Commercial vehicles see robust sales in January 2018

The CV industry continues its strong growth story on the back of economic reforms that has led to a strong focus on infrastructure development, helping the OEMs register strong double digit growth month-on-month.

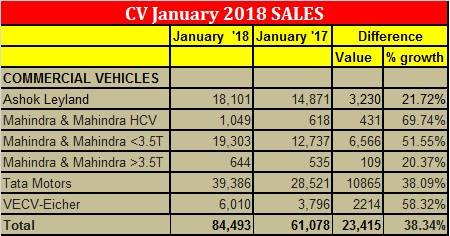

Commercial vehicle sales remain positive in the first month of the calendar year 2018, all OEMs continue to report positive growth. However, there is a indication of growth moderating this month. After, witnessing a growth of over 50 percent in November and December 2017, the CV major’s Tata Motors and Ashok Leyland’s have witnessed sales settling down to 38 and 22 percent respectively in January 2018.

As economic activities start improving on the back of a strong focus on infrastructure development, along with logistics sector witnessing a growth opportunity from the demand of the construction sector, leading to CV segment witness a sustain growth over the last 3-4 months. Industry analysts anticipate the Q4 FY 2017-18 likely to be positive for the CV sector.

In the first nine months of FY18 (April-December 2017), the overall commercial vehicles industry reported total sales of 574,337 units, registering a double-digit growth of 15.19 percent YoY. The M&HCVs contributed 39 percent to the overall CV volumes, recording total sales of 222,831 units, a effective growth of 9.27 percent.

The key drivers for the uptick in sales of the M&HCV segment can be attributed to stricter enforcement of overloading across the country, which resulted in fleet operators preferring rated loads; this also helped in driving demand for higher tonnage trucks. Additionally, with the implementation of GST, the productivity of trucks also improved significantly, which supported sales of M&HCV to remain in the fast lane. Fleet operators have been looking optimising operational costs with higher tonnage trucks. With higher productivity, better turnaround time, and optimium utilisation of truck has gone up significantly which has benefitted fleet operators by enabling a superior cost of operations.

How the OEMs fared in January

Tata Motors sold 39,386 units against 28,521 units in January 2017, an increase of 38 percent YoY. After witnessing robust growth over the last three months, the M&HCVs sales moderated at 12, 804 units, up by 13 percent. The I&LCV truck segment grew by 55 percent YoY, on the back of an increased thrust in agriculture, FMCG and E-commerce sectors. The company also registered increasing demand for container and refrigerated trucks in I&LCV segment.

The SCV cargo and pickup segment sales was 17,948 units, posting a strong growth of 75 percent YoY on the back of new product launches and improvement in consumer sentiments especially within the e-commerce sector and government/municipal applications. The commercial passenger carrier segment saw sales of 4,093 units, a growth of 3 percent YoY.

According to Tata Motors, “On the account of robust infrastructural developments coupled with growing logistics requirements arising from the construction sector. The demand for M&HCVs trucks was led by increasing restrictions on overloading, fresh tenders in the car carrier and petroleum sectors as well as coal and cement movement triggered by key infrastructure projects. However, the growth was lower than expected owing to challenges arising out of supply constraints on key parts.”

Ashok Leyland sales appear to have moderated in January 2018, it sold overall 18,101 units up by 22 percent. (January 2017: 14,872). The M&HCV remained positive, despite the growth coming down to 13 percent with sales of 13,643 units (January 2017: 12,056). The company reported LCV sales of 4,458 units, a growth of a strong 58 percent YoY (January 2017: 2,816).

Mahindra & Mahindra’s overall CV sales grew by a strong 51 percent to 21,002 units (January 2017: 13,890). The M&HCV sales registered a growth of massive 70 percent to 1,049 units albeit on a low previous year sales (January 2017:618). The below-3.5T GVW segment saw a strong growth of 52 percent YoY, selling 19,309 units (January 2017: 12,737), while those in the above-3.5T GVW segment grew by 20 percent with sales of 644 units (January 2017: 535).

VE Commercial Vehicles domestic sales were up by 58.3 percent with total sales of 6,010 units (January 2017: 3796 units).

RELATED ARTICLES

Maruti Suzuki’s SUV and MPV production jumps 100% to 58,226 units in January 2024

Utility vehicle market leader’s two plants in Haryana along with Suzuki Motor Gujarat’s facility hit a record monthly hi...

Car and SUV users in Bengaluru and Pune took over 27 minutes to travel 10km in CY2023

Traffic remains a challenge worldwide as life returns to pre-pandemic levels. Four Indian cities are among the 80 cities...

Indian car and 2W OEMs recall 284,906 vehicles in 2023 and 5.35 million since 2012

CY2023 saw three two-wheeler manufacturers proactively recall 122,068 motorcycles and five car and SUV producers recall ...

01 Feb 2018

01 Feb 2018

43090 Views

43090 Views

Autocar Pro News Desk

Autocar Pro News Desk