September as the carmaker shipped 7,676 units, 26 percent lower than the previous year. As a result, total car sales for the company in September grew by 3.7% to 113,759 units.

Hyundai Motor India was the second largest carmaker spot as it reported its highest ever domestic monthly sales in September as it registered a 21.3 percent year-on-year growth in sales to 42,505 units (September 2014: 35,041).

A strong response to its compact Creta SUV and sustained demand for the premium hatchback Elite i20 helped the automaker post high sales last month.

Commenting on the sales, Rakesh Srivastava, senior VP (Sales and Marketing), HMIL, said: "Hyundai grew by 21.3 percent with its highest-ever monthly domestic sales of 42,505 units in a single month in the last 17 years, on the strong performance of its modern premium brands – Creta, Elite i20, i20 Active and Grand i10, while also registering 14.2 percent growth in the first-half of this fiscal year.”

Given the strong demand for the Creta, Hyundai has already restructured its manufacturing and ramped up its production by 50 percent from 5,000 units planned earlier to almost 7,500 units a month. It has also deferred exports of the Creta by a few months to accommodate high demand in the local market.

The company had sold 7,437 units of the SUV in August 2015, and while the breakup for the Creta last month is not known yet, it is likely to retain the title of the most sold SUV in September as well.

However, the country’s largest passenger car exporter saw a dip in exports for yet another month with a 14.6 percent fall to 14,030 units in September. Total sales for the company including exports in the month were 9.8 percent higher at 56,535 units.

Honda Cars India reported growth of 23 percent with monthly domestic sales of 18,509 units in September 2015 (September 2014: 15,015).

Surprisingly, the Amaze toppled both the City and the Jazz to become the company’s most sold car in India with sales of 6,577 units. Meanwhile, the City sold 5,702 units and the new Jazz sold a total of 4,762 units. The split for the remaining cars was 759 units for the Brio, 643 units for the Mobilio and 66 units for the CR-V.

For the first half of the fiscal (April-September 2015), the carmaker sold a total of 97,217 units against 88,200 units for the corresponding period last year, marking a growth of 10%.

Home-grown automaker, Mahindra & Mahindra reported a 7 percent decline in passenger vehicle sales to 19,564 units from 21,141 units sold in the same period a year ago, as rising competition continued to weigh on the company.

According to Pravin Shah, president and chief executive (automotive), M&M, “While the auto industry witnessed a slow and fragmented recovery, the recent interest rate reduction by the RBI is bound to infuse optimism. If the majority of the rate cut is passed on to customers by lending institutions, it will bring back the momentum in auto sales especially during the upcoming festival season. Our TUV300, which was launched in September, has received a very good response and we expect this to boost our overall performance going forward.”

Mahindra launched the TUV300, its first new model in more than four years, on September 10 and is planning to launch another new compact SUV in the next two months. By enhancing its product portfolio with fresh launches, the company plans to regain lost market share in the utility vehicle segment.

Meanwhile, Ford India sold 22,428 vehicles in combined domestic wholesales and exports in September, compared to 13,742 vehicles in the corresponding month last year.

With strong performance of the Figo Aspire and launch of the new Figo hatchback, the company’s domestic sales in September improved to 8,274 vehicles from 6,786 units in September 2014. Exports were also sharply up to 14,154 vehicles from 6,956 in the same period last year.

“With the launch of the all-new Figo, we are stepping closer to our promise of launching three brand new products for Indian consumers by the first quarter of 2016. Backed by a strong growth vision and great products like the new Figo and Aspire, we look forward to welcome many more customers to the Ford family this festive season,” said Anurag Mehrotra, executive director, Marketing, Sales & Service at Ford India, while commenting on the sales performance.

Toyota Kirloskar Motors sold 11, 401 units in the domestic market and exported 1,252 units of the Etios in September 2015 when compared to 12, 542 units sold in the domestic market and 1,502 units.

Commenting on the sales, N Raja, director and senior VP, Sales and Marketing said: "We have maintained cumulative growth of 11% from January to September 2015 when compared to the industry which has grown 5% from January to August in 2015...We are hopeful that with the recent repo rate cut and the approaching festive season, we will soon see a boost in sales in the upcoming months.”

With the festive season right upon us and the recent interest rate reduction by the Reserve bank of India, passenger vehicle sales look all set to pick up steam. Expectation of a turnaround in demand led growth in the second half also seems to be well anchored now and most automakers should make the most of the favourable scenario and post better numbers in the months to come.

Two-wheeler sales slow down as buyers remain sombre

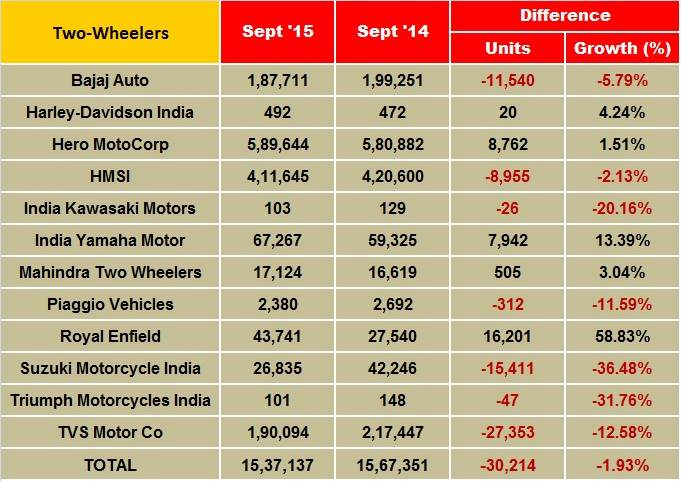

Seven out of 12 major two-wheeler manufacturers in India have registered a year-on-year decline in their sales volumes for September 2015. While total two-wheeler industry sales stood at 15,37,137 units during the last month, volumes were down by 1.06% YoY.

Among the companies that have registered a decline in their YoY September 2015 sales are Bajaj Auto, Honda Motorcycle & Scooter India (HMSI), TVS Motor Company, Suzuki Motorcycle India, Piaggio Vehicles, India Kawasaki Motors and Triumph Motorcycles India.

Hero MotoCorp, India Yamaha Motor, Royal Enfield, Mahindra Two Wheelers and Harley-Davidson Motor Company India recorded an upward move in their respective monthly sales numbers for September.

Crossing the magic monthly consolidated sales (including exports) mark of 600,000 units, India’s largest two-wheeler manufacturer by volumes, Hero MotoCorp (HMCL) registered total sales of 606,744 units during September 2015, recording flat growth of 0.44% YoY. The company had recorded total despatches of 604,052 units in September 2014. In terms of additional sales (domestic and exports) by units, the company sold just 2,692 units more than sales volume in September 2014.

On the domestic front, it sold 589,644 units during September 2015, which marked a YoY growth of 1.51% for the company.

However on the cumulative domestic sales front, crossing the three million sales mark for the two quarters in the ongoing financial year, the company has recorded total sales of 31,15,854 units between April-September 2015. Cumulative sales are down by 5.91% when compared to the sales of the corresponding period from the last fiscal.

The company, which has just rolled out two new 110cc scooter models – Maestro Edge and Duet – is looking to garner sales and boost its overall share in the booming scooter market as the festive season begins. First to retail, hence, will be the stylish looking Maestro Edge model while the more affordable Duet model will be retailed later in the festive month.

Honda Motorcycle & Scooter India (HMSI) registered total domestic sales of 411,645 units as against sales of 420,580 units in September 2014, down 2.13% YoY. HMSI continues to see de-growth in its motorcycle portfolio that is largely covered by the growth recorded by its scooters, primarily the Activa models.

The company sold 147,258 motorcycles during September 2015 as against total motorcycle sales of 179,456 units in September 2014, down 17.94% YoY. Its scooter sales last month stood at 264,385 units as against 241,124 units in September last year, a YoY growth of 9.65%.

On the cumulative sales front, HMSI has recorded total sales of 21,70,425 units for the last two quarters of the ongoing financial year, a growth of 2.92 percent YoY, all thanks to its robust scooter sales.

Third in the order in terms of domestic volumes, TVS Motor Company reported total domestic sales of 190,094 units during September 2015, which was down by 6.70% YoY. On the cumulative domestic sales front, the company secured total sales of 10,63,664 units, which highlights a marginal growth of 1.20% YoY.

To boost sales of its commuter motorcycle portfolio, the company rolled out its high- mileage model, the TVS Sport, on September 21. The new TVS Sport model, which is now updated with a number of cosmetic and mechanical changes, is the third high-mileage model in the ongoing calendar year after Bajaj Auto’s Platina ES (claimed fuel efficiency of 96.9 kilometres per litre tested by ARAI) and Hero’s Splendor iSmart (ICAT certified mileage of 102.50 kilometres per litre). HMSI, on the other hand, has on offer HET technology across its commuter motorcycle models, which has enabled marginal mileage enhancements on its models.

Fourth in the row is Bajaj Auto, which recorded domestic sales of 187,711 units in September 2015, down by 5.79% YoY. On the cumulative front, the company has sold 955,148 units in the past two quarters. The cumulative domestic sales for Bajaj Auto for April-September 2015 recorded flat growth of 0.28% YoY.

The company has made a decent comeback in the market through its high-volume models such as the CT100, which is the most affordable commuter from the stable, the Platina and the new Pulsars. Reports suggest that Bajaj Auto is working on lining up new models for the festive season which will include all-new Avenger models and possibly another Pulsar motorcycle. The KTM models, on the other hand, continue to provide a steady traction to the company in the midsized motorcycle segment.

Growing on the back of the success of its scooter models, India Yamaha Motor has registered total domestic sales of 67,267 units during September 2015. The month was also the second month in a row when the Japanese company managed to register total monthly sales of more than 60,000 units. While the new Fascino scooter is fetching good volumes, the Ray Z and Ray models have now stabilised as they jointly see a stable monthly sales of close to 9,000-10,000 units.

Royal Enfield, a unit of Eicher Motors, has sold 43,741 units in the domestic market during September 2015, up by 59% YoY. The company had sold 27,540 motorcycles in September last year. While the company is currently working on a number of models revolving around new engine platforms for domestic as well as export markets, the management is also aggressively focussing on its UK-based operations.

Suzuki Motorcycle India sold 26,835 units in the domestic market last month, down by a substantial 36.48% YoY. However, all thanks to its new Gixxer models that have provided good traction to the company in the 150cc premium commuter motorcycle segment. The cumulative domestic sales of the company show that it has sold a total of 168,614 units in the last two quarters. This showed a growth of 1.29% YoY.

Rising from a low base, Mahindra Two Wheelers recorded a YoY growth of 3.04% in its September 2015 sales of 17,124 units. Piaggio Vehicles sold a total of 2,380 Vespa scooters in the last two quarters recording a decline of 11.59% YoY in volumes. The new 150cc Vespa models are expected to deliver some fresh volumes to the company.

The superbike companies Harley-Davidson Motor Co India, India Kawasaki and Triumph Motorcycles India sold 492 units, 103 units and 101 units respectively during the last month. Of these, only the American bikemaker reported a YoY growth of 4.24% for September 2015 sales.

However, on the cumulative domestic sales front, all three have reported a decline in their respective sales volumes for the past two quarters.

M&HCV sales maintain healthy growth in September

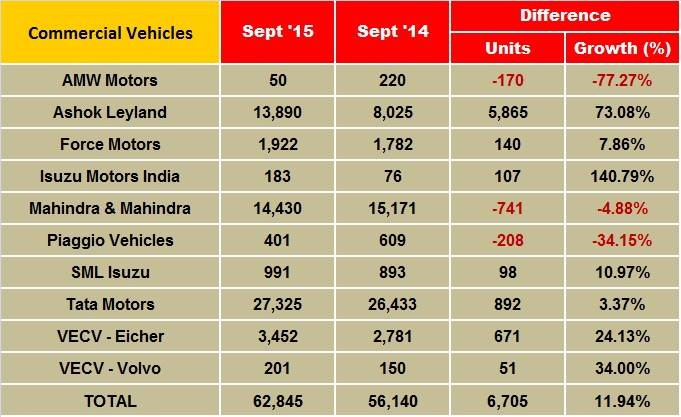

Medium and heavy commercial vehicle (M&HCV) sales maintained their growth in September 2015 as all key manufacturers registered increased sales numbers, showing consistent growth for over a year now. This growth though has not yet percolated down to the LCV segment, as it remains negative due to various factors including unavailability of finance and the rural market slowdown.

However, experts believe that this growth in the M&HCV segment is largely driven by the replacement demand by fleet operators and preference for heavy vehicles.

Speaking to Autocar Professional on the consistent growth in the M&HCV segment, R Ramakrishnan, senior vice-president, Product Strategy & Planning and Customer Value Creating, Commercial Vehicle Business Unit, Tata Motors, said, “The overall M&HCV segment is positive largely due to the replacement demand. Industrial output is still quite low; in mining only coal is able to take care of import substitution and coal mining are helping whereas iron ore is nowhere near where it was some years ago. Infrastructure is beginning to fall in place but still early days. So the heavy truck demand is largely replacement demand.”

Coming to specific manufacturer numbers, Tata Motors’ total sales of 29,039 units in the month point to flat growth (September 2014: 28,943). While M&HCV sales were a strong 52.9 % growth at 15,915 units (September 2014: 10,404), LCV sales were down 29% YoY at 13,124 units (September 2014: 18,539).

Ashok Leyland’s total sales were up a massive 61% at 14,771 units (September 2014: 9,185). Its M&HCVs notched up healthy 83% growth, selling 12,134 units. (September 2015: 6,625). LCV numbers were up 3% with sales of 2,637 units (September 2014: 2,560 units).

Mahindra M&HCV sales rose 184%, albeit on a low base, selling 511 units (September 2014: 180 units). While the below-3.5 T GVW segment declined 9%, it sold 13,460 units (September 2014-14,731 units). However, the above 3.5T GVW segment registered strong 77 % growth selling 459 units (September 2014-260 units).

VE Commercial Vehicles maintained its double-digit growth in the month. the company sold 3,452 units registered a growth of 24.1% (September 2014: 2,781).

(With inputs from Shourya Harwani, Amit panday and Kiran Bajad)

Also read: PVs and CVs grow, motorcycles and 3-wheelers fall in H1

RELATED ARTICLES

Maruti Fronx sells 135,000 units in 12 months, second best-selling Nexa model in FY2024

Baleno-based Fronx compact SUV with 134,735 units accounts for 21% of Maruti Suzuki’s record utility vehicle sales of 64...

Utility vehicle share of PV sales jumps to 60% in FY2024, cars and sedans hit new low of 37%

Sixty percent of the record 4.21 million passenger vehicle sales in India came from 2.52 million UVs, a big leap from th...

Mahindra XUV300 tops 250,000 sales ahead of XUV3XO reveal

The popular compact SUV, which ranks among India’s Top 20 utility vehicles for FY2024, is among the SUVs which have powe...

By Autocar Pro News Desk

By Autocar Pro News Desk

06 Oct 2015

06 Oct 2015

25082 Views

25082 Views