Maruti Suzuki and Honda increase PV market share in April-July 2017

The continued surge in demand for SUVs, particularly in July due to GST-driven price reductions, sees Maruti further increase its stranglehold on the Indian market while Honda sees a smart uptick in demand thanks to the WR-V.

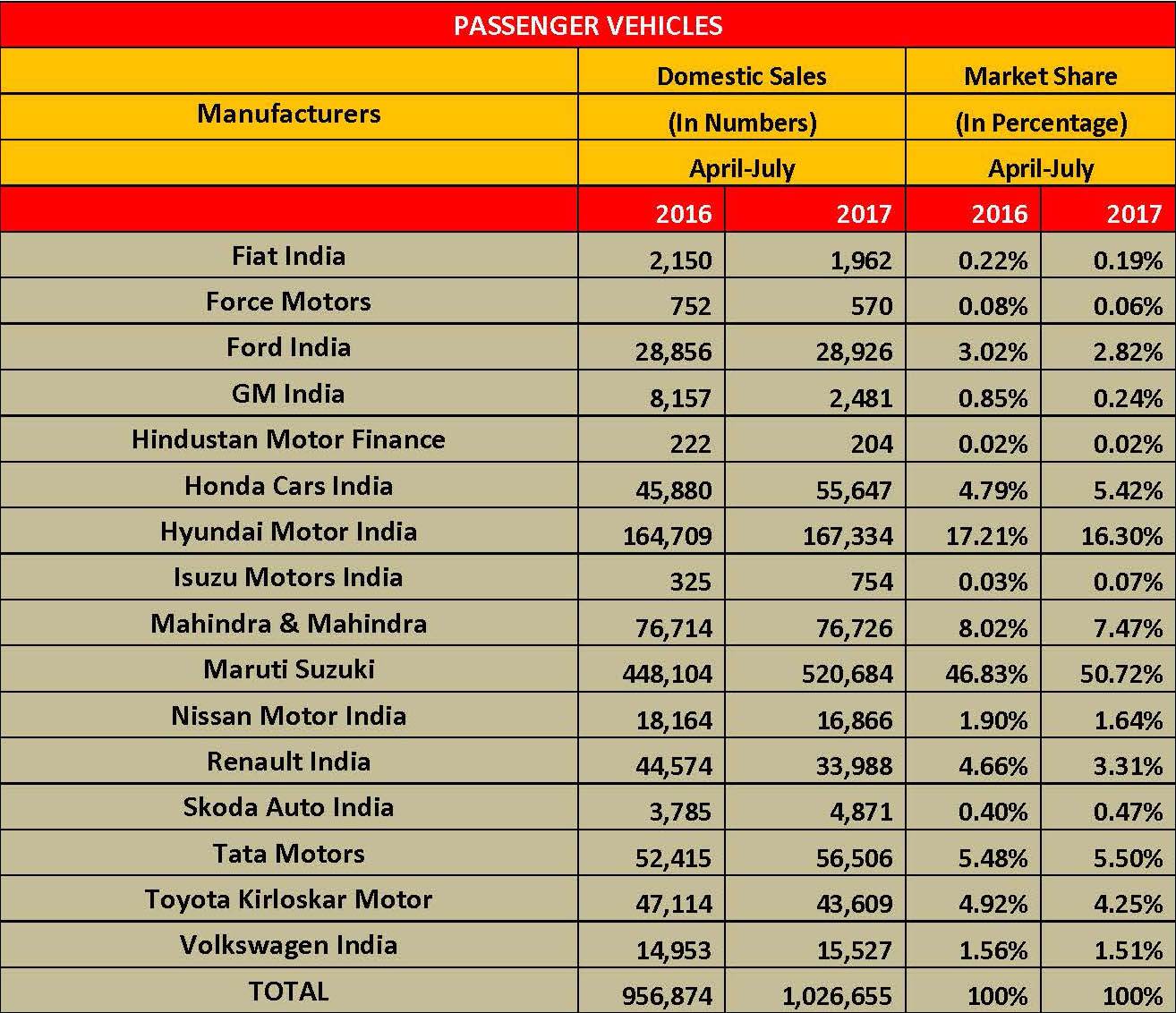

Maruti Suzuki has further strengthened its stranglehold on the domestic passenger vehicle (PV) market in July 2017. The country’s largest carmaker, which had a market share of 46.83% in April-July 2016, has now grown its PV market share by a sizeable 3.89 percent to 50.72 percent over a 12-month period. With sales of 520,684 units in April-July 2017, out of a cumulative industry total of 1,026,655 units, every second PV sold in India is a Maruti.

With Hyundai Motor India, the only other automaker with a double-digit market share (16.30%), the other 13 OEMs are fighting for the rest of the 33 percent of the PV market. This makes for a tough slog in India’s competitive, price-sensitive market and entry for newcomers a formidable challenge.

As per the latest industry sales data, only five OEMs out of 15 have managed to grow their market share – Maruti Suzuki India (+3.89%), Honda Cars India (+0.63%), Tata Motors (+0.02%), Skoda Auto India (+0.07) and Isuzu Motors India (+0.04%), the last two on a very low year-ago base.

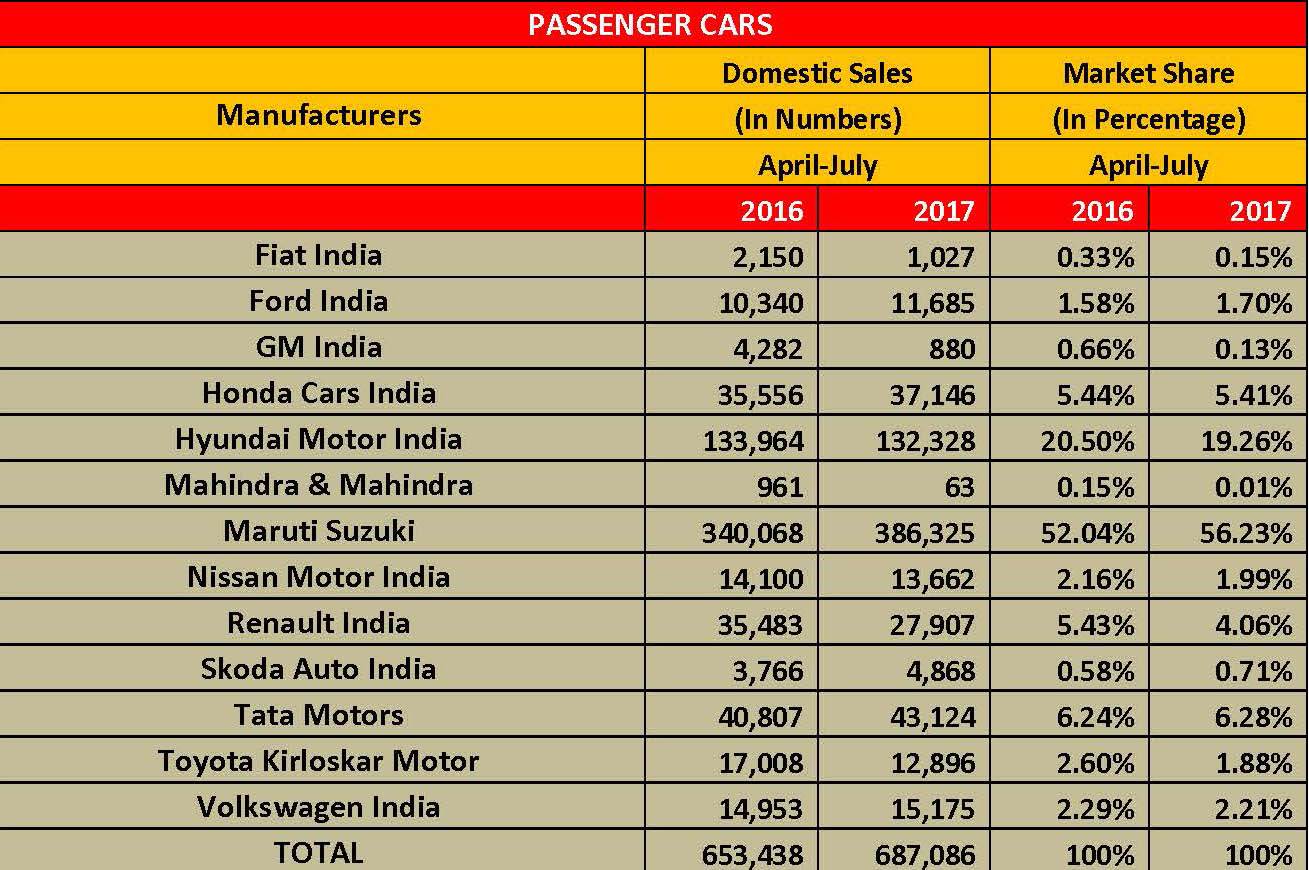

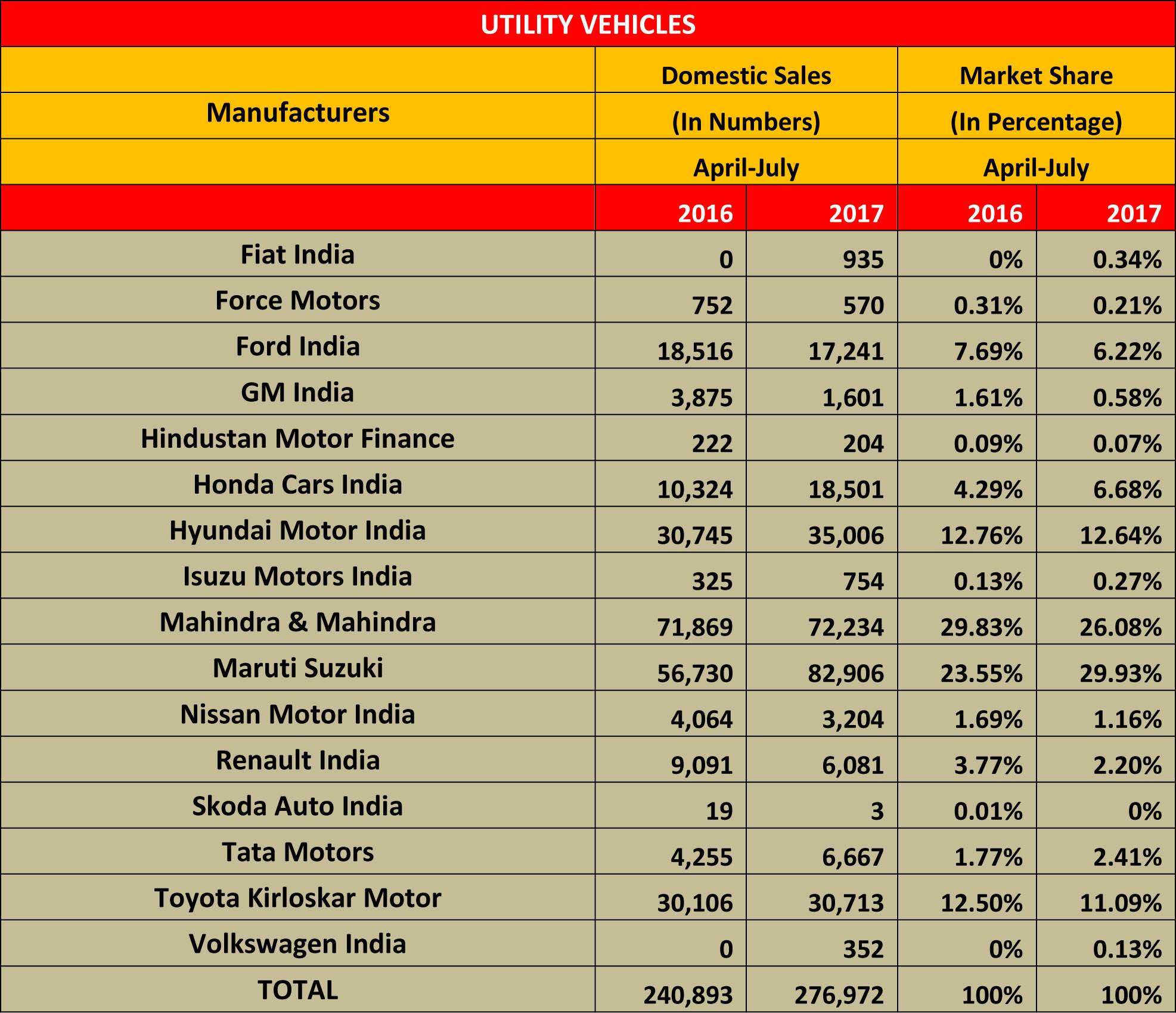

While Maruti, Ford India and Tata Motors are the only ones to have expanded their market share in the passenger car segment, the surging wave of demand for SUVs has helped Maruti, Honda, Tata Motors and Isuzu grow their UV market share. Fiat India with the recently launched Jeep Compass is the newest claimant for market share in this space.

The four-month period has seen some key players lose PV market share including Hyundai Motor India (-0.91%), Mahindra & Mahindra (-0.54%), Nissan Motor India (-0.26%), Renault India (-1.35%), Toyota Kirloskar Motor (-0.67%) and Volkswagen India (-0.05%).

Of the total 1,026,655 units sold in the April-July 2017 period, 687,086 comprise passenger cars (66.92%) and 276,972 utility vehicles (26.97%). A year ago, in April-July 2016, of the total 956,874 PVs sold, cars accounted for 653,438 units (68.28%) and UVs comprised 240,893 (25.17%), indicating growing demand for SUVs in the country. What also helped drive demand were the massive GST-driven price reductions across SUVs and cars.

UVs impact market share

Let’s see where Maruti Suzuki has benefited. Of the 520,684 units sold, 386,325 were passenger cars, a year-on-year growth of 13.6% (April-July 2016: 340,068).

While demand for the bread-and-butter entry level duo of the Alto and Wagon R continues to be strong, with 145,820 units sold (+14.1%), demand for the Swift, Celerio, Ignis, Baleno and new Dzire rose 19.6% to 218,430 units. Meanwhile, the Ciaz sedan, now sold as a premium model from the Nexa channel, sold 22,075 units (+17.1%). Maruti’s overall sales in April-July 2017 received a turbocharged boost from demand for its UVs, more specifically the Vitara Brezza. The company’s UVs (Gypsy, Ertiga, S-Cross and Vitara Brezza) sold a total of 82,906 units (+46%), which is indicative of the strong contribution to overall numbers in the five-month period.

Within the UV segment, Maruti, not surprisingly with its 46% YoY growth, has made the maximum gains in market share – a good 6.38 percentage points. In the April-July 2017 period, the company sold a total of 82,906 units to grow market share to 29.93 percent from 23.55 percent a year.

The other OEM to make smart progress in the first fourmonths of the ongoing fiscal year is Honda Cars India. The Japanese carmaker sold a total of 55,647 units (+21.28%) giving it a PV market share of 5.42 percent in April-July 2017 (Aprril-July 2016: 4.79%). Giving a boost to sales in this fiscal is the recently launched WR-V crossover which has contributed 15,217 units or an average of 3,804 units per month.

In fact, the WR-V went ahead of the longstanding Honda best-seller, the City sedan, in July. In the ongoing fiscal, the City has sold a total of 20,035 units. While the company’s share in the passenger car market dipped slightly, from 5.44 percent a year ago to 5.41 percent now, a surge of demand for the WR-V helped Honda grow its UV market share to 6.68 percent from 4.29 a year ago. Of the 18,501 UVs Honda sold in April-July 2017, the WR-V accounts for an overwhelming 15,217 or 82.24%. Little wonder then that Honda Cars India’s CEO Yoichiro Ueno has voiced his disappointment over the recent additional 10% GST cess on large cars and SUVs.

Tata Motors too has grown market share. Demand for the Tiago hatchback, Tigor compact sedan and the Hexa SUV saw the company sell a total 56,506 units in April-July 2017 (+7.8%). While the company’s PV share has risen to 5.40% from 5.48% a year ago, the boost has come from the UV segment where its share is up to 2.41 percent from 1.77 percent a year ago. In comparison, its passenger car share has risen marginally from 6.24 percent to 6.28 percent in April-July 2017.

Industry data: SIAM

RELATED ARTICLES

Maruti Suzuki’s SUV and MPV production jumps 100% to 58,226 units in January 2024

Utility vehicle market leader’s two plants in Haryana along with Suzuki Motor Gujarat’s facility hit a record monthly hi...

Car and SUV users in Bengaluru and Pune took over 27 minutes to travel 10km in CY2023

Traffic remains a challenge worldwide as life returns to pre-pandemic levels. Four Indian cities are among the 80 cities...

Indian car and 2W OEMs recall 284,906 vehicles in 2023 and 5.35 million since 2012

CY2023 saw three two-wheeler manufacturers proactively recall 122,068 motorcycles and five car and SUV producers recall ...

By Autocar Pro News Desk

By Autocar Pro News Desk

14 Aug 2017

14 Aug 2017

28161 Views

28161 Views